According to SSA.gov, to qualify for Part D Extra Help, you must be receiving Medicare and have limited resources and income. Furthermore, you must reside in one of the 50 States or the District of Columbia.

Full Answer

What drugs are covered in Part D?

Jul 24, 2021 · There are specific criteria you need to meet in order to qualify for the program. 1 To be eligible for Part D, you must first be eligible for Medicare at large. The rules for Medicare eligibility are straightforward. Beyond that, there are other specific rules for enrolling in Part D that you need to know.

How do I know if I have Medicare Part D?

Apr 16, 2021 · Eligibility for Medicare Part D Extra Help is based on your income and assets, and the limits change yearly. In 2021, you may be eligible for Medicare Part D Extra Help if: Individual: your annual income no more than $19,320, and the value of your assets is no more than $14,790. Married couple: your combined income is no more than $26,130, and the value of your assets …

What are the requirements for Medicare Part D?

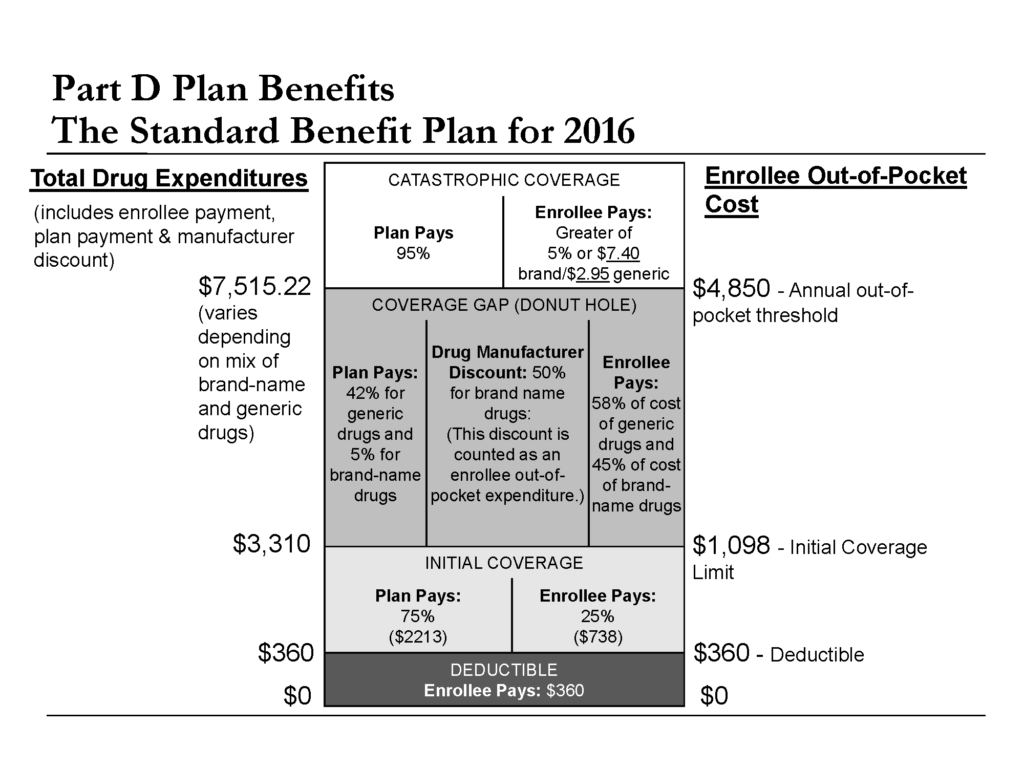

What Medicare Part D drug plans cover. Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site. Costs for Medicare drug coverage. Learn about the types of costs you’ll pay in a Medicare drug plan. How Part D works with other insurance

What are the stages of Medicare Part D?

Qualify for extra help from Medicare to pay the costs of Medicare prescription drug coverage (Part D). You'll need to meet certain income and resource limits. Programs for people in U.S. territories Programs in Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, American Samoa, for people with limited income and resources.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

Does everyone pay for Medicare Part D?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Who are Medicare Part D eligible individuals?

Those 65 or older who are entitled to or already enrolled in Medicare are eligible for Part D drug insurance. Also eligible are people who have received Social Security Disability Insurance (SSDI) benefits for more than 24 months and those who have been diagnosed with end-stage renal disease.

Can I enroll in Medicare Part D at any time?

When you first become eligible for Medicare, you can join a plan. Open Enrollment Period. From October 15 – December 7 each year, you can join, switch, or drop a plan. Your coverage will begin on January 1 (as long as the plan gets your request by December 7).

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What happens if I don't want Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

How do I know if I have Medicare Part D?

To learn more about the Medicare Advantage plans and the Medicare Part D plans in your area, you can use the Medicare Plan Finder, a searchable tool on the Medicare.gov website. You can also call 1-800-MEDICARE (1-800-633-4227) or speak to someone at your local State Health Insurance Assistance Program (SHIP).

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.Sep 27, 2021

When did Part D become mandatory?

January 1, 2006The benefit went into effect on January 1, 2006. A decade later nearly forty-two million people are enrolled in Part D, and the program pays for almost two billion prescriptions annually, representing nearly $90 billion in spending. Part D is the largest federal program that pays for prescription drugs.Aug 10, 2017

When did Medicare Part D become mandatory?

January 1, 2006Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription drug benefit, authorized by Congress under the “Medicare Prescription Drug, Improvement, and Modernization Act of 2003.”[1] This Act is generally known as the “MMA.”

What Is The Medicare Part D Extra Help Program?

The Medicare Extra Help (or Low-Income Subsidy) program is for people who need financial assistance with their Medicare Part D coverage. Prescripti...

Who Qualifies For Medicare Part D Extra Help?

Eligibility for Medicare Part D Extra Help is based on your income and assets, and the limits change yearly. In 2017, you may be eligible for Medic...

What If I Don’T Qualify For Medicare Extra Help?

If you don’t qualify to receive Extra Help, there are still ways to save money. Your State Medical Assistance (Medicaid) office or your State Healt...

How Can I Find A Plan That Helps Me Save on Medicare Part D Costs?

Even if you don’t qualify for the Extra Help this year, one of the simplest ways you can reduce prescription drug costs is by taking the time to co...

What is the second requirement for Medicare?

The second requirement for Medicare eligibility is to demonstrate medical need. Medicare leaves no room for interpretation here. You will be eligible for the program if you meet at least one of the following criteria.

What is Medicare a federal program?

Medicare is a federal healthcare program that Americans pay into with taxes. It makes sense that the government would want to make sure that you have ties to the country before they allowed you access to that benefit.

How long does a disability last?

You have a disability that is expected to last longer than 12 months. This disability can be for any number of reasons but must be approved for Social Security Disability Insurance (SSDI) to be eligible for Medicare. You cannot sign up for Medicare until you have been on SSDI for 24 months.

Who is James Lacy?

James Lacy, MLS, is a fact checker and researcher. James received a Master of Library Science degree from Dominican University. Before you can take advantage of a Part D plan, you must first be eligible to sign up. There are specific criteria you need to meet in order to qualify for the program. 1 .

What is MA PD?

There are Medicare Advantage Prescription Drug Plans (MA-PD plans) that include Part D coverage. In summary, you will need to have one of these Medicare plans or combinations to be eligible for Part D coverage: Part D + Part A. Part D + Part B. Part D + Original Medicare (Parts A and B) MA-PD. There are times you may be eligible for Medicare ...

What happens if you don't sign up for Medicare?

If you do not sign up yourself, you will be automatically enrolled in Original Medicare and a Part D plan by the government. You will have the option to change to a MA-PD or pick a different Part D plan at a later time. What It Means to Be Dual Eligible for Medicare and Medicaid.

What percentage of Americans have two or more chronic medical conditions?

You are 65 years or older. More than 60 percent of Americans in this age group have two or more chronic medical conditions. Even if you do not have any medical problems at the present time, you are at a statistically higher risk for developing one.

How to reduce Medicare Part D cost?

Here are other ways to reduce costs for Medicare Part D prescription medications: Switch to a generic form of the prescription drug if available (check with your doctor first). Ask your doctor about less expensive brand-name drugs. Use a mail-order pharmacy, which may provide savings if you’re ordering a larger quantity of medications.

What to do if you don't qualify for extra help?

If you don’t qualify to receive Extra Help, there are still ways to save money. Your State Medical Assistance (Medicaid) office or your State Health Insurance Assistance Program (SHIP) can provide you more information on payment assistance for prescription drug costs.

What is Medicare Extra Help?

If you’re eligible for the Medicare Extra Help program, the level of assistance you get depends on your income and financial resources. The program caps the costs you pay for covered generics and brand-name medications.

How much does a burial plot cost?

Burial plot and up to $1,500 for burial costs if you’ve set aside money for this purpose. Personal or household items. Furniture. You may automatically qualify for Extra Help if you have Medicare and also: Receive full Medicaid coverage (meaning you’re eligible for the full range of Medicaid benefits).

Does Medicare cover coinsurance?

Each Medicare plan that covers prescription drugs typically places covered medications into different “cost tiers,” and your copayment and coinsurance costs will depend on which tier your prescriptions fall onto. Typically, medications on higher tiers have higher cost sharing amounts.

Does Medicare cover out of pocket costs?

If you’re one of many beneficiaries who takes prescription drugs, you know that even if you have Medicare Part D prescription drug coverage, there are usually still out-of-pocket costs you’re responsible for. Prescription costs like copayments, coinsurance, and deductibles can quickly skyrocket depending on the medications you take, how often, ...

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is SSI benefits?

A monthly benefit paid by Social Security. SSI is for people with limited income and resources who are disabled, blind, or age 65 or older. SSI benefits aren't the same as Social Security retirement or disability benefits.

What is the PACE program?

PACE. PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

How much does Medicare Part D cost?

Medicare Part D plans are also provided through private insurance companies. The national average Part D premium is $33.19, according to My Medicare Matters. But depending on where you live and the type of plan you have, Medicare Part D costs will vary.

What is the difference between Medicare Part A and Part B?

All programs require eligibility for Medicare Part A, but the main difference between each is the federal poverty level (FPL) range that those seeking help must be within.

What is a Part C plan?

A Part C plan combines other parts of Medicare (Original Medicare and, usually, Part D) and can provide you with a broader range of benefits. These plans are sold through private insurance companies that are approved by Medicare.

When are Medicare premiums due?

Pay on time to avoid coverage cancellation. Medicare premiums are due the 25th day of the month. Don’t miss more than 3 consecutive months of payments to Medicare. Coverage will end in the fourth month if payments aren’t made.

What is the CMS?

The Centers for Medicare and Medicaid Services (CMS) provide assistance with premium payments. Medicaid operates four types of Medicare Savings Programs (MSP): Most of the help you can get to pay premiums are available through these programs.

How much is Part B insurance?

The standard Part B premium as of 2019 is $135.50, but most people with Social Security benefits will pay less ($130 on ).

Can you get Medicare out of pocket?

Each state manages MSP funds and decides who qualifies. Programs can pay for all, or just some, of your Medicare out-of-pocket expenses, which includes premiums.

How old do you have to be to qualify for Medicare?

You’re an American citizen who lives in the country or a permanent resident who has lived here for five or more continuous years, and. You’re 65 or older or under 65 and qualify for Medicare due to having a disability, ESRD, or ALS.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers inpatient hospital, hospice, and skilled nursing facility care. Part A also covers home health care. You can sign up for Part A: During your Initial Enrollment Period (IEP), if you’re not automatically enrolled, or. At any time after you’re first eligible.

How long does it take to get Medicare?

Generally, you’re eligible to enroll in Medicare once you turn 65 and you enter your Initial Enrollment Period . Your initial enrollment is a seven-month period : It begins three months before the month you turn 65 and ends three months after you turn 65. For example, if you turn 65 in September, you can apply for Medicare from June ...

When is the open enrollment period for Medicare?

The Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31 each year. If you’re already enrolled in a Medicare Advantage plan, you can switch to a different one (with or without drug coverage) or drop your plan and return to Original Medicare.

Who administers Medicare?

The Medicare program is administered by the Centers for Medicare & Medicaid Services (CMS ), with help from the Social Security Administration (SSA) and the Railroad Retirement Board (RRB).

What is a Part C plan?

Part C Plans Are an Alternative to Original Medicare. Medicare Advantage plans provide Part A and Part B benefits. Most plans have built-in Part D prescription drug coverage. Some also offer other benefits, such as vision and dental coverage.

Who is Leonie Dennis?

Leonie Dennis is a rising subject matter expert in the Medicare and ACA healthcare reform landscape. She holds a Bachelor of Science in Marketing from William Paterson University of New Jersey.

What to do if you disagree with Medicare decision?

If you disagree with the decision we made about your eligibility for Extra Help, complete an Appeal of Determination for Extra Help with Medicare Prescription Drug Plan Costs. We also provide Instructions for Completing the Appeal.

Can you get help with Medicare?

With the Medicare Savings Programs (MSP), you can get help, from your state, paying your Medicare premiums. In some cases, MSPs may also pay Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) deductibles, coinsurance, and copayments if you meet certain conditions. If you qualify for certain MSPs, you automatically qualify ...

Can Medicare beneficiaries get extra help?

Table of Contents. Medicare beneficiaries can qualify for Extra Help paying for their monthly premiums, annual deductibles, and co-payments related to Medicare Part D (prescription drug coverage).

What is Medicare dual eligible?

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. Since it can be easy to confuse the two terms, Medicare and Medicaid, it is important to differentiate between them. While Medicare is a federal health insurance program for seniors and disabled persons, Medicaid is a state and federal medical assistance program for financially needy persons of all ages. Both programs offer a variety of benefits, including physician visits and hospitalization, but only Medicaid provides long-term nursing home care. Particularly relevant for the purposes of this article, Medicaid also pays for long-term care and supports in home and community based settings, which may include one’s home, an adult foster care home, or an assisted living residence. That said, in 2019, Medicare Advantage plans (Medicare Part C) began offering some long-term home and community based benefits.

How old do you have to be to apply for medicare?

Citizens or legal residents residing in the U.S. for a minimum of 5 years immediately preceding application for Medicare. Applicants must also be at least 65 years old.

What is dual eligible?

Definition: Dual Eligible. To be considered dually eligible, persons must be enrolled in Medicare Part A, which is hospital insurance, and / or Medicare Part B, which is medical insurance. As an alternative to Original Medicare (Part A and Part B), persons may opt for Medicare Part C, which is also known as Medicare Advantage.

How much does Medicare Part B cost?

For Medicare Part B (medical insurance), enrollees pay a monthly premium of $148.50 in addition to an annual deductible of $203. In order to enroll in a Medicare Advantage (MA) plan, one must be enrolled in Medicare Parts A and B. The monthly premium varies by plan, but is approximately $33 / month.

Does Medicare provide long term care?

Long-Term Care Benefits. Medicaid provides a wide variety of long-term care benefits and supports to allow persons to age at home or in their community. Medicare does not provide these benefits, but some Medicare Advantage began offering various long term home and community based services in 2019. Benefits for long term care may include ...

What is the income limit for Medicaid in 2021?

In most cases, as of 2021, the individual income limit for institutional Medicaid (nursing home Medicaid) and Home and Community Based Services (HCBS) via a Medicaid Waiver is $2,382 / month. The asset limit is generally $2,000 for a single applicant.

Is there an age limit for Medicare?

Eligibility for Medicare is not income based. Therefore, there are no income and asset limits.