Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services. Once you reach this limit, you’ll pay nothing for covered services. Each plan can have a different limit, and the limit can change each year.

Full Answer

How do I Pay my Medicare premiums without social security?

If you’re not receiving Social Security benefits, you’ll need to pay your Medicare premiums directly. Signing up for an automatic debit from your checking account or automatic credit card payment will help ensure that you don’t miss payments accidentally. But if you opt to pay your premiums manually, you’ll need to make sure to stay on top of them.

Who doesn't have to pay a premium for Medicare Part A?

Who doesn't have to pay a premium for Medicare Part A? A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don’t pay a premium for Part A.

What happens if I Don't Pay my Medicare Part B premium?

What will happen if I don't pay my Part B premium? Your Medicare Part B payments are due by the 25th of the month following the date of your initial bill. For example, if you get an initial bill on February 27, it will be due by March 25. If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment.

How much will I Owe for Medicare Part D?

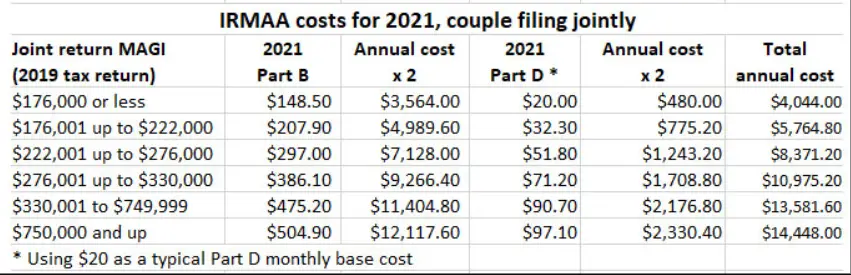

Most people will pay the standard amount for their Medicare Part B premium. However, you’ll owe an IRMAA if you make more than $88,000 in a given year. For Part D, you’ll pay the premium for the plan you select.

Do some people pay nothing for Medicare?

Who doesn't have to pay a premium for Medicare Part A? A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don't pay a premium for Part A.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Does Medicare pay all your bills?

En español | Medicare covers some but not all of your health care costs. Depending on which plan you choose, you may have to share in the cost of your care by paying premiums, deductibles, copayments and coinsurance. The amount of some of these payments can change from year to year.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What does Part B give back mean?

The Medicare Part B give back is a benefit specific to some Medicare Advantage plans. This benefit covers up to the entire Medicare Part B premium amount for the policyholder. The give back benefit can be a great way for beneficiaries to save, as the premium is deducted from their Social Security checks each month.

Who qualifies for free Medicare Part A?

age 65 or olderYou are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Do I pay for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Does Medicare only pay 80%?

You will pay the Medicare Part B premium and share part of costs with Medicare for covered Part B health care services. Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10.

How much does Medicare Part B cost?

But you still have to pay your Medicare Part B premium ($148.50). Plans with a $0 premium may recoup those costs through higher deductibles, coinsurance, copays, and possibly less coverage. You want to weigh all costs before choosing a plan.

Is Medicare Advantage free?

Medicare Advantage Plans are NOT Free. Though Medicare Advantage can have a $0 premium, they can, like we said above, charge you copays, coinsurance, and sometimes deductibles. Remember $0 premium doesn’t mean it’s a $0 plan.

What happens if you don't enroll in Medicare B?

People who don’t enroll in Medicare B when first eligible are charged a late enrollment penalty that amounts to a 10 percent increase in premium for each year they were eligible for Medicare B but not enrolled.

How long do you have to pay Medicare taxes if you have end stage renal disease?

You have end-stage renal disease (ESRD) and are receiving dialysis, and either you or your spouse or parent (if you’re a dependent child) worked and paid Medicare taxes for at least 10 years.

How long does Medicare coverage last?

Medicare coverage begins as soon as your SSDI begins, and Medicare Part A has no premiums as long as you or your spouse (or parent, if you’re a dependent child) worked and paid Medicare taxes for at least 10 years.

How much is Medicare premium for 2020?

These premiums are adjusted annually. Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly). For 2020, the threshold for having to pay higher premiums based on income increased.

Do you have to pay Social Security premiums if you are 65?

You may also not have to pay the premium: If you haven’t reached age 65, but you’re disabled and you’ve been receiving Social Security benefits or Railroad Retirement Board disability benefits for two years. You have end-stage renal disease (ESRD) and are receiving dialysis, and either you or your spouse or parent (if you’re a dependent child) ...

Do you have to pay Medicare premiums?

A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don’t pay a premium for Part A. You may also not have to pay the premium: If you haven’t reached age 65, but you’re disabled and you’ve been receiving Social Security benefits ...

What happens if you don't pay Medicare?

What happens when you don’t pay your Medicare premiums? A. Failing to pay your Medicare premiums puts you at risk of losing coverage, but that won’t happen without warning. Though Medicare Part A – which covers hospital care – is free for most enrollees, Parts B and D – which cover physician/outpatient/preventive care and prescription drugs, ...

What happens if you fail to make your Medicare payment?

Only once you fail to make your payment by the end of your grace period do you risk disenrollment from your plan. In some cases, you’ll be given the option to contact your plan administrator if you’re behind on payments due to an underlying financial difficulty.

How long does it take to pay Medicare premiums after disenrollment?

If your request is approved, you’ll have to pay your outstanding premiums within three months of disenrollment to resume coverage. If you’re disenrolled from Medicare Advantage, you’ll be automatically enrolled in Original Medicare. During this time, you may lose drug coverage.

How long do you have to pay Medicare Part B?

All told, you’ll have a three-month period to pay an initial Medicare Part B bill. If you don’t, you’ll receive a termination notice informing you that you no longer have coverage. Now if you manage to pay what you owe in premiums within 30 days of that termination notice, you’ll get to continue receiving coverage under Part B.

What happens if you miss a premium payment?

But if you opt to pay your premiums manually, you’ll need to make sure to stay on top of them. If you miss a payment, you’ll risk having your coverage dropped – but you’ll be warned of that possibility first.

When does Medicare start?

Keep track of your payments. Medicare eligibility begins at 65, whereas full retirement age for Social Security doesn’t start until 66, 67, or somewhere in between, depending on your year of birth.

When is Medicare Part B due?

Your Medicare Part B payments are due by the 25th of the month following the date of your initial bill. For example, if you get an initial bill on February 27, it will be due by March 25. If you don’t pay by that date, you’ll get a second bill from Medicare asking for that premium payment.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Can I qualify for QI if I have medicaid?

You can’t qualify for the QI program if you have Medicaid. If you have a monthly income of less than $1,456 or a joint monthly income of less than $1,960, you are eligible to apply for the QI program. You’ll need to have less than $7,860 in resources. Married couples need to have less than $11,800 in resources.