When you have decided on a Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What is the best Medicare supplement insurance?

Shop carefully and make sure you are comparing like plans. There are numerous free resources to help you make a decision. If you have Original Medicare, you may wish to consider the purchase of Medicare Supplemental Insurance plan, more commonly known as “Medigap.”. These plans, which are sold in every state by private insurance companies, can help cover some of the …

What are the top 5 Medicare supplement plans?

Aug 17, 2021 · How do I shop for a Medigap policy? There are a few ways to find out what policies are available in your area. Enter your ZIP code on the Medicare search tool to see which plans are offered in your state. Contact your State Health Insurance Assistance Program (SHIP) to find out which insurance companies sell Medigap policies in your state.

What is the best Medicare insurance plan?

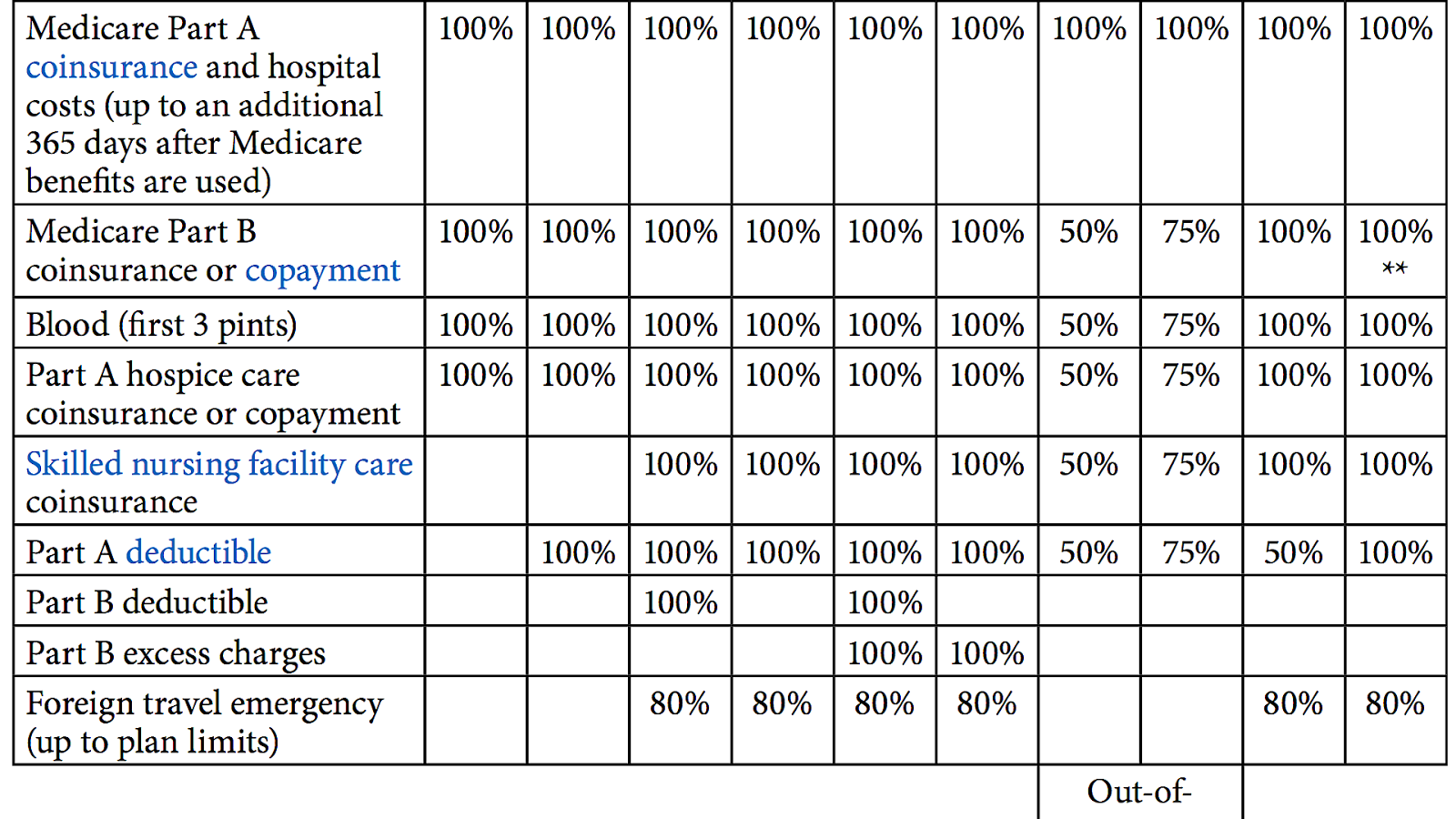

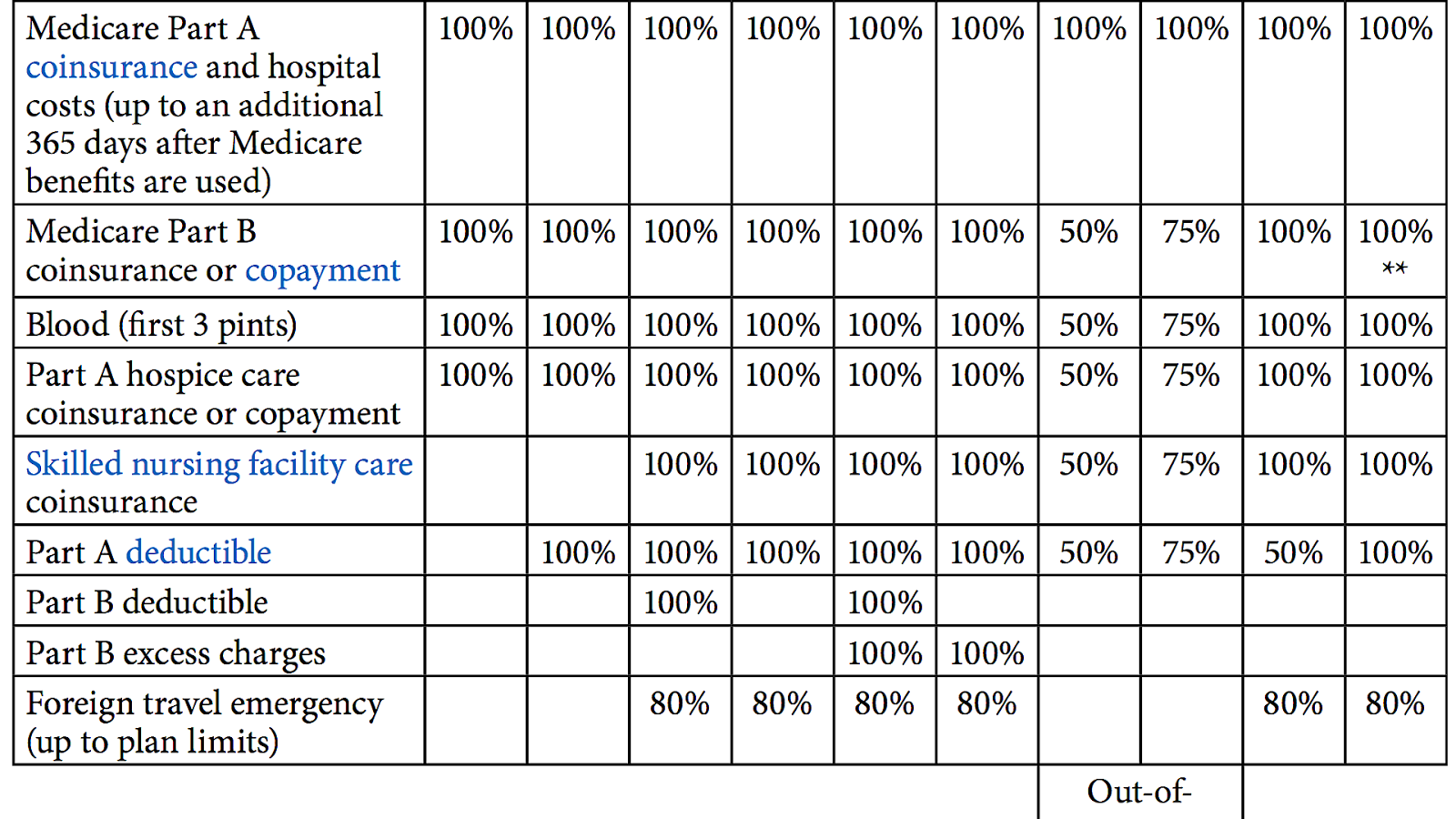

Medigap policies are standardized. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance." Insurance companies can sell you only a standardized policy identified in most states by letters. All policies offer the same basic benefits [glossary] but some offer additional benefits, so you …

What is the best Medicare plan for You?

Get the basics. When you first enroll in Medicare and during certain times of the year, you can choose how you get your Medicare coverage. There are 2 main ways to get Medicare: Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare ...

Does Medigap cover Medicare Supplement?

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance.". Insurance companies can sell you only a "standardized" policy identified in most states by letters. All policies offer the same basic. benefits.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What are the benefits of Medicare Advantage?

Medicare Advantage (also known as Part C) 1 Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. 2 Plans may have lower out-of-pocket costs than Original Medicare. 3 In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs. 4 Most plans offer extra benefits that Original Medicare doesn’t cover—like vision, hearing, dental, and more.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

When to buy a Medigap policy

The best time to buy a#N#Medigap#N#Medicare Supplement Insurance (Medigap)#N#An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare).#N#policy is when you’re 65 (or older) and first get both Part A and Part B. You need both Part A and Part B to buy a Medigap policy.

How to buy a Medigap policy

Medigap plans are standardized, and in most cases named by letters, like Plan G or Plan K.

Is Medicare Supplement Insurance the only alternative?

Medicare Supplement Insurance isn’t the only alternative available for beneficiaries who are worried about covering those out-of-pocket costs remaining after Medicare pays its share. Medicare Advantage plans, also known as Medicare Part C, are health plans issued by a private insurer that cover your Medicare Part A and Part B benefits.

Does Massachusetts have Medicare Supplement?

Medicare Supplement Plans in Massachusetts. Like we mentioned above, Medicare Supplement Insurance plans are structured differently in Massachusetts. Residents of the Bay State only have two plans to choose from: the Core Plan and the Supplement 1 Plan. Both plans cover basic benefits:

Do you have to pay Medicare premiums if you are 65?

Part A covers inpatient hospital services, as well as care in a hospice or skilled nursing facility and some home health care expenses. Most people don’ t have to pay a premium for Part A ( premium-free Part A), but if you’re 65 and you didn’t pay the Medicare tax for 10 years or more, you may have to pay a premium.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare have a penalty for enrolling in Medicare?

In order to encourage people to enroll in Medicare, the federal government imposes a penalty on people who enroll in Medicare after their Initial Enrollment Period has passed and if they don’t qualify for any of the Special Enrollment Periods described above.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

What is a Medigap plan?

Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need.

What is Medigap insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.