What is the average cost of Medicare supplement plans?

This year, the average Medicare member will have on average thirty-nine plans to chose from in their area. This is the highest number captured in the last ten years, up by more than ten since 2015. This year 3,834 plans are available in total, and almost ninety percent include coverage to reduce the costs of prescription drugs.

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

Which Medicare supplement plan should I Choose?

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

How much does a Medicare supplemental insurance plan cost?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

How much do Medicare Supplement plans usually cost?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Does Medicare Supplement cost increase with age?

Medicare Supplement Insurance premiums tend to increase with age.

How is Medigap pricing set?

The premium is based on the age you are when you buy (when you're "issued") the Medigap policy. Premiums are lower for people who buy at a younger age and won't change as you get older. Premiums may go up because of inflation and other factors, but not because of your age.

Why are Medigap policies so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Is Plan F better than Plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Do Medigap premiums vary by state?

Medicare Supplement (Medigap) plan premiums vary from state to state. Although the benefits are standardized, Medicare costs by state are not the same. There are many reasons why some states have more expensive Medigap plans than others.

What is the most expensive Medicare plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is the factor that determines the premiums for Medicare Supplement Insurance?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age .

What are the factors that affect the cost of Medicare Supplement?

There may be plans available in your area that cost less than the average listed above for your age. Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates. A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan ...

How Does Age Affect Medicare Supplement Insurance Premiums?

There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates in 2020.

Why does my Medigap premium increase?

As you age, your Medigap plan premiums will gradually increase each year. Medigap premiums can increase over time due to inflation and other factors , regardless of the pricing model your insurance company uses.

What is the lowest Medicare premium for 2020?

Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 ( $184.93 per month) and highest for beneficiaries at age 85 ( $299.29 per month). Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 ( $143.46 per month) and highest for beneficiaries at age 85 ( $235.87 per month).

How does age affect Medicare premiums?

How Does Age Affect Medicare Supplement Insurance Premiums? 1 Community-rated Medigap plans#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market. 2 Issue-age-rated Medigap plans#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age. 3 Attained-age-rate Medigap plans#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

How much is the Part B tax deductible for 2021?

In 2021, the Part B deductible is $203 per year.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, helps cover the cost of some of the out-of-pocket expenses required by Original Medicare (Medicare Parts A and B) such as deductibles, copayments, coinsurance and more.

What happens if you apply for Medicare Supplement?

If you apply for a Medicare Supplement Insurance plan during your Medigap Open Enrollment Period, you will have guaranteed issue rights. That means an insurance company is not allowed to use medical underwriting to charge you a higher rate for your coverage.

How many Medigap benefits are there?

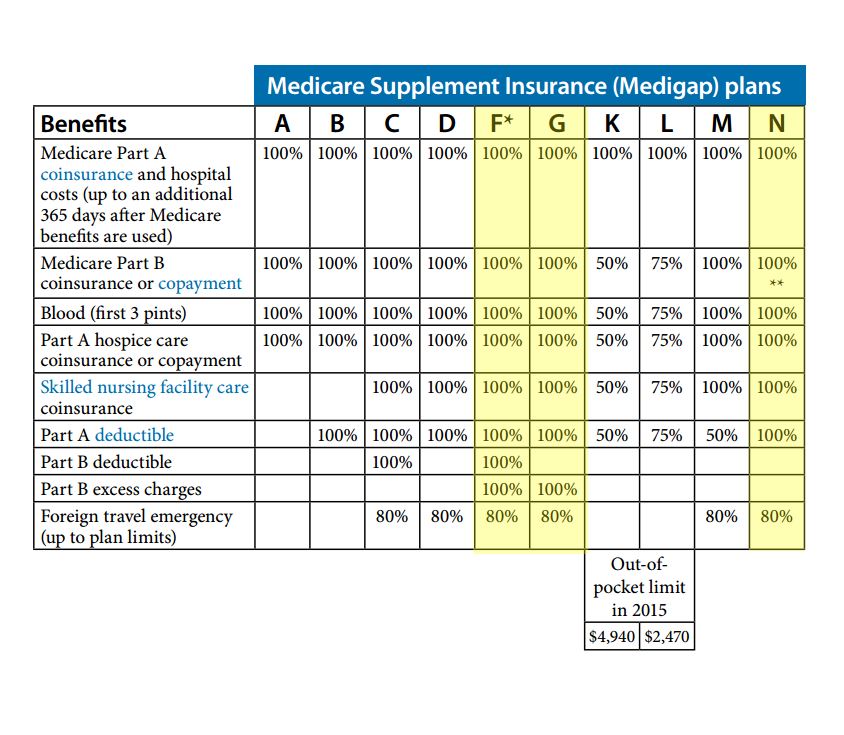

One big factor in the cost of a Medicare Supplement Insurance plan is the level of coverage provided. There are nine benefit areas covered by the 10 standardized Medigap insurance plans that are available in most states. The coverage of each plan is standardized by the federal government and remains consistent across every carrier in every state.

Why are women's Medicare premiums lower?

Because women have a longer life expectancy, they are sometimes granted lower premiums for Medicare Supplement Insurance plans.

Why do we need supplemental insurance?

Because the whole purpose of supplemental insurance is to help you save money, it’s natural to wonder how much these plans cost so you can get a better understanding of their true value .

Is it uncommon for a product to cost more in a large city than it does in a more rural?

The cost of living can be significantly different in one market compared to another. It’s not uncommon for a product to cost more in a large city than it does in a more rural setting, and the same can be said for Medicare Supplement Insurance plans.

Is more coverage more expensive?

Plans offering more coverage can sometimes be more expensive than plans with more basic coverage.

What are the factors to consider when shopping for Medicare Supplement Insurance?

Your unique health coverage needs and budget are important factors to consider as you shop for Medicare Supplement Insurance plans.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What Is the Best Medicare Supplement Insurance Plan in 2021-2022?

There isn't one “best” Medigap plan. A specific Medigap plan might work for you if it offers coverage that works for your needs and comes with premiums that fit your budget.

What Is Medigap Insurance?

Medicare Supplement plans (commonly referred to as Medigap) are insurance plans that work alongside your Medicare Part A and Part B benefits and help cover some of your Medicare deductibles, coinsurance, copays and other costs.

What Happened to Plan C and Plan F in 2020?

Medigap Plan F and Plan C are not available to anyone who became eligible for Medicare on or after January 1, 2020.

What Are High Deductible Plans F and G?

Plan F and Plan G both offer high deductible options, which carry a deductible of $2,490 in 2022.

Why MedicareSupplement.com?

A licensed insurance agent can help you compare Medicare Supplement Insurance plans that are available in your area. After you use the comparison chart above, you can ask a licensed agent about the types of Medigap plans that may be offered where you live.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

What is the best Medicare Supplement?

As mentioned above, your best Medicare Supplement plan will be the plan that balances costs and coverage. In general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums.

How much does Medigap Plan G cost?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give you comprehensive medical coverage from a well-rated company. However, all Supplement plans have standardized benefits that will help protect you from out-of-pocket medical expenses you'd have with Original Medicare (Part A and Part B).

What is the most popular Medicare plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of its comprehensive benefits, about 49% of Medicare Supplement enrollees have chosen this plan. Plan G has 22% of the market, making it the most popular choice for those who are newly eligible for Medicare.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

What is the best Medigap plan?

If you qualified for Medicare before Jan. 1, 2020, Plan F is the best Medigap plan. Plans will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

How much is Medicare Part A deductible for 2022?

Say you need surgery in the upcoming year. For the 2022 plan year, the Medicare Part A deductible is $1,556. Some Medicare Supplement policies, such as Plan A, provide no coverage for this deductible. Therefore, you would be responsible for paying the entire $1,556 out of pocket before your Original Medicare coverage would kick in.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

What is Medicare Select?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. policies that may require you to use certain providers. If you buy this type of Medigap policy, your premium may be less.

Why do premiums go up?

They may be the least expensive at first, but they can eventually become the most expensive. Premiums may also go up because of inflation and other factors.

What does each insurance company decide?

Each insurance company decides how it will set the price, or. premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. , for its Medigap policies. It’s important to ask how an insurance company prices its policies. The way they set the price affects how much you pay now ...

Why do insurance premiums go up?

Premiums are lower for people who buy at a younger age and won’t change as you get older. Premiums may go up because of inflation and other factors , but not because of your age.

Does Medigap charge the same monthly premium?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age.

Can you compare a Medigap policy?

As you shop for a Medigap policy, be sure to compare the same type of Medigap policy, and consider the type of pricing used .

How do I decide which Medicare Supplement plan is right for me?

Your health needs and budget will help you decide which Medicare Supplement plan might be best for you.

What to think about when choosing a Medicare Supplement Plan?

When choosing a Medicare Supplement plan, it's a good idea to think about things like premiums, your out-of-pocket medical expenses and what Original Medicare will and will not cover.

What is the decision guide for AARP?

The Decision Guide provides you with information about AARP Medicare Supplement Plans.

What is the difference between Medicare Supplement Plan A and B?

Plans A & B. Medicare Supplement Plan A offers just the Basic Benefits, while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible , which could be one of the largest out-of-pocket expenses if you need to spend time in a hospital.

What is a Medicare Supplement monthly premium?

Monthly Premium. A monthly premium is the fee you pay to the plan in exchange for coverage. Each Medicare Supplement plan has a different monthly premium.

How much is Medicare Part B deductible?

In most cases, you’re responsible for your Medicare Part B deductible, which is an annual cost of $198 in 2020.

What is a K and L plan?

Plans K & L are cost sharing plans with lower monthly premiums. They pay a percentage of the coinsurance instead of the full amount, and you are responsible for the rest. Once the out-of-pocket limit is reached, these plans pay 100% of covered services for the rest of the calendar year.