One way to accomplish a one-time annual payment or a semi-annual payment is to request the “Coupon Book” payment option from your Medicare Part D plan and send in all of the coupons at one time along with a check for the total of your monthly premiums - or send six coupons for a semi-annual payment. And, as noted by one of our readers:

Full Answer

How do I Pay my Medicare Advantage plan premiums?

If you have a Medicare Advantage plan or prescription drug plan with a monthly premium, you have several options for paying. Automatic payments from checking account, credit, or debit card – Sign up online for automatic payments from your checking account, credit, or debit card.

Can the amount of Medicare Part D premiums change?

The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB]. If you have questions about your Medicare drug coverage, contact your plan.

Why do I have to pay more for Medicare drug coverage?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you’re married and file jointly), you’ll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

How do I get my Part D premium deducted from Social Security?

Contact your plan (not Social Security or the Railroad Retirement Board (RRB)) if you want your premium deducted from your monthly Social Security or RRB payment. If you want to stop premium deductions and get billed directly, contact your plan. How much does Part D cost? Most people only pay their Part D premium.

Can you pay Part D annually?

Am I allowed to pay my monthly Medicare Part D premiums on an annual or semi-annual basis? Yes. Some people may wish to pay all twelve of their monthly Medicare plan premiums at one time instead of budgeting for the twelve monthly payments (or pay Medicare plan premiums semi-annually or quarterly).

Do Medicare Part D plans renew automatically?

Like Medicare Advantage, your Medicare Part D (prescription drug) plan should automatically renew. Exceptions would be if Medicare does not renew the contract with your insurance company or the company no longer offers the plan.

How do I pay Part D?

En español | You should check with your plan, but most plans allow you to mail in payments You should check with your plan, but most plans allow you to mail in payments or arrange for direct payment made from your bank account or credit card.

Do you have to renew Medicare Part D every year?

Do I have to reenroll in my Medicare Part D prescription drug plan every year? En español | No. If you like your current Part D drug plan, you can keep it without doing anything additional. You don't have to reenroll or inform the plan that you're staying.

How often can you change Medicare Part D plans?

You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want.

Do I need to renew medical every year?

Medi-Cal members must renew their coverage each year to keep their health care benefits. Some members may be renewed automatically, but a packet will be mailed to members annually if the county is not able to verify all your information. The forms in this packet must be filled out and returned.

Is Part D premium automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Can I pay Part D premiums from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.

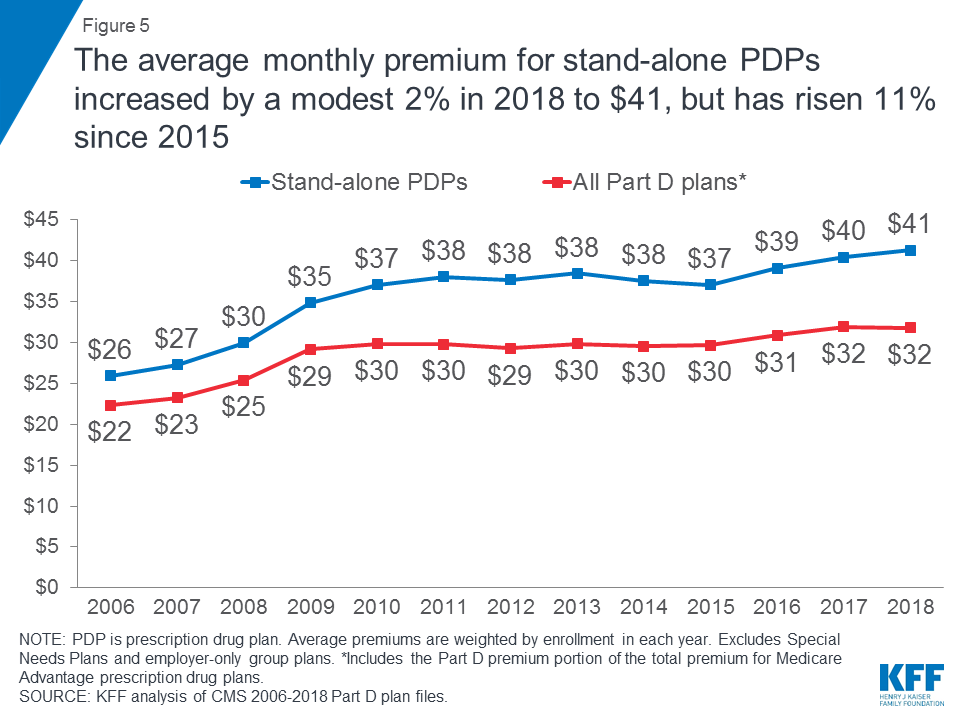

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Can you use GoodRx If you have Medicare Part D?

While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.

Can I add Part D to my Medicare at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

How long does Medicare Part D penalty last?

Since the monthly penalty is always rounded to the nearest $0.10, she will pay $9.70 each month in addition to her plan's monthly premium. Generally, once Medicare determines a person's penalty amount, the person will continue to owe a penalty for as long as they're enrolled in Medicare drug coverage.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

Can you pay your insurance premiums by mail?

Monthly bill – You can pay by mail each month (we will provide you a monthly bill). You can also make advance payments. If making a payment for the entire year, you will only need to submit one bill along with a check for the total premium amount due for the year.

Can you pay Social Security premiums with a personal check?

In other words, you cannot pay part of the premium with a benefit check and part with a personal check or automatic withdrawal.