Send refunds to: Regular mail UnitedHealthcare Insurance Company P.O. Box 101760 Atlanta, GA 30392-1760 Overnight mail UnitedHealthcare Insurance Company – Overnight Delivery

Full Answer

How do I request a refund from UnitedHealthcare insurance company?

Mail to: UnitedHealthcare Insurance Company P.O. Box 101760 Atlanta, GA 30392-1760 Signature of Requestor: Date: Please select one (by checking the appropriate box): Immediate Recoupment of Payment Refund Check Attached Provider/Physician/Supplier Name

How do I file multiple claims with UnitedHealthcare?

Complete a separate form for each claim. If you have other insurance or Medicare and it is primary to your UnitedHealthcare plan, include that corresponding Explanation of Benefits (EOB) with your claim. After your claim is processed, you’ll receive an EOB.

How do I get a refund for an overpayment to Medicare?

Call 1-800-727-6735 with questions related to overpayments. Send refunds to: Include documentation that shows the overpayment, including member’s name, health plan ID number, date of service and amount paid. If possible, also include a copy of the provider remittance advice (PRA) that corresponds with our payment.

Are over-the-counter products (OTC) part of my Medicare plan?

Sign in to medicare.uhc.com to learn if OTC benefits are part of your Medicare Advantage plan. Check your Over-the-Counter Products Catalog or Over-the-Counter Products Card benefit to confirm.

How do I submit a claim for UnitedHealthcare reimbursement?

How to submit claims in 2 stepsSign in to your health plan account to find your submission form. Sign in to your health plan account and go to the “Claims & Accounts” tab, then select the “Submit a Claim” tab. ... Submit your claim by mail.

How do I get a refund from Medicare overpayment?

Submit a check with the Part A Voluntary Refund Form. When the claim(s) is adjusted, Medicare will apply the monies to the overpayment. Option 2: Submit the Part A Voluntary Refund Form without a check and when the claim(s) are adjusted, NGS will create an account receivable and generate a demand letter to you.

Does United Healthcare do reimbursement?

Use this Request for Reimbursement form to ask for payment from your HRA for eligible care you've already paid for with a credit card, cash or check. What expenses are eligible? ▶ A general list of eligible expenses and frequently asked questions is available on your member website.

How long does it take for UHC to reimburse?

Online claims: Claims submitted online at myuhc.com® will typically be reimbursed to you within 2–3 days of the claim being processed.

What happens if I overpaid Medicare?

Federal law requires the Centers for Medicare & Medicaid Services (CMS) to recover all identified overpayments. When an overpayment is $25 or more, your Medicare Administrative Contractor (MAC) initiates overpayment recovery by sending a demand letter requesting repayment.

How does a provider refund Medicare?

Voluntary Refund (Provider/Beneficiary Reported) If the amount of deductible or coinsurance liability collected from the beneficiary changes because of the identified overpayment, the provider must return the over collected funds to the beneficiary as appropriate.

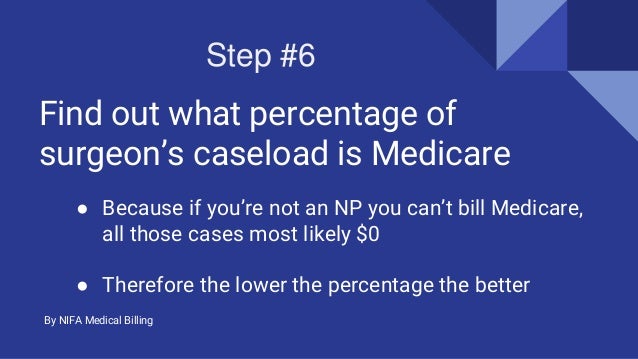

How is UnitedHealthcare reimbursed for Medicare Advantage plans?

In accordance with CMS guidelines, UnitedHealthcare Medicare Advantage covered PA assistant-at-surgery services are reimbursed at 80 percent of the lesser of the actual charge or 85 percent of what a physician is paid under the Medicare Physician Fee Schedule.

Does UnitedHealthcare follow Medicare guidelines?

UnitedHealthcare follows Medicare coverage guidelines and regularly updates its Medicare Advantage Policy Guidelines to comply with changes in Centers for Medicare & Medicaid Services (CMS) policy.

What is the timely filing limit for UHC Medicare Advantage?

Time limits for filing claims For commercial plans, we allow up to 180 days for non-participating health care providers from the date of service to submit claims. For MA plans, we are required to allow 365 days from the “through” date of service for non-contracted health care providers to submit claims for processing.

How do I get reimbursed for Medicare Part B premium?

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

How do you qualify for Medicare Part B refund?

How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

How does Medicare Part B reimbursement work?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

What happens after a claim is processed?

After your claim is processed, you’ll receive an EOB. This explains the charges applied to your deductible (the amount you pay for covered services before your plan begins to pay), plus any charges you may owe the provider. Keep your EOB on file in case you need it in the future.

Can an out of network provider submit a claim?

In that case, an out-of-network provider cannot submit a claim on your behalf, and you may have to submit this claim on your own. 1. Sign in to your health plan account to find your submission form. Sign in to your health plan account and go to the “Claims & Accounts” tab, then select the “Submit a Claim” tab.

How to offset Medicare overpayment?

If you would like to have the overpayment immediately offset the overpayment from your next check from Medicare, simply complete the Immediate Offset Request Form. The request may be submitted via regular mail or fax, and the request must include documentation on the overpayment to be offset.

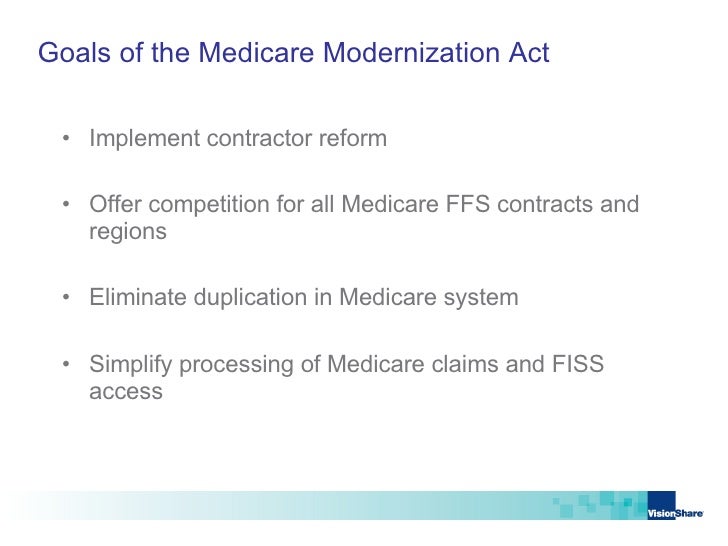

What is MMA in Medicare?

By choosing immediate recoupment, you are waiving your right to interest under Section 935 of the Medicare Modernization Act (MMA) in the event that the overpayment is reversed at the Administrative Law Judge (ALJ) or subsequent higher levels of appeal. Other helpful tips: