How do I read Medicare EOB?

- Log in to your account at bcbsm.com. If you haven't registered, follow the instructions to sign up.

- Your latest EOB will be under Claims on the top menu. You can choose to receive only your EOBs online, eliminating the...

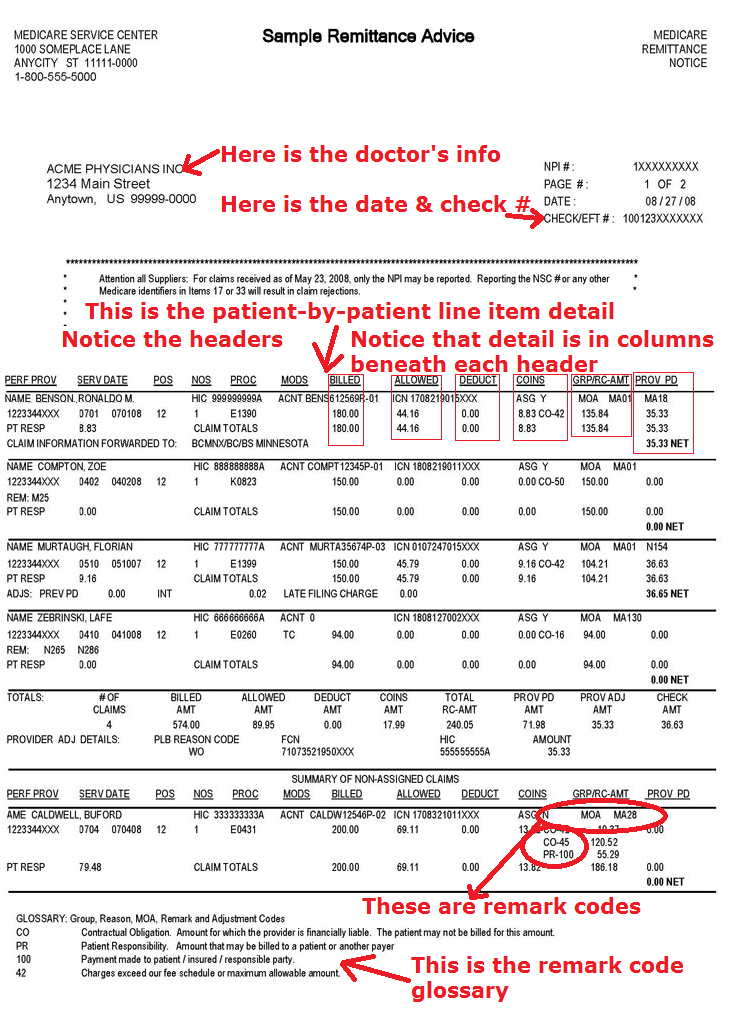

- How much the provider charged. This is usually listed under a column titled "billed" or "charges."

- How much Medicare allowed. Medicare has a specific allowance amount for every service. ...

- How much Medicare paid. ...

- How much was put toward patient responsibility.

What is an EOB and how do you read it?

Jan 18, 2022 · Here’s how: Monitor your deductible payments. Full payment of your deductible means that your insurance coverage can start for applicable services. Be ready for additional expenses by checking your total costs against your plan’s MOOP. Also, be alert and find out if you are nearing the coverage ... ...

How long should you keep Medicare EOB?

Each month you fill a prescription, your Medicare Prescription Drug Plan mails you an "Explanation of Benefits" (EOB). This notice gives you a summary of your prescription drug claims and costs. When should I get it? Monthly Who sends it? Your plan What should I do if I get this notice? Review your notice and check it for mistakes.

How to read your prescription drug EOB?

Sep 15, 2021 · How to Read Medicare EOBs. How much the provider charged. This is usually listed under a column titled "billed" or "charges." How much Medicare allowed. Medicare has a specific allowance amount for every service. It usually provides a breakdown on the EOB for what was ... How much Medicare paid. For ...

How to read Your Part B Medicare statement?

Accessing Your Medicare Summary Notice Online. Create or log into your Medicare account. At the top of the homepage, click “Get your Medicare Summary Notices (MSNs) electronically” under the section for messages. Once you arrive at the communication preferences page, …

How do you read an EOB statement?

How do I read an EOB?The name of the person who received services (you or a family member your plan covers)The claim number, group name and number, and patient ID.The doctor, hospital or other health care professional that provided services.Dates of services and the charges.More items...

How do I read a Medicare Summary Notice?

It's not a bill. It's a notice that people with Original Medicare get in the mail every 3 months for their Medicare Part A and Part B-covered services. The MSN shows: All your services or supplies that providers and suppliers billed to Medicare during the 3-month period.

How do you read an EOB for dummies?

1:342:35How to Read Your Medical EOB - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe amount you pay for the service this is the amount that you will be billed. Remember the EOB isMoreThe amount you pay for the service this is the amount that you will be billed. Remember the EOB is not a bill it just shows you how the costs are distributed. If you have any questions by your EOB.

What information is found on the Explanation of Benefits EOB?

An Explanation of Benefits, commonly referred to as an EOB is a statement from your health insurance company providing details on payment for a medical service you received. It explains what portion of services were paid by your insurance plan and what part you're responsible for paying.Oct 1, 2019

Should I keep Medicare summary notices?

How Long Should You Keep Medicare Summary Notices? Most experts recommend saving your Medicare summary notices for one to three years. At the very least, you should keep them while the medical services listed are in the process of payment by Medicare and supplemental insurance.

How do I know what Medicare has paid?

You can also contact your local Health Insurance Counseling & Advocacy Program (HICAP) office online or at 1-800-434-0222. You will also receive an Explanation of Benefits (EOB) from your Medigap company or retiree plan. The EOB will show you how much was paid.

What are 3 figures that are commonly depicted on an EOB?

An EOB typically describes:the payee, the payer and the patient.the service performed—the date of the service, the description and/or insurer's code for the service, the name of the person or place that provided the service, and the name of the patient.More items...

What key areas do you look at on the EOB and why?

Important information outlined in your EOB includes:What medical services or products your health care provider performed or prescribed.How much your provider charged for those services or products.What amount your plan will pay for those services or products.More items...

What is EOB posting?

Insurance Payment Posting: All payers either send an EOB (explanation of benefits) or ERA (electronic remittance advice) towards the payment of a claim. The medical billing staff posts these payments immediately into the respective patient accounts, against that particular claim to reconcile them.

What is the allowed amount listed on an EOB?

Allowed Amount: maximum allowed charge as determined by your benefit plan after subtracting Charges Not Covered and the Provider Discount from the Amount Billed. 25. Deductible Amount: the amount of allowed charges that apply to your plan deductible that must be paid before benefits are payable. 26.

How do you read a medical claim?

What information does a medical claims file contain?National Provider Identifier (NPI) for the attending physician and the service facility.Primary diagnosis code.Inpatient procedure, if applicable.Diagnosis-related group (DRG)Name of the patient's insurance company, and.Overall charge for the claim.

Why does EOB say I owe money?

If you pay a copay (a fixed amount for each visit) or coinsurance (a percentage of health costs after meeting your deductible), this will be reflected on your EOB. The amount you owe the provider after insurance. Remember: Your EOB isn't a bill, and if you owe a balance, you should receive a bill from your provider.Jan 6, 2020

How to Read Medicare EOBs

Medicare EOBs are sent each time Medicare processes a claim from one of your health care providers. You should receive one a few weeks or so after any medical services.

How to Read Medicare MSNs

You receive a Medicare Summary Notice every quarter that you receive Medicare-covered health care services. The notice summarizes how much Medicare paid for services during that period and how much you may owe out-of-pocket.

What Is an Explanation of Benefits?

An explanation of benefits (EOB) is a notice from your Medicare provider that you receive monthly or after accessing health care services. It includes a description of your plan, the costs of services, how much your insurer covered and out-of-pocket costs you may have to pay.

How to Read an EOB

EOBs may look different depending on your provider, but they generally include similar information. An EOB summarizes the items and services you accessed, the amount charged to Medicare, how much was covered by Medicare and how much you owe.

What Is a Medicare Summary Notice?

A Medicare Summary Notice (MSN) is a statement you receive every three months from Medicare that details the health care services you accessed during that period. It includes how much Medicare paid and how much you may have to pay the provider.

How to Read a Medicare Summary Notice

The MSNs for Part A and Part B are issued by Medicare, and their formats are identical.

How can I see my EOB statements online?

If you'd like to save time and paper, you can also get your EOB statements online.

Still have questions?

Please call the customer service number that’s listed on your EOB or on the back of your Blue Cross ID card.

Information in an Explanation of Benefits

Your EOB has a lot of useful information that may help you track your healthcare expenditures and serve as a reminder of the medical services you received during the past several years.

Why Is Your Explanation of Benefits Important?

Healthcare providers’ offices, hospitals, and medical billing companies sometimes make billing errors. Such mistakes can have annoying and potentially serious, long-term financial consequences.

EOBs and Confidentiality

Insurers generally send EOBs to the primary insured, even if the medical services were for a spouse or dependent. 3 This can result in confidentiality problems, especially in situations where young adults are covered under a parent's health plan, which can be the case until they turn 26 .

Protecting Yourself Against Medicare Fraud and Abuse

Tanya Feke, MD, is a board-certified family physician, patient advocate and best-selling author of "Medicare Essentials: A Physician Insider Explains the Fine Print."

The Medicare Summary Notice

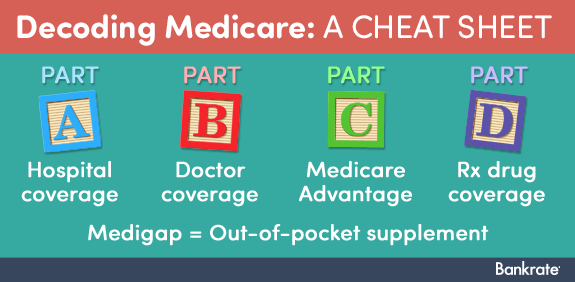

If you are on Original Medicare (Part A and Part B), you will receive a Medicare Summary Notice (MSN) quarterly, i.e., every 3 months. You will receive separate MSNs for Part A and Part B coverage.

Medicare Advantage and Part D Prescription Drug Plans

If you are on a Medicare Advantage (Part C) or Medicare Part D plan, you will not receive a Medicare Summary notice from CMS. You will receive a statement directly from the insurance company that sponsors your plan. The document you receive is called an Explanation of Benefits (EOB).

How to Use the MSN and EOB

Whether you receive a Medicare Summary Notice or an Explanation of Benefits, it is important to save copies of these statements for your records. You can compare them against any medical bills you receive. It is encouraged that you also keep a log of any services you receive and on what days to make sure you are not being improperly billed.

Taking Action

Whenever you see something that does not match up with your records, reach out to your healthcare provider or medical office for clarification. There could have been a misunderstanding or a true billing error. In the worst-case scenario, it could be a sign of Medicare fraud and abuse.

A Word From Verywell

Too many people assume that their healthcare bills are accurate and pay them outright. You could be at risk for overbilling or Medicare fraud. Learn how to read your Medicare Summary Notice to make sure you are not paying more than your fair share.