You must submit PROOF OF PAYMENT to the District Human Resources/Benefits Unit to be reimbursed for Medicare premiums. Submit one of the following forms annually (paper size 8 X 11 only please). The form must indicate the recipient name, social security number, the effective date of Medicare coverage and monthly premium amount. New enrollees must notify the District within the first month of coverage, as there will be no retro payment.

Who is eligible for Medicare Part B premium reimbursement?

For those who qualify, there are multiple ways to have your Medicare Part B premium paid. In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What zip codes qualify for Medicare rebates?

Remember to add $148.50 back to your income amount (your total income amount is based on the amount before the Part B premium is subtracted). Your total monthly income includes all sources of money you receive (i.e. pensions, part-time job, alimony payments, etc.). Q4: Do your “liquid personal assets” add up to less than $7,860 (or $11,800 if ...

How does income affect monthly Medicare premiums?

Jul 27, 2021 · If you want Medicare to pay for your care, you’ll need to send a form to request reimbursement. Seeing a Non-participating Doctor These doctors accept Medicare patients, but they haven’t agreed to Medicare’s rates. They may choose to accept Medicare rates in your case, or they may decide to bill you up to 15% more than the Medicare rate.

What is the monthly premium for Medicare Part B?

The Blue Cross and Blue Shield Service Benefit Plan will reimburse these members up to $600 every calendar year for their Medicare Part B premium payments. Each eligible member on a contract: • Has his or her own $600 benefit • Uses his or …

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

How do I get my Medicare reimbursement?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

How do I get reimbursed for Part B premium?

Submit Medicare Part B premium proof of payment and a completed reimbursement form for each eligible dependent to HealthEquity in one of the following ways: Scan and upload them to healthequity.com. Fax them to 1-801-999-7829. (Be sure to include a cover sheet.)

Can Medicare premiums be reimbursed?

You can use the ICHRA to reimburse premiums for Medicare and Medigap as well as other costs. Employers have more choice in which medical costs are eligible for reimbursement under an ICHRA.

How long does it take to get Medicare reimbursement?

Using the Medicare online account We'll pay your benefit into the bank account you've registered with us. You can register your bank details through your Medicare online account or Express Plus Medicare mobile app. When you submit a claim online, you'll usually get your benefit within 7 days.Dec 10, 2021

What is Medicare reimbursement based on?

Medicare reimbursement rates will be based upon Current Procedural Terminology codes (CPT). These codes are numeric values assigned by the The Centers for Medicare and Medicaid Services (CMS) for services and health equipment doctors and facilities use.Dec 9, 2021

Who gets Medicare Part B reimbursement?

Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement. 4.

Is Medicare Part B reimbursement considered income?

On researching, it seems many employers issue a check separately for the reimbursed premiums; this is then deducted from Medical Expenses claimed, so if they file using the Standard Deduction, it is non-taxable income.May 31, 2019

Can HRA be used for premiums?

Can I use an HRA to pay insurance premiums? You absolutely can! There are two different kinds of health reimbursement arrangements that are relatively new to the market that allow employers to reimburse for health insurance premiums.Oct 22, 2020

Can a Section 105 plan reimburse Medicare premiums?

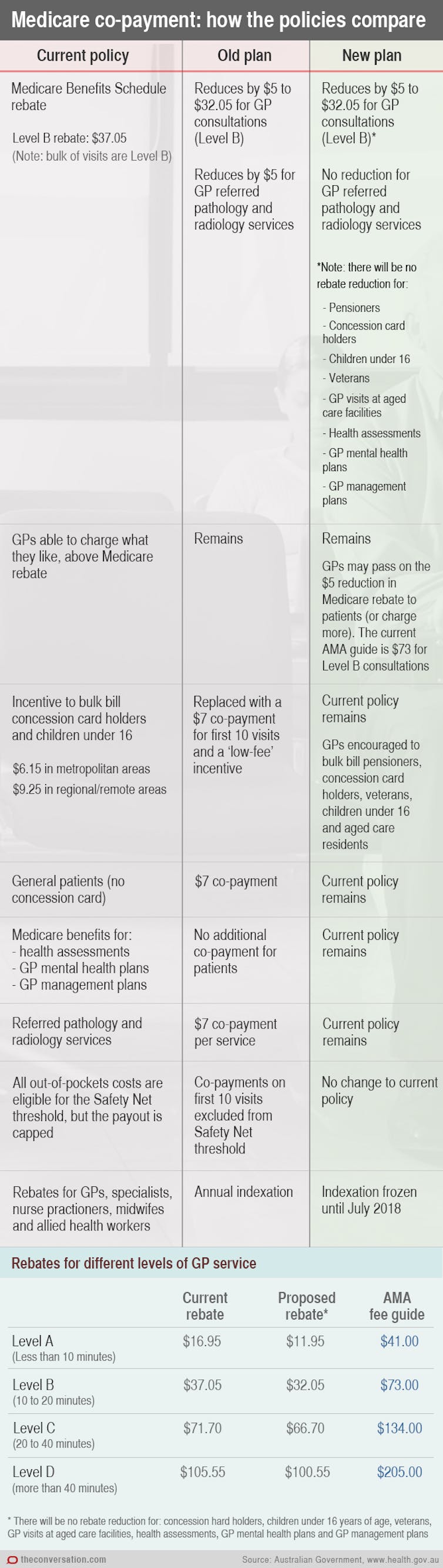

Section 105 plans enable employers to reimburse employees with tax free money for most major insurance premiums. In addition to premiums, employers can also choose to reimburse for eligible expenses specified in IRS Publication 502.Nov 30, 2020

Can you have an HRA and Medicare?

The health reimbursement arrangement (HRA) is another health benefit that can also help the elderly and disabled get their medical expenses covered—and the good news is, HRAs and Medicare can be used together.Mar 24, 2021

Medicare Premium: What Is It and How Does It Work?

Your Medicare premium is the monthly payment you make to have a Medicare insurance plan. Medicare insurance has four parts: Part A (hospital insura...

Medicare Premium Assistance: What Options Are available?

The Centers for Medicare and Medicaid Services (CMS) provide assistance with premium payments. Medicaid operates four types of Medicare Savings Pro...

How to Qualify For Help With Medicare Premiums

You may qualify for help with paying your premiums through Medicare Savings Programs if you: 1. Are eligible for or have Medicare Part A 2. Meet in...

Help Paying Medicare Prescription Drug (Part D) Premiums

You may be able to get help with Medicare premiums for your prescription drug coverage through the Part D Low-Income Subsidy (LIS) program, also ca...

Alternative Medicare Assistance Programs

Programs outside of Medicare that can help pay premiums are generally for Medicare Part D plans. Depending on the state you live in, you may be abl...

Evaluating Your Medicare Needs

With all the different parts of Medicare and different premiums for each part, it can be a little confusing to understand how Medicare works. Healt...

When are Medicare premiums due?

Pay on time to avoid coverage cancellation. Medicare premiums are due the 25th day of the month. Don’t miss more than 3 consecutive months of payments to Medicare. Coverage will end in the fourth month if payments aren’t made.

How much does Medicare Part D cost?

Medicare Part D plans are also provided through private insurance companies. The national average Part D premium is $33.19, according to My Medicare Matters. But depending on where you live and the type of plan you have, Medicare Part D costs will vary.

What is a Part C plan?

A Part C plan combines other parts of Medicare (Original Medicare and, usually, Part D) and can provide you with a broader range of benefits. These plans are sold through private insurance companies that are approved by Medicare.

What is the CMS?

The Centers for Medicare and Medicaid Services (CMS) provide assistance with premium payments. Medicaid operates four types of Medicare Savings Programs (MSP): Most of the help you can get to pay premiums are available through these programs.

What is the difference between Medicare Part A and Part B?

All programs require eligibility for Medicare Part A, but the main difference between each is the federal poverty level (FPL) range that those seeking help must be within.

How much is Part B insurance?

The standard Part B premium as of 2019 is $135.50, but most people with Social Security benefits will pay less ($130 on ).

Can you get Medicare out of pocket?

Each state manages MSP funds and decides who qualifies. Programs can pay for all, or just some, of your Medicare out-of-pocket expenses, which includes premiums.

When was the Medicare buy in manual released?

Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”) On September 8, 2020, the Centers for Medicare & Medicaid Services (CMS) released an updated version of the Manual for State Payment of Medicare Premiums (formerly called “State Buy-in Manual”). The manual updates information and instructions to states on federal ...

How many people pay Medicare Part B?

States pay Medicare Part B premiums each month for over 10 million individuals and Part A premium for over 700,000 individuals.