When is an a7003 nebulizer considered for coverage?

A small volume nebulizer (A7003, A7004, A7005), and related compressor (E0570) are considered for coverage when it is reasonable and necessary to administer the following FDA-approved inhalation solutions listed below:

What is a Medicare reimbursement rate for CPT codes?

A Medicare reimbursement rate is the amount of money that Medicare pays doctors and other health care providers for the services and items they administer to Medicare beneficiaries. CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes.

How to get reimbursement from Medicare?

How to Get Reimbursed From Medicare To get reimbursement, you must send in a completed claim form and an itemized bill that supports your claim. It includes detailed instructions for submitting your request. You can fill it out on your computer and print it out.

What is the CPT code for a filter nebulizer?

An E0565 or E0572 compressor and filtered nebulizer (A7006) are c onsidered for coverage when it is reasonable and necessary to administer pentamidine to beneficiaries with HIV, pneumocystosis, or complications of organ transplants (refer to the Group 1 Codes in the LCD-related Policy Article for applicable diagnoses).

Does Medicare pay for an Albuterol inhaler?

Generic albuterol is covered by most Medicare and insurance plans, but some pharmacy coupons or cash may be lower.

Are ultrasonic nebulizers covered by Medicare?

Does Medicare Cover Nebulizers? Medicare covers nebulizers as durable medical equipment. Nebulizers, along with accessories and medications, are all covered by Medicare Part B if they're used at home. Medicare will pay for nebulizers only if you have a prescription for a medically necessary reason.

How do I bill Medicare for a nebulizer?

For Medicare to cover the cost of a nebulizer, it must have an expected life span of 3 years or more and must be purchased or rented from an approved supplier. If someone rents their equipment, they automatically own the equipment after 13 months.

Does Medicare cover CPT code?

The Level II HCPCS codes, which are established by CMS's Alpha-Numeric Editorial Panel, primarily represent items and supplies and non-physician services not covered by the American Medical Association's Current Procedural Terminology-4 (CPT-4) codes; Medicare, Medicaid, and private health insurers use HCPCS procedure ...

What diagnosis codes will cover nebulizer?

For HCPCS codes A4619, E0565, E0572:CodeDescriptionA15.0Tuberculosis of lungB20Human immunodeficiency virus [HIV] diseaseB59PneumocystosisE84.0Cystic fibrosis with pulmonary manifestations60 more rows

Does Medicare pay for breathing machine?

Medicare pays the supplier to rent a CPAP machine for 13 months if you've been using it without interruption. After Medicare makes rental payments for 13 continuous months, you'll own the machine.

What is CPT code for nebulizer?

You should submit the appropriate evaluation and management (E/M) office visit code, the code for the nebulizer treatment (94640, “Pressurized or nonpressurized inhalation treatment for acute airway obstruction or for sputum induction for diagnostic purposes (e.g., with an aerosol generator, nebulizer, metered dose ...

What is the CPT code for nebulizer treatment?

94640 – Pressurized or non-pressurized inhalation treatment for acute airway obstruction or for sputum induction for diagnostic purposes (e.g., with an aerosol generator, nebulizer, metered dose inhaler or intermittent positive pressure breathing [IPPB] device).

What is the HCPCS code for nebulizer?

E0570HCPCS code E0570 for Nebulizer, with compressor as maintained by CMS falls under Humidifiers and Nebulizers with Related Equipment .

Why would Medicare deny a claim?

Medicare may issue denial letters for various reasons. Example of these reasons include: You received services that your plan doesn't consider medically necessary. You have a Medicare Advantage (Part C) plan, and you went outside the provider network to receive care.

What procedures are not covered by Medicare?

Some of the items and services Medicare doesn't cover include:Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

What are Medicare give back benefits?

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium.

Document Information

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply.

CMS National Coverage Policy

CMS Manual System, Pub. 100-03, Medicare National Coverage Determinations Manual, Chapter 1, Section 200.2, Section 280.1

Coverage Guidance

For any item to be covered by Medicare, it must 1) be eligible for a defined Medicare benefit category, 2) be reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed body member, and 3) meet all other applicable Medicare statutory and regulatory requirements. The purpose of a Local Coverage Determination (LCD) is to provide information regarding “reasonable and necessary” criteria based on Social Security Act § 1862 (a) (1) (A) provisions. In addition to the “reasonable and necessary” criteria contained in this LCD there are other payment rules, which are discussed in the following documents, that must also be met prior to Medicare reimbursement:.

How long does it take for Medicare to process a claim?

Medicare claims to providers take about 30 days to process. The provider usually gets direct payment from Medicare. What is the Medicare Reimbursement fee schedule? The fee schedule is a list of how Medicare is going to pay doctors. The list goes over Medicare’s fee maximums for doctors, ambulance, and more.

What to do if a pharmacist says a drug is not covered?

You may need to file a coverage determination request and seek reimbursement.

Does Medicare cover out of network doctors?

Coverage for out-of-network doctors depends on your Medicare Advantage plan. Many HMO plans do not cover non-emergency out-of-network care, while PPO plans might. If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company.

Do participating doctors accept Medicare?

Most healthcare doctors are “participating providers” that accept Medicare assignment. They have agreed to accept Medicare’s rates as full payment for their services. If you see a participating doctor, they handle Medicare billing, and you don’t have to file any claim forms.

Do you have to pay for Medicare up front?

But in a few situations, you may have to pay for your care up-front and file a claim asking Medicare to reimburse you. The claims process is simple, but you will need an itemized receipt from your provider.

Do you have to ask for reimbursement from Medicare?

If you are in a Medicare Advantage plan, you will never have to ask for reimbursement from Medicare. Medicare pays Advantage companies to handle the claims. In some cases, you may need to ask the company to reimburse you. If you see a doctor in your plan’s network, your doctor will handle the claims process.

Can a doctor ask for a full bill?

In certain situations, your doctor may ask you to pay the full cost of your care–either up-front or in a bill; this might happen if your doctor doesn’t participate in Medicare. If your doctor doesn’t bill Medicare directly, you can file a claim asking Medicare to reimburse you for costs that you had to pay.

What is the HCPCS code for a nebulizer?

A7003 is a valid 2021 HCPCS code for Administration set, with small volume nonfiltered pneumatic nebulizer, disposable or just “ Nebulizer administration set ” for short, used in Lump sum purchase of DME, prosthetics, orthotics .

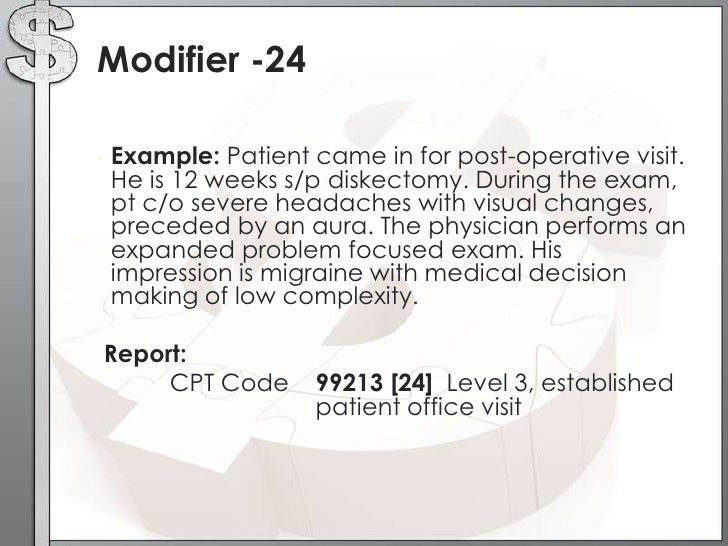

What is a modifier in a report?

Modifiers may be used to indicate to the recipient of a report that: A service or procedure has both a professional and technical component. A service or procedure was performed by more than one physician and/or in more than one location. A service or procedure has been increased or reduced.

General Information

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply.

CMS National Coverage Policy

Title XVIII of the Social Security Act (SSA) §1833 (e) prohibits Medicare payment for any claim lacking the necessary documentation to process the claim

Article Guidance

Medicare provides preventive coverage only for certain vaccines. These include:

ICD-10-CM Codes that Support Medical Necessity

Covered ICD-10 codes for Influenza, Pneumococcal, Pneumococcal and Seasonal Influenza Virus Vaccines received during the same visit and Hepatitis B

Bill Type Codes

Contractors may specify Bill Types to help providers identify those Bill Types typically used to report this service. Absence of a Bill Type does not guarantee that the article does not apply to that Bill Type.

Revenue Codes

Contractors may specify Revenue Codes to help providers identify those Revenue Codes typically used to report this service. In most instances Revenue Codes are purely advisory. Unless specified in the article, services reported under other Revenue Codes are equally subject to this coverage determination.

What is the unit dosage of J7620?

For instance, J7620 describes albuterol and ipratropium, with unit dosages of 2.5 mg and 0.5 mg, respectively. Code J7620 is often called a “DuoNeb” because the nebulizing product is a combination of two medication agents. For higher doses, if supported by medical necessity, you may report J7620 x 2 (or more).

Who must capture all pertinent information in their documentation?

Physicians must capture all pertinent information in their documentation and, in turn, coders (or those who validate pre-coded electronic health record charges) must account for all related services, medications, and supplies.

Do you have to bill technical and professional components separately?

Some payers may require billing the technical and professional components separately with modifiers TC Technical component and 26 Professional component. For example, a patient who has suffered asthma attacks over the past six months is diagnosed with acute exacerbation of asthma, confirmed by an O2Sat.

Can you bill O2Sat for cough?

Even a persistent cough with no definitive diagnosis may justify a separately billable O2Sat. Based on the results of the O2Sat, the physician may decide the patient warrants further (possibly immediate) services, such as inhalation treatment.

Is there a charge for nebulizing equipment?

When the medication and mask are provided in the doctor’s office, there is no charge for the use of the nebulizing machinery (e.g., E0570 Nebulizer, with compressor) because this is rolled into the visit. For example, a patient with coughing, wheezing, and shortness of breath arrives at the emergency room (ER).