How To Sell Medicare Supplement Plans

- Obtain the necessary license. The first step to selling Medicare Supplement insurance is to obtain a license. You need...

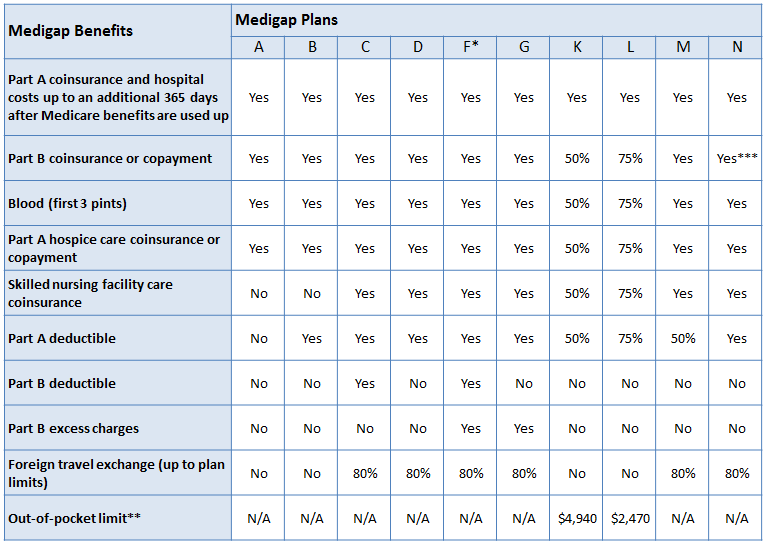

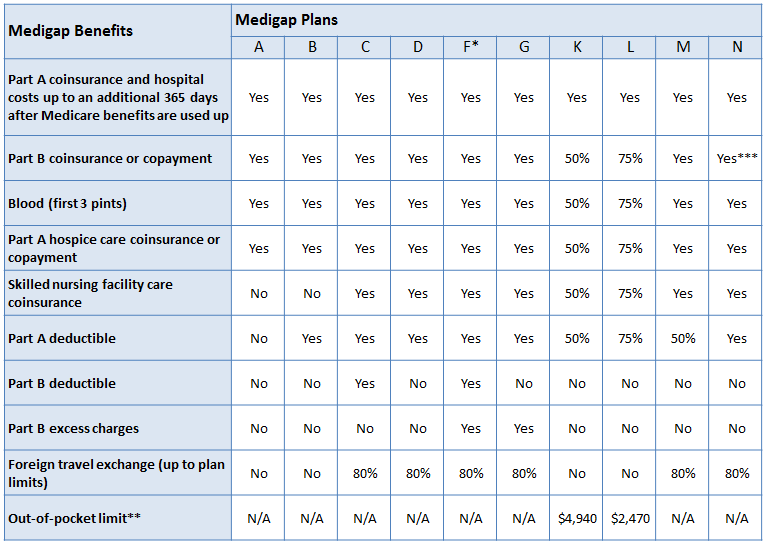

- Understand the options for clients. Clients have a lot of options when it comes to Medicare Supplement plans. There are...

- Focus on differentiating factors. Medicare Supplement plans are the same across insurance...

Full Answer

How to get started in Medicare sales?

How To Sell Medicare Supplement Plans Obtain the necessary license. The first step to selling Medicare Supplement insurance is to obtain a license. You need... Understand the options for clients. Clients have a lot of options when it comes to …

What companies sell Medicare supplements?

Nov 09, 2020 · Finally, if you want to sell Medicare Supplements, you obviously need some prospects to sell them to. Here are the most popular ways to get Medicare Supplement leads: Sell to your existing book (looking at insurance agents in different fields or financial planners/advisors) Cold-calling; Door knocking

How to start selling Medicare?

How to Get Started Selling Medicare Supplements Determining the Best Medicare Supplement plans. Choosing the best Medicare Supplement plans should be based on many... Humana Plan F Medicare Supplement Example. You’ll notice you can pull the relevant information for a specific company. United Health ...

What license do you need to sell Medicare supplements?

May 30, 2019 · The Best Way to Sell Medicare Supplements Just like with selling any health insurance, Medicare comes with rules and regulations. The first step to selling Medicare supplements is obtaining a license to sell Medicare in your …

How do you make money selling Medicare supplements?

There are really three paths you can take to have a lucrative Medicare business:One sale at a time.Build a field force to sell underneath you.Add Medicare to your current offering (i.e: financial advisors or P&C agencies)Dec 21, 2020

What is the commission on a Medicare supplement policy?

A recent report indicates that first-year commissions for enrollments in Medigap are approximately 20 percent of annual premiums, but they can vary based on the state or plan type. The commission for subsequent years (i.e., the renewal commission) is set at 10 percent of the premium.Oct 12, 2021

Can you sell Medicare door to door?

People representing Medicare plans aren't allowed to: Come to your home uninvited to sell or endorse anything. Call you unless you're already a member of the plan. If you're a member, the agent who helped you join can call you. Require you to speak to a sales agent to get information about the plan.

Is Medicare hard to sell?

No, it's not hard to sell Medicare Supplements. When you're first starting, it should be easy, because everyone on Medicare needs one. It's just an insurance product. You're not a member – you're a policyholder, and that means a lot to people.May 26, 2020

What is a Medicare insurance broker?

A Medicare insurance broker is typically an independent insurance agent who's licensed to sell Medicare plans on behalf of multiple insurance companies.Apr 6, 2021

What is an FMO?

FMO — Field Marketing Organizations A field marketing organization (FMO) is basically the same as an independent marketing organization (IMO). FMOs are typically top-level organizations that are licensed to sell health insurance products in most, if not all, states.Oct 17, 2019

Can a Medicare agent call you?

– A Medicare health or drug plan can call you if you're already a member of the plan. The agent who helped you join can also call you. – A customer service representative from 1-800-MEDICARE can call you if you've called and left a message or a representative said that someone would call you back.

Can you cold call for Medicare?

CMS has strict guidelines around contacting Medicare beneficiaries. In general, you can't market through unsolicited direct contact. (Often referred to as cold calling and includes going door-to-door.) Referred beneficiaries must contact you or the plan directly.Jun 16, 2021

Is there life insurance through Medicare?

Does Medicare Cover Life Insurance Costs? Medicare is a federal program that provides hospital and medical insurance for individuals who are eligible due to age or disability. It is strictly health insurance that covers some medically related expenses and does not cover life insurance premium costs.

Is there money in selling Medicare?

Myth #3: There's no money in selling Medicare. The real value of Medicare sales comes in the renewal income. Typically, after you help your client enroll in a plan, you will receive an initial payment for the first year of the policy.Mar 13, 2018

Is being a Medicare agent worth it?

Medicare agents have significant earning potential and a promising future of stable career growth – but it's not just about the money. Medicare agents also get to help others while taking control of their own careers. For the right person, Medicare sales can be a very rewarding and lucrative career.Jul 1, 2020

Can you sell life insurance and Medicare at the same time?

Under CMS guidelines, brokers are not permitted to cross-sell nonhealth-related products during a Medicare Advantage or Part D sale. So, anything that is not a health-related product, such as life insurance policies or annuities, cannot be cross-sold during a Medicare sale.Jun 25, 2018

What is Medicare Supplement insurance?

Original Medicare Part A & B + Medicare Supplement + Part D. Medicare Supplement insurance is also referred to as a Medigap policy by CMS. These names are interchangeable. Your client should expect to pay monthly premiums for Original Medicare Part B, their Supplement and their Part D drug plan.

How long does Medicare Supplement pay commission?

Here are the two most important things you need to know about Medicare Supplement commissions. Medicare Supplements pay the same commission for seven years.

How many seniors will be in the US by 2040?

Plus, Medicare sales are at an all-time high because of the aging population. The U.S. Census says that by 2040 there will be about 82.3 million senior citizens.

What is high deductible F?

High deductible F is a hybrid Medicare Supplement plan that allows your clients to keep their monthly costs down, while still having the protection of a Medicare Supplement Plan F.

How long does Medicare Part B last?

Your clients IEP begins 3 months before the month they turn 65, their birth month and ends 3 months after. Below are some common examples of Medicare Part B covered services: Doctor’s visits. Ambulance services.

Is Medicare Supplement Plan G the same as Plan F?

Medicare Supplement Plan G. Plan G offers all the same benefits as Plan F except the Part B deductible. Clients often choose Plan G instead of Plan F because the annual Part B deductible of $183 (2017 number) is less than the increased premiums to have a Plan F.

Does UHC offer Medicare Supplement?

UHC offers a Medicare supplement insurance Plan F for the same 65-year-old female in Missouri for $188 ($38 less than Humana for the same coverage) per month as well as the 5% household discount.