How to Pick the Best Medicare Supplement Plan in Five Simple Steps

- Pick the best Medicare Supplement plan based on your coverage needs. ...

- Find the best Medicare Supplement plan for your budget. Once you’ve listed Medicare Supplement Insurance plans that cover your health care needs, a great way to narrow down your options ...

- Sign up during your Medicare Supplement Open Enrollment Period. ...

Full Answer

What are the top 5 Medicare supplement plans?

Sep 16, 2018 · One way to compare the benefits offered by the 10 standardized Medicare Supplement plans is to take a look at this chart. Think about which services you use the most and where your highest Medicare out-of-pocket costs have been. For example, is there a good chance you’ll spend some time in a skilled nursing facility?

What is the best and cheapest Medicare supplement insurance?

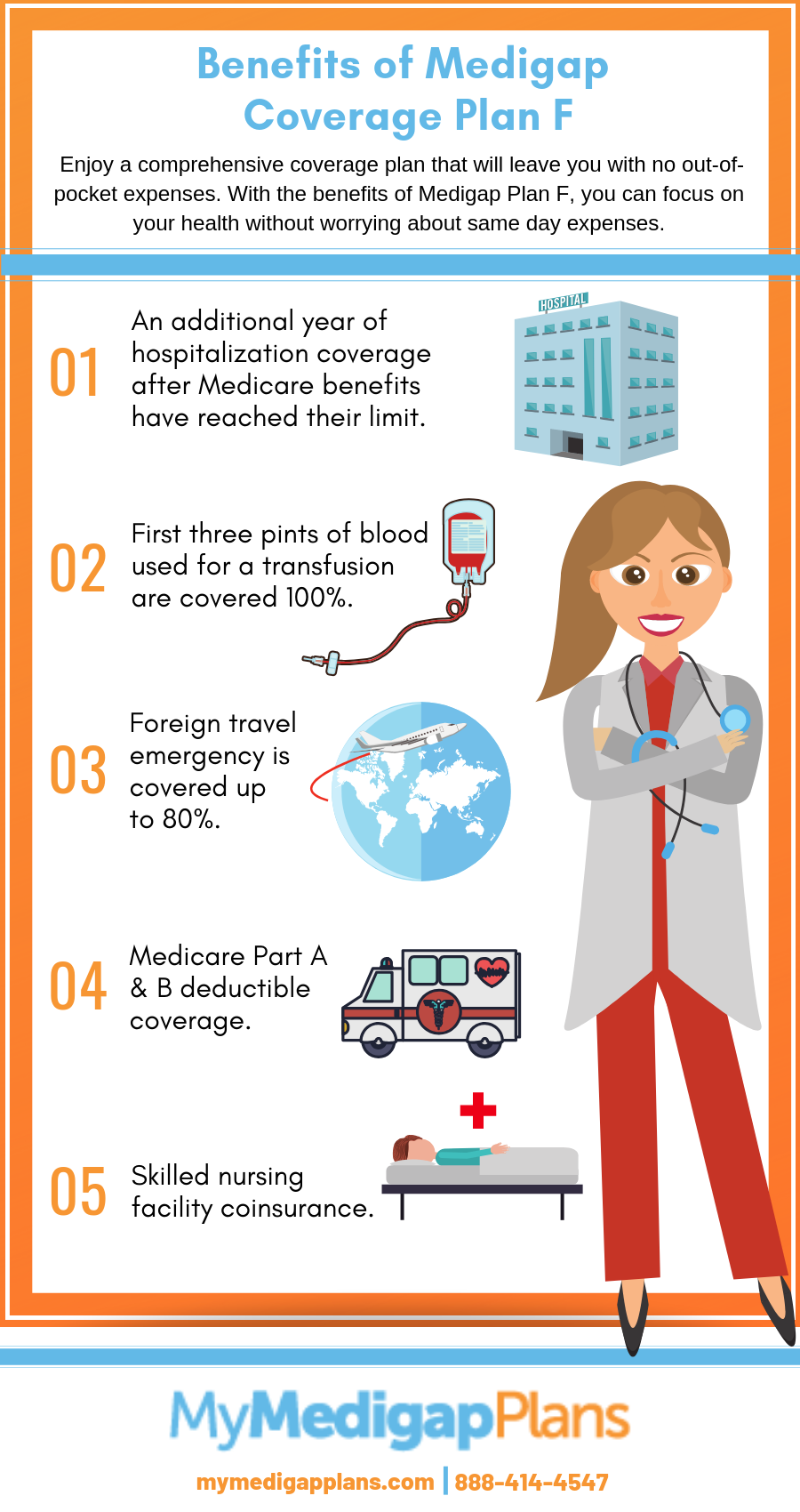

Mar 24, 2022 · Medicare Supplement Insurance helps you manage out-of-pocket costs for covered services Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020

What are the best Medicare plans?

Feb 09, 2022 · Also offers Medicare Part D for prescription drug coverage In business for over 100 years, Mutual of Omaha offers coast-to-coast coverage to U.S. adults exploring their Medicare Supplement plan...

What is the most comprehensive Medicare supplement plan?

Nov 18, 2021 · Medicare Supplement Plan D. Medigap Plan D could be the best Medicare Supplement Insurance plan for some enrollees, depending on their coverage needs. Plan D covers everything that Plan F does, with the exception of the Medicare Part B deductible and Part B excess charges.

Which Medicare Supplement plan has the highest level of coverage?

Medicare Supplement Plan G is the best overall plan that provides the most coverage for seniors and Medicare enrollees. Plan G will cover almost everything except the Part B deductible.Mar 16, 2022

How do I know which Medicare plan is best for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What is the most popular Medigap plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021.Oct 6, 2021

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

What is the difference between Medicare Part C and Part D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

How much does AARP Medicare Supplement Plan N cost?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan K$70Plan L$136Plan N$167Plan N (1)$1506 more rows•Jan 24, 2022

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the deductible for Medicare Supplement plan g?

Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

What is a Medigap Plan C?

Medigap Plan C is another option that can offer tremendous value to beneficiaries. Plan C covers everything that Plan F covers, with the exception of Medicare Part B excess charges.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Does Medigap Plan N have the same coverage as Plan D?

Plan N offers the exact same coverage as Medigap Plan D, except for one difference: When it comes to Medicare Part B coinsurance, Medigap Plan N requires a coinsurance payment of up to $20 for some office visits and up to $50 for emergency room visits that do not result in an inpatient admission.

Is Medicare Supplement the best?

There is no definitive Medicare Supplement Insurance plan that is the “best.” The right plan for you is the one that is most closely aligned with your needs and budget.

How to choose a Medigap plan?

Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan. Step 2.

What is Medigap insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

How to Choose the Best Medicare Supplement Plans in 2021

When deciding on a Medicare supplement plan (Medigap), knowing the purpose of what these plans provide is key to making a good decision. A Medigap plan is extra insurance you can buy to work in-sync with your Medicare Part A and Part B coverage.

What Does a Medicare Supplement Plan Typically Cost?

The cost for a Medicare supplement depends upon multiple factors, such as your age, gender, zip code, tobacco use, plan, the plan carrier, and more. You may be able to find a Medigap plan as low as $90 and another as high as $250. It is very dependent on the plan itself and where you live.

What Do Medicare Supplement Plans Not Cover?

A Medicare supplement will cover any service that Original Medicare covers, first. It is as simple as this: if Medicare pays, so will your Medicare supplement; if Medicare does not cover a service, neither will your Medicare supplement.

What is the Difference Between a Medicare Supplement Plan and Medicare Advantage?

Medicare supplement plans are secondary to Original Medicare. They are designed to help pick up the costs after Original Medicare pays for the service. These plans will travel with you all over the U.S. and you can see any doctor that accepts Medicare.

What is a Medicare Supplement Plan?

A Medicare supplement plan, also known as Medigap, is a secondary insurance plan sold by private insurance companies. They help cover the gaps in Original Medicare such as deductibles, copays, and coinsurance. There are 10 standardized Medicare supplement plans that vary in coverage.

What is the Most Popular Medicare Supplement Plan?

Medicare supplement Plan G is the most popular Medicare supplement plan in 2021. Plan G will help cover Medicare-approved Part A hospital costs and services, the Part A deductible, and the Part B coinsurance.

How to Find the Best Medicare Supplement Plan for You

The best Medicare supplement (Medigap) plan for you is not necessarily the same plan that is best for your neighbor. There are 10 standardized Medigap plans on the market, and each plan has a different set of benefits and premiums.

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

How to find the right Medicare supplement plan?

Here are the key steps to finding the right supplement plan for you: 1. Analyze your options. One of the best things about Medicare supplement plans is that they are all standardized, and they can all be used anywhere a provider accepts Medicare payments. Currently, there are 10 plans on the market, and they are labeled with letters, from A-N.

How long do you have to enroll in Medicare at 65?

Don’t delay. When you turn 65, you have an initial enrollment period of seven months that includes three months before your birthday, your birthday month and the three months that follow. If you’re enrolling in Original Medicare (versus Medicare Advantage ), this is when you want to get your Medicare supplement policy.

What is a good agent?

A good agent can help you walk through the various plans and pinpoint which one best suits your lifestyle. However, look for an independent broker who works with a variety of companies rather than someone associated with a specific insurer.

Can you buy a Medicare supplement plan after the initial period ends?

Once that initial period ends, you can still buy a Medicare supplement plan, but the door opens for insurers to start asking all sorts of questions about your health status.

Does Medicare have a basic plan?

All plans offer basic benefits, but some offer additional benefits. The U.S. Centers for Medicare & Medicaid Services has this handy chart on its website Medicare.gov that may help you out. If you live in Massachusetts, Minnesota or Wisconsin, your options will be different.

Does Medicare cover everything?

Medicare health insurance generally offers good coverage, but it doesn’t cover everything. However, if you have an Original Medicare plan rather than a Medicare Advantage plan, you also have the option to fill many of the coverage gaps by purchasing a private Medicare supplemental insurance plan, also known as a Medigap plan. 1.

Is Plan A from Company X the same as Plan A from Company Y?

Because the plans are standardized, Plan A from Company X is exactly the same as Plan A from Company Y. It makes it easy to shop. You simply need to compare prices and look for a private insurance company you trust. No need to pull out a spreadsheet and compare deductibles, networks and copays.

Which Medicare plan offers the most supplemental coverage?

Plans C, F and G offer the most supplemental coverage, paying many of your out-of-pocket costs for Medicare-approved services. Consider one of these plans if you are willing to pay a monthly premium that is typically higher in exchange for more covered benefits and lower out-of-pocket costs.

What is Medicare Supplement?

Medicare Supplement insurance plans, also called Medigap plans, provide help with some of the out-of-pocket expenses not paid for by Original Medicare. When you go to the doctor under Original Medicare, you still have expenses to pay. Medicare Supplement insurance plans work with your Medicare Part A (hospital stays) and Medicare Part B ...

What is the difference between Medicare Supplement Plan A and Plan B?

Plans A and B: Lower Benefits, Higher Out-of-Pocket. Medicare Supplement Plan A offers just the Basic Benefits while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible. The Medicare Part A deductible could be one of your largest out-of-pocket expenses if you need to spend time in a hospital.

Why are coinsurance premiums lower?

The premiums are typically lower because, for some services, they pay a percentage of the coinsurance instead of the full coinsurance amount. Once the out-of-pocket limit is reached, these plans pay 100% of covered services for the rest of the calendar year.

How much does Plan N pay for Part B?

1 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in an inpatient admission. 2 Care needed immediately because of an injury or an illness of sudden and unexpected onset.

Does Plan N cover Medicare Part B?

Plan N covers the Medicare Part B coinsurance, but you pay copayments for covered doctor office and emergency room visits in exchange for a monthly premium that tends to be more mid-range.

Does Medicare Supplement cover doctor visits?

Medicare Supplement insurance plans work with your Medicare Part A (hospital stays) and Medicare Part B (doctor visits) to help lower the out-of-pocket medical costs that Original Medicare doesn’t cover. The Medicare Supplement plans that are available to you depend on the state in which you live.