Full Answer

How do I get Medicare coinsurance?

One way you can get some coverage for Medicare coinsurance is by purchasing Medicare Supplement Insurance. Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs, such as coinsurance, copayments and deductibles.

What is coinsurance on a Medicare policy?

After meeting your $233 deductible, coinsurance is usually 20 percent of the Medicare-approved cost of most doctor services. Coinsurance varies from policy to policy. Will Howery, MBA | 0:48 What is coinsurance?

What is the typical coinsurance amount for Medicare drug plans?

While 20 percent is the typical coinsurance amount for Medicare Advantage plans, some plans may feature a 70-30 or 90-10 split. Medicare Prescription Drug Plans may feature coinsurance or copay amounts that vary depending on the type of drug and what tier that drug is in, according to your Medicare drug plan formulary.

How do I calculate coinsurance on my medical bills?

So if your medical bill is $1,500 and you have a $500 deductible, the portion of the bill to which coinsurance will apply is $1,000. With a 20% coinsurance clause, you would pay $700 ($500 + $200 [20% of remaining $1,000]). The sum total, $700, is known as your "out-of-pocket" expense.

Does Medicare pay for coinsurance?

Coinsurance is when you and your health care plan share the cost of a service you receive based on a percentage. For most services covered by Part B, for example, you pay 20% and Medicare pays 80%.

How does Medicare calculate coinsurance?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items.

How do you get coinsurance?

CoinsuranceIf you've paid your. deductible. The amount you pay for covered health care services before your insurance plan starts to pay. With a $2,000 deductible, for example, you pay the first $2,000 of covered services yourself. ... If you haven't met your deductible: You pay the full allowed amount, $100.

What is the coinsurance amount for original Medicare?

20%After your deductible is met, you typically pay 20% of the In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you're responsible for the difference.

What is the Medicare coinsurance rate for 2021?

$371Part A Deductible and Coinsurance Amounts for Calendar Years 2021 and 2022 by Type of Cost Sharing20212022Daily coinsurance for 61st-90th Day$371$389Daily coinsurance for lifetime reserve days$742$778Skilled Nursing Facility coinsurance$185.50$194.501 more row•Nov 12, 2021

Does AARP pay Medicare coinsurance?

AARP Medicare Supplement Plan C Plan C includes all of the benefits offered under Plan A. For those who are eligible, AARP's Plan C also covers: Coinsurance for care provided in a skilled nursing facility. Your Medicare Part A deductible ($1,408 in 2020)

Is it better to have coinsurance or not?

Co-Pays are going to be a fixed dollar amount that is almost always less expensive than the percentage amount you would pay. A plan with Co-Pays is better than a plan with Co-Insurances.

What does coinsurance apply to?

Coinsurance is a percentage of a medical charge you pay, with the rest paid by your health insurance plan, which typically applies after your deductible has been met. For example, if you have 20% coinsurance, you pay 20% of each medical bill, and your health insurance will cover 80%.

What does 80% coinsurance mean for an insurance policy?

One definition of “coinsurance” is used interchangeably with the word “co-pay” – the amount the insurance company pays in a claim. An eighty- percent co-pay (or coinsurance) clause in health insurance means the insurance company pays 80% of the bill. A $1,000 doctor's bill would be paid at 80%, or $800.

Does Medigap cover coinsurance?

All Medigap plans provide Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. Medicare Part B coinsurance or copayment are fully provided by Plans A, B, C, D, F, G, M, and N. Plan L provides 75% coverage, and Plan K provides 50%.

How much is Medicare Part B coinsurance?

With Medicare Part B, after you meet your deductible ( $203 in 2021), you typically pay 20 percent coinsurance of the Medicare-approved amount for most outpatient services and durable medical equipment.

What is Medicare supplement?

Medicare supplement or Medigap plans cover various types of Medicare coinsurance costs. Here’s a breakdown of what Medigap plans cover in terms of Part A and Part B coinsurance. Plan A and Plan B cover: Part A coinsurance and hospital costs up to 365 days after you’ve used up your Medicare benefits. Part A hospice coinsurance.

How much will Medicare pay in 2021?

If you have Medicare Part A and are admitted to a hospital as an inpatient, this is how much you’ll pay for coinsurance in 2021: Days 1 to 60: $0 daily coinsurance. Days 61 to 90: $371 daily coinsurance. Day 91 and beyond: $742 daily coinsurance per each lifetime reserve day (up to 60 days over your lifetime)

What is Medicare Part B?

Medicare Part B. Medigap. Takeaway. Medicare coinsurance is the share of the medical costs that you pay after you’ve reached your deductibles. Although original Medicare (part A and part B) covers most of your medical costs, it doesn’t cover everything. Medicare pays a portion of your medical costs, and you’re responsible for the remaining amount.

What is the original Medicare?

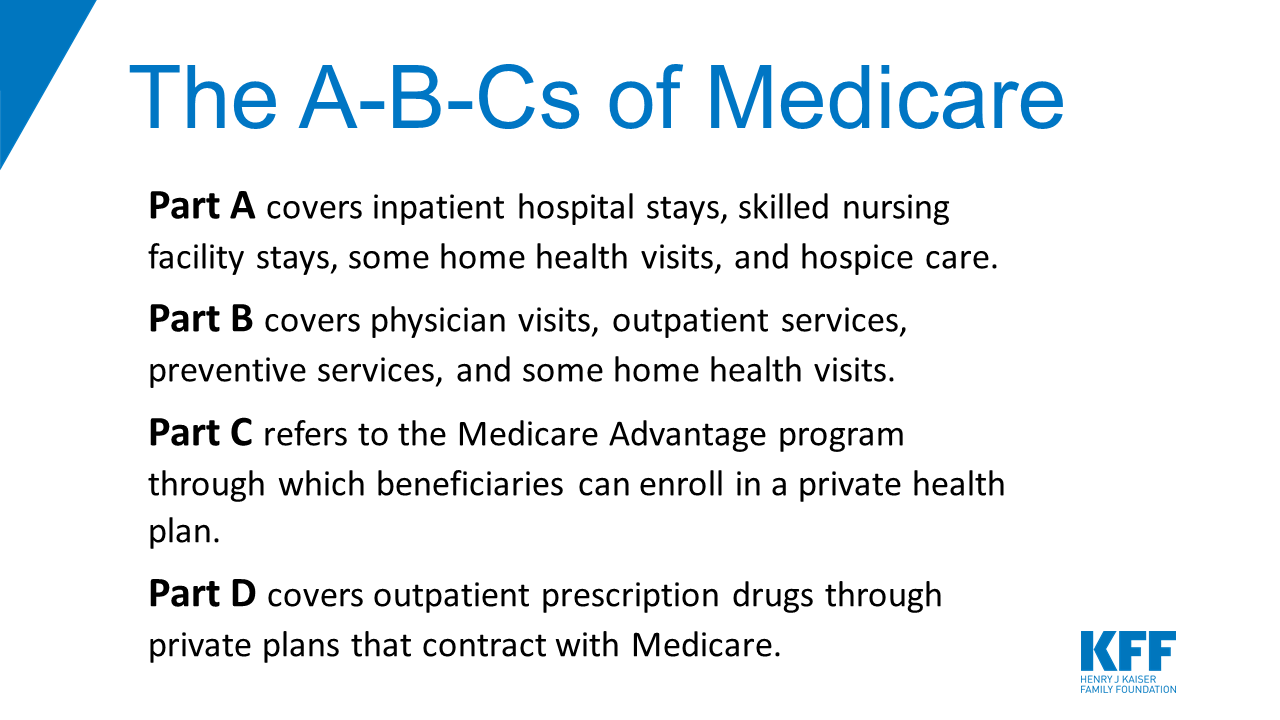

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is coinsurance in Medicare?

Coinsurance is when you and your health care plan share the cost of a service you receive based on a percentage. For most services covered by Part B, for example, you pay 20% and Medicare pays 80%.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What would happen if Joe had a Medicare Advantage plan?

So, if Joe had a Medicare Advantage plan rather than Original Medicare in the example above, he might pay a $30 copay when he visited the doctor. Medicare Advantage is an alternative to Original Medicare (Parts A & B). It’s another way to get your Medicare benefits.

How much does Medicare pay for Joe?

Medicare pays 80% of the cost, which is $176. Joe pays 20% of the cost, which is $44. If Joe has a Medicare supplement insurance plan, his share of the cost might be covered by the plan.

Does Medicare Advantage have an out-of-pocket limit?

Medicare Advantage plans are required to set an out-of-pocket limit for plan members. There’s no out-of-pocket limit with Original Medicare. It’s your money, and it’s important to understand your Medicare costs and how they are calculated.

Does Joe have Medicare?

Joe has Original Medicare (Parts A & B), and he has already met his Part B deductible for the year. Joe’s doctor “accepts assignment,” meaning that she agrees to take the Medicare-approved amount—what Medicare says is appropriate—as full payment for her services.

What is the amount of coinsurance for $1,500?

So if your medical bill is $1,500 and you have a $500 deductible, the portion of the bill to which coinsurance will apply is $1,000. With a 20% coinsurance clause, you would pay: $500 deductible + $200 (20% of remaining $1000) = $700. The sum total, $700, is known as your out-of-pocket expense. The insurance company, paying the majority ...

What is a coinsurance policy?

Coinsurance, a term found in every health insurance policy, is your out of pocket expense for a covered medical or health care cost after the deductible, which generally renews annually, has been paid on your health care plan. ...

Is it important to read the conditions of a health insurance policy?

It's important to fully read all conditions of a policy before you make your choice or sign a waiver of health insurance, for any policy. If you have questions , speak to your representative to fully understand your options .

Can you have two health insurance plans?

If you have two health insurance plans and one has a different coinsurance clause, you may be able to coordinate benefits to cover more of the cost. Once your required annual deductible is paid each year, you will only be responsible for the coinsurance amount listed in your policy.

Medicaid

Medicaid is a joint federal/state program that helps with medical costs for some people with limited income and resources.

Medicare Savings Programs

State Medicare Savings Programs (MSP) programs help pay premiums, deductibles, coinsurance, copayments, prescription drug coverage costs.

PACE

PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

Lower prescription costs

Qualify for extra help from Medicare to pay the costs of Medicare prescription drug coverage (Part D). You'll need to meet certain income and resource limits.

Programs for people in U.S. territories

Programs in Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, American Samoa, for people with limited income and resources.

Find your level of Extra Help (Part D)

Information for how to find your level of Extra Help for Medicare prescription drug coverage (Part D).

Insure Kids Now

The Children's Health Insurance Program (CHIP) provides free or low-cost health coverage for more than 7 million children up to age 19. CHIP covers U.S. citizens and eligible immigrants.