Who qualifies for Medicare insurance options?

Medicare is health insurance for people 65 or older. You're first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig's disease).

Is Aetna Medicare Advantage the same as Medicare?

Both terms refer to the same thing. Instead of Original Medicare from the federal government, you can choose a Medicare Advantage plan (Part C) offered by a private insurance company. These plans include all of the benefits and services of Parts A and B. They may include prescription drug coverage as part of the plan.

Does Aetna offer original Medicare?

Aetna Medicare Advantage plans can be different from Original Medicare in terms of benefits and costs. Aetna Medicare Advantage plans may include coverage for things that Original Medicare generally doesn't cover, such as routine vision, routine dental, routine hearing care, and prescription drugs you take at home.

What type of insurance is Aetna Medicare?

Aetna Medicare is a HMO, PPO plan with a Medicare contract. Our SNPs also have contracts with State Medicaid programs. Enrollment in our plans depends on contract renewal. Plan features and availability may vary by service area.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What benefits does Aetna offer?

Take care of body and mind with online fitness classes, health coaching, weight-loss programs and mental health services at lower or even no cost. Aetna members may also receive discounts on prescriptions, medical supplies, vision and hearing products, and vitamins and supplements.

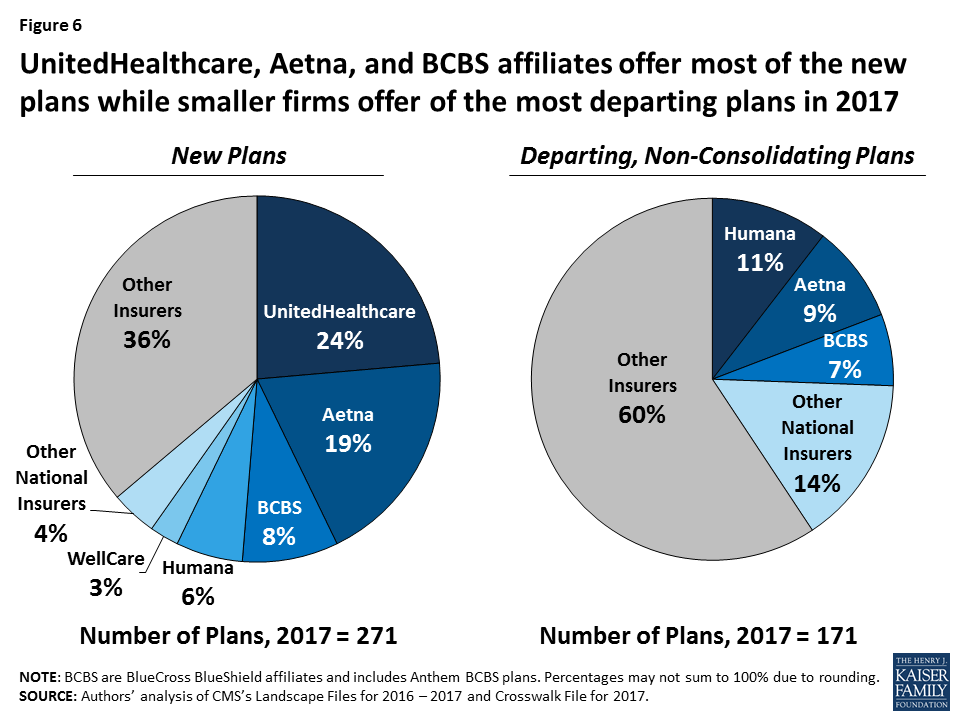

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium.

How much is copay for Aetna?

Participating Physician Office Visit Participating Providers $25 Copayment per visit Non-Participating Providers 40% of Allowance Specialist Office Visit Participating Providers $50 Copayment per visit Non-Participating Providers 40% of Allowance Surgical Care in Ambulatory Surgical Center or other Outpatient Medical ...

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Does Medicare cover dental?

Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Does a Medicare Advantage plan replace Medicare?

Medicare Advantage does not replace original Medicare. Instead, Medicare Advantage is an alternative to original Medicare. These two choices have differences which may make one a better choice for you.

What is Aetna Advantage?

Aetna's non-medical Medicare Advantage benefits are part of the company's “Resources For Living” program. Under Aetna Medicare Advantage, you may be eligible to receive home maintenance, help with daily caregiving needs, recreational activities, and volunteer opportunities.

Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What are the advantages and disadvantages of Medicare Advantage plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

How to enroll in Aetna over the phone?

Phone. Or, enroll in an Aetna Medicare plan over the phone by calling a licensed agent at 1-855-335-1407 (TTY: 711), Monday to Friday, 8 AM to 8 PM.

Who is Caremark for Aetna?

Aetna has selected Caremark as the prescription management and mail delivery service for our members. If you do not intend to leave our site, close this message.

What is the number to call for D-SNP?

Medicare Supplement Insurance (Medigap) Plan. To enroll in a Medicare Supplement Insurance plan, please call us at 1-800-358-8749 (TTY: 711) , Monday to Friday, 8 AM to 8 PM ET. Aetna is the brand name for insurance products ...

Does Aetna use Payer Express?

Aetna handles premium payments through Payer Express, a trusted payment service. Your Payer Express log-in may be different from your Aetna secure member site log-in.

Is Aetna a subsidiary of Aetna?

Aetna is the brand name for insurance products issued by the subsidiary insurance companies controlled by Aetna, Inc. The Medicare Supplement Insurance plans are insured by Aetna Health and Life insurance Company, Aetna Life Insurance Company, American Continental Insurance Company or Continental Life Insurance Company of Brentwood, Tennessee, all Aetna Companies. Not connected with or endorsed by the U.S. Government or the Federal Medicare Program.

Eligibility Rules

You must meet the following eligibility rules to qualify for an Aetna Medicare Advantage plan:

Find your Aetna Medicare Advantage plan

By entering my contact information and pressing "Get started" above, I consent to receive e-mails, telephone calls, text messages and artificial or pre-recorded messages from Aetna Medicare or its affiliates and third-party partners, including but not limited to TZ Insurance Solutions LLC, or their service provider partners on their behalf, regarding their products and services, including Medicare Advantage plans, MA-PD plans, Medicare Part D plans or Medicare Supplement Insurance plans, at the e-mail address and telephone number provided above, including my wireless number, if provided, utilizing an automated telephone dialing system.

How long does Medicare last after your 65th birthday?

That’s the period of seven-months around your 65th birthday – running from the three months before your birthday month, through the month of your birthday and through the three months after your birthday month. But should you enroll in Medicare when you first become eligible?

What is the number to call Medicare?

Call us at 1-833-329-0412 to chat about any Medicare questions you have.

What is the penalty for Medicare Part D?

Understanding the Medicare Part D penalty. The penalty for Part D/prescription drug coverage is 1% of the average Part D premium multiplied by the number of months you are late enrolling. In 2018, the average premium was about $33 a month.

What is the Medicare program for 65?

For over 50 years, most Americans have received a pretty memorable present on their 65th birthday: Medicare. Medicare is the government-sponsored health care program for people 65 and over, as well as a few others who aren’t yet 65. Your first opportunity to enroll when you turn 65 is during your Initial Enrollment Period (IEP).

What is Part A and Part B?

Part A covers things like hospital stays. Part B covers things like visits to your doctor. Because Parts A and B were the first two parts of Medicare, together they are often referred to as Original Medicare. With Part B you pay a monthly premium to maintain your coverage.

Do you have to pay late enrollment penalty for Medicare?

Second, if you wait until after your Initial Enrollment Period to enroll in Medicare, you might have to pay a late enrollment penalty for coverage. Not everyone who delays enrollment is subject to penalties.

Do you have to check with your Medicare administrator before making a decision?

Be sure to check with your benefits administrator before making a decision. If you’re worried about paying the premiums associated with certain parts of Medicare, consider the benefits that come with your premiums . After all, you’ve earned those benefits .

How to compare Aetna plans?

Visit your benefits enrollment site to compare Aetna ® plans side by side, and pick the best one for you. From checkups to managing chronic conditions to emergency services, you’ll find health care for the whole you.

What is Aetna Life Insurance?

Legal notices. Aetna is the brand name used for products and services provided by one or more of the Aetna group of companies, including Aetna Life Insurance Company and its affiliates (Aetna). This material is for information only. Health benefits and health insurance plans contain exclusions and limitations.

How many tiers are there in a drug plan?

Each main plan type has more than one subtype. Some subtypes have five tiers of coverage. Others have four tiers, three tiers or two tiers. This search will use the five-tier subtype. It will show you whether a drug is covered or not covered, but the tier information may not be the same as it is for your specific plan. Do you want to continue?

Is Aetna Inc. responsible for the CDC?

You are now being directed to the CDC site. Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites. Continue.

Is Aetna liable for the content of linked sites?

Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites. Please log in to your secure account to get what you need. You are now leaving the Aetna Medicare website.

Does Aetna provide care?

Provider participation may change without notice. Aetna does not provide care or guarantee access to health services. Estimated costs not available in all markets. The tool gives you an estimate of what you would owe for a particular service based on your plan at that very point in time.

Is it important to choose a health insurance plan?

Choosing a plan is an important part of your life and health, but it doesn’t have to feel overwhelming. These enrollment tips and resources can help you prepare .

What is the number to call Medicare?

Call us at 1-833-329-0412 (TTY: 711) to chat about any Medicare questions you have.

What is EOC in Medicare?

The Evidence of Coverage (EOC) contains important details about your Medicare plan costs and benefits. Learn the key parts of your EOC with this guide.

Is it overwhelming to sign up for Medicare?

Signing up for Medicare can be overwhelming. Learn about the experts who are available to help every step of the way.

Is it important to enroll in Medicare at age 65?

Understanding Medicare enrollment periods. Turning 65 may be important when it comes to Medicare, but you’ll need to keep track of several other key dates. Learn more about the enrollment periods that cover everything from signing up for the first time to making changes to your Medicare plan. Read more Read less.

What is Medicare Advantage HMO?

With our Medicare Advantage HMO plans, you typically choose a primary care physician who helps coordinate your care within a network of doctors and hospitals. It’s Medicare coverage that can help you get the right care at the right time. Read More Read Less.

What is dual eligible special needs?

Our dual-eligible Special Needs Plan is a type of Medicare Advantage plan that offers extra benefits, available to anyone who has both Medicare and Medicaid. We can help you find out if you qualify.

Does Aetna Medicare Advantage include prescription drug coverage?

Aetna Medicare Advantage plans take a total approach to health. Our Part C plans often include prescription drug coverage and extra benefits. And many feature an affordable plan premium – sometimes as low as $0.

Can you see out of network providers with Medicare Advantage?

With our Medicare Advantage HMO-POS plans, you have the flexibility to see out-of-network providers for certain services. You may pay more when you go out of network. It’s a coordinated approach to your Medicare coverage that may give you more options.

Can you use a HMO POS plan with Medicare?

With our Medicare Advantage HMO-POS plans, you can enjoy all the benefits of receiving care through a network provider. You typically choose a primary care physician and most of our HMO-POS plans require you to use a participating provider for medical care. Most of our HMO-POS plans provide you with flexibility to go to licensed dental providers either in or out of our network for routine dental care. You may pay more when you go out of network. It’s a coordinated approach to your Medicare coverage that may give you more options.

How many steps does it take to join Aetna?

All it takes is three easy steps to join the Aetna ® network. We know paperwork isn’t fun, so we included tips to make it all go smoother.

What is Aetna Life Insurance?

Aetna is the brand name used for products or services provided by one or more of the Aetna group of subsidiary companies, including Aetna Life Insurance Company and its affiliates (Aetna). This material is for informtion only.

How long does it take to get a CAQH credential?

This step can take 45 to 180 days depending on the status of your CAQH application and whether you’ve authorized Aetna to access your application. If you’re already registered with CAQH, make sure your attestation has not expired and you have authorized Aetna to access your application. This will help speed things up. You’ll receive a written notification when your credentialing is finished.

How many tiers are there in a drug plan?

Each main plan type has more than one subtype. Some subtypes have five tiers of coverage. Others have four tiers, three tiers or two tiers. This search will use the five-tier subtype. It will show you whether a drug is covered or not covered, but the tier information may not be the same as it is for your specific plan. Do you want to continue?

Is Aetna a part of CVS?

and its subsidiary companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites. Aetna is proud to be part of the CV S Health family . You are now being directed to the CVS Health site.

Is Aetna responsible for the content of linked sites?

Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites. Continue. You are now being directed to the US Department of Health and Human Services site.

Is Aetna liable for non-Aetna sites?

You are now leaving the Aetna website. Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites. Continue.

Do you qualify for Medicaid?

If you have limited assets, special needs or a disability, you may qualify for Medicaid coverage. It's offered at no or very low cost for those who qualify. Find out if you qualify for your state's Medicaid program.

Aetna and Medicaid

We manage plans across the country including the Children's Health Insurance Plan (CHIP), plans for people on Medicaid and Medicare and long-term care programs. Our plans go by different names in different states, but they all offer the same high-quality care.

Why Would Anyone Wait to Enroll in Medicare?

So, What If I Already Have Coverage?

- There are also specific rules that apply to whether you pay a penalty for late enrollment in Medicare Part D. Do you have prescription drug coverage through your employer that pays, on average, at least as much as Medicare’s standard? If not, then you could be subject to a penalty if you don’t enroll in prescription drug coverage when you first become eligible for Medicare. Once …

What Are The Penalties Associated with Late Enrollment?

- If you don’t meet the criteria for an exception, you may be subject to a penalty. This comes in the form of higher premiums for Part B and/or Part D. How much do your premiums go up if you don’t have alternate coverage and don’t enroll when you first become eligible? That depends on how long you wait. But the longer you delay, the higher your premium will be. For example, your mont…

Do I Wait Or Not?

- Ultimately, only you can determine when it’s best for you to enroll in Medicare once you’re eligible. Will you have coverage that gives you an exception to delay enrollment without being subject to a penalty? Be sure to check with your benefits administrator before making a decision. If you’re worried about paying the premiums associated with certain parts of Medicare, consider the ben…