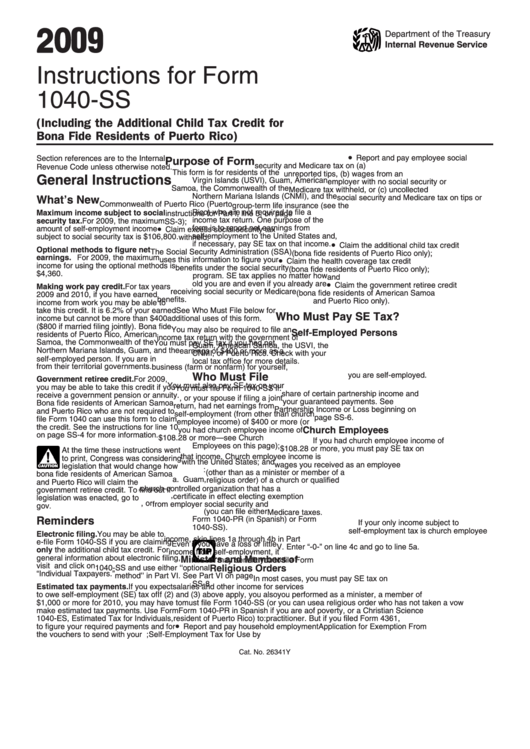

Actually paying your Social Security and Medicare taxes involves completing a couple of forms along with your IRS Form 1040 (your income tax form). File Schedule C (Profit or Loss from a Business) as well as Schedule SE (Self-Employment Tax). All of these forms are available from the IRS's website, and include instructions for filling them out.

Full Answer

How to pay Social Security and Medicare taxes?

How to Pay Social Security and Medicare Taxes. 1. Work with an accountant or tax professional. Tax laws are subject to change, and can be complex. Talk to an accountant or tax professional if you ... 2. Fill out the required IRS forms. Actually paying your Social Security and Medicare taxes involves ...

Are Medicare and Social Security tax withholdings supposed to be on 1040?

June 7, 2019 4:34 PM Are you supposed to include medicare and social security tax withholdings on line 13 of 1040-ES or just the federal income tax withholding portion? You would just include the Federal Income Tax that will be withheld from your pay during 2018 to compute this.

How do I enter additional Medicare tax on Form 1040?

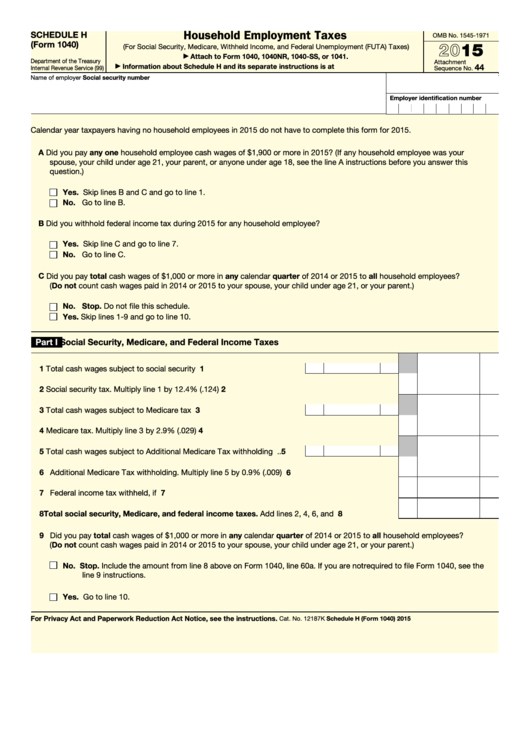

You paid total cash wages of $1,000 or more in any calendar quarter of 2019 or 2020 to all household employees. See the instructions for line 11 for payments of social security taxes reported on Schedule H (Form 1040) that may be deferred. Enter the total Additional Medicare Tax from line 18 of Form 8959 on line 5.

How do I enter the health coverage tax credit on 1040-SS?

Enter the amount of tax due (from Form 8919, line 13) and "Uncollected Tax" on the dotted line next to line 6, and include this tax in the total for line 6. Attach to Form 1040-SS the completed Form 8919. Repayment of excess advance payments of the health coverage tax credit.

Where Do Social Security and Medicare taxes go on 1040?

Report the total on line 33. This amount represents your total tax payments throughout the year.

Does 1040 include Social Security tax?

The amount of Social Security payroll tax you've paid appears in Box 4 of your W-2 each year. If you've paid Social Security tax above income of $110,100, you are entitled to a credit from the IRS. If you are eligible, you enter the excess amount on Line 69 of your Form 1040, or Line 41 of Form 1040A.

Where do you put Medicare wages and tips on 1040?

Box 5 "Medicare wages and tips": This is total wages and tips subject to the Medicare component of social security taxes. Box 6 "Medicare tax withheld": This is Medicare tax withheld from your pay for the Medicare component of social security taxes.

Are Social Security and Medicare included in federal income taxes?

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.

Can you claim Medicare withholding on 1040?

Any withheld Additional Medicare Tax will be credited against the total tax liability shown on the individual's income tax return (Form 1040 or 1040-SR).

Is Social Security and Medicare included in tax bracket?

FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings.

What line does federal income tax withheld go on 1040?

If you already had some federal tax withheld from your income, you can enter that amount on Line 17. You will also need to attach Schedule 4 if you have paid other taxes.

Are Medicare wages the same as gross wages?

It is calculated the same way as Social Security taxable wages, except there is no wage limit. Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

Is Social Security wages the same as gross income?

Social Security wages are not the same as gross income. While the amount of Social Security wages and gross income are often identical, they just as easily may not be. Gross income is the total of all compensation from which the amount of taxes and other withholdings are calculated.

How do I pay Social Security tax?

You can get these forms from the IRS on their website at www.irs.gov. Send the tax return and schedules, along with your self-employment tax, to the IRS. Even if you don't owe any income tax, you must complete Form 1040 and Schedule SE to pay self-employment Social Security tax.

Why do I pay Social Security and Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

What taxes are included in federal income tax?

Here's how the IRS defines income tax: “Taxes on income, both earned (salaries, wages, tips, commissions) and unearned (interest, dividends). Income taxes can be levied on both individuals (personal income taxes) and businesses (business and corporate income taxes).”

Refund of Taxes Withheld in Error

- Determine the amount of your income subject to Social Security and Medicare taxes. If you are paying Social Security (SS) and Medicare taxes on your own, it is most likely because you are self-employed. To calculate your tax, you must first add up all of the income you earned. However, exclude:[1] X Trustworthy Source US Social Security Administration Independent U.…

- Calculate the amount you owe in Social Security taxes. Currently, Social Security taxes amou…

Self-Employment Tax

International Social Security Agreements

References/Related Topics

- If social security or Medicare taxes were withheld in error from pay that is not subject to these taxes, contact the employer who withheld the taxes for a refund. If you are unable to get a full refund of the amount from your employer, file a claim for refund with the Internal Revenue Service on Form 843, Claim for Refund and Request for Abatement....