When you’re eligible for Medicare, you can still have private insurance coverage provided by an employer. Generally speaking, you’re eligible for Medicare when you: are age 65 or older have a qualifying disability receive a diagnosis of ESRD or ALS How Medicare works with your group plan’s coverage depends on your particular situation, such as:

Full Answer

Are you eligible for Medicare Part A?

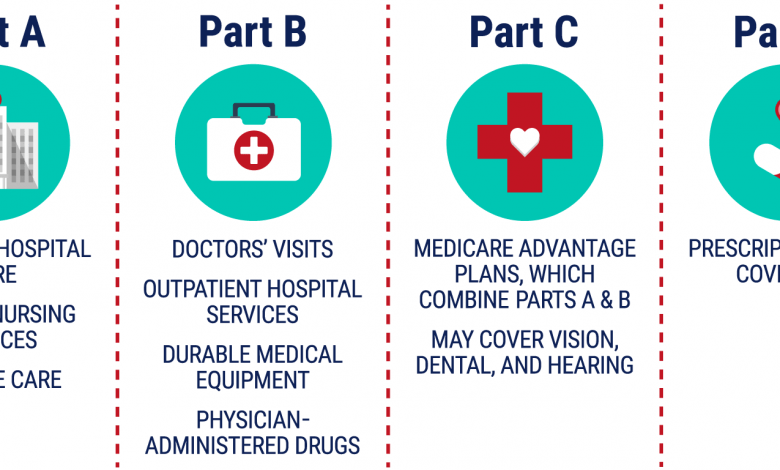

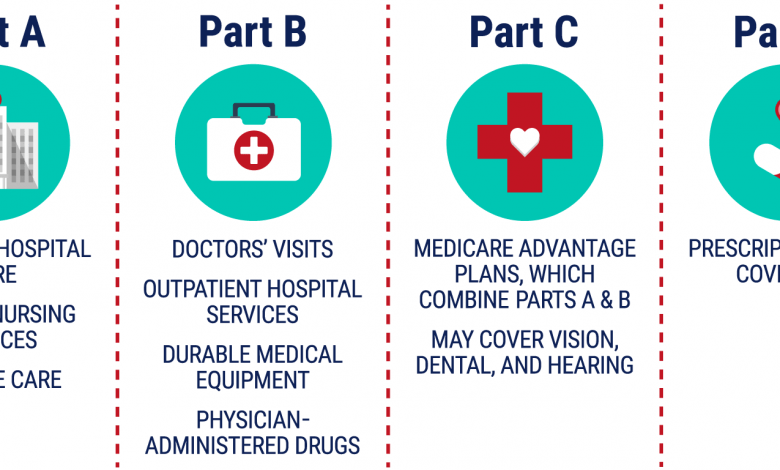

Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance). You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

Can you have both Medicare and private insurance?

It’s possible to have both Medicare and private insurance. You may have both if you’re covered under an employer-provided plan, COBRA, or TRICARE. If you have both Medicare and private insurance, there are guidelines about which provider pays first for your healthcare services.

Do you qualify for Medicaid if you have other health insurance?

You may still qualify for Medicaid, even if you have other health insurance coverage, and coordination of benefits rules decide who pays your bill first. Some Medicaid programs pay for care directly, while others use private insurance carriers to offer Medicaid coverage.

How many employees do you need to have to qualify for Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

Can Medicare and private insurance be used together?

It is possible to have both private insurance and Medicare at the same time. When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer.

What three ways can a person qualify for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

What makes you not eligible for Medicare?

Did not work in employment covered by Social Security/Medicare. Do not have 40 quarters in Social Security/Medicare-covered employment. Do not qualify through the work history of a current, former, or deceased spouse.

How do I switch from private insurance to Medicare?

How to switchTo switch to a new Medicare Advantage Plan, simply join the plan you choose during one of the enrollment periods. You'll be disenrolled automatically from your old plan when your new plan's coverage begins.To switch to Original Medicare, contact your current plan, or call us at 1-800-MEDICARE.

Do I automatically get Medicare when I turn 65?

You automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

Can my wife get Medicare if she never worked?

Can I Get Medicare If I've Never Worked? If you've never worked, you may still qualify for premium-free Medicare Part A. This is based on your spouse's work history or if you have certain medical conditions or disabilities. It's also possible to get Medicare coverage if you pay a monthly Part A premium.

When should you apply for Medicare?

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65.

Are you eligible for Medicare if you never worked?

You can still get Medicare if you never worked, but it will likely be more expensive. Unless you worked and paid Medicare taxes for 10 years — also measured as 40 quarters — you will have to pay a monthly premium for Part A. This may differ depending on your spouse or if you spent some time in the workforce.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Can I Use Private Insurance Instead Of Medicare

Medicare is a federal health care program designed to provide benefits for those 65 and older or those who are younger in age but have been diagnosed with a qualified medical condition. But what if you want to use private insurance instead?

Medicare And Military Health Benefits

If you are active-duty military and enrolled in TRICARE, which is the health insurance policy offered to U.S. service members, it will cover the services and supplies that Medicare typically covers.

Are There False Positives

The FDA issued an alert in early October about the potential for false-positive results with some home COVID-19 tests produced by Ellume, which were sold at various retailers nationwide.

Group Health Insurance From Workplace

Much like other insurers, Medicare has its own COB rules with commercial health plans. This sets up a game plan as to which one pays first.

Which Is Better For Those With Dependents

Typically, private insurance is a better option for people with dependents. While Medicare plans offer coverage only to individuals, private insurers usually allow people to extend health coverage to dependents, including children and spouses.

If You Can Have Medicare And Private Insurance How Does That Work

If you have private health insurance along with your Medicare coverage, the insurers generally do coordination of benefits to decide which insurer pays first.

What Is The Benefit Of Private Health Insurance

The advantage of choosing a private health insurance plan versus a group health insurance plan offered by your employer is that you will likely have a wider range of choices in terms of insurance companies, plan types, tiers, networks, and various options from which to choose.

What age do you have to be to be enrolled in Medicare?

are age 65 or over and enrolled in Medicare Part B. have a disability, end stage renal disease (ESRD), or amyotrophic lateral sclerosis (ALS) and are enrolled in both Medicare Part A and Part B. have Medicare and are a dependent of an active duty service member with TRICARE.

What percentage of Americans have private health insurance?

Others include Medicaid and Veteran’s Affairs benefits. According to a 2020 report from the U.S. Census Bureau, 68 percent of Americans have some form of private health insurance. Only 34.1 percent have public health insurance, including 18.1 percent who are enrolled in Medicare. In certain cases, you can use private health insurance ...

How does Medicare work with a group plan?

How Medicare works with your group plan’s coverage depends on your particular situation, such as: If you’re age 65 or older. In companies with 20 or more employees, your group health plan pays first. In companies with fewer than 20 employees, Medicare pays first. If you have a disability or ALS.

How to contact the SSA about Medicare?

Contacting the SSA at 800-772-1213 can help you get more information on Medicare eligibility and enrollment. State Health Insurance Assistance Program (SHIP). Each state has its own SHIP that can aid you with any specific questions you may have about Medicare. United States Department of Labor.

What is the process called when you have both insurance and a primary?

When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer. Once the payment order is determined, coverage works like this: The primary payer pays for any covered services until the coverage limit has been reached.

What is health insurance?

Health insurance covers much of the cost of the various medical expenses you’ll have during your life. Generally speaking, there are two basic types of health insurance: Private. These health insurance plans are offered by private companies.

Does Medicare pay first or second for ESRD?

You have ESRD. COBRA pays first. Medicare may pay second, depending whether there’s overlap between your COBRA coverage and your first 30 months of Medicare eligibility based on having ESRD.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When did Medicare start providing prescription drugs?

Since January 1, 2006, everyone with Medicare, regardless of income, health status, or prescription drug usage has had access to prescription drug coverage. For more information, you may wish to visit the Prescription Drug Coverage site.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months. ( Note: If you have Lou Gehrig's disease, your Medicare benefits begin the first month you get disability benefits.)

Medicare As An Automatic

In some cases, Medicare is an automatic. For instance, Medicare.gov says that if you receive benefits via either Social Security or the Railroad Retirement Board (RRB) for more than four months before turning 65, you automatically receive Medicare Part A (hospital insurance) and Part B (medical insurance).

Choosing the Private Insurance Option

If none of these situations apply to you and you want to use private insurance instead, it’s important to understand that there is only a seven-month window in which you can apply for Medicare benefits, according to Medicare.gov.

Using Medicare With Other Insurances

You can also have both Medicare and private insurance to help cover your health care expenses. In situations where there are two insurances, one is deemed the “primary payer” and pays the claims first. The other becomes known as the “secondary payer” and only applies if there are expenses not covered by the primary policy.

What is the best age to enroll in Medicare?

Enrolling in Medicare. Enrolling in Medicare when you turn 65 can help save you money and ensure a seamless transition. There are many things to consider when reviewing your health care coverage as you age into Medicare. We’re here to answer your questions and find the best solution for you.

How many employees can you have to sign up for Medicare?

If your employer has less than 20 employees, signing up for Part A and Part B when you're first eligible, would allow your Medicare coverage to pay prior to any other coverage.

What happens if you don't enroll in Part B?

Note: If you do not enroll in Part B when you are first eligible, you may incur a late enrollment penalty and a gap in coverage if you decide to enroll later.

How long before you apply for Medicare should you stop contributing to your HSA?

Note: To avoid a tax penalty, you should stop contributing to your Health Savings Account (HSA) at least 6 months before you apply for Medicare.

Do you have to enroll in Part B of tricare?

However, if you have TRICARE and are an active-duty service member (or the spouse or dependent child), you are not required to enroll in Part B to maintain your coverage. If you have only Veterans' benefits, you should enroll in Part A and Part B when you're first eligible.

Can you delay enrolling in Medicare?

If you do enroll in Medicare, that doesn’t necessarily mean you need to drop your private health insurance.