How can I reduce my Medicare Part B premium? To request a reduction of your Medicare premium, call 800-772-1213 to schedule an appointment at your local Social Security office or fill out form SSA-44 and submit it to the office by mail or in person. Who is eligible for Medicare Part B reimbursement?

Full Answer

How to appeal a higher Medicare Part B premium?

There are 7 qualifying life-changing events:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

How can I reduce my Medicare premiums?

Those eight events are:

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage (Retirement)

- Work Reduction (Partial-Retirement)

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment (if your employer went through bankruptcy or reorganization that caused your income to change)

Do You Pay Part B premium with Medicare Advantage?

The Medicare Advantage insurance company can pay either the whole or a portion of the Part B premium for enrollees. Since the Advantage plan handles your claim instead of Medicare, these plans make more sense than a standard Part C policy. How can Medicare Advantage plans give you back some of your Part B premium money?

How can I reduce my Medicare Part B premiums?

Those premiums are a burden for many seniors, but here's how you can pay less for them.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.

Why is my Medicare Part B bill so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Can Medicare Part B be down?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.

Why did Medicare Part B premium go up so much in 2022?

CMS explained that the increase for 2022 was due in part to the potential costs associated with the new Alzheimer's drug, Aduhelm (aducanumab), manufactured by Biogen, which had an initial annual price tag of $56,000.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.

What is Social Security extra help?

An Extra Help "Notice of Award" from Social Security. An orange notice from Medicare that says your copayment amount will change next year. A monthly benefit paid by Social Security to people with limited income and resources who are disabled, blind, or age 65 or older.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What happens if you opt out of Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Why do I have to pay for Medicare Part B?

You must keep paying your Part B premium to keep your supplement insurance. Helps lower your share of costs for Part A and Part B services in Original Medicare. Some Medigap policies include extra benefits to lower your costs, like coverage when you travel out of the country.

How much is Medicare Part B 2021?

The standard premium for Medicare Part B is $148.50 per month in 2021 – but that assumes you’re not a higher earner. Those with higher income levels are subject to higher premium costs.

How long can you go without Medicare?

But for each 12-month period you go without Medicare coverage despite being eligible, you’ll be hit with a penalty that raises your Part B premium cost by 10 percent.

Is Medicare Part A free for 2021?

July 13, 2021. facebook2. twitter2. While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here’s how you can pay less for them. 1.

Can you defer income to future taxes?

If you’re able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns.

Why do people get higher Medicare premiums?

The most common reason that people get assessed higher Medicare premiums is because they have recently retired. Their income two years ago was higher than it is now that they are retired. You can file a reconsideration request to appeal your Medicare IRMAA.

Do Medicare premiums go toward Part B?

Many people who are new to Medicare are surprised at the monthly cost of Part B Medicare premiums. Medicare premiums sometimes come as a shock to new Medicare beneficiaries. Maybe you noticed that the federal government has been deducting taxes out of your paychecks for years. And yes, these deductions go toward funding your future Part A Medicare ...

Can you deduct Medicare premiums on taxes?

Yes, Medicare premiums can be deducted from taxes in the right circumstances. if you have had enough medical expenses to file an itemized deduction for medical expenses on your Form 1040.

Does Medicare Advantage have a zero premium?

In some states though, particularly in Florida, there are some Medicare Advantage plans that not only have a zero-premium, but also offer you a Part B premium reduction. The way this works is that the Advantage plan pays for a portion of your Part B premiums.

Do you have to be enrolled in Medicare Supplement or Medicare Advantage?

Whether you decide to enroll in a Medicare Supplement or a Medicare Advantage plan, you must first be enrolled in both Medicare Parts A and B. That means that you are paying for Part B every month even if you enroll in a low-premium Medicare Advantage plan.

Does Social Security ask for proof of income?

Social Security will ask for proof of your higher income then versus now. If you can show that your income is lower than before, Social Security may reduce those premiums for you and lower or cancel your IRMAA.

What is the standard Part B premium for 2014?

In 2014, the standard Part B premium will be the same as now: $104.90 a month . The threshold for paying the higher premiums is modified adjusted gross income of $85,000, or $170,000 for married couples filing joint tax returns.

What to do if you stop working and cut your Part B?

If you or your spouse stop working or cut work hours, you also can question the excess Part B premium. In such circumstances, contact Social Security, which handles Medicare applications. Be ready to provide documentation to support your appeal.

How much is MAGI for Part B?

MAGI here includes tax-exempt interest as well as your regular AGI. If you're just over those thresholds, you'll pay $146.90 a month for Part B. Premiums step up three more times at various higher levels of MAGI. The highest premium is $335.70 a month.

Will Medicare Part B premiums stay the same?

Premiums will stay the same in 2014 for Medicare Part B, stepping up by the same amounts as before for higher-income retirees and other participants in the government health care plan.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

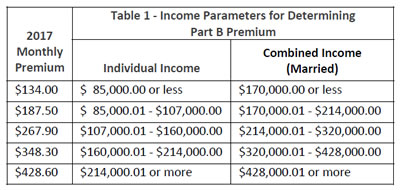

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is IRMAA 2021?

Right now in 2021, Part D premiums range from around $7 to over $180/month, depending on where you live. (For more on finding the right Part D plan, visit our pages about Part D .)

What happens if Medicare denies your appeal?

If they deny your appeal, they will provide instructions on how to appeal the denial to an Administrative Law Judge. Be aware that you will continue to pay the higher Medicare Part B premium while your appeal is in process. However, if your appeal is approved, it could be retroactive for any months you have already paid.

How much is Part B deductible in 2021?

In return for covering a small, once annual Part B deductible ($203 in 2021) you can sometimes find premiums as much as $250 lower than a Plan F. That keeps money in your pocket. Medigap plans L, M, N and High Deductible F are also great solutions for high income individuals.

What happens if you owe a higher premium?

If they determine you owe a higher premium based on your MAGI, they will send you a letter to notify you of your new amount. They will also give you the reason for their determination. If you disagree with this amount, you have the right to appeal it via a reconsideration request.

What is MAGI on SSA-44?

Your MAGI amount is made up of your total adjusted gross income plus any tax-exempt interest income. (The Form SSA-44 has instructions which explain which line numbers from your IRS Tax return that you will use to calculate this number).