If you’re looking to reenroll in Medicare Part B, follow these steps:

- Go to the Social Security Administration website.

- Complete the application.

- Mail all required documents to the Social Security office. Include all required official or certified documents to allow for a seamless process.

- To switch to a new Medicare Advantage Plan, simply join the plan you choose during one of the enrollment periods. ...

- To switch to Original Medicare, contact your current plan, or call us at 1-800-MEDICARE.

What if I overpaid my Medicare premium?

Aug 11, 2020 · If you’re looking to reenroll in Medicare Part B, follow these steps: Go to the Social Security Administration website. Complete the application. Mail all required documents to the Social Security office. Include all required official or certified documents to …

Who qualifies for the GIVE BACK benefit?

When you're enrolled in Medicare Part B, you must pay a monthly premium of $170.10. The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage (MA) plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount. Even though you're paying less for the monthly premium, you don't …

Who is eligible for Medicare Part B reimbursement?

It is pretty easy to qualify for the Medicare Give Back benefit as the eligibility criteria are straightforward. First, you must be enrolled in Original Medicare. You need to have both Medicare Part A and Medicare Part B coverage. Next, you must pay your own monthly Part B premium.

Are you eligible for a Medicare reimbursement?

Mar 29, 2021 · There are two common ways to get up to $144 back on Medicare premiums. 1. Qualify by your income and assets. Basically, the state will pay for your Part B premium which in 2021 is $148.50. Income limits are listed below. Each state will be a little different with qualification requirements and applying. We will use Tennessee for this illustration.

Can you go back to Medicare?

At any point during your first year in a Medicare Advantage plan, you can switch back to Original Medicare without penalty. If you left Medigap for Medicare Advantage, your trial right allows you to switch back to your Medigap policy.

What is the $144 back on Medicare?

The Medicare Part B give back is a benefit specific to some Medicare Advantage Plans. This benefit covers up to the entire Medicare Part B premium amount for the policyholder. The give back benefit can be a great way for beneficiaries to save, as the premium is deducted from their Social Security checks each month.

When can I re enroll in Medicare?

When you first get Medicare (Initial Enrollment Periods for Part C & Part D)If you joinYour coverage beginsDuring one of the 3 months before you turn 65The first day of the month you turn 65During the month you turn 65The first day of the month after you ask to join the plan1 more row

Can you lose Medicare once you have it?

If you qualify for Medicare by age, you cannot lose your Medicare eligibility.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What is Medicare good cause reinstatement?

You can also ask for reinstatement under the Medicare Good Cause policy. If you prove there's “good cause” (or reason) for not paying premiums — typically an emergency, chronic illness, or other related situation — you'll still have to pay all owed premiums within a specified period of time to resume coverage.Aug 11, 2020

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

Will I lose my Medicare if I go back to work?

Under this law, how long will I get to keep Medicare if I return to work? As long as your disabling condition still meets our rules, you can keep your Medicare coverage for at least 8 ½ years after you return to work.

How do you lose Medicare Part A?

Depending on the type of Medicare plan you are enrolled in, you could potentially lose your benefits for a number of reasons, such as:You no longer have a qualifying disability.You fail to pay your plan premiums.You move outside your plan's coverage area.Your plan is discontinued.More items...

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What is the Part B premium reduction benefit?

When you're enrolled in Medicare Part B, you must pay a monthly premium of $170.10. The giveback benefit, or Part B premium reduction, is when the Part C Medicare Advantage (MA) plan reduces the amount you pay toward that premium. Your reduction could range from less than $1 to the full premium amount.

How do I receive the giveback benefit?

If you enroll in a plan that offers a giveback benefit, you'll find a section in the plan's summary of benefits or evidence of coverage (EOC) that outlines the Part B premium buy-down. Here, you'll see how much of a reduction you'll get. Or, you can contact the plan directly.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does to take advantage of the savings opportunity.

Downsides to the Medicare giveback benefit

While the giveback benefit can help save you money, there are a few things to be aware of when considering enrolling in an MA plan that offers it.

What Is The Medicare Part B Give Back Benefit?

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan.

Who Is Eligible For The Medicare Part B Give Back Benefit?

It is pretty easy to qualify for the Medicare Give Back benefit as the eligibility criteria are straightforward. First, you must be enrolled in Original Medicare. You need to have both Medicare Part A and Medicare Part B coverage. Next, you must pay your own monthly Part B premium.

Applying For A Medicare Part B Give Back Benefit

So, what is the enrollment process for the Give Back benefit? Many people are looking to save as much money as possible when it comes to their health care costs, so they want to know how to get signed up for this program. The process is quite simple, so here is how to do it.

The Bottom Line

Since most people on Medicare are receiving Social Security benefits, finding a way to reduce the cost of your health insurance is always a plus. The Medicare Give Back program can do just that by paying for a portion or even all of your Medicare Part B premium.

What is the deadline for Medicare give back benefit?

There is no deadline to qualify for the give back benefit. You must already be enrolled in Medicare Part A and Part B, and you must pay your own monthly Part B premium. You then simply need to enroll in a Medicare Advantage plan that offers this benefit.

What is this benefit?

The giveback benefit is actually part of the Part B premium reduction that first appeared in 2003. A Federal regulation allowed for a reduction in payments of the Medicare +Choice plans and that helped to fund the giveback.

How do you qualify?

There are two common ways to get up to $144 back on Medicare premiums.

Always Be Wary of Scams

Remember to watch out for ads that say “you may” qualify. The key word here is MAY. Also, these are usually ads that come from insurance agents or companies that sell leads to agents. Medicare or Social Security will never call you and if you are getting a letter from them it will clearly state who it is from.

Additional Benefits Possible

Yet another question we hear all the time is “am I getting every benefit I can?” Things to consider: • Ads you see can list all the benefits that are on every plan, everywhere. • No plan will have every benefit in existence. • Some benefits may not be offered in your county or state.

What is this benefit?

The giveback benefit is actually part of the Part B premium reduction that first appeared in 2003. A Federal regulation allowed for a reduction in payments of the Medicare +Choice plans and that helped to fund the giveback.

How do you qualify?

There are two common ways to get up to $144 back on Medicare premiums.

Always Be Wary of Scams

Remember to watch out for ads that say “you may” qualify. The key word here is MAY. Also, these are usually ads that come from insurance agents or companies that sell leads to agents. Medicare or Social Security will never call you and if you are getting a letter from them it will clearly state who it is from.

What is Medicare Part B give back?

Part B Premium Reduction Give Back Plans. The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isn’t available in all areas. Those with this plan may see a higher amount on their Social Security check, ...

How many states will have Medicare Advantage in 2021?

In 2021, there will be 48 states offering a Medicare Advantage plan with a Part B premium reduction. So, it’s fair to say the popularity of these plans is increasing.

What is a Part B premium reduction plan?

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage , you’ll see a section that says Part B premium buy-down; this is where you can see how much of a reduction you’ll get.

How much does Part B premium cost?

These plans reduce your Part B premium up to the full standard amount of $148.50 each month and add the money to your Social Security check.

Can Medicare Advantage pay Part B?

The Medicare Advantage insurance company can pay either the whole or a portion of the Part B premium for enrollees. Since the Advantage plan handles your claim instead of Medicare, these plans make more sense than a standard Part C policy. How can Medicare Advantage plans give you back some of your Part B premium money?

Is Part B reduction worth it?

Many beneficiaries are unaware of the many limitations that come with Advantage plans. A Part B reduction may not be worth the additional cost-sharing . Beneficiaries on a budget should consider High Deductible Plan G or High Deductible Plan F. The premiums are more affordable than the standard versions.

Who is eligible for Part B buy down?

Who is Eligible for the Part B Buy-Down Plan? Those that pay their own Part B premium will be eligible for the Part B buy-down. But, anyone with Medicaid or other forms of assistance that could pay the Part B premium can’t enroll in these plans.

When do you get Medicare Part B?

Generally, people are first eligible for Medicare Part B when they turn 65 years old, unless they have other qualifying conditions. Part B covers medically necessary services and supplies, such as: outpatient care and emergency room visits. preventive services including tests and screenings. ambulance transport.

What happens if you don't pay Medicare?

If a person does not pay following the 3-month grace period, they will get a termination notice stating they no longer have Medicare coverage. However, if a person pays their missed premiums within 30 days of the termination notice, they will continue to receive Part B coverage.

How much is Medicare premium 2021?

For individuals with an income below $88,000, the standard premium is $148.50 in 2021, with an annual deductible of $203. According to the Centers for Medicare and Medicaid Services, about 7% of Medicare Part B beneficiaries will pay a higher income adjusted premium.

What is a good cause policy for Medicare?

Medicare good cause policy. If a person feels they have a good reason or cause for not paying their premiums, they can ask Medicare for reinstatement under the Medicare good cause policy. The individual must be able to prove the reason for missing payments.

What are the benefits of Medicare?

Medicare extends both Medicare Part A and Part B benefits to people who are: 1 aged 65 or older 2 disabled and receiving Social Security Income (SSI) or Railroad Retirement Board (RRB) benefits 3 diagnosed with end stage renal disease (ESRD) 4 diagnosed with amyotrophic lateral sclerosis (ALS)

When is the Medicare enrollment period?

Medicare General Enrollment Period. January 1 to March 31 is the Medicare general enrollment period (GEP). People can join or reenroll in Medicare parts A and B for coverage to begin on July 1. People with an advantage plan can also switch between plans or join original Medicare.

Can you change your Medicare coverage during a SEP?

Medicare allows exceptions for significant life events, such as divorce, and offers special enrollment periods (SEPs). Qualifying individuals can reenroll in original Medicare or change their Medicare coverage during a SEP.

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

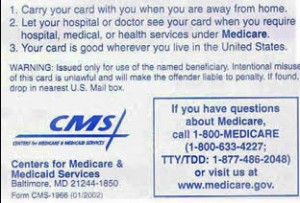

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.

What happens if you call Medicare?

However, if you call (as noted in the commercial’s small print), your call will be transferred to a licensed insurance agent who may or may not sell plans in your area. And, if there is no plan in your area, you may hear about other plans that are available to you. The best place to start is the Medicare Plan Finder.

How to qualify for Medicare premium reduction?

To qualify for a premium reduction, you must: Be a Medicare beneficiary enrolled in Part A and Part B, Be responsible for paying the Part B premium, and. Live in a service area of a plan that has chosen to participate in this program.

What is a reduction in Part B premium?

This is a reduction in the Part B premium you must pay. For example, if a beneficiary is on Social Security, the Part B premium comes out of the monthly benefit before it hits the individual’s bank account. The reduction in the plan’s payment reduces that premium, which means more money in the individual’s bank account.

Does SNP include prescription drug coverage?

A few of these plans do not include prescription drug coverage. Some Special Needs Plans (SNP) also offer this benefit. But, in these cases, the beneficiary may not qualify. For example, there is a SNP for those residing in nursing homes.