Part A

| File Individual Tax Return | File Joint Tax Return | Monthly Adjustment | 2020 Part B Monthly Premium |

| $87,000 or Less | $174,000 or Less | $0.00 | $144.60 |

| $87,001 to $109,000 | $174,001 to $218,000 | $57.80 | $202.40 |

| $109,001 to $136,000 | $218,001 to $272,000 | $144.60 | $289.20 |

| $136,001 to $163,000 | $272,001 to $326,000 | $231.40 | $376.00 |

Full Answer

What is the monthly premium for Medicare Part B?

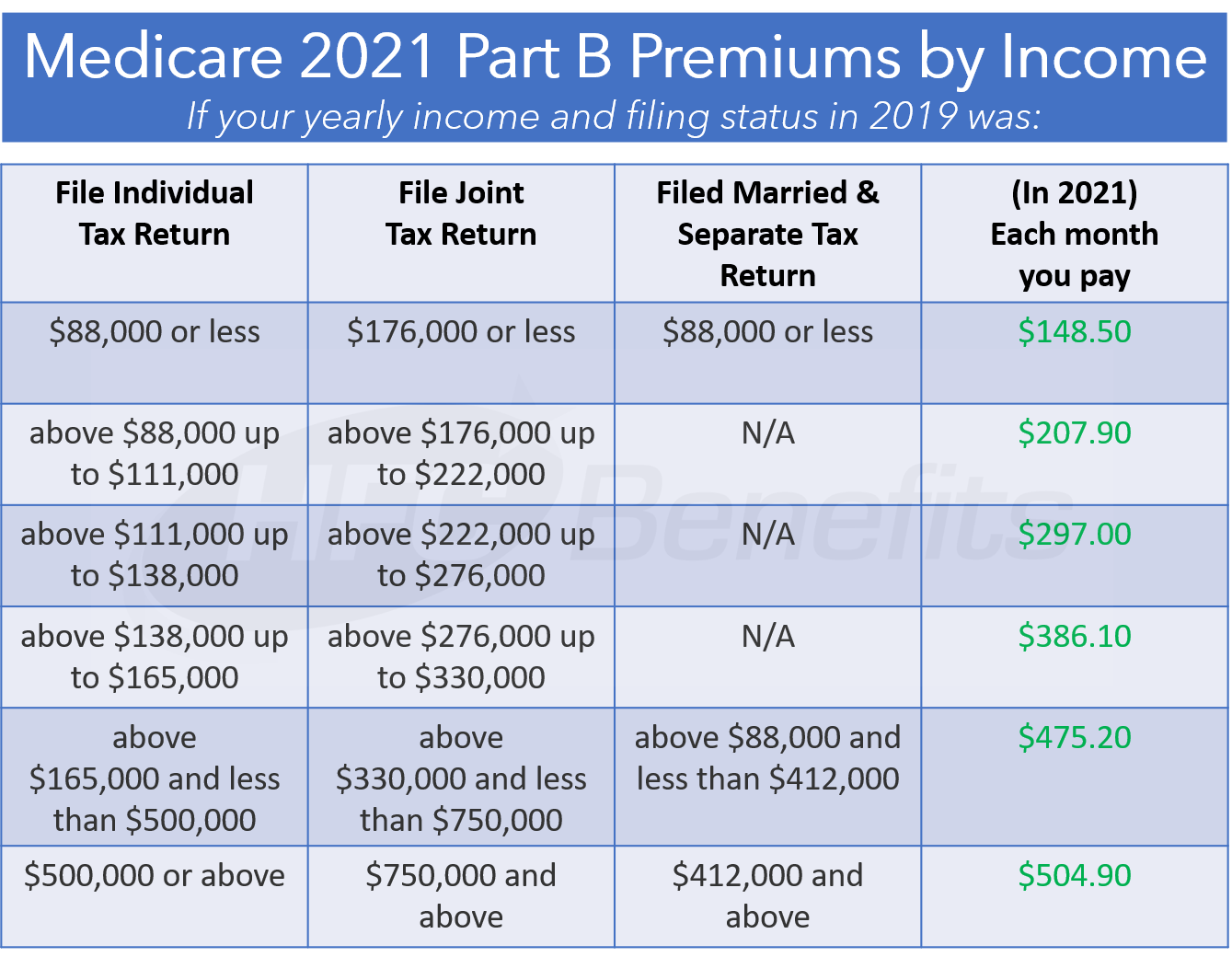

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How are Medicare Part B premiums determined?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

How much does Medicare Part B cost?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

How much does Medicare premium cost?

Medicare. Medicare Premiums explained: Which part is more convenient for you? Medicare. Medicare Costs 2022: Does Medicare cover Home Health Care? The US Centers for Medicare & Medicaid Services have announced the increases for both the standard premium ...

What are 2021 Medicare premiums?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the monthly Medicare premium for 2020?

$144.60The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the standard Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is Medicare 2020 B premium?

Part B Monthly Premium The standard Part B premium amount in 2020 is $144.60 or higher depending on your income. However, most people who get Social Security benefits pay less than this amount ($130 on average).

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

How can I lower my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

Why did my Medicare premium increase for 2022?

The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

Why did Medicare premiums go up for 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

How much does Medicare cost out of your Social Security check?

How much is taken out of your Social Security check for Medicare? Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2022, the Part B premium is $170.10.

How much is Medicare Part B 2020?

Part B. On November 8, 2019, CMS announced that the monthly Medicare Part B premium will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for Medicare Part B beneficiaries increased $13, from $185 in 2019 to $198 in 2020.

How many people are enrolled in Medicare Part B in 2020?

Here’s how your clients’ annual incomes will affect their Medicare Part B monthly premiums for 2020. Almost 61 million Medicare enrollees are enrolled in Medicare Part A, Part B, or both programs. Be sure you can answer your clients’ questions around these cost increases or help them reassess their coverage if needed.

What is Part A deduction for 2020?

2020 Part A Deductible & Coinsurance Amounts. If you have clients who are considered “held harmless,” they will pay less than the standard Part B premium. (The “Hold Harmless Provision” states that certain beneficiaries’ Part B premium increases cannot exceed the increase in their Social Security benefits.)

Will Medicare be released in 2021?

The Centers for Medicare & Medicaid Services have released the Medicare costs for 2021. Please see our most recent article, 2021 Medicare Part A and Part B Premiums and Deductibles, for current facts and figures.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What percentage of Medicare Part B premiums are based on income?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table:

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

What percentage of Medicare Part B premiums are based on income?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table:

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Medicare Part B Income-Related Monthly Adjustment Amounts

Every beneficiary’s Part B monthly premium is based on his or her income. The 2020 Part B total premiums for high income beneficiaries are shown in the following table:

Senior65.com Next Steps

If you want to find a plan that will help pay for the deductibles and coinsurance amounts not covered by Medicare, give us a call at 800-930-7956. We would be glad to discuss your options and help you select and enroll in a plan that meets your needs. There is never a cost or hidden fee to work with us.

Stay in touch

Subscribe to be always on top of news on Medicare, Medigap, Medicare Advantage, Part D and more!

How much is the 2020 deductible?

The annual deductible in 2020 will increase to $198, up from $185 in 2019. The monthly premium will increase to $144.60 for 2020, up from $135.50 in 2019. However, the amount of monthly premium is adjusted based on revised income levels, as reflected in the chart below:

How much is Medicare Part A premium?

Generally, there is no monthly Part A premium for those with 40+ quarters of Medicare-covered employment. Individuals who have at least 30 quarters of coverage can buy Part A for $252 in 2020 (up from $240 in 2019); those with less than 30 quarters can buy Part A for $458 per month in 2020 (up from $447 in 2019).

When will Medicare Part A and Part B be released?

On November 8, 2019 , the Centers for Medicare & Medicaid Services (CMS) released the 2020 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What does Medicare Part A cover?

About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.