- Compare the Part D options in your area by using the Plan Finder tool at Medicare.gov. ...

- If you select Continue without logging in , you’ll be able to choose the type of coverage you want, such as a Part D drug plan. ...

- Now indicate whether you get help with your medical expenses. If you’re not sure, you can find out by logging in to your Medicare account.

- If you don’t receive any help , you’ll be asked if you want to see your drug costs when you compare plans. ...

- Enter the names of your medications. Be sure to include ones you take regularly so that you’ll get a good estimate of ongoing costs. ...

- Choose up to five pharmacies where you want to fill your prescriptions. Many plans charge lower copayments for preferred pharmacies. ...

- You’ll receive a list of drug plans in your area. ...

- To sign up for a Part D plan, click Enroll. You’ll need your Medicare number and the date that your Parts A and B coverage started. ...

Full Answer

How to find the best Medicare Part D plan?

How to shop for and compare Medicare Part D plans

- Know what you need. The first step in choosing a plan once you’ve set up your primary Medicare plan is to consider your needs.

- Start shopping early. These are a lot of questions to consider. ...

- Gather helpful information. ...

- Check your eligibility for assistance programs. ...

How to find the best Medicare Part D drug plan?

Why you should compare Medicare Part D plans

- The plan provides coverage for all your prescription drugs.

- You’ve evaluated the copayment and coinsurance costs for your prescription drugs.

- You’ve weighed your options between a standalone Medicare prescription drug plan (PDP) as a supplement to Original Medicare or a Medicare Advantage prescription drug plan (MAPD).

How much does Medicare Plan D cost?

Medicare Part D provides coverage for prescription medications. The average Part D plan premium in 2021 is $41.64 per month. 1

What is best Medicare Part D plan?

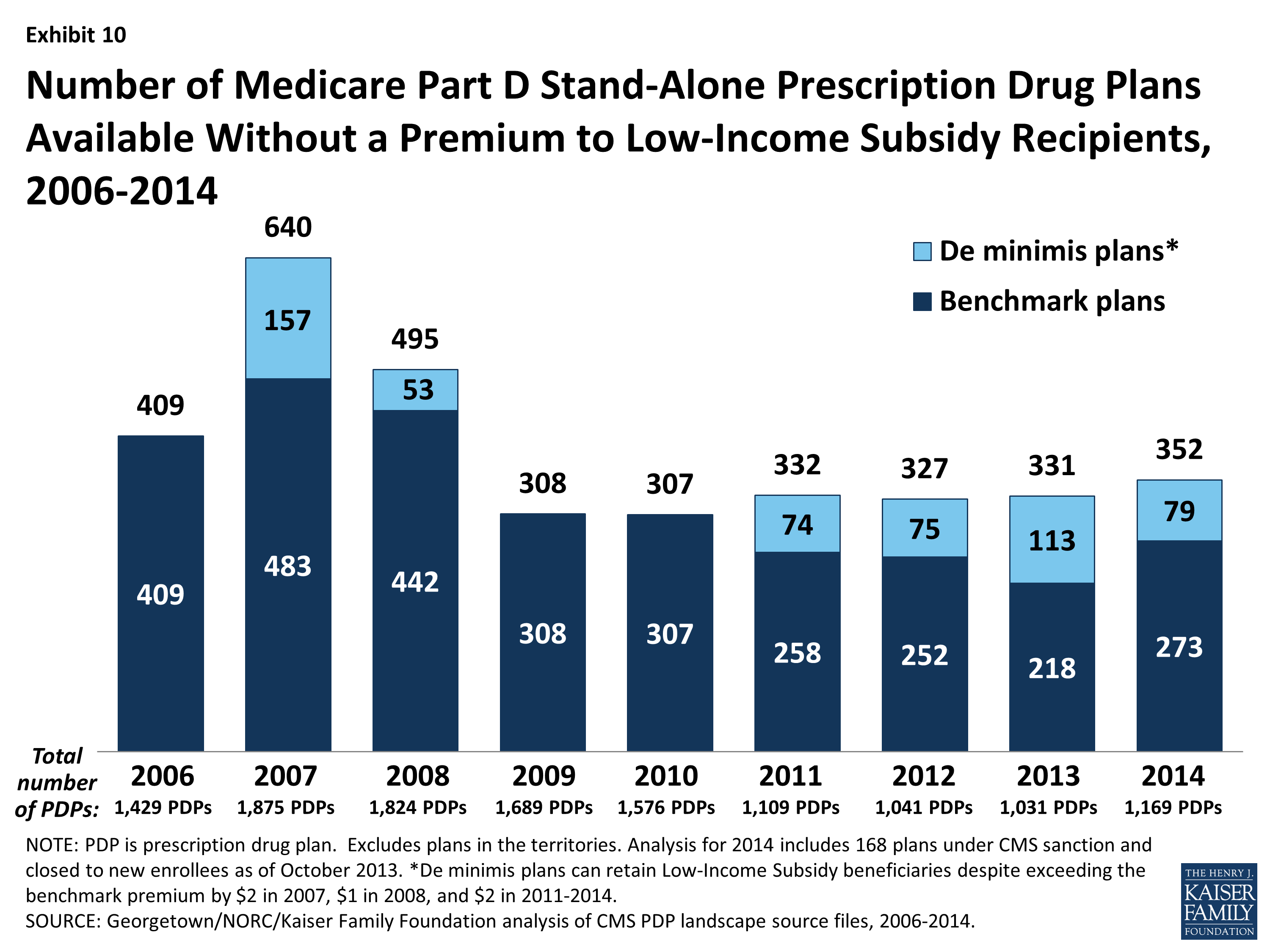

Medicare beneficiaries will have fewer Medicare Part D stand-alone prescription drug plans ... says Medicare beneficiaries need to review their current plan and determine whether it’s still their best option or if they need to change providers.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Can I add Medicare Part D at anytime?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

How do I submit Medicare Part D?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

How long does it take to get Medicare Part D after applying?

When you first get Medicare (Initial Enrollment Periods for Part C & Part D)If you joinYour coverage beginsDuring the month you turn 65The first day of the month after you ask to join the planDuring one of the 3 months after you turn 65The first day of the month after you ask to join the plan1 more row

How do I pay Part D premiums?

Medicare Premium Payment OptionsOne-Time Online Payments. ... Automatic Payments. ... Express Scripts Medicare® (PDP) Customers. ... Social Security or Railroad Retirement Board (RRB) Benefits Check Withdrawal. ... Pay by Phone. ... Pay by Check.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Is Medicare Part D optional or mandatory?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don't take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare.

How to get a Part D plan?

Here’s what you need to do to get Part D: Enroll in Medicare Part A or Part B, or both. Live in a county where the plan is offered. And here are the ways you can get coverage.

What is Medicare Part D?

How to buy your Part D plan. Medicare Part D plans cover outpatient prescription drugs. Choose from a standalone plan or drug coverage included in a Medicare health plan.

What is the state health insurance assistance program?

The State Health Insurance Assistance Program offers free, independent counseling services and local workshops to help with your health care benefit decisions. Visit medicare.gov, or talk to a Medicare expert, like an agent, broker or health plan sales rep.

Does Part D cover outpatient prescriptions?

But it doesn’t include coverage for most outpatient prescription drugs, like the medicines you take every day or for short periods of time. A Part D prescription drug plan would help pay for these types of medicines.

Does Medicare have a penalty if you don't have a Part D plan?

If you don’t, you’ll likely have to pay a penalty if you enroll in one later. That penalty gets added to the monthly premium and continues as long as you have a Part D plan.

Do you pay the least for prescriptions?

You pay the least amount for your prescriptions when you use a pharmacy in the network . Check the list to make sure your pharmacy, or a pharmacy you are willing to use, is part of the network.

Can you use Medicare Supplement Plan without prescription?

You use Original Medicare for your health care needs and want prescription drug coverage. You have a Medicare Supplement plan. These plans don’t include outpatient prescription drug coverage, so you’ll choose a standalone Part D plan too. You have a Medicare Cost plan without outpatient prescription drug coverage.

How to select a Medicare Part D plan?

Unless you’re really comfortable using a computer and other Internet tools, the best way to select a Part D plan is to contact the government’s 1-800-MEDICARE call center and ask the customer service agent to spend some time and walk you through the process of using Medicare.gov’s online Plan Finder to select a new plan.

When was Medicare Part D created?

Medicare beneficiaries access these prescription drug benefits through private Part D plans – the Medicare drug benefit program created in 2003. Because it is based on competition among individual plans, seniors and people with disabilities have many options.

How long does Medicare cover prescriptions?

As an additional safeguard, your Medicare prescription drug insurer must generally offer enrollees a 90-day filling of their current medications when the plan benefits change from one year to the next – under certain circumstances.

What is the Donut Hole in Part D?

To make Part D coverage palatable to budget analysts in Washington – who need to sign off before lawmakers can create something like a prescription drug benefit – the law’s authors created a “ donut hole ” (also known as the coverage gap), and you had to pay your drug costs yourself while you were in the donut hole.

How to contact Medicare Advantage?

Call 1-844-309-3504. 2. Check your Medicare Advantage plan. If you have a Medicare Advantage plan, you usually have to receive your drug benefits through the plan rather than a separate Part D insurer. If you are one of the growing number of Medicare beneficiaries who receive their hospital and physicians benefits ( Medicare Part A and Part B) ...

Why do we need a Part D?

These are people who enrolled in Part D because prescription drugs have historically been one of the expenses that were most concerning to beneficiaries. (Nearly $1 of every $5 Medicare dollars goes toward outpatient prescription drug costs, mostly via Part D coverage.)

Does Medicare Part D pay to shop around?

It pays to shop around. Even without major coverage changes, new and different offerings can come to your area, so it still pays to shop around for new plans. Medicare Part D is the private sector’s first foray into a part of the Medicare program where all benefits are delivered by the private sector.

What is Medicare Plan D?

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as ...

What is Medicare Supplement Plan D?

Medicare Supplement Plan D. Medicare Part D. Helps play some of the costs original Medicare doesn’t cover, which are mostly copays, coinsurance, and deductibles. Only works with Original Medicare. Must have both Parts A and B to enroll. Provides prescription drug coverage to Medicare beneficiaries.

How long does Medigap Plan D last?

The best time to get Medigap Plan D (or any Medicare Supplement plan) is during your Medigap Open Enrollment Period (OEP) because you won’t have to go through medical underwriting. 4. Your Medigap OEP last for six months and begins ...

How much is coinsurance for Part B?

For example, Part B charges a 20% coinsurance for covered services after you’ve met your Part B deductible ($203 in 2021). 1 If you have total medical charges are $20,000, for instance, your coinsurance would be $4,000. The higher your total charges, the higher your coinsurance, and there’s no limit to how much you can be charged ...

How much is the cost of a Plan D in 2021?

The average monthly premiums can vary, depending on your state of residence. In 2021, it ranged between $192-265 for Plan D and $202-280 for Plan C for a nonsmoking male living in Orlando, Florida. 6.

What is Plan D?

Plan D covers 80 percent of the cost for qualified emergency care you receive in a foreign country after you pay a $250 deductible. You’re covered for the first 60 days of foreign travel with a lifetime limit of $50,000. 3. No networks. You can visit any provider nationwide who accepts Medicare. Guaranteed renewable.

Can you keep Plan C?

If you do, you will be “grandfathered in,” which means you can keep Plan C for as long as you continue to pay the premiums. Plan C was one of the guaranteed issue plans insurance companies offered. But starting 2020, Medicare Plan D replaced Plan C as one of the guaranteed issue plans for new enrollees.

What do you need to know before enrolling in a Part D plan?

The most important preparation you can do before finding a Part D plan is recording information about your medications.

How does dosage affect Part D?

Your dosage can affect your final cost or enact certain plan restrictions depending on the Part D plan. The frequency of the medication. The number of pills you take also affects the cost, so double check how often you take your medication and write it down. Once you have these recorded, you’ll be able to compare plans, apples-to-apples.

When is the best time to sign up for Part D?

If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties. Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month.

Is Medicare Part D a good program?

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs. 1. But before diving into the deep end of Part D plans, you’ll want to perform due diligence ...

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How to enroll in Medicare?

Enroll on the Medicare Plan Finder or on the plan's website. Complete a paper enrollment form. Call the plan. Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started.

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

What is a PACE plan?

Programs of All-inclusive Care for the Elderly (PACE) organizations are special types of Medicare health plans. PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. with drug coverage.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Do you have to have Part A and Part B to get Medicare?

You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan , and not all of these plans offer drug coverage. Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in ...

What is a Medigap policy?

Medigap policy with creditable drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage.

Can you get your Medicare coverage back if you have a Medigap policy?

If your Medigap policy covers prescription drugs, you'll need to tell your Medigap insurance company if you join a Medicare Prescription Drug Plan. The Medigap insurance company will remove the prescription drug coverage from your Medigap policy and adjust your premium. Once the drug coverage is removed, you can't get that coverage back, even though you didn't change Medigap policies.

Does Medigap have to send a notice?

Your Medigap company must send you a notice each year telling you if the prescription drug coverage in your Medigap policy is creditable. Keep these notices in case you decide later to join a Medicare drug plan.

Do you have to pay late enrollment penalty for Medigap?

You'll probably have to pay a late enrollment penalty if you have a Medigap policy that doesn't include creditable prescription drug coverage and you decide to join a Medicare Prescription Drug Plan later. This means you'll pay a higher monthly premium than if you joined when you were first eligible.

What is Medicare Part D?

Medicare Part D is a specific type of private, government-regulated prescription drug plan that works with your Medicare coverage. You’re eligible to enroll in a Part D plan if you receive Medicare upon turning 65. You’re also able to enroll if you sign up for Medicare due to a disability. If you delay getting Part D coverage for a while ...

How much does Medicare Part D cost in 2020?

In 2020, the average Medicare beneficiary will have a choice of 28 plans. 1 Nationwide, the base premium for Part D coverage is about $32 a month.

How many people are enrolled in Medicare Part D?

According to the Kaiser Family Foundation, over 70% of Medicare beneficiaries are enrolled in Medicare Part D prescription drug coverage. Some are enrolled through a standalone RX plan, and others through a coverage option like Medicare Advantage that includes Part D.

How long can you go without Medicare Part D?

How and Why to Avoid Delaying Your Medicare Part D Coverage. If you go longer than two months without creditable prescription drug coverage, you’ll face a late enrollment penalty when you enroll in Medicare Part D. The permanent late enrollment penalty is 1% of the average nationwide Part D standalone premium, multiplied by the number ...

Is Medicare Part D coverage optional?

In spite of this, most Medicare beneficiaries – particularly those with chronic conditions – will still want to get Medicare Part D coverage.

Can you postpone Medicare Part D?

You can postpone Medicare Part D enrollment without penalty for as long as you maintain your creditable coverage. If you’re in the end stages of a life-threatening disease and under Medicare hospice care, Medicare Part A covers medications related to the terminal condition.

Is it a good idea to get Medicare Part D?

Common chronic conditions such as multiple sclerosis, cardiovascular diseases, and respiratory illnesses have high drug costs that make having Part D a huge relief. If you have multiple chronic conditions (which apply to seven out of 10 Medicare beneficiaries), it’s probably a good idea to get Medicare Part D drug coverage. Learn the Basics.

When to buy a Medigap policy

The best time to buy a Medigap Medicare Supplement Insurance (Medigap) An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare). policy is when you’re 65 (or older) and first get both Part A and Part B. You need both Part A and Part B to buy a Medigap policy.

How to buy a Medigap policy

Medigap plans are standardized, and in most cases named by letters, like Plan G or Plan K.