How much does Medicare Part a cost?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty. How much is the Part A late enrollment penalty?

How can I see basic costs for people with Medicare?

Find out if Medicare covers a specific test, item or service that's not listed under the detailed Medicare cost information section of this page. 2022 costs at a glance. Part A premium: Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022.

How much does Medicare Part a cost in 2022?

For detailed cost information . Visit Medicare.gov to find more detailed Medicare cost information by service, and to see how Medicare calculates late enrollment penalties. Or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

How do Medicare Advantage enrollees pay their premiums?

Medicare spending statistics. To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare: Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure.

Why did ObamaCare website crash?

It ultimately failed because of several factors, the inspector general concluded, including poor technical decisions and wasting too much time developing policy and not enough time creating the website.Feb 24, 2016

Why did the HealthCare.gov launch fail?

While website capacity was initially cited as the main issue, additional problems arose mainly due to the website design not being complete. Users cited issues such as drop down menus not being complete and insurance companies cited issues with user data not being correct or complete when it reached them.Nov 18, 2016

Is HealthCare.gov a government website?

Healthcare.gov is the website published by the federal government that is intended to serve as the central online hub for the rollout of the federal government's Patient Protection and Affordable Care Act (ACA or commonly referred to as Obamacare).

Is HealthCare.gov a legitimate website?

Spend some time with HealthCare.gov to learn the basics about getting health coverage. It's the official Marketplace website. Compare insurance plans carefully before making your decision. If you have questions, contact the Health Insurance Marketplace® call center at 1-800-318-2596.

Was HealthCare.gov a success?

Millions Now Have Access to Affordable Healthcare Over the past two years, the operations of the health insurance marketplace have only gotten better. At the close of open enrollment in February 2015, Healthcare.gov had enabled over 11.7 million enrollments or automatic re-enrollments.

What contributed to the failure of the HealthCare.gov website in 2013?

The system defects in the website, enrollment, identity, and infrastructure services should have been identified and fixed before launch, and they were further proof that CMS was in over its head as the technology project lead and probably putting that head in the sand when sharing status updates with the project ...Oct 29, 2018

Is HealthCare.gov the same as marketplace?

A service that helps people shop for and enroll in health insurance. The federal government operates the Health Insurance Marketplace®, available at HealthCare.gov, for most states. Some states run their own Marketplaces.

Why health insurance is so expensive?

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

What is the income limit for Obamacare 2021?

Obamacare Subsidy EligibilityHousehold size100% of Federal Poverty level (2021)400% of Federal Poverty Level (2021)1$12,880$51,5202$17,420$69,6803$21,960$87,8404$26,500$106,0004 more rows•Jan 21, 2022

Who pays if you buy insurance directly from a marketplace?

With most job-based health insurance plans, your employer pays part of your monthly premium. If you enroll in a Marketplace plan instead, the employer won't contribute to your premiums.

How much did the Affordable Care Act cost?

“ObamaCare” is the common name for marketplace health insurance that is made more affordable by the Affordable Care Act. The average cost of an Obamacare plan ranges from $328 to $482 but varies depending on the company, type of plan, and where you live.Dec 1, 2021

What is the legitimate website for Obamacare?

HealthCare.govThe official ObamaCare website, that is the official health insurance marketplace website under the Affordable Care Act, is HealthCare.gov.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Get help paying costs

Learn about programs that may help you save money on medical and drug costs.

Part A costs

Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

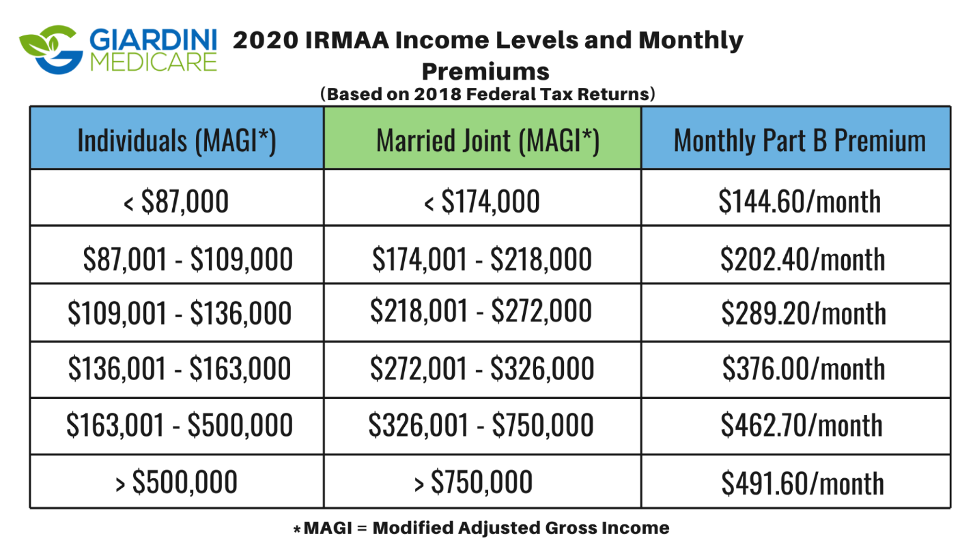

Part B costs

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty.

Costs for Medicare health plans

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C).

Compare procedure costs

Compare national average prices for procedures done in both ambulatory surgical centers and hospital outpatient departments.

Ways to pay Part A & Part B premiums

Learn more about how you can pay for your Medicare Part A and/or Medicare Part B premiums. Find out what to do if your payment is late.

Costs at a glance

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

What is copay in Medicare?

Copay : A flat fee you pay for covered services. Coinsurance : The percentage of costs you pay after reaching your deductible. Knowing how these expenses work is essential to understanding the costs of Medicare. Learn more about about health insurance premiums, deductibles, copayments, and coinsurance.

Do you have to pay penalties for Medicare if you don't sign up?

You will have to pay penalties for some parts of Medicare if you don’t sign up when you’re first eligible and don’t have a particular set of circumstances — like leaving your workplace coverage.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

How much will Medicare copay be in 2021?

The copay amounts for people who reach the catastrophic coverage level in 2021 will increase slightly, to $3.70 for generics and $9.20 for brand-name drugs. Medicare beneficiaries with Part D coverage (stand-alone or as part of a Medicare Advantage plan) will have access to insulin with a copay of $35/month in 2021.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

Is Medicare Advantage available for ESRD?

Under longstanding rules, Medicare Advantage plans have been unavailable to people with end-stage renal disease (ESRD) unless there was an ESRD Special Needs Plan available in their area. But starting in 2021, Medicare Advantage plans are guaranteed issue for all Medicare beneficiaries, including those with ESRD. This is a result of the 21st Century Cures Act, which gives people with ESRD access to any Medicare Advantage plan in their area as of 2021.

Is there a donut hole in Medicare?

The Affordable Care Act has closed the donut hole in Medicare Part D. As of 2020, there is no longer a “hole” for brand-name or generic drugs: Enrollees in standard Part D plans pay 25 percent of the cost (after meeting their deductible) until they reach the catastrophic coverage threshold.

What is the maximum deductible for Part D?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans will be $445 in 2021, up from $435 in 2020. And the out-of-pocket threshold (where catastrophic coverage begins) will increase to $6,550 in 2021, up from $6,350 in 2020.

How much is the Part A deductible for 2021?

If the person needs additional inpatient coverage during that same benefit period, there’s a daily coinsurance charge. For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020).