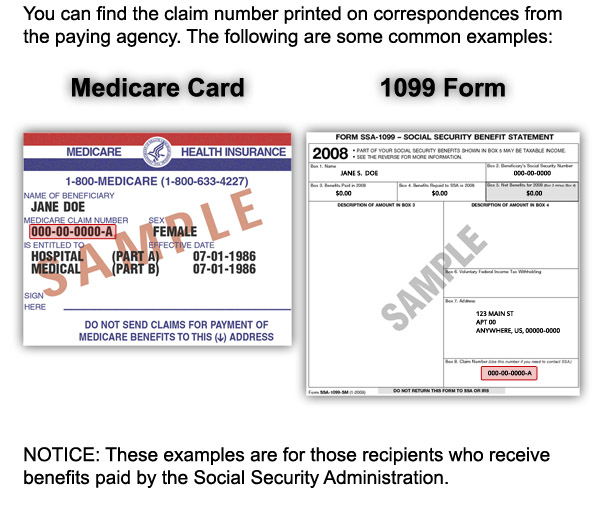

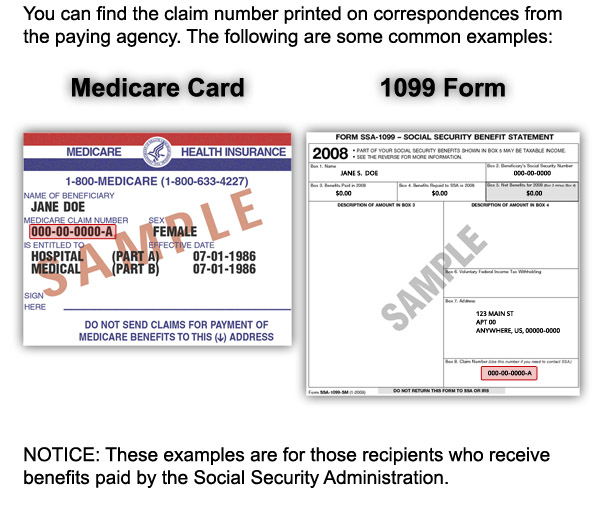

Provide your Medicare number, insurance policy number or the account number from your latest bill. Identify your claim: the type of service, date of service and bill amount. Ask when your claim will be processed and when you will find out how much has been paid by Medicare or your Medigap

Medigap

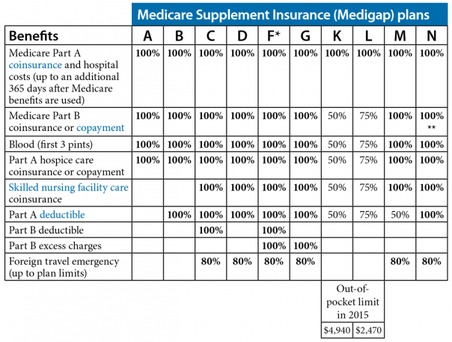

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

How to check Medicare claims?

claims: Log into (or create) your secure Medicare account. You’ll usually be able to see a claim within 24 hours after Medicare processes it. Check your Medicare Summary Notice (MSN) . The MSN is a notice that people with Original Medicare get in the mail every 3 months. It shows: Learn more about the MSN, and view a sample.

Where to file Medicare claims?

- Before filing claims electronically to Railroad Medicare, you must have an EDI enrollment packet on file with Palmetto GBA. ...

- View the Electronic Filing Instructions

- Palmetto GBA Interactive CMS-1500 Claim Form Instructions — This resource can also be helpful to providers who submit electronic claims. ...

How do doctors get paid from Medicaid?

Medicaid pays about 61% of what Medicare pays, nationally, for outpatient physician services. The payment rate varies from state to state, of course. But if 61% is average, you can imagine how ...

Can you check Medicare claims online?

You can use your Medicare online account to manage details and claims, access statements and get letters online. To do your business with us online, create a myGov account and link to Medicare. You can get help to manage your Medicare online account.

How can I tell if Medicare paid a claim?

You can also contact your local Health Insurance Counseling & Advocacy Program (HICAP) office online or at 1-800-434-0222. You will also receive an Explanation of Benefits (EOB) from your Medigap company or retiree plan. The EOB will show you how much was paid.

How far back can you bill Medicare claims?

12 monthsMedicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share.

How do you send a corrected claim to Medicare?

To submit a corrected claim to Medicare, make the correction and resubmit it as a regular claim (Claim Type is Default) and Medicare will process it.

Who adjudicates Medicare claims?

Administrative Law Judge (ALJ) – Adjudicator employed by the Department of Health and Human Services (HHS), Office of Medicare Hearings and Appeals (OMHA) that holds hearings and issues decisions related to level 3 of the appeals process.

Can you back bill Medicare?

Answer: The short answer is Yes, but there are some specifics that you need to be aware of. Retroactively billing Medicare is critical for most organizations as providers often start without having a Medicare number. This is in large part due to how long the provider enrollment process takes with Medicare.

What is the maximum allowable time from the date of service that a claim can be submitted to Medicare?

12 monthsB. Policy: The time limit for filing all Medicare fee-for-service claims (Part A and Part B claims) is 12 months, or 1 calendar year from the date services were furnished.

What is the difference between a corrected claim and a replacement claim?

A corrected or replacement claim is a replacement of a previously submitted claim (e.g., changes or corrections to charges, clinical or procedure codes, dates of service, member information, etc.). The new claim will be considered as a replacement of a previously processed claim.

How do you correct a claim?

Make Changes, Add Reference/Resubmission Numbers, and Then Resubmit: To resolve a claim problem, typically you will edit the charges or the patient record, add the payer claim control number, and then resubmit or “rebatch” the claim.

Can you file a corrected claim to Medicare electronically?

A claim correction may be submitted online via the Direct Data Entry (DDE) system.

What is claim adjudication?

After a medical claim is submitted, the insurance company determines their financial responsibility for the payment to the provider. This process is referred to as claims adjudication. The insurance company can decide to pay the claim in full, deny the claim, or to reduce the amount paid to the provider.

What does adjudicated mean in medical billing?

Payer adjudication is when a third-party payer receives your medical claim and starts the review process. The payer decides, based on the information you provide, whether the medical claim is valid and should be paid. Expect payers to review claims meticulously.

What are the five steps in the Medicare appeals process?

The Social Security Act (the Act) establishes five levels to the Medicare appeals process: redetermination, reconsideration, Administrative Law Judge hearing, Medicare Appeals Council review, and judicial review in U.S. District Court. At the first level of the appeal process, the MAC processes the redetermination.

When is Medicare payment due?

You’ll have your payment due on the 25th of the month, so pay early to allow processing time. Whether you prefer making individual payments or enjoy the convenience of automated payment options, Medicare's online portal has you covered.

How often do you get Medicare premiums?

If you only have Medicare Part B and don’t get your Part B premiums deducted from your benefits, you’ll receive a premium bill every three months . If you have to buy Part A or owe Part D income-related monthly adjustment amounts (IRMAA), you’ll get a monthly premium bill.

What to do if you don't receive Medicare?

If you don’t receive these benefits, you’ll need to decide how to pay your Medicare premium bill (in which case, you may need to use Form CMS-500 ). There are several payment options, including sending a check or money order, mailing your credit card information or using your bank’s payment service.

How long does it take to get your Easy Pay payment?

Complete the online form with your details and submit it. It will take between 6-8 weeks before Easy Pay starts deducting your payments, so remember to make manual payments until you receive confirmation you’re signed up to Easy Pay.

Can you save on Medicare Supplement?

Learn How to Save on Medicare. Medicare Supplement Insurance plans (also called Medigap) can’t cover your Medicare premiums, but they can help make your Medicare spending more predictable by paying for some of your other out-of-pocket costs such as Medicare deductibles, copayments, coinsurance and more.

Does Medicare Easy Pay work?

Medicare Easy Pay is another payment option available to MyMedicare members. This program costs nothing to use, and it automatically deducts premiums from your checking or savings account when they’re due, ensuring you maintain continuous coverage. You’re also able to view your premium payment history online with Easy Pay.

How often do you get a Medicare summary notice?

Medicare summary notice. People with Original Medicare will receive a Medicare Summary Notice (MSN) in the mail every three months for their Medicare Parts A and B-covered services. This is strictly a notice, not a bill.

What to do with Medicare notice?

What to do with the notice. If you have other insurance, check to see if it covers anything that Medicare didn’t. Keep your receipts and bills, and compare them to your MSN to be sure you got all the services, supplies, or equipment listed. If you paid a bill before you got your notice, compare your MSN with the bill to make sure you paid ...

What to do if you paid before you got your MSN?

If you paid a bill before you got your notice, compare your MSN with the bill to make sure you paid the right amount for your services. If an item or service is denied, call your medical provider's office to make sure they submitted the correct information. If not, the office may resubmit.

How long does interest accrue on a recovery letter?

Interest accrues from the date of the demand letter and, if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter, is assessed for each 30 day period the debt remains unresolved. Payment is applied to interest first and principal second. Interest continues to accrue on the outstanding principal portion of the debt. If you request an appeal or a waiver, interest will continue to accrue. You may choose to pay the demand amount in order to avoid the accrual and assessment of interest. If the waiver/appeal is granted, you will receive a refund.

What is BCRC in Medicare?

The BCRC begins identifying claims that Medicare has paid conditionally that are related to the case, based upon details about the type of incident, illness or injury alleged. Medicare's recovery case runs from the “date of incident” through the date of settlement/judgment/award (where an “incident” involves exposure to or ingestion of a substance over time, the date of incident is the date of first exposure/ingestion).

What happens if a Medicare claim is not successful?

If the claim is not successful you should see an error code which will give instructions on how to resolve the issue before re-submitting the claim.

Why does Medicare return an error code?

Medicare will return an error code indicating why it was rejected and you will need to resolve this prior to resubmitting the claim. This is commonly due to missing claim information etc.

What is a processing report in a claim?

Processing Report: The Processing Report provides a summary of information including the charge amount and the claim benefit paid. If there has been no claim benefit paid there will be an explanation code and text with information on why ...

How long does it take to process a J15 claim?

Otherwise, you may contact the J15 Part A Provider Contact Center at (866) 590-6703 if the claim has not moved to a finalized location (XB9997) after 30 days (new claim) or 60 days (adjusted claim). The claim is missing information necessary to process the claim. The claim can be corrected or resubmitted.

When a claim is submitted to the Fiscal Intermediary Shared System (FISS), multiple editing processes are applied

When a claim is submitted to the Fiscal Intermediary Shared System (FISS), multiple editing processes are applied to identify possible errors. The chart below summarizes what happens to a claim that is subject to an edit and the appropriate process available to make claim corrections. Additional information about each claim correction process follows.