After making this comparison, if you want to switch to another Part D plan, you can enroll online on Medicare’s plan-finder website, or call Medicare, or call the plan. You do not have to inform your current plan. Signing up with a new plan automatically cancels your coverage from the old one.

Full Answer

Do I have to reenroll in my Medicare Part D prescription drug plan?

Mar 06, 2021 · The amount of the Part D late enrollment penalty depends on how long you went without prescription drug coverage. Medicare calculates the amount by multiplying the number of months you didn’t have prescription drug coverage by 1% of the national base beneficiary premium. In 2021, the national base beneficiary premium is $33.06.

How does Medicare disenroll you from insurance?

Nov 15, 2009 · There are many plans available in each state, which can make it difficult to know which plan to choose and whether you will save money on your prescription medications by enrolling in a Part D plan. Premiums for Part D plans range from low cost (under $20 per month) to more than $100 each month, with most plans falling within the $30 to $60 per ...

How do I switch my Medicare Part D plan?

After making this comparison, if you want to switch to another Part D plan, you can enroll online on Medicare’s plan-finder website, or call Medicare, or call the plan. You do not have to inform your current plan. Signing up with a new plan automatically cancels your coverage from the old one. Your new coverage will begin Jan. 1.

How do I reenroll in Medicare Part B?

New! Revisions to the Prescription Drug Plan Enrollment and Disenrollment Guidance and Individual Enrollment Request Form to Enroll in a Part D plan for CY 2021. On August 11, 2020, CMS released the “Enrollment Guidance Policy Changes and Updates and Model Medicare Advantage and Prescription Drug Plan Individual Enrollment Request Form for Contract Year …

How do I disenroll from Medicare Part D?

- Call us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.

- Mail or fax a signed written notice to the plan telling them you want to disenroll.

- Submit a request to the plan online, if they offer this option.

- Call the plan and ask them to send you a disenrollment notice.

When can you cancel Part D?

Can I change my Part D plan every year?

Will my Part D plan automatically renew?

Do I need to cancel my old Part D plan?

Can you change Part D plans without penalty?

How do I change Part D plans?

What is the Best Medicare Plan D for 2022?

- Best in Ease of Use: Humana.

- Best in Broad Information: Blue Cross Blue Shield.

- Best for Simplicity: Aetna.

- Best in Number of Medications Covered: Cigna.

- Best in Education: AARP.

Can Medicare Part D be changed anytime?

Do I have to renew Medicare Part D every year?

Are you automatically enrolled in Medicare Part D?

Do I need Medicare Part D if I don't take any drugs?

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How long can you go without Medicare Part D?

However, if you go without Medicare Part D or other creditable prescription drug coverage for a continuous period of 63 days or longer after your IEP is over, you could be subject to a Part D late enrollment penalty. Coverage could come from a stand-alone prescription drug plan, a Medicare Advantage plan with prescription drug coverage (Part C), ...

What is a prescription drug plan?

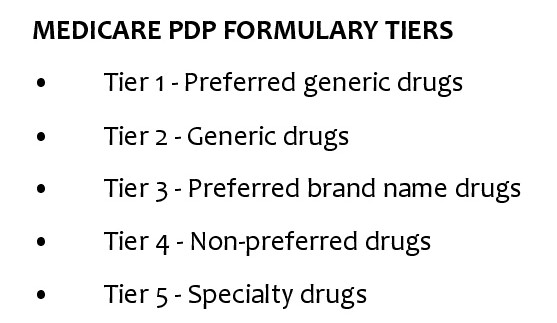

Prescription Drug plans include formularies, which are a list of the medications that are covered under the plan. Some formularies have tiers. Medications in lower tiers may have lower costs. Generic medications are often included in the lower tiers.

What is Medicare Advantage?

A Medicare Advantage plan is an alternative way to get your Original Medicare (Part A and Part B) benefits. These plans might also offer coverage for additional services like routine vision or dental care, and prescription medications. Medicare Part D enrollment provides you with choices of plans in most service areas.

Does Medicare Part D cover dental?

Medicare Part D enrollment provides you with choices of plans in most service areas. All plans are required by Medicare to offer a standard level of coverage. Some plans may offer additional benefits beyond this standard.

When do you get an IEP?

Your Initial Enrollment Period (IEP) occurs when you first become eligible for Medicare. For most people, eligibility happens when you turn 65 . The IEP begins three months before the month you turn 65. It includes your birthday month and the three months following for a total of seven months. During that time, you can enroll in a Part D ...

When is the fall open enrollment period for Medicare?

Medicare also offers a Fall Open Enrollment Period (OEP) every year that runs from October 15 to December 7. This period allows for Medicare Part D enrollment as well. You can also switch from one prescription drug plan to another during this time.

What is a SEP in Medicare?

Special Enrollment Periods or SEPs offer the chance for Medicare Part D enrollment when certain events happen in your life. Those events might include changing where you live or losing your current coverage. If your current plan changes its contract with Medicare or you have an opportunity to get other coverage, you might also qualify for an SEP.

What is Medicare Part D?

Medicare Part D allows people enrolled in Medicare to choose from a number of prescription drug plans (PDPs) that offer a set of basic prescription services.

How much is Medicare Part D 2020?

The ten most popular stand-alone Part D plans for 2020 have premiums that vary from $17/month to $76/month. Some of those plans are enhanced and some are basic—in general, the enhanced plans have higher premiums, while the basic plans have lower premiums. One of the most helpful online resources is the government's Medicare plan finder tool, ...

When does Medicare open enrollment start?

If you have Medicare, you can enroll in a Part D drug plan during the open enrollment period, which begins on October 15 and lasts until December 7 each year, with plan selections effective on January 1. If you have a Part D drug plan already, you can change to a different plan during this enrollment period.

What is Medicare Rights Center?

The Medicare Rights Center, an independent, non-profit group, is the largest organization in the United States (aside from the federal government) that provides information and assistance for people with Medicare. Its site has a section about Medicare Part D drug coverage, including information about programs that could help you pay for your prescription drug costs. A unique feature of the site is the Medicare Interactive Counselor, a tool that walks you through the process of finding the drug plan that makes sense for you.

State-by-State Guide to Face Mask Requirements 122 Comments

Following federal guidance, many states dropping mask orders for fully vaccinated people

AARP In Your State

Visit the AARP state page for information about events, news and resources near you.

When is the Medicare enrollment period?

Medicare General Enrollment Period. January 1 to March 31 is the Medicare general enrollment period (GEP). People can join or reenroll in Medicare parts A and B for coverage to begin on July 1. People with an advantage plan can also switch between plans or join original Medicare.

Can you change your Medicare coverage during a SEP?

Medicare allows exceptions for significant life events, such as divorce, and offers special enrollment periods (SEPs). Qualifying individuals can reenroll in original Medicare or change their Medicare coverage during a SEP.

What are the benefits of Medicare?

Medicare extends both Medicare Part A and Part B benefits to people who are: 1 aged 65 or older 2 disabled and receiving Social Security Income (SSI) or Railroad Retirement Board (RRB) benefits 3 diagnosed with end stage renal disease (ESRD) 4 diagnosed with amyotrophic lateral sclerosis (ALS)

When do you get Medicare Part B?

Generally, people are first eligible for Medicare Part B when they turn 65 years old, unless they have other qualifying conditions. Part B covers medically necessary services and supplies, such as: outpatient care and emergency room visits. preventive services including tests and screenings. ambulance transport.

What is DME in Medicare?

ambulance transport. durable medical equipment (DME) such as crutches and wheelchairs. mental health services. Medicare extends both Medicare Part A and Part B benefits to people who are: aged 65 or older. disabled and receiving Social Security Income (SSI) or Railroad Retirement Board (RRB) benefits.

What happens if you don't pay Medicare?

If a person does not pay following the 3-month grace period, they will get a termination notice stating they no longer have Medicare coverage. However, if a person pays their missed premiums within 30 days of the termination notice, they will continue to receive Part B coverage.

Does Medicare Part B have a late enrollment penalty?

An individual who wants to reenroll in Medicare Part B may have to pay a late enrollment penalty. Generally, the penalty cost is linked to the length of the gap in coverage. The monthly premium also increases by 10% for each 12-month period an individual was eligible for, but did not have, Part B.