Medicare Complement Plan (MCP) is a Point-of-Service (POS) or Preferred Provider Organization (PPO) plan designed for retirees of self-insured employer groups as a way to complement a member’s primary Medicare coverage.

How do I pick a Medicare supplement plan?

“Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time. To buy a Medigap policy, it’s best to enroll during your Medigap Open Enrollment period, which lasts six months.

Which Medicare supplement plan should I Choose?

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

Do I need to consider a Medicare supplement plan?

The purpose of Medicare Supplement Insurance is to cover the cost left by deductibles and coinsurance in Original Medicare, but as full Medicaid coverage should cover the majority of those costs, a Medicare Supplement Insurance policy isn’t necessary. 3 A number of factors influence your coverage eligibility and decisions.

How to pick a Medicare supplement plan?

- Your health – How many times a year do you visit a doctor, specialist, or hospital? ...

- Your budget – Do you want to pay less each month or pay less when you visit a doctor? ...

- Your doctor – Choosing an HMO plan means you have a PCP who works together with a team of specialists to help you stay healthy and get the care that ...

What is Tufts Medicare Complement Plan?

Tufts Medicare Complement (TMC) plan is a Medicare-retiree Health Maintenance Organization (HMO) plan that complements a member's primary Medicare coverage. To maintain eligibility and qualify for this plan, members must maintain Medicare Parts A and B coverage, and must enroll in TMC through the GIC.

What is the difference between Tufts Medicare complement and Tufts Medicare Preferred?

Members enrolled in the Tufts Health Plan Medicare Complement Plan may utilize any provider that accepts Medicare. Tufts Health Plan Medicare Preferred is an HMO plan with a Medicare contract. Enrollment in Tufts Health Plan Medicare Preferred depends on contract renewal.

Is Tufts Medicare complement a supplement?

About the Plan Our Tufts Medicare Preferred Supplement Core plan is a private insurance that helps defray the costs of Original Medicare coverage. This plan pays the copays and coinsurance for most medical and hospital services covered through Medicare.

What is Medicare MCP?

A Monthly Capitation Payment (MCP) is a payment made to physicians for most dialysis-related physician services furnished to Medicare End Stage Renal Disease (ESRD) patients on a monthly basis.

Is Tufts Medicare or medicaid?

With Tufts Health Unify (our Medicare-Medicaid One Care plan for people ages 21 to 64), members get all the benefits of MassHealth and Medicare, plus other benefits, including a care manager, a personalized care plan, a 24/7 NurseLine, and long-term services and supports.

Is Tufts Medicare Preferred an HMO?

Our Tufts Health Plan Medicare Preferred HMO plans are Medicare Advantage plans (also known as Medicare Part C) that offer comprehensive medical coverage beyond Original Medicare (Medicare Parts A & B).

What is the federal ID number for Tufts Health Plan?

04-2985923The Employer Identification Number (EIN) for Tufts Associated Health Plans, Inc. is 04-2985923.

Can I have a Medicare Advantage plan and a Part D plan?

Plans can now cover more of these benefits. You can join a separate Medicare drug plan (Part D) to get drug coverage. Drug coverage (Part D) is included in most plans. In most types of Medicare Advantage Plans, you don't need to join a separate Medicare drug plan.

Are all Medicare Part D plans the same?

All Medicare drug coverage must give at least a standard level of coverage set by Medicare. However, plans offer different combinations of coverage and cost sharing. Plans offering Medicare drug coverage may differ in the drugs they cover, how much you have to pay, and which pharmacies you can use.

What is the difference between Medicare Part B and Part D?

Medicare Part D pays for most at-home medications, while Medicare Part B generally pays for drugs that a person receives at a doctor's office, hospital, or infusion center. Part B also pays for additional services, such as doctor's visits and some medical procedures.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What is Medicare Supplement Insurance?

Key Takeaways. Medicare Supplement Insurance, or Medigap, is a type of health insurance policy sold by private insurance companies to complement Medicare policies. It covers common gaps in Medicare’s standard insurance plans. Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider.

What is Medicare Part C?

Medicare Part C is also known as a Medicare Advantage plan. As with Medigap plans, Medicare Advantage (MA) plans come from private providers. These plans include and replace Medicare Parts A, B, and usually Part D coverage, but not hospice care. 5 6 Medicare Advantage plans generally include:

How much will Medicare premiums be in 2021?

Monthly premiums are updated annually and range from $259 to $471 in 2021, depending on an individual's quarterly coverage eligibility. 8 Medigap plans will assist with covering these out-of-pocket expenses. Even though premiums may be free for most Medicare enrollees, they must cover certain out-of-pocket expenses.

How long is the Medigap open enrollment period?

The Medigap Open Enrollment Period (OEP) is six months from the first day of an individual's 65th birthday month. These plans may also have open enrollment for six months after signing up for Part B coverage. 3 . Insured individuals pay monthly premiums for private Medigap policies directly to the insurance provider.

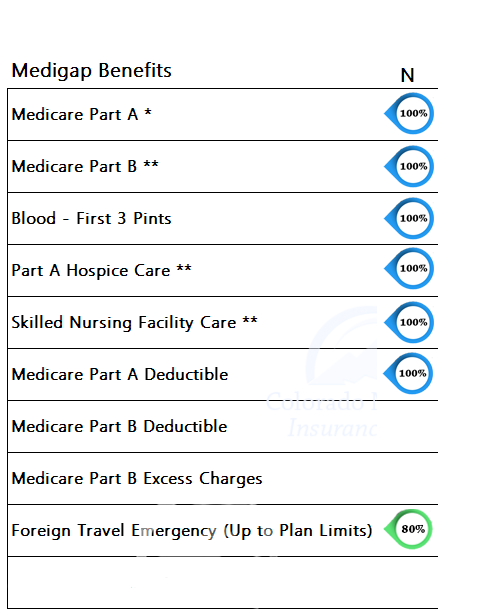

Does Medicare Supplement cover gaps?

Medicare Supplement Insurance covers common gaps in Medicare’s standard insurance plans. People who apply for Medigap coverage must take part in Medicare Parts A and B. Medigap plans supplement, but do not replace, primary Medicare coverage. 1 There are 10 Medigap plans, from Plan A to Plan N. 2 .

Does Medigap pay monthly premiums?

Insured individuals pay monthly premiums for Medigap policies directly to the insurance provider . Medigap coverage is different from Medicare Part C, which is also known as a Medicare Advantage plan.

Does Medigap pay directly to the hospital?

The private insurer then remits the difference directly to the healthcare provider. Some plans submit payments to hospitals based upon the Medicare Part A claim information, but this is less common.

Health Care Services and Medical Supplies

Wellcare Complement Assist (HMO) covers additional benefits and services, some of which may not be covered by Original Medicare (Medicare Part A and Part B).

Prescription Drug Costs and Coverage

The Wellcare Complement Assist (HMO) plan offers the following prescription drug coverage, with an annual drug deductible of $480 (excludes Tiers 1 and 6) per year.