Here are some tips on how to pick the best Medicare supplement plan: -Think about your needs and budget. Medicare supplement plans can be expensive, so you’ll need to think about how much you can afford to spend on health insurance each month.

Full Answer

What are the top 5 Medicare supplement plans?

May 06, 2022 · Mutual of Omaha. AM Best 2021 rating: A+. Medigap plans offered: A, F, HD-F, G and N. Also offers Medicare Part D for prescription drug coverage. In business for over 100 years, Mutual of Omaha ...

What is the best Medicare supplement insurance?

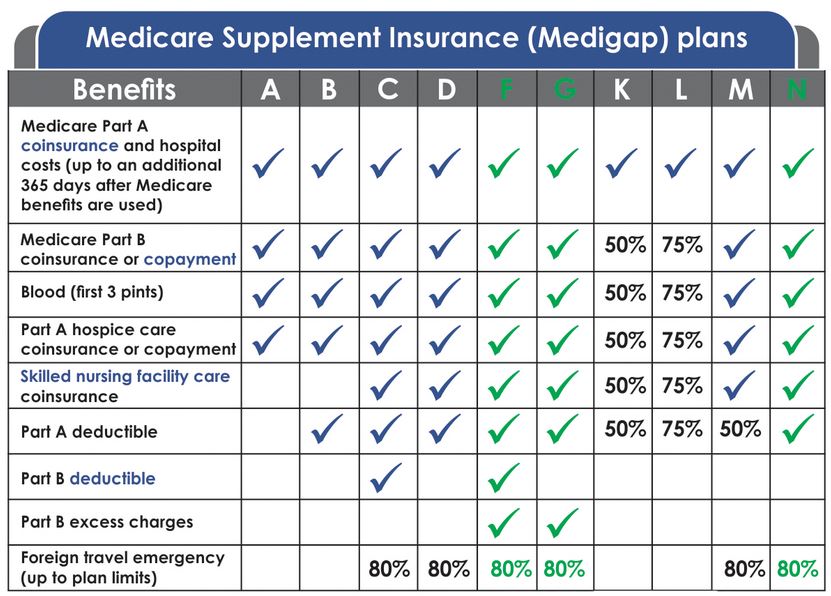

However, be assured there are optional plans designed to supplement the Original Medicare program. Medicare Supplement Options Currently on the market are 10 supplemental plans. Though they are sold by private insurance companies, the plans must adhere to federal and state laws developed for your protection.

What is the average cost of a Medicare supplement?

Feb 03, 2022 · How to Choose the Best Medicare Supplement Insurance Plan. There are 10 standardized Medicare Supplement Insurance plans available in most states. Learn more about popular Medicare Supplement (Medigap) plans like Plan G, Plan F and Plan N, and compare free quotes as you're choosing the best plan to fit your health care needs.

Where to get free Medicare advice?

Get the basics. When you first enroll in Medicare and during certain times of the year, you can choose how you get your Medicare coverage. There are 2 main ways to get Medicare: Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare ...

What are the top 3 most popular Medicare supplement plans in 2021?

Which Medicare supplement plan has the highest level of coverage?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the highest rated supplemental insurance?

- Best Overall: Mutual of Omaha.

- Best User Experience: Humana.

- Best Set Pricing: AARP.

- Best Medigap Coverage Information: Aetna.

- Best Discounts for Multiple Policyholders: Cigna.

What is the deductible for Plan G in 2022?

Do Medigap premiums increase with age?

What is the Best Medicare Plan D for 2022?

- Best in Ease of Use: Humana.

- Best in Broad Information: Blue Cross Blue Shield.

- Best for Simplicity: Aetna.

- Best in Number of Medications Covered: Cigna.

- Best in Education: AARP.

What is the average cost of supplemental insurance for Medicare?

Does Medicare cover dental?

Who is Aflac's largest competitor?

Does Plan G cover prescriptions?

What is the difference between Plan G and high deductible plan G?

Does Medicare Part G cover prescriptions?

Health Care Costs and Original Medicare

Original Medicare provides health insurance coverage for hospital stays, doctor's office visits, lab testing, medical supplies and some other services. For Medicare beneficiaries, other out-of-pocket costs can add up quickly.

Choosing the Best Medicare Supplement Plan for You

Medigap plans supplement your Original Medicare coverage with benefits that help fill in some key cost gaps. The basic benefits of each type of Medicare Supplement Insurance plan are standardized by Medicare, though the policies themselves are sold by private companies.

Getting the Most From Medicare Supplement Insurance

If you buy a plan during your Medigap open enrollment period, insurers cannot deny you a policy or charge more for your Medigap plan based on your health or pre-existing conditions. If you don't purchase a Medicare Supplement Insurance plan during your open enrollment period, you could potentially be denied coverage or pay higher monthly premiums.

Medicare Advantage Plans Replace Original Medicare Benefits

Another health plan option is Medicare Advantage plans. It is important to note that Medicare Advantage and Medicare Supplement Insurance are different. Medicare Advantage plans are an alternative to Original Medicare, while Medigap plans work alongside your Original Medicare benefits to help cover out-of-pocket costs.

Get Help Buying the Right Medigap Plan for You

The right Medicare Supplement Insurance plan is the one that best matches your health care cost requirements and your budget. A licensed agent can answer your questions and help you determine which plan is right for you.

Compare Medigap plans in your area

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareSupplement.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage have out of pocket costs?

Medicare Advantage. Out-of-pocket costs vary—plans may have lower out-of-pocket costs for certain services. You may pay the plan’s premium in addition to the monthly Part B premium. (Most plans include Medicare drug coverage.) Plans may have a $0 premium or may help pay all or part of your Part B premiums.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance).

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

Does Medicare Supplement Insurance cover the gap?

Medicare Supplement Insurance helps you pay for the gaps in Medicare coverage. Once Medicare pays its share of the services you are receiving, Medigap will help you pay the rest. If your Part B policy says it covers 80% of a doctor’s visit, Medicare will pay that. Medigap kicks in for the other 20%.

Does Medigap pay 100% of Medicare?

Once beneficiaries meet the out-of-pocket yearly limit and the Medicare Part B deductible, the Medigap plan will pay 100% of all covered costs for the rest of the year. Best for: People who want a medium level of coverage and can afford to pay for costs until they reach the out-of-pocket limit.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

Do you have to pay Medicare premiums if you are 65?

Part A covers inpatient hospital services, as well as care in a hospice or skilled nursing facility and some home health care expenses. Most people don’ t have to pay a premium for Part A ( premium-free Part A), but if you’re 65 and you didn’t pay the Medicare tax for 10 years or more, you may have to pay a premium.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

What costs are not covered by original Medicare?

By itself, original Medicare (Parts A and B) generally pays about 80% of the cost for doctors, hospitals, and medical procedures. The patient is responsible for paying the rest, and there is no limit on out-of-pocket expenses.

What does the standard Medigap coverage provide?

In general, Medigap covers your coinsurance bill once you’ve paid the Medicare deductible. Some plans (B, D, G, and N) pay your Part A deductible as well. (Plans C and F also pay the Part A deductible but aren’t available to new enrollees.)

When is the best time to buy a Medigap policy?

In most cases, the best time to buy a Medigap policy is during your open-enrollment period. This period may start either in the month you turn 65 and enroll in Medicare Part B, or when your employer-provided group healthcare coverage ends and you enroll in Part B.

How do I identify which Medigap plan I need?

When picking a Medigap plan, think about both your current and future healthcare needs. It’s important to choose carefully, because there’s no guarantee you’ll be able to switch plans later .

How do I shop for a Medigap policy?

There are a few ways to find out what policies are available in your area.

The bottom line

Medigap plans help cover costs related to Medicare Parts A and B that you'd otherwise pay yourself. The best time to choose a Medigap plan is generally when you first sign up for Medicare, when you won't have to go through medical underwriting.

How to find the right Medicare supplement plan?

Here are the key steps to finding the right supplement plan for you: 1. Analyze your options. One of the best things about Medicare supplement plans is that they are all standardized, and they can all be used anywhere a provider accepts Medicare payments. Currently, there are 10 plans on the market, and they are labeled with letters, from A-N.

Can you buy a Medicare supplement plan after the initial period ends?

Once that initial period ends, you can still buy a Medicare supplement plan, but the door opens for insurers to start asking all sorts of questions about your health status.

Does Medicare cover everything?

Medicare health insurance generally offers good coverage, but it doesn’t cover everything. However, if you have an Original Medicare plan rather than a Medicare Advantage plan, you also have the option to fill many of the coverage gaps by purchasing a private Medicare supplemental insurance plan, also known as a Medigap plan. 1.

Can you have a Medicare Advantage plan if you have an Original Medicare?

However, if you have an Original Medicare plan rather than a Medicare Advantage plan, you also have the option to fill many of the coverage gaps by purchasing a private Medicare supplemental insurance plan , also known as a Medigap plan. 1.

How long do you have to enroll in Medicare at 65?

Don’t delay. When you turn 65, you have an initial enrollment period of seven months that includes three months before your birthday, your birthday month and the three months that follow. If you’re enrolling in Original Medicare (versus Medicare Advantage ), this is when you want to get your Medicare supplement policy.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage Plans offer prescription drug coverage. with prescription drug coverage. Now that you have some information for how to choose a Medicare drug plan, you may want to learn more about Medigap and Medicare drug coverage.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is Medicare tier?

Look at Medicare drug plans with “. tiers. Groups of drugs that have a different cost for each group. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” that charge you nothing or low copayments for generic prescriptions.

What is periodic payment to Medicare?

The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

What is a drug list?

A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. (a list of prescription drugs covered by a drug plan). Then, compare costs. I want extra protection from high prescription drug costs. Look at drug plans offering coverage in the.

What is formulary in insurance?

formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. (a list of prescription drugs covered by a drug plan). Then, compare costs.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.