To opt out, you will need to:

- Be of an eligible type or specialty.

- Submit an opt-out affidavit to Medicare.

- Enter into a private contract with each of your Medicare patients. ...

Should I drop Medicare Part?

To drop Part B (or Part A if you have to pay a premium for it), you usually need to send your request in writing and include your signature. Contact Social Security. If you recently got a welcome packet saying you automatically got Medicare Part A and Part B, follow the instructions in your welcome packet, and send your Medicare card back. If you keep the card, you agree to …

Can I decline part a Medicare?

Mar 26, 2016 · In that case, you need to take action if you want to opt out. On the other hand, if you must apply for Medicare A and B (because you’re not receiving retirement or disability benefits), it’s up to you to decide whether to opt in. Strictly speaking, you can’t opt out of Part A if you’re receiving Social Security retirement or disability ...

Should I terminate Part B of Medicare?

Oct 27, 2014 · If you want to disenroll from Medicare Part A, you can fill out CMS form 1763 and mail it to your local Social Security Administration Office. Remember, disenrolling from Part A would require you to pay back all the money you may have received from Social Security, as well as any Medicare benefits paid.

Can You unenroll from Medicare?

Oct 28, 2020 · Physicians choosing to opt-out must submit a signed affidavit to Medicare stating they are choosing to opt-out of the program. This can be automatically renewed every two years if the physician does not contact Medicare to opt-in. Opting out of Medicare is a quick way to lose out on the growing market of aging people in the US.

Can you reject Medicare Part A?

Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits and must repay anything you have already received when you withdraw from the program.

Can you opt out of Medicare A?

The problem is that you can't opt out of Medicare Part A and continue to receive Social Security retirement benefits. In fact, if you are already receiving Social Security retirement benefits, you'll have to pay back all the benefits you've received so far in order to opt out of Medicare Part A coverage.

How do I get rid of Medicare Part A?

How to drop your Medicare drug planCall us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.Mail or fax a signed written notice to the plan telling them you want to disenroll.Submit a request to the plan online, if they offer this option.Call the plan and ask them to send you a disenrollment notice.

How do I cancel my Medicare Part A and B?

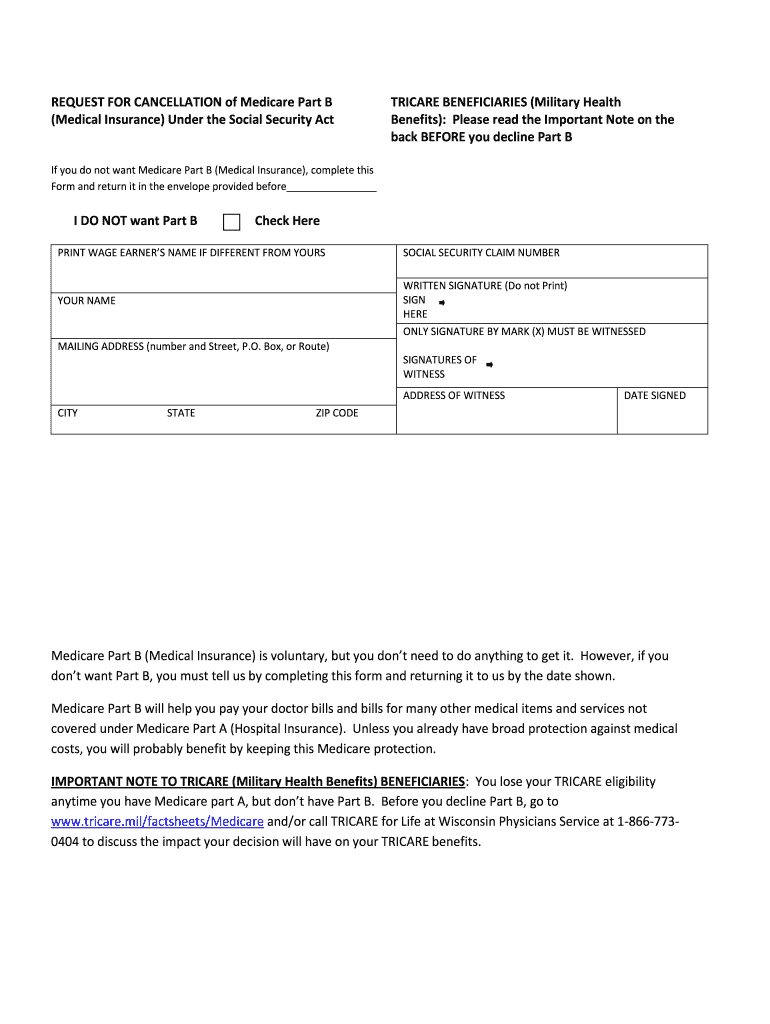

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 (PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA (1-800-772-1213) to get this form.

What parts of Medicare are mandatory?

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

Is Medicare Part A free?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

When did Medicare Part D become mandatory?

January 1, 2006In 2003 the Medicare Modernization Act created a drug benefit for seniors called Part D. The benefit went into effect on January 1, 2006.Aug 10, 2017

Can I opt out of Medicare Part B at any time?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.Nov 24, 2021

Can I cancel Medicare Part B if I have other insurance?

A. Yes, you can opt out of Part B. (But make sure that your new employer insurance is “primary” to Medicare.

What happens if I don't want Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How much is Medicare Part A deductible for 2014?

With Medicare Part A, you are responsible for a hospital inpatient deductible. Here is what this looks like for 2014 according to Medicare.gov: $1,216 deductible for each benefit period. Days 1-60: $0 coinsurance for each benefit period. Days 61-90: $304 coinsurance per day of each benefit period. Days 91 and beyond: $608 coinsurance per each ...

How much is Medicare coinsurance for days 91 and beyond?

Days 91 and beyond: $608 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Opting out of Medicare Part A would render you ineligible to collect Social Security and if you’ve already started collecting Social Security, ...

What was the ruling in Hall v. Sebelius?

The ruling was against the retirees, citing the original law Congress enacted when creating the Medicare program .

What happens when a doctor opts out of Medicare?

When a physician completely opts out of Medicare, they must have a written contract with their Medicare patients. It states that the patient is fully responsible for paying the physician’s charges. The contract must also be signed by the doctor and patient.

What is the third option for Medicare?

The third option is to opt-out. This means that both the service provider and the patient must sign a contract stating they are not eligible to submit bills to or receive payment from Medicare for reimbursement.

What is a non-participation provider?

Non-participation, or a “non-par provider,” is defined in the above agreement by the Centers for Medicare & Medicaid Services (CMS) as, “a provider involved in the Medicare program who has enrolled to be a Medicare provider but chooses to receive payment in a different method and amount than Medicare providers classified as participating.”

Who manages Medicare?

Medicare is governed and managed by the Social Security Administration . Physicians, non-physician health care specialists, and health care providers accepting Medicare assignments agree to accept payments from Medicare for any services.

Who is responsible for paying the physician's charges?

It states that the patient is fully responsible for paying the physician’s charges. The contract must also be signed by the doctor and patient . Doctors who want to stay out of the Medicare system must take care to maintain their opt-out status or it may be terminated involuntarily.

How long does it take to terminate an opt out?

You can terminate your opt-out status within the first 90 days of submitting an initial opt-out affidavit. (Once an opt-out has been automatically renewed, you can no longer terminate early.)

How to cancel opt out on Mac?

To cancel your opt-out status, you’ll need to mail a cancellation request to your MAC at least 30 days before your opt-out period is set to expire. If you don’t submit your cancellation request before the 30-day period, your opt-out status will automatically renew for another two-year cycle.

What is PECOS system?

PECOS is the online Medicare enrollment management system which allows you to review information currently on file and withdraw electronically. The PECOS system has print and video tutorials to walk you through different scenarios of withdrawing from Medicare:

What is PECOS Medicare?

PECOS is the online Medicare enrollment management system which allows you to: Enroll as a Medicare provider or supplier. Revalidate (renew) your enrollment. Withdraw from the Medicare program. Review and update your information. Report changes to your enrollment record. Electronically sign and submit your information.

How long does it take to withdraw from Medicare?

Withdraw from Medicare. If you retire, surrender your license, or no longer want to participate in the Medicare program, you must officially withdraw within 90 days. DMEPOS suppliers must withdraw within 30 days.

What is a private contract with Medicare?

This contract will reflect the agreement between you and your patients that they will pay out of pocket for services, and that nobody will submit the bill to Medicare for reimbursement.

How often does an opt out affidavit renew?

If you’re currently opted out, your opt-out status will automatically renew every two years. If you submitted an opt-out affidavit before June 16, 2015 and never renewed it, you’ll need to submit a new opt-out affidavit.

When do you get Part A and Part B?

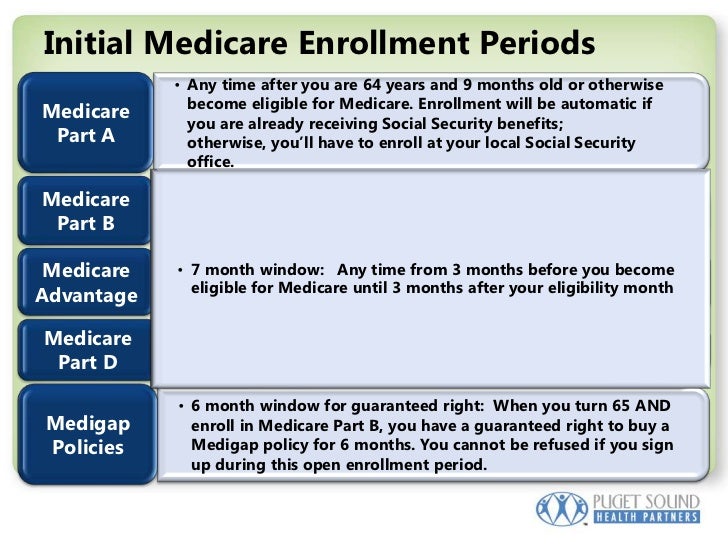

You will automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.)

What happens if you don't get Part B?

NOTE: If you don’t get Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part B because you have coverage based on your (or your spouse’s) current employment.

What is the individual health insurance marketplace?

NOTE: The Individual Health Insurance Marketplace is a place where people can go to compare and enroll in health insurance. In some states the Marketplace is run by the state and in other states it is run by the federal government. The Health Insurance Marketplace was set up through the Affordable Care Act, also known as Obamacare.

Do you have to pay a penalty if you don't get Part A?

NOTE: If you don’t get Part A and Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part A and Part B because you have coverage based on your (or your spouse’s) current employment.

What happens if you don't sign up for Medicare?

If you do not sign up for Medicare Part A or Part B when you first become eligible, you may be subject to a late enrollment penalty if you choose to sign up later on. The Part A late enrollment penalty is only applicable to beneficiaries who do not qualify for premium-free Part A (which we’ll outline below).

How long do you have to pay Medicare taxes to get premium free?

You will qualify for premium-free Medicare Part A benefits if you worked and paid Medicare taxes for at least 10 full years (40 quarters).

What is the cost of Medicare Part B in 2021?

Most beneficiaries pay the standard Part B premium of $148.50 per month in 2021. Some higher income-earners will pay more for their Part B coverage.

How much will Medicare pay in 2021?

You will pay $259 per month in 2021 for Medicare Part A if you paid Medicare taxes for between 30 and 39 quarters. If you paid Medicare taxes for fewer than 30 quarters, your Part A premium will be $471 per month in 2021. If you do not qualify for premium-free Part A, you will need to manually enroll in Medicare Part A.

How much is the late enrollment penalty for Part B?

The Part B late enrollment penalty is up to 10 percent of the standard Part B premium for each 12-month period that you could have had Part B but did not. ...

What happens if you have health insurance and still work?

If you are still working and have quality health insurance provided by your employer, you can have coordination of benefits to cover your health care costs. If your employer has fewer than 20 employees, Medicare will be the primary payer.

Is it mandatory to enroll in Medicare Advantage?

It is not mandatory to enroll in Medicare Advantage plans or Medicare Part D prescription drug plans. However, Part D plans also have late enrollment penalties if you choose not to sign up but decide you want a plan later.

Why do people delay Medicare Part B?

Some people delay enrollment in Medicare Part B to avoid paying the premium – especially if they have other coverage. The same can be true of Part A, for people that must pay a premium for it. If you delay enrollment in Part B or Part A, make sure you plan it well to avoid problems. For example:

How long do you have to enroll in Medicare after your spouse's employment ends?

After the month coverage or employment ends (whichever happens first), you might have an 8-month Special Enrollment Period (SEP) to enroll in Medicare without a penalty.

What is the phone number for eHealth?

We’re always happy to answer your questions. Call one of our eHealth licensed insurance agents at 1-888-296-0117 (TTY users 711). Representatives are available from 8 AM to 8 PM Monday through Friday, and from 10 AM to 7 PM Saturdays, Eastern time.

Is Medicare Part A or B?

Traditional Medicare refers to Medicare Part A, which is hospital insurance, and Part B, which is medical insurance. Part A can be premium-free if you’ve worked and paid taxes long enough. (You need to have paid Medicare taxes for at least 10 years to get Part A without a premium.)