If you are unable to get a full refund of the amount from your employer, file a claim for refund with the Internal Revenue Service on Form 843, Claim for Refund and Request for Abatement (PDF). Attach the following items to Form 843: A copy of your Form W-2 to prove the amount of social security and Medicare taxes withheld,

Can I get Out of the OASDI tax?

This is very rare, though. You and your employer both need to be part of the religious group, which needs to have been in existence continuously since or before Dec. 31, 1950, and there are other qualifiers. Some nonresident aliens can get out of paying the OASDI tax (though most do).

How much do self-employed pay in OASDI tax?

It changes every year. Last year, self-employed taxpayers paid 12.4% of their income to the OASDI tax up to $137,700.

Why is the OASDI tax only 15 cents?

The reason that it's "about 15 cents" is that a tiny bit of what's left over – less than a penny from each dollar you contribute – goes toward managing the Social Security program. What Percentage of My Paycheck Is Taken Out for the OASDI Tax?

How do I claim a social security or Medicare tax refund?

You must first attempt to claim a Social Security or Medicare tax refund from your employer. If you can't get a full refund from your employer, you can submit your refund claim to the Internal Revenue Service (IRS) on Form 843. 7

How do I get my Oasdi refund?

To get a refund for the excess withholding, fill out IRS Form 843: Claim for Refund and Request for Abatement according to the Form 843 Instructions and mail it in separately. Make a copy to keep with your tax return paperwork.

Can Social Security tax be refunded?

If your employer has withheld Social Security or Medicare taxes in error, follow these steps: Request a refund from your employer. You must first request a refund of these taxes from your employer. If your employer is able to refund these taxes, no further action is necessary.

How do you get excess Social Security back?

If you had more than one employer and too much Tier 2 RRTA tax withheld, you may request a refund of the excess Tier 2 RRTA tax using Form 843PDF. Attach copies of your Forms W-2, Wage and Tax Statement for the year to Form 843.

What taxes do you get refunded?

Simple Summary. Every year, your refund is calculated as the amount withheld for federal income tax, minus your total federal income tax for the year. A large portion of the money being withheld from each of your paychecks does not actually go toward federal income tax.

What taxes do I get back?

You can receive a refund of federal and state income taxes withheld during the year if your actual tax liability is less than what was withheld. In addition, you can get even more back than you paid in if you qualify for refundable tax credits.

What if I overpaid Medicare taxes?

You are entitled to a refund of the excess amount if you overpay your FICA taxes. You might overpay if: You aren't subject to these taxes, but they were withheld from your pay. You didn't owe FICA taxes, but you made estimated tax payments.

What happens if too much Medicare tax is withheld?

(Code Sec. 3102(f)(1)) Any excess additional Medicare tax withheld is credited against the total tax liability shown on the employee's income tax return.

What is the Medicare tax liability?

The Social Security/Medicare Tax Liability. The Internal Revenue Code (IRC) imposes the liability for social security and Medicare taxes on both the employer of, and the employee, who earns income from wages in the United States. The Internal Revenue Code also grants an exemption from social security and Medicare taxes to nonimmigrant students, ...

How to access IRC section?

To access the applicable IRC sections, Treasury Regulations, or other official tax guidance, visit the Tax Code, Regulations, and Official Guidance page. To access any Tax Court case opinions issued after September 24, 1995, visit the Opinions Search page of the United States Tax Court.

Do non-resident aliens pay Social Security taxes?

Resident aliens, in general, have the same liability for Social Security/Medicare Taxes that U.S. Citizens have. Nonresident aliens, in general, are also liable for Social Security/Medicare Taxes on wages paid to them for services performed by them in the United States, with certain exceptions based on their nonimmigrant status.

Does the F-1 exemption apply to nonimmigrants?

The exemption does not apply to F-1,J-1,M-1, or Q-1/Q-2 nonimmigrants who become resident aliens. G-visas. Employees of international organizations are exempt on wages paid to them for services performed within the United States by employees of such organizations.

Does the F-2 exemption apply to spouses?

The exemption does not apply to spouses and children in F-2, J-2, M-2, or Q-3 nonimmigrant status. The exemption does not apply to employment not allowed by USCIS or to employment not closely connected to the purpose for which the visa was issued.

Who is liable for Social Security taxes?

Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees. In general, aliens performing services in the United States as employees are liable for U.S. Social Security and Medicare taxes.

Is a F-1 student exempt from Social Security?

As discussed above, this means that foreign students in F-1, J-1, M-1, Q-1 or Q-2 nonimmigrant status who have been in the United States less than 5 calendar years are still NONRESIDENT ALIENS and are still exempt from social security/Medicare taxes. This exemption also applies to any period in which the foreign student is in " practical training " ...

Step 1

Add together all of the Social Security withheld from your wages, shown in box 4 of your Forms W-2. For instance, if you worked for two employers and one withheld $3,844 and one withheld $2,926.40, the total Social Security withheld is $6,770.40.

Step 3

Enter the amount of the overpayment on line 69 of Form 1040. If you are using Form 1040A, add the amount of the overpayment to the credits you calculate for line 44, write "Excess SST" and the amount of the credit in the space to the left of line 44.

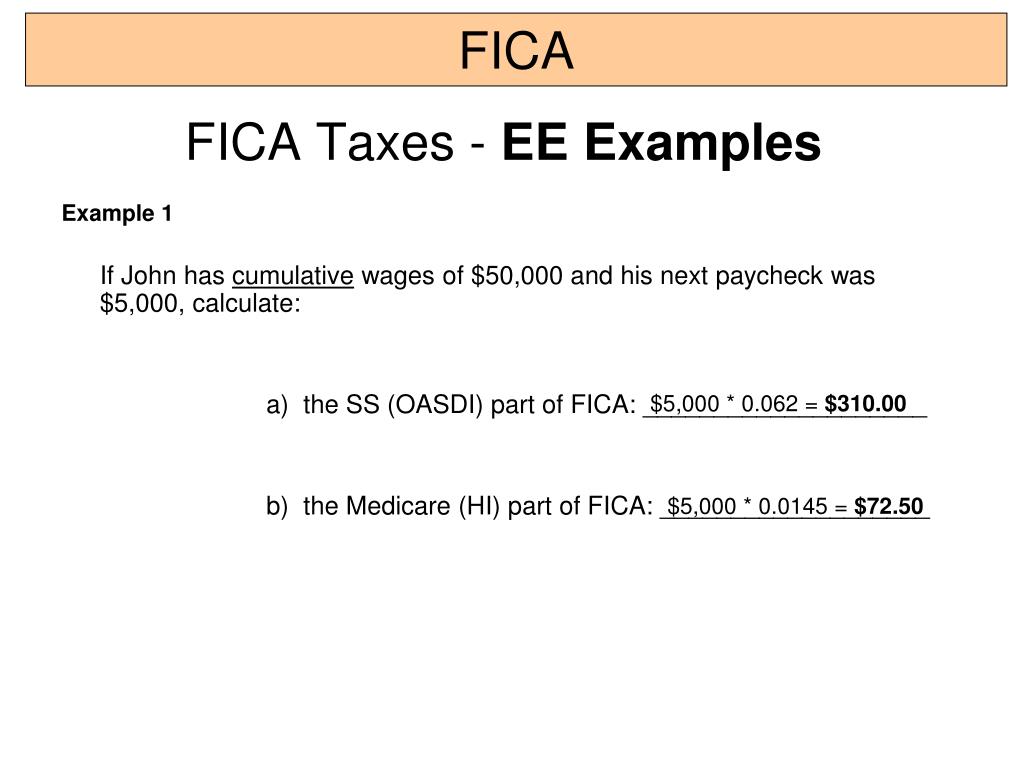

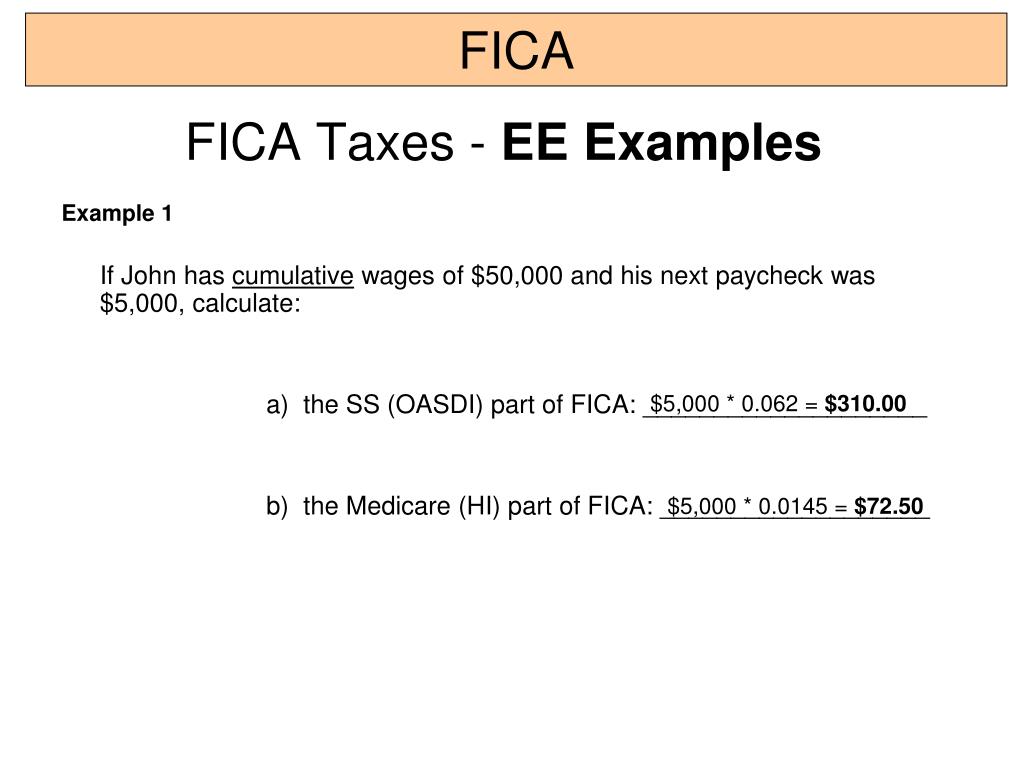

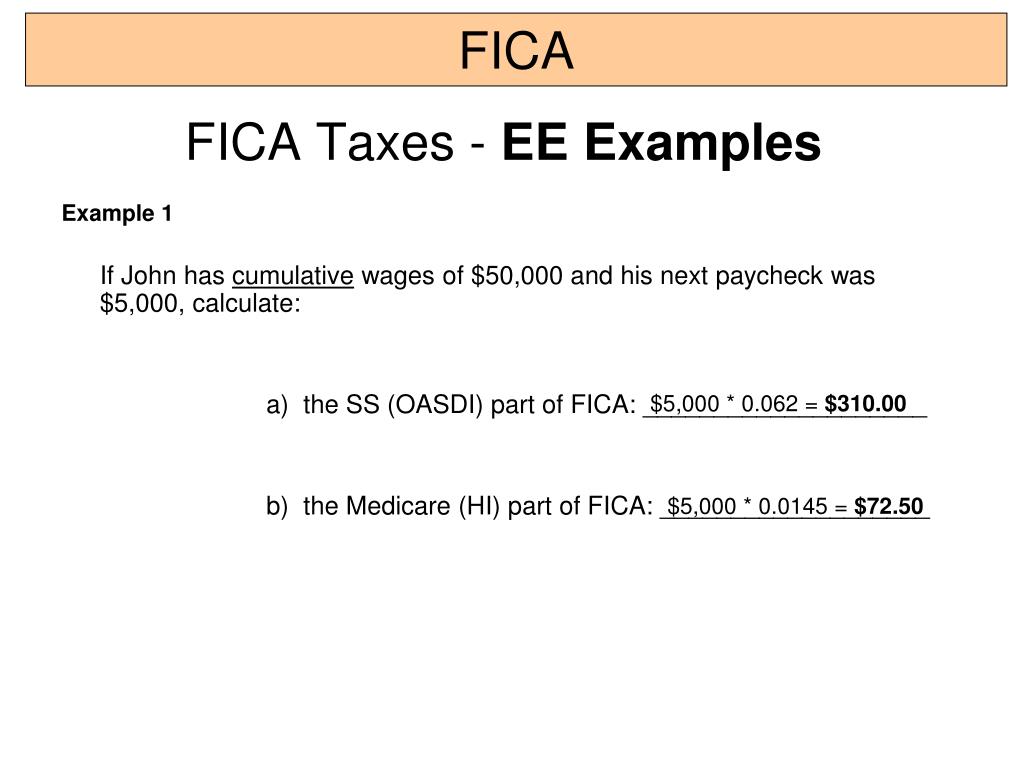

What is OASDI tax?

OASDI stands for Old Age, Survivors and Disability Insurance. It's a tax that you and your employer both pay to fund Social Security. In fact, it's often called the "Social Security" tax. Making matters more complicated, the OASDI tax is part of FICA taxes, which stands for the Federal Insurance Contributions Act.

How much is OASDI 2021?

OASDI is paid on wages up until you earn $142,800," she says. She adds that $142,800 is for 2021. It changes every year. Last year, self-employed taxpayers paid 12.4% of their income to the OASDI tax up to $137,700.

Can non-resident aliens get out of OASDI?

Some nonresident aliens can get out of paying the OASDI tax (though most do). Foreign government employees can get out of it. But for most people reading this, it's a certainty. You're paying it. But at least you'll get your money back when you start receiving Social Security checks.

Do I have to pay back taxes if I don't pay my taxes?

Well, yes and no. Technically, you don't (payments don't automatically come out of the checks or direct deposits you are sent). But you're supposed to pay the OASDI tax. You're supposed to pay the 12.4% yourself. If you don't pay those taxes, you'll owe back taxes. There's really no way out of this.

Can you get out of paying if you are a religious?

Sometimes you can get out of paying if you are part of a qualifying religious group. This is very rare, though. You and your employer both need to be part of the religious group, which needs to have been in existence continuously since or before Dec. 31, 1950, and there are other qualifiers.

Will Social Security increase over the next 10 years?

Yes, but don't start spending that money you haven't earned yet. Since you brought it up, President Joe Biden proposed a plan during his campaign in which the cap would be raised to $400,000. That would, it has been estimated, increase Social Security revenue by $740 billion over the next 10 years.

Does an S corp pay taxes on W-2s?

Because OASDI is only paid on earned wages, S-corps only pay it on the wages reported on their W-2s, and then they don't pay the tax on the distributions they take from their company. Whereas a sole proprietor or single member LLC will pay that 12.4% tax on all income up until that $142,800 threshold.".

How to get a FICA tax refund?

1. Use Sprintax for FICA Tax Refund. FICA taxes are paid by the employer to the IRS. They don’t keep it with them after deducting from your paycheck. So, Employer is going to ask you to get refund directly from the IRS. There’s an easy way to request refund using Sprintax.

What is FICA tax?

FICA stands for The Federal Insurance Contributions Act. Do you want to know how to get a FICA Tax refund from IRS if you paid those taxes while on F1 Visa, CPT or OPT? FICA tax = 6.2 % for Social Security + 1.45 % Medicare tax. Students on F1 Visa who are working on OPT are Exempt from FICA Tax for a certain period.

Do I have to pay FICA taxes on my paycheck?

In other words, you don’t have to pay FICA taxes on your paycheck. Some employers would deduct those taxes from your paycheck. But, you can get a refund on FICA taxes from the IRS. This guide will walk you through the instructions and additional details. FICA stands for The Federal Insurance Contributions Act.

Can I claim FICA back from my paycheck?

The employer’s payroll processing team should be aware of this. If not, no worries , you can educate them and ask them not to deduct FICA taxes from your paycheck. Worst Case: If they continue to deduct the FICA taxes, you can claim it back while filing your taxes in April (or later).

Do non-resident aliens pay Social Security?

Nonres ident aliens, in general, are also liable for Social Security/Medicare Taxes on wages paid to them for services performed by them in the United States, with certain exceptions based on their nonimmigrant status. The following classes of nonimmigrants and nonresident aliens are exempt from U.S. Social Security and Medicare taxes:

Can I get my FICA tax refund back?

You can ask your employer to read the IRS site about FICA Taxes. If they continue to deduct taxes, then you can request a refund of FICA taxes withheld from your paycheck back from IRS.