How can I reduce my Medicare premiums?

Aug 30, 2021 · You can file a reconsideration request to appeal your Medicare IRMAA. Social Security will ask for proof of your higher income then versus now. If you can show that your income is lower than before, Social Security may reduce those premiums for you and lower or cancel your IRMAA. Pay Medicare Premiums with your HSA

How to save money on your Medicare premiums?

Assuming your MAGI in retirement will be less than $88,000, you can eliminate the additional premium. That is over $1,400 in savings. Return Form SSA-44 to your local Social Security Office Here is how to reduce your Part B premiums: complete form SSA-44, which can be found on the Social Security Administrations website, SSA.gov/forms.

Could Medicare premiums lower your taxes?

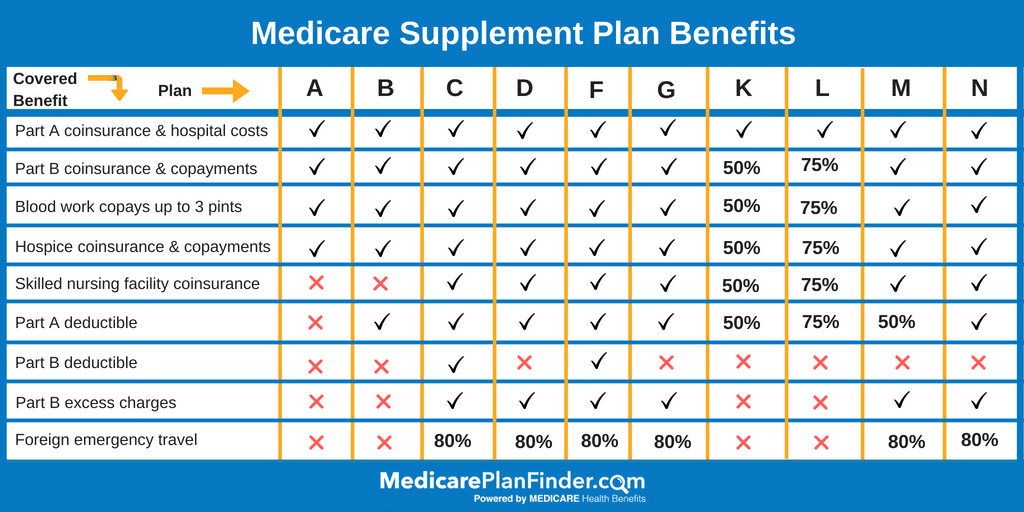

Jun 14, 2015 · Because the benefits are standardized, price is the only difference between plans. That means you can lower your Medicare Supplement premiums without losing or changing benefits. By standardizing the plans it means that the benefits of all Plan F’s are identical, all Plan G’s are identical, all Plan N’s are identical, and so on. In fact, Medicare tells the supplement …

Can I avoid paying more in Medicare premiums?

Dec 21, 2016 · Keep filing the Life-Changing Event form yearly until your income lowers to the basic amount. Don't forget a onetime increase in your income such as property that is sold, cashing in your IRA, or...

How can I get my Medicare payments lowered?

Do Medicare premiums decrease with income?

How do I get my $144 back from Medicare?

What income level does Medicare premiums increase?

Why is my Medicare premium so high?

What income is used to determine Medicare premiums 2021?

Will Social Security get a $200 raise in 2021?

Why do doctors not like Medicare Advantage plans?

Can I get Medicare Part B for free?

What is deducted from your monthly Social Security check?

Does Social Security count as income?

Is Social Security income included in MAGI for Medicare?

Can you deduct Medicare premiums?

Deductible medical expenses include premiums you paid for Parts B, D, and Medicare Advantage. However, there are limits to this deduction. First, you must have enough total deductions to itemize your deductions rather than taking the standard deduction.Second, you cannot deduct all your medical charges.

Does having money in retirement lower your premiums?

Having money in a retirement account won’t lower your premiums. However, it will help you afford healthcare premiums along with all your other living expenses. It’ll feel like you reduce Medicare premiums when you have more money set aside for retirement.

Do you pay Medicare if you are a high income taxpayer?

Most people pay a standard rate for Medicare. If you’re a high-income taxpayer, you pay more. If your income is more than $88,000 for individuals or $176,000 for married couples, you’ll have a higher premium or an Income Related Monthly Adjustment Amount .In assessing IRMAA, Medicare doesn’t look at your current income.

Does Medicare look at your income?

If your income is more than $88,000 for individuals or $176,000 for married couples, you’ll have a higher premium or an Income Related Monthly Adjustment Amount .In assessing IRMAA, Medicare doesn’t look at your current income. It looks back two years.

How to avoid late penalties on Medicare?

Avoid Late Penalties by Signing Up When First Eligible. While avoiding penalties doesn’t directly reduce Medicare premiums, it does prevent them from becoming higher. You can sign up for Medicare three months before your 65th birthday month. You then have a seven-month-long Initial Enrollment Period. There’s a financial motive to enroll ...

How long do you have to wait to sign up for Medicare?

You can sign up for Medicare three months before your 65th birthday month. You then have a seven-month-long Initial Enrollment Period. There’s a financial motive to enroll during that time. In general, if you wait and sign up for Part B later, you will pay a late enrollment penalty.

Why do people delay enrolling in Medicare?

Some people delay enrolling in Medicare because they have other insurance that’s cheaper or has other advantages. Those advantages won’t matter if your plan doesn’t count as “creditable coverage” and you have to pay a late enrollment penalty.

Why is price the only difference between Medicare plans?

Because the benefits are standardized, price is the only difference between plans. That means you can lower your Medicare Supplement premiums without losing or changing benefits. By standardizing the plans it means that the benefits of all Plan F’s are identical, all Plan G’s are identical, all Plan N’s are identical, and so on. ...

Do Medicare Supplement plans charge different prices?

Government publication on Medicare Supplement plans consumers are warned that although the plans are identical, different insurance companies can and do charge wildly different prices.

Is Medicare Supplement Plan standardized?

Unlike Medicare Advantage Plan, Medicare supplement plans are standardized by the Center for Medicare and Medicaid Services. Where Medicare Parts A & B pay for 80% or more of the covered medical costs, the Medicare supplement plan is designed to cover all or some of Medicare’s co-pays and deductibles.

What is Medicare Supplement Plan?

Where Medicare Parts A & B pay for 80% or more of the covered medical costs, the Medicare supplement plan is designed to cover all or some of Medicare’s co-pays and deductibles. That is why a Medicare supplement is also called a Medigap plan. It fills the gaps left by Original Medicare.

What does it mean to standardize Medicare?

By standardizing the plans it means that the benefits of all Plan F’s are identical, all Plan G’s are identical, all Plan N’s are identical, and so on. In fact, Medicare tells the supplement plans what must be covered, what to pay and when. Although the plans and the benefits they offer are required to be identical in every way, ...

What is Medicare billing?

Medicare sets the prices for services to Medicare beneficiaries (aka you the patient) Medicare becomes a “one stop” billing center. After Medicare makes its payment, Medicare sends the remaining claim onto the Medigap insurer for payment. All payment goes directly to the doctor’s office or hospital.

Can a doctor bill Medicare?

The contract also provides that the doctor’s office cannot bill a Medicare beneficiary unless you give written permission via an Advanced Beneficiary Notification (ABN). The only money allowed to be collected from a Medicare beneficiary, without an ABN, are any co-pays or deductibles determined by the Medigap policy.

Will Medicare premiums decrease in 2020?

If you are still making a good income, whether through working or investments, now is a great time to determine if some proactive tax planning to lower your 2020 income will also help you decrease your premiums for Medicare. For those of you who don’t know, your Medicare premiums are based on your income.

Can I deduct my Medicare premiums if I am still employed?

If you are a Medicare recipient who is still employed, you have a few ways to lower your AGI and MAGI. The easiest way is to contribute to your workplace 401 (k) plan. Self-employed individuals should be able to deduct their Medicare premiums.

Is Medicare based on income?

For those of you who don’t know, your Medicare premiums are based on your income. The formula for Medicare premiums contains cliffs, leading to dramatically higher premiums if you make just one extra dollar in a given tax year. Similarly, some adjustments for inflation for 2021 can further complicate planning for your Medicare premiums.

When will Medicare Part D kick in?

By 2021, surcharges for Medicare Part B and Medicare Part D will kick in for singles who had more than $88,000 of income. Medicare surcharge comes into play for couples who made more than $176,000, based on their 2019 tax returns.

Does Medicare surcharge mean better coverage?

editor. To be clear, paying higher Medicare premiums will not translate into better coverage or care. The Medicare surcharge simply means that recipients will have varying premiums for the same service and coverage.

Can self employed people deduct Medicare premiums?

The easiest way is to contribute to your workplace 401 (k) plan. Self-employed individuals should be able to deduct their Medicare premiums. More tax deductions should result in a lower AGI overall, which could help lower future Medicare surcharges.

When is the best time to do a quick review of where you expect your income to fall?

Year’s end is the best time to do a quick review of where you expect your income to fall. If you procrastinate and wait until the tax-filing season, you will not be able to make most of the money moves that could help lower your Medicare premiums in the future. Keep in mind, the tax planning that you do now is for your 2022 Medicare premiums ...

When does Medicare enrollment end?

Your initial window to enroll in Medicare begins three months before the month of your 65th birthday, and ends three months after that month. If you don’t sign up during that seven-month period, you can enroll during Medicare’s General Enrollment Period (January 1 through March 31) each year.

Is Medicare Part A free for 2021?

July 13, 2021. facebook2. twitter2. While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here’s how you can pay less for them. 1.

How long can you go without Medicare?

But for each 12-month period you go without Medicare coverage despite being eligible, you’ll be hit with a penalty that raises your Part B premium cost by 10 percent.

How much is Medicare Part B 2021?

The standard premium for Medicare Part B is $148.50 per month in 2021 – but that assumes you’re not a higher earner. Those with higher income levels are subject to higher premium costs.

Can you defer income to future taxes?

If you’re able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns.

How to request a reduction in Medicare premium?

To request a reduction of your Medicare premium, call 800-772-1213 to schedule an appointment at your local Social Security office or fill out form SSA-44 and submit it to the office by mail or in person.

How much will Medicare premiums go up in 2021?

Standard Medicare premiums can, and typically do, go up from year to year. Increases from the standard premium, which is $148.50 a month in 2021, start with incomes above $88,000 for an individual and $176,000 for a couple who file taxes jointly. Updated May 13, 2021.

Will Medicare Part B premiums stay the same?

Premiums will stay the same in 2014 for Medicare Part B, stepping up by the same amounts as before for higher-income retirees and other participants in the government health care plan.

What to do if you stop working and cut your Part B?

If you or your spouse stop working or cut work hours, you also can question the excess Part B premium. In such circumstances, contact Social Security, which handles Medicare applications. Be ready to provide documentation to support your appeal.

What is the standard Part B premium for 2014?

In 2014, the standard Part B premium will be the same as now: $104.90 a month . The threshold for paying the higher premiums is modified adjusted gross income of $85,000, or $170,000 for married couples filing joint tax returns.

How much is MAGI for Part B?

MAGI here includes tax-exempt interest as well as your regular AGI. If you're just over those thresholds, you'll pay $146.90 a month for Part B. Premiums step up three more times at various higher levels of MAGI. The highest premium is $335.70 a month.