Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Is Plan G the best Medicare supplement plan?

With Plan F not available to people new to Medicare, Medigap Plan G has now become the most popular of all the Medicare supplement plans for 2022, and for good reason. Plan G offers fantastic coverage for those on Part A and B Medicare, with only one small annual deductible to pay.

What are Medicare supplement plans does Aetna offer?

What is an Aetna Medicare Supplement Plan? An Aetna Medicare Supplement plan may help you pay for certain out-of-pocket costs associated with Original Medicare, including copayments, coinsurance, and deductibles. This coverage could give you some peace of mind, considering that Original Medicare has no out of pocket maximum.

What Medicare plans does Aetna cover?

All plans acquired through Aetna that cover parts A and B of Original Medicare are called Medicare Advantage plans because they are acquired through a private Medicare-approved provider. These plans are considered Part C of Medicare.

Does Aetna have a Medicare Advantage plan?

Depending on where you live, you may be able to enroll in one of the following types of Aetna Medicare Advantage plans: Aetna Medicare Advantage HMO (Health Maintenance Organization) plans may have lower costs than other types of Medicare Advantage plans because they use a contracted provider network to keep health-care expenses low.

_AHD.pdf.transform/download/image.jpeg)

What is plan G Medicare supplement?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

What does supplemental plan G pay for?

Medicare Supplement Plan G covers your percentage of any medical benefit that Original Medicare covers, except for the outpatient deductible. So, it helps to pay for inpatient hospital costs, such as the first three pints of blood, skilled nursing facility care, and hospice care.

Does Medicare Plan G pay for everything?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What is not covered under plan G?

Also, Plan G usually doesn't cover prescription drugs. Some MedSup policies used to, but that's no longer the case. For that, you need to enroll in Medicare Part D.

Does Plan G cover prescriptions?

Medicare Supplement plans, including Plan G, do not cover the cost of prescription medications. To tap into this coverage, you'll need to add a Medicare Part D prescription drug policy to your Original Medicare plan.

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What is the monthly premium for Plan G?

Understanding your health-care costs with Medicare Plan GOriginal MedicareMedicare Plan GPart B premium$1,782$1,782Medigap premium$0$1,500Part A deductible$1,484$0Part B deductible$203$2033 more rows•Sep 22, 2021

What is the plan g deductible for 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.

Does Medicare Plan G have a maximum out-of-pocket?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year. If you are interested in an out-of-pocket limit, consider Plan K or Plan L. Plan G is most similar in coverage to Plan F.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

Are all Plan G Medicare supplements the same?

All Medicare Supplement plans, including Plan G, are standardized in the following ways: Benefits – You don't have to worry about which company offers the best or most benefits. The benefits of a Plan G will be the same regardless of the company you select.

A Short History of Aetna Medicare Supplement Plans

First, you should know that this company has been around a long time. Aetna first opened its doors as a life insurance company in 1850. In 1963, an...

Why Consider Aetna Medicare Supplement Plans in 2018?

Aetna paid their very first Medicare insurance claim in 1966, only a few years after Medicare opened its doors. If you consider purchasing an Aetna...

Aetna Medicare Supplement Plan Flexibility

There are some reasons to consider Medicare Supplements over Advantage: 1. No networks: The first problem is that almost all MA plan protection rel...

Compare The Most Popular Aetna Medicare Supplement Plans in 2018

One of the good things about Medicare Supplement plans is that they are all standardized by the government. Most states rely on federal standards;...

Best Aetna Medicare Supplement Plans For 2018

If you plan to travel and would prefer to just pay for your insurance and not worry about most healthcare costs, you might be happiest with Plan F....

Enrolling in Aetna Medicare Supplement Plans For 2018

Unlike with Medicare Advantage, there aren’t any certain times of the year that you have to wait for the enrollment period. There are times when yo...

Sample Rates For Aetna Medicare Supplement Plans For 2018

Naturally, the price you have to pay each month for your Medigap could impact your choices. Typically, retired people need to manage their budgets...

Why We Recommend Aetna Medicare Supplement Plans in 2018 to Many Clients

Aetna has established themselves for many decades as a top performer in the Medicare Supplement market. In addition, they have won clients over wit...

What is Medicare Supplement?

With a Medicare Supplement plan, you’ll enjoy a variety of benefits, including: No restrictive provider networks. The freedom to visit any physician, specialist or hospital that accepts Medicare patients.

Does Medicare cover out of pocket expenses?

A reliable way to limit your out-of-pocket costs. Medicare provides you with coverage for health-related expenses, but it doesn’t cover everything. There may be some gaps in Medicare coverage. A Medicare Supplement Insurance plan can help you with out-of-pocket expenses.

What is Medicare Plan G?

FAQ. Take Aways. Medicare Plan G is the fastest growing Medigap Plan in America. Aetna Plan G does not use a network, go wherever Original Medicare is accepted. Aetna offers a 30 day free look period on new policies.

When does Medicare Supplement Plan G start?

Medicare Supplement Plan G offers the most comprehensive coverage for seniors whose Medicare coverage starts on Jan. 1, 2020.

Why is Aetna Plan G modest?

Typically modest for Aetna Plan G due to the larger number of seniors insured. Aetna uses the “attained-age” rating method when setting monthly premiums for Medicare Supplement insurance plans. Attained-age rating bases premiums on your current age.

What is a PPO plan?

A PPO is a preferred provider organization. The PPO is only available with a Medicare Advantage plan. It does not work with Original Medicare. Medicare Plan G does not use a network. You can see any doctor you choose that excepts Original Medicare.

When will Medicare Part B be available?

Offers the highest benefit level for beneficiaries new to Medicare starting Jan. 1, 2020. Except for the Medicare Part B deductible, fills in the coverage gaps left after Original Medicare (that’s why it’s frequently called Medigap Plan G)

Which plan has the highest number of beneficiaries?

Medicare Plan F has the highest number of beneficiaries enrolled, but Plan G is quickly catching up. Here’s why: Plan F is no longer available to those who become eligible for Medicare after Jan. 1, 2020. Plan G offers the highest level of coverage for seniors whose Medicare enrollment starts after Jan. 1, 2020.

Does Aetna Medicare plan G have a rate lock?

If you’re shopping for a Medigap policy, Aetna Medicare Plan G offers some advantages: 12-month rate-lock: A guarantee that your rates won’t increase the first year.

How long does Medicare Supplement Plan A last?

This is typically one of the least expensive supplement policies; you can expect the following benefits if your purchase a Medicare Supplement Plan A: Full coverage for your Medicare Part A hospital coinsurance and hospital costs, including an extra 365 days of coverage after Original Medicare coverage is exhausted.

What is Medicare Supplement?

To help make costs associated with health care more predictable, many Medicare beneficiaries purchase Medicare Supplement (Medigap) plans, which help fill in the financial gaps between your medical expenses and what Original Medicare will pay .

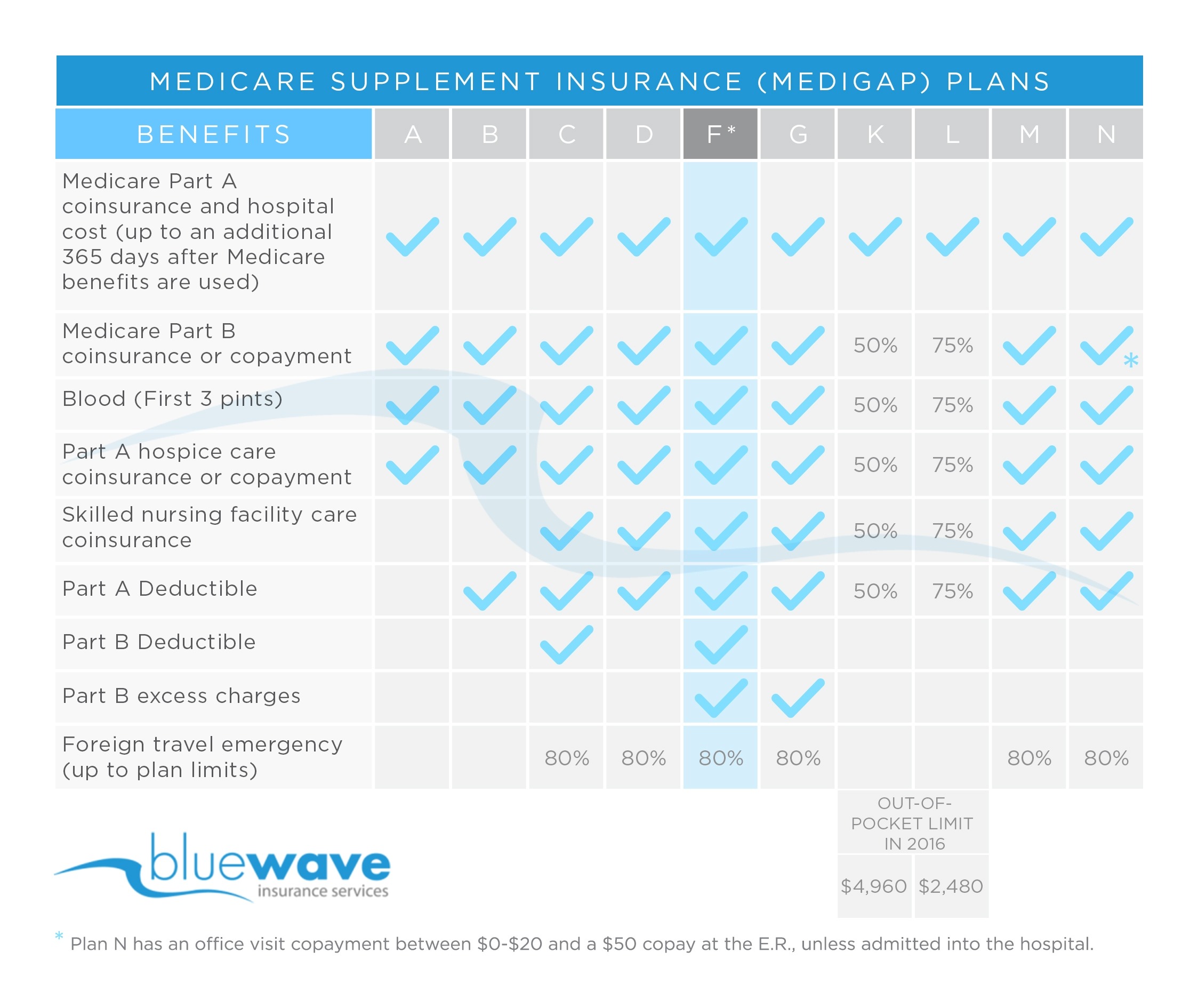

What states offer Medicare Supplement Plans?

Medicare Supplement plans are standardized into 10 different policy types, designated by letters from A through N, which are available in all but three states: Wisconsin, Minnesota, and Massachusetts (these three states offer different standardized plans). Aetna offers three of the 10 available Medicare Supplement plans in the states where these policies are allowed, and each covers different out-of-pocket expenses. Most Medicare Supplement plans allow you to visit any health-care provider that accepts Original Medicare insurance. However, some Medigap plans known as Medicare SELECT plans include provider networks you must use to receive care.

Does Aetna offer Medicare Supplement?

Aetna offers three of the 10 available Medicare Supplement plans in the states where these policies are allowed, and each covers different out-of-pocket expenses. Most Medicare Supplement plans allow you to visit any health-care provider that accepts Original Medicare insurance. However, some Medigap plans known as Medicare SELECT plans include ...

Does Medicare cover copayments?

Last Updated : 10/21/2018 4 min read. If you are a current Original Medicare beneficiary or about to become eligible for Medicare coverage, you know that there are some health-care costs that Original Medicare does not cover, such as copayments and deductibles.

Does Aetna cover vision?

There are monthly premiums associated with all Aetna Medicare Supplement plans in addition to your Original Medicare premiums, and benefits can only be used for services that Original Medicare covers. This means that costs associated with vision and dental care, hearing aids, and private duty nursing, for example, ...

Aetna & Medigap

AM Best – the insurance industry gold standard for quality-assurance ratings – gives Aetna an “A” as a company. This alone should give you a high degree of confidence that Aetna’s plans are competitive and their services are reliable. When you’re shopping for policy’s, it’s important to keep in mind both price AND quality of service.

What is Aetna Medicare Supplement Rate Increase History?

Don’t forget; all insurance companies increase their rates. This practice is not unique to Aetna. It is helpful information to have an idea of a company’s rate increase history, but it is not necessarily make-or-break information.

Does Medicare Advantage include Silversneakers?

The program that many Medicare Advantage plans include in their coverage is SilverSneakers. This program doesn’t cost anything extra for policyholders, and they pay for it when they pay their deductibles or premiums each year or each month.

Does Medicare have unlimited gyms?

There are over 13,000 locations spread throughout the country, and it partners with some Medicare Advantage plans to offer unlimited gym access. Along with unlimited gym access, participants get free fitness classes located in the gym and outside that cater to all experience levels.

Does Medicare cover gym memberships?

Unfortunately, gym memberships are not on the list of covered expenses under Original Medicare. It won’t cover fitness program fees or gym memberships. This means you pay 100% of the costs associated with it if you plan to get a gym or fitness program membership.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G – What does it cover? Plan G is a great option if you’re looking for a plan that has comprehensive benefits and low out of pocket costs.#N#All Medicare Supplement Insurance Plans are Standardized by the government. This means that the plan benefits are exactly the same from company to company.

What does Plan G cover?

Plan G covers Skilled Nursing and rehab facility stays and also Hospice care.

Does Plan G save you money?

Even though Plan F covers the Part B deductible, it’s usually at a much higher cost each month for Plan F premiums . The insurance company charges you much more to pay that deductible for you.

How much does Plan G cover?

Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5.

What is the difference between Plan G and Plan F?

Plan G is most similar in coverage to Plan F. The only difference is that Plan F covers your Part B deductible, while Plan G does not. Plan F will have limited enrollment for some beneficiaries beginning in 2020.

What is the second most comprehensive Medicare supplement plan?

The plans are named by letter, ranging from A to N. Plan G is the second-most comprehensive Medicare supplement plan available, next to Plan F. Plan G is also growing in popularity. 1.

Why do people call Medicare Supplement Plans “Medigap”?

Some people call Medicare supplement plans “Medigap” because they “fill in the gaps” that exist in Medicare. Plan G is one of 10 major Medicare supplement plans currently offered to new Medicare enrollees. The plans are named by letter, ranging from A to N.

How to contact Debra from Medicare?

Call a Licensed Agent: 833-271-5571. Debra is 64 and plans to retire next year. She will apply for Medicare Part A and Part B. Debra loves to be outside, gardening or walking her dogs. She has had a few suspicious lesions removed recently by her dermatologist, who doesn’t accept Medicare assignment.

Does Debra have a Medigap Plan G?

After doing some research, Debra decided to purchase Medigap Plan G, as it will cover any Part B excess charges from her dermatologist and pay for emergency services abroad.

When is the best time to enroll in Medigap?

That’s the six months immediately after you turn 65 and sign up for Part B, when you’re guaranteed by federal law to be accepted by any plan, regardless of health.

What is the most popular Medicare plan?

Plan F is the most popular plan because it covers all of the costs Medicare does not. However, starting in 2020, Plan F like will no longer be available to new beneficiaries.

Is Medicare Supplement Plan a good option?

With Medicare, you may feel as though you are paying more out-of-pocket expenses than you initially thought you would be. To help cover these costs, a Medicare Supplement plan can be a great option.

Does Medicare cover Plan G?

Plan G covers all additional expenses Medicare does not, with the exception of the deductible paid by Part B beneficiaries. With Plan F unavailable new enrollees, Plan G is a popular replacement option for people who opt for supplemental coverage.

Does Aetna offer Medicare?

Aetna offers affordable supplement plans for Medicare subscribers. Aside from affordability Aetna promotes wellness and health within communities by offering grant programs and through the support of non-profit organizations. They are considered top tier within the Medicare Supplement market.