Are they lowering Medicare age?

· "This bill simply shifts risk to Medicare recipients by adding billions of new costs to Medicare," Sen. Rick Scott, R-Fla., said Feb. 14 in blocking requests on the Senate floor to expedite passage...

How to switch your Medicare drug plan?

Prescription drugs will cost less as the "doughnut hole," the gap in Medicare Part D coverage, shrinks until it is eliminated in 2020. Taken together, various measures in the law will save the …

How will Medicare change?

· The standard Part B premium is $170.10 for 2022 (largest increase in program history, but Social Security COLA also historically large). The Part B deductible is $233 in 2022 …

Is Medicare available at 60?

Medicare does not pay for all of your health care costs. If you have Original Medicare, you may want to consider Medicare supplemen-tal insurance, also called Medigap insurance. This insurance helps pay for costs such as deductibles, co-insurance, and co-payments. A Medigap plan may also pay for some types of care Medicare doesn’t cover. As of June 1, 2010, people …

Will Medicare be reduced?

Regardless of the outcome, the eligibility age for Medicare won't change overnight. Lowering the eligibility age is no longer part of the U.S. Government's budget for Fiscal Year 2022. So, the Medicare eligibility age will not see a reduction anytime in the next year.

What does the build back better bill due for Medicare?

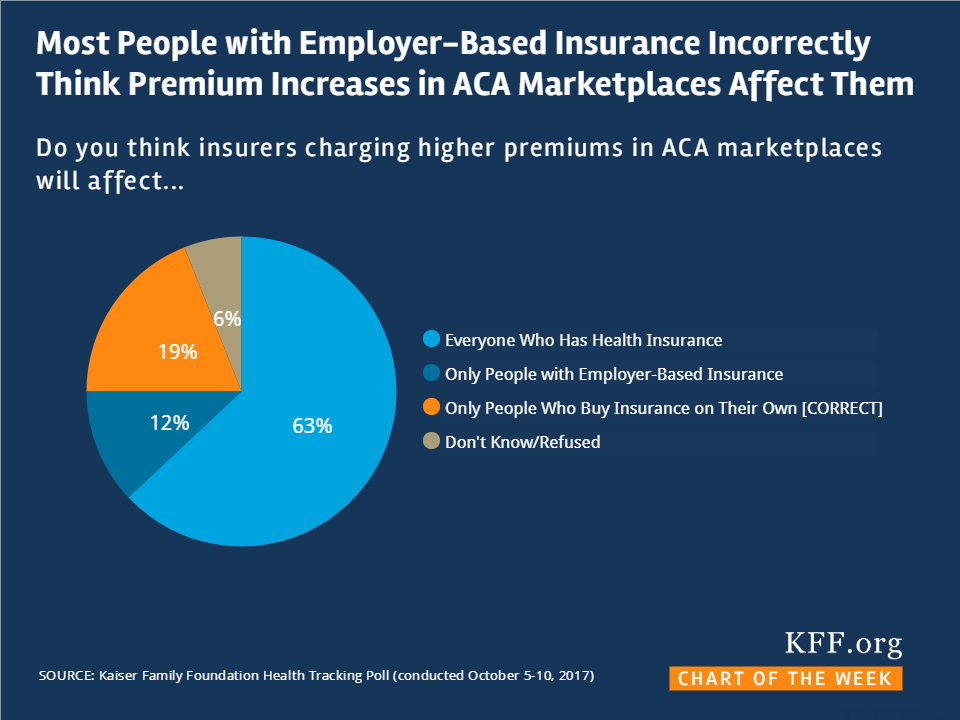

The BBBA would grant premium tax credit subsidies through 2025 to people with incomes below 138 percent of the poverty level ($36,570 for a family of four) who are not otherwise eligible for Medicaid.

Will postal retirees be forced into Medicare?

Law requires postal retirees to enroll in Medicare. The landmark Postal Service Reform Act (H.R. 3076) Congress passed this week ends the mandate that the Postal Service pre-fund its retiree health benefit costs and requires postal workers to enroll in Medicare Parts A and B when they turn 65.

What are proposed changes to Medicare?

The annual Part B deductible will be $233 this year, an increase of $30. For Medicare Part A, which covers hospitalizations, hospice care and some nursing facility and home health services, the inpatient deductible that enrollees must pay for each hospital admission will be $1,556, an increase of $72 over 2021.

Will build back better lower Medicare age?

The BBBA—at least in its current form—would not lower the Medicare eligibility age, nor would it expand fee-for-service (FFS) Medicare coverage to dental or vision services. The legislation does, however, provide a new hearing benefit in Medicare FFS.

Has Build Back Better Act passed?

The bill was passed 220–213 by the House of Representatives on November 19, 2021. To provide for reconciliation pursuant to title II of S. Con.

What is the average pension for a US postal worker?

As an example of USPS retirement under CSRS, a postal worker with a high-3 average of around $60,000 and 20 years of service earns $1,824 a month without any deductions. That equals about $22,000 annually. A worker with the same salary and 40 years of service earns $3,837 monthly, or about $46,000 annually.

Do most federal retirees take Medicare Part B?

About 70% of federal retirees enroll in Part B, which means paying two premiums and in essence two duplicative insurance programs. A portion of the retirees that join Part B might do so as a hedge against the elimination of FEHB retiree benefits.

Do postal workers receive Social Security?

Current postal workers and those hired after 1983 pay into the Federal Employees Retirement System (FERS) and are eligible for Social Security benefits.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.

Is Medicare rates going up in 2021?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021). And those with fewer than 30 quarters worth of Medicare taxes will likely see a jump from the current rate of $471 in 2021 to $499 in 2022.

When did the Supreme Court uphold the Affordable Care Act?

En español | The Supreme Court on June 28 gave the Affordable Care Act a mostly clean bill of health. The court upheld the law's constitutionality, keeping provisions already in effect and allowing other measures to phase in as scheduled. Sign up for the AARP Health Newsletter.

How much money does Medicare save?

Taken together, various measures in the law will save the average Medicare beneficiary $4,181 over 10 years. A beneficiary with high drug costs will save about $16,000. Some Medicare patients may receive more intensive follow-up care after hospitalization to keep them from being readmitted.

How much is Medicare rebate per family?

Rebates will average $151 per eligible family. If you're a high-wage taxpayer who makes over $200,000 as an individual, or $250,000 for a couple, you'll have to pay higher Medicare hospital insurance taxes on income and earnings. Marsha Mercer is an independent journalist.

When did Medicaid expand to low income?

The Affordable Care Act called for every state to expand Medicaid to low-income adults under 65 starting in 2014. An individual with income up to $15,415 and a family of three with $26,344 in 2012 would meet income guidelines. The law was expected to bring 16 million uninsured into Medicaid.

Does Medicare reduce Medicare Advantage?

The law changes some payments to doctors, hospitals and other providers. It reduces payments to Medicare Advantage, and some companies offering these plans may charge higher premiums or cut benefits. High-income beneficiaries will continue to see higher premiums for Medicare Part B and Part D prescription plans.

Can states opt out of Medicaid expansion?

But the Supreme Court ruled that states may opt out of the expansion. About a dozen governors have said they won't expand Medicaid or are weighing that course of action. Check with your state Medicaid office. I'm uninsured and don't qualify for Medicare or Medicaid.

When did Medicare start putting new brackets?

These new brackets took effect in 2018, bumping some high-income enrollees into higher premium brackets.

How to contact Medicare for lower cost?

Looking for Medicare coverage with lower costs? Talk with a licensed advisor now. Call 1-844-309-3504.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

Hearing Loss Services

With many Medicare beneficiaries having hearing issues, hearing care is one of the most expensive services that is not currently covered by Medicare. The Build Back Better plan looks to add hearing coverage to Medicare starting in 2023.

Redesigning Medicare Part D

Medicare Part D currently is known for having an awful design for drug coverage with high out-of-pocket costs, but has no limit on the total amount that beneficiaries pay out-of-pocket each year. There are multiple phases including a deductible, an initial coverage phase, a coverage gap phase, and the catastrophic phase.

How did the ACA reduce Medicare costs?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare. But implementing the cuts has been a bit of an uphill battle.

Why did Medicare enrollment drop?

When the ACA was enacted, there were expectations that Medicare Advantage enrollment would drop because the payment cuts would trigger benefit reductions and premium increases that would drive enrollees away from Medicare Advantage plans.

What is Medicare D subsidy?

When Medicare D was created, it included a provision to provide a subsidy to employers who continued to offer prescription drug coverage to their retirees, as long as the drug covered was at least as good as Medicare D. The subsidy amounts to 28 percent of what the employer spends on retiree drug costs.

How much will Medicare Part B cost in 2021?

In 2021, most Medicare Part B enrollees pay $148.50/month in premiums. But beneficiaries with higher incomes pay additional amounts – up to $504.90 for those with the highest incomes (individuals with income above $500,000, and couples above $750,000). Medicare D premiums are also higher for enrollees with higher incomes.

What percentage of Medicare donut holes are paid?

The issue was addressed immediately by the ACA, which began phasing in coverage adjustments to ensure that enrollees will pay only 25 percent of “donut hole” expenses by 2020, compared to 100 percent in 2010 and before.

How many people will be on Medicare in 2021?

However, those concerns have turned out to be unfounded. In 2021, there were 26 million Medicare Advantage enrollees, and enrollment in Advantage plans had been steadily growing since 2004.; Medicare Advantage now accounts for 42% of all Medicare beneficiaries. That’s up from 24% in 2010, which is the year the ACA was enacted (overall Medicare enrollment has been growing sharply as the Baby Boomer population ages into Medicare, but Medicare Advantage enrollment is growing at an even faster pace).

What is the medical loss ratio for Medicare Advantage?

This is the same medical loss ratio that was imposed on the private large group health insurance market starting in 2011, and most Medicare Advantage plans were already conforming to this requirement; in 2011, the average medical loss ratio for Medicare Advantage plans was 86.3%. The medical loss ratio rules remain in effect, but starting in 2019, the federal government has reduced the reporting burden for Medicare Advantage insurers.

How much will Medicare premiums drop in 2020?

The Centers for Medicare & Medicaid Services (CMS) also expects Medicare Advantage premiums to drop by 23 percent from 2018 to 2020.

Why are Medicare Advantage plans more efficient?

Advocates of the privatization of Medicare claim that Medicare Advantage plans are more efficient because the plans receive a set payment for each enrollee, what’s known as a capitation payment. “They pay for all of the enrollee’s healthcare out of that payment and they get to keep the remainder,” Huckfeldt said.

Why is Medicare Advantage so difficult to compare to Medicare Advantage?

Comparing traditional Medicare to Medicare Advantage is difficult, because even Medicare Advantage plans vary among themselves in terms of quality and cost. To help older adults make smarter healthcare choices, the executive order will push for them to have access to “better quality care and cost data.”.

What does the Medicare order mean for older adults?

The order calls for older adults to have “more diverse and affordable plan choices ” — which largely means more Medicare Advantage plans.

How many Medicare beneficiaries have MSA?

Only about 5,600 Medicare beneficiaries had a MSA in 2019, according to the Kaiser Family Foundation. The order would also allow older adults who choose not to receive benefits under Medicare Part A (inpatient care in a hospital or other facility) to keep their Social Security retirement insurance benefits.

What is value based care?

However, some healthcare professionals welcomed the order’s emphasis on “ value-based care ,” in which providers are paid for the quality of care they provide rather than how many services they bill for. Because of the lack of detail in the executive order, it’s difficult to say what effect this will have on Medicare.

What is the executive order for Medicare?

Written by Shawn Radcliffe on October 10, 2019. Share on Pinterest. An executive order aimed at “strengthening” Medicare is mainly focused on providing older adults with more Medicare Advantage plans and options. Getty Images.

Who introduced the Postal Service Reform Act of 2021?

The new bill, titled the Postal Service Reform Act of 2021 (H.R. 3076), was introduced May 11 by House Committee on Oversight and Reform Chairwoman Carolyn Maloney, D-NY. In advance of a committee hearing marking up the proposal, NARFE National President Ken Thomas sent a letter outlining the association’s views on the bill.

Will the Postal Service increase health insurance?

Postal reform legislation recently introduced in the House of Representatives has the potential to increase health care premiums for federal employees and retirees enrolled in Federal Employees Health Benefits (FEHB) plans. The new bill, titled the Postal Service Reform Act of 2021 (H.R. 3076), was introduced May 11 by House Committee on Oversight and Reform Chairwoman Carolyn Maloney, D-NY. In advance of a committee hearing marking up the proposal, NARFE National President Ken Thomas sent a letter outlining the association’s views on the bill.

Should the PSHB program retain all postal employees?

NARFE suggests that if Congress permits the creation of a new PSHB program, the program should retain all postal employees and retirees, rather than single out and exclude retirees without Medicare. This would prevent the type of cherry-picking the FEHB program has long opposed, a move that could set a dangerous precedent for the future ...

Does the NARFE bill require actuarially equivalent coverage?

The bill requires coverage in each to be “actuarially equivalent,” so that each plan covers a similar amount of expected costs. NARFE has had long-standing concerns that previous postal bills would force current postal retirees into Medicare as a condition of keeping FEHB plans in retirement.

Does the USPS prefund health insurance?

In addition to the possible creation of a PSHB program, the bill would end the requirement that USPS fully prefund the future health insurance benefits of its retirees. No other agency or private-sector company operates under such a mandate, which has cost the agency tens of billions of dollars and is the driving force behind the Postal Service’s financial losses throughout the last decade. Finally, the bill would maintain USPS service standards, protecting six-day delivery and requiring the agency to meet annual performance targets and consult the Postal Regulatory Commission before slowing mail delivery. NARFE has long advocated for repeal of the prefunding mandate and supports these critical provisions to preserve this universal service upon which Americans rely.