Aging comfortably as a baby boomer is a major concern. By 2020, retiring baby boomers are expected to more than double Medicare and Medicaid costs. As a result, some pundits anticipate that the Trust Fund will be bankrupt by 2033.

How will the baby boomer generation impact Medicare?

May 02, 2022 · According to U.S. Census data, the population of Medicare beneficiaries will grow by 36 percent by the end of this decade as the massive baby boomer generation ages in to the nation’s largest health insurance program. “Last year, the oldest of the nation’s nearly 77 million baby boomers turned 65 and became eligible for Medicare.

How will baby boomers affect social security?

The Baby Boomer Effect and Controlling Health Care Costs. In 2000, the Medicare-eligible population in the United States numbered 35.1 million. By 2030, this number is expected to increase to 69.7 million. This will put Medicare’s annual acute care costs around $259.8 billion in 2030. As the baby boomer generation, born between 1946 and 1964, reaches retirement age, …

Will Baby Boomers be able to afford health care expenses?

10,000 Baby boomers per day retire and go from paying into Medicare to collecting Medicare So 10,000 per day are joining those that are consuming 14,500 per person per year in benefits costs Granted - they paid into Part A But 3/4 of Part B costs comes out of the general taxation funds - and that is jacking the budget higher every year

Are baby boomers putting a strain on the health care industry?

Dec 27, 2019 · With the aging of the baby boomer population, the Medicare program experienced a large increase in the proportion of beneficiaries ages 65 to 74. This shift toward a younger Medicare population, however, explains very little of why Medicare per-beneficiary spending growth was low from 2007 to 2015.

How will baby boomers affect Social Security and Medicare funds?

What is the impact of the baby boomer generation today?

How will baby boomers retiring affect the economy?

Which is an anticipated impact of the aging baby boomer generation on healthcare providers group of answer choices?

How do baby boomers affect society?

How do baby boomers act as consumers?

Prefer buying products in-store rather than online. Place importance on the quality of interactions with brands and their employees, both in-store and online. Value trusted recommendations and reviews when making purchase decisions.Apr 8, 2021

When can baby boomers collect Social Security?

What percentage of baby boomers have no retirement savings?

What year will most baby boomers retire?

What are the major issues of concern for older Americans is ageism?

Why are baby boomers living longer?

What services do baby boomers need?

How much will Medicare cost in 2030?

By 2030, this number is expected to increase to 69.7 million. This will put Medicare’s annual acute care costs around $259.8 billion in 2030. As the baby boomer generation, born between 1946 and 1964, reaches retirement age, the need for Medicare and age-related health care services will continue to rise, taking health care expenses upwards ...

When did the baby boomer generation retire?

As the baby boomer generation, born between 1946 and 1964, reaches retirement age, the need for Medicare and age-related health care services will continue to rise, taking health care expenses upwards with them. Controlling the rising costs of health care is a major concern for the baby boomer generation, as anticipated expenses outstrip ...

Will the baby boomer trust fund go bankrupt?

As a result, some pundits anticipate that the Trust Fund will be bankrupt by 2033. Meanwhile, taxes will cover only 48 percent of the associated health care costs.

What percentage of baby boomers are childless?

The need for senior living communities will likely increase as the baby boomer generation ages. According to the Pew Research Center, about 20 percent of baby boomers are childless, which means that these individuals won’t have the traditional safety net of close family to help care for them as they get older. Another 20 percent of boomers are aging alone because they do not have a spouse or partner and their children live more than 500 miles away. This leaves a full 40 percent of individuals over age 65 on their own.

What are the problems of living alone?

Older adults who live alone typically struggle more with managing medications, nutrition, and wound treatment. They’re more susceptible to scams and often suffer from loneliness. These problems can lead to greater health problems and higher health care costs.

Changes in Medicare Spending Levels and Growth by Age Group, 2007–2015

In 2011, the first members of the baby boom generation turned age 65 and began entering the Medicare program in large numbers. Baby boomers started joining Medicare during a period of historically low growth in traditional Medicare spending per beneficiary.

How We Conducted This Study

Data sources: Medicare Master Beneficiary Summary File and its associated Cost and Use segment for the years 2007–2015. This data set provides information about each beneficiary’s age and total annual spending. Only spending for Medicare Parts A and B are included in this analysis.

Acknowledgments

The authors would like to thank Christine Lai and Alexander Podczerwinski for assistance with data analysis.

What are the health problems of the baby boomers?

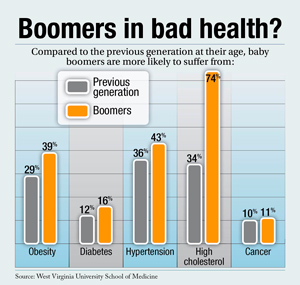

Regardless of their longer life expectancy, baby boomers were more likely to have higher rates of hypertension, higher cholesterol, obesity and diabetes. 2 These results indicate that seniors will push the cost of health care higher and increase the need for health care professionals as the boomers age. The researchers declared that there is “a clear need for policies that expand efforts at prevention and healthy lifestyle promotion in the baby boomer generation.” 2 Medical students will need to learn how to discuss preventative measures with elderly patients.

How many baby boomers will retire in 20 years?

Approximately 75 million Americans make up the baby boom generation, and every year for the next 20 years roughly 3 million baby boomers will reach retirement age. 2 These facts will drastically change society, public policy and health care as Americans’ needs evolve and boomers leave the workforce in growing numbers.

What is a baby boomer?

Individuals born between the years 1946 and 1964 are categorized as baby boomers, according to The U.S. Census Bureau.

Do baby boomers have high cholesterol?

Regardless of their longer life expectancy, baby boomers were more likely to have higher rates of hypertension, higher cholesterol, obesity and diabetes. 2 These results indicate that seniors will push the cost of health care higher and increase the need for health care professionals as the boomers age. The researchers declared that there is “a ...

How many geriatricians will be needed by 2030?

According to a study conducted by the Alliance for Aging Research, 33,000 geriatricians will be needed by 2030, and currently there are only 8,800 practitioners that are certified. 1.

Does Medicare cover hospice?

This part of Medicare pays for inpatient hospital care as well as hospice. For people who are discharged from the hospital, it also covers short-term stays in skilled nursing facilities or, as an alternative for people who choose not to go to a facility, home healthcare services.

Is Medicare Part A funded by the Trust Fund?

Only Medicare Part A is funded by the Medicare Trust Fund. That is the only part of Medicare that faces insolvency. Medicare Parts B, C, and D have other sources of funding, the main one being what you pay in monthly premiums.

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

How much did Medicare spend in 2016?

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

Is Medicare going bankrupt?

Bankruptcy is a legal process that declares a person, business, or organization unable to pay their debts. Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses.

Is Medicare insolvent?

Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Does Medicare cover hearing aids?

As it stands, many people argue that Medicare does not cover enough. For example, Medicare does not cover the cost of corrective lenses, dentures, or hearing aids even though the most common things that happen as we age are changes in vision, dental health, and hearing.

When will the youngest boomers retire?

Born between 1946 and 1964, 1 this vast cohort began to reach age 62 in 2008. By 2031 , the youngest boomers will have passed the Social Security full retirement age of 67 (for people born in 1960 or later), at which point there will be 75 million people over the age of 65—nearly twice the 39 million who were 65 in 2008.

How long can you live on Social Security?

In 1935, when Social Security started, people who reached 65 could expect to live an additional 12.5 years. Now, women who turn 65 can expect to live another 21.5 years, while for men, life expectancy at 65 is 19 more years. 2 . Let’s look at the facts to see where Social Security stands going forward.

How long can a woman live at 65?

Now, women who turn 65 can expect to live another 21.5 years, while for men, life expectancy at 65 is 19 more years. 2 . Let’s look at the facts to see where Social Security stands going forward.

Is there a surplus in Social Security?

Currently, there is a large Social Security surplus— at the beginning of 2020, there was almost $2.9 trillion in the trust funds that cover retirees and those with disabilities (there are two funds, together known as OASDI ). 3 But according to the 2020 Annual Report of the Board of Trustees, which oversees the Federal Old-Age and Survivors Insurance (OASI) and Federal Disability Insurance (DI) trust funds, the OASI, which covers retiree benefits, is projected to run out of money in 2034. 4

Will Social Security be paid in 2034?

But once the reserves are gone in 2034, only an estimated 76% of expected Social Security benefits will continue to be paid from the government’s tax revenues. 4 .

Is there a reduction in Social Security benefits?

Clearly, there's cause for concern. A reduction in benefits is not ideal, and 2034 is only 14 years away. But this is not a "surprise" issue. Since Feb. 1, 2016, there have been 45 proposals reported by the Social Security Administration currently in various stages of review by the U.S. government. 6 Here are three ideas that have been proposed:

What is the retirement age for people born in 1960?

Full retirement age is already scheduled to rise during the coming years to age 67 for those born in 1960 and later. Some are arguing that it should be 69 or 70, given how lifespans have expanded since Social Security was initiated. Increase the payroll tax rate to 15.08%.