Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

What are the benefits of plan N?

Jul 22, 2021 · The Plan N offers coverage for the deductible of Part A. It’s one of the few supplement plans that offer you coverage for emergency services bought outside the country. You can also expect coverage for care at a nursing facility. Cons However, there are copays that you need to pay.

What does Medicare supplement plan N cover?

Jun 06, 2021 · Medicare Supplement Plan N works with Original Medicare (Part A and Part B) to cover the cost gaps. Also known as Medigap Plan N, this plan covers all of the major gaps (i.e., deductibles , coinsurance , copayments , blood, and foreign …

Does AARP plan N cover Medicare deductible?

Jan 24, 2022 · What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and covers 80% of medical costs incurred during foreign travel. Plan N does not provide coverage for the Medicare Part B deductible ($233 in 2022). Moreover, its copays do not count towards meeting the Part B deductible.

What if Medicare denies coverage?

What Does Medicare Plan N Cover? This standardized Medicare Supplement covers the 20% that Medicare Part B doesn’t. It also pays for your hospital deductible and all your hospital costs. You will pay your own excess charges, Part B deductible, and some small copays at the doctor’s office and the emergency room.

See more

Mar 02, 2022 · Medicare Supplement Plan N is a standardized Medicare Supplement insurance plan available in most states nationwide. As a Medicare Supplement, this plan helps cover certain cost-sharing expenses that would otherwise be the …

What does an n plan cover?

What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and covers 80% of medical costs incurred during foreign travel. Plan N does not provide coverage for the Medicare Part B deductible ($233 in 2022).Jan 24, 2022

What is the N policy?

Medicare Supplement Plan N is one type of insurance policy that you can purchase to help lower your out-of-pocket costs from Medicare. These plans can cover costs like premiums, copays, and deductibles.

What is difference between Plan G and N?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

Does Plan N have copays?

With Plan N, you are responsible for copayments up to $20 when you visit the doctor's office (or up to $50 for emergency room visits). You are also responsible for any excess charges, the additional amount a doctor may charge for services above what Medicare covers.Oct 1, 2021

Does Medicare Plan N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.May 12, 2020

Is Medicare Plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Can I switch from Plan N to G?

Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F? Yes, you can change from a Medicare Advantage plan to a Medigap with Guarantee Issue Rights during the first 12 months of enrolling in a Medicare Advantage plan. After that, you may need to wait until the Annual Enrollment Period to switch.

Can you switch from Plan N to Plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.Jan 30, 2021

How much does AARP plan n cost?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan G (1)$173Plan K$70Plan L$136Plan N$1676 more rows•Jan 24, 2022

Does AARP plan n pay Medicare deductible?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor's office and emergency room visits.Nov 23, 2021

Is Plan Na plan good?

Our Review of Medicare Supplement Plan N Medigap Plan N has seen a rising enrollment rate in recent years, and for good reason. Plan N offers suitable coverage and will typically be found at a more affordable price than other Medigap plans. Plan N does not provide coverage of the Medicare Part B deductible.Jan 4, 2022

Is Medicare Plan N a good plan?

Medigap Plan N combines fairly extensive coverage with relatively modest premiums, making Plan N a good policy. It is important to remember that Pl...

How popular is Medicare Plan N?

Amount 10% of all Medigap enrollees have Plan N, making it the third most popular plan overall, and the second most popular plan for new enrollees.

Does Plan N have a deductible?

Most Plan N policies do not have a deductible. However, beneficiaries enrolled in Plan N are required to meet the Medicare Part B deductible, $233...

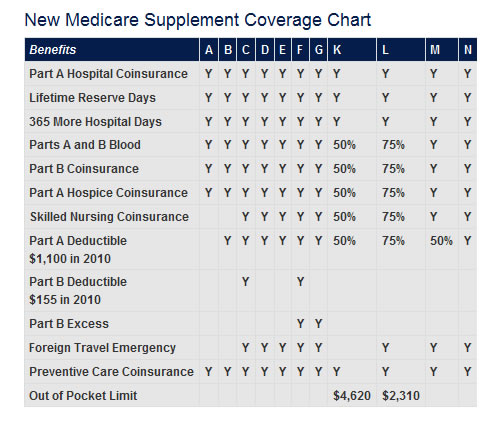

Does Plan N have a maximum out-of-pocket limit?

Plan N does not have an out-of-pocket limit. Only two supplement plans have an out-of-pocket limit: Plans K and L.

Can I have Medigap Plan N while enrolled in a Medicare Advantage plan?

No. Medigap policies are only available to people enrolled in the Original Medicare program. They cannot be used by beneficiaries in Medicare Advan...

How much does Plan N cost monthly?

Plan N does not have a set premium but ranges from $85 to $200. The premium will depend on several factors such as zip code, gender, age, tobacco u...

What is the deductible for Plan N?

In 2022, the deductible is $233 which is the Part B annual deductible that you are responsible for with Plan N. The Part B deductible is one gap th...

What is the difference between Plan G and Plan N?

Plan N has more out-of-pocket than Plan G, but the premium for Plan N is typically lower. You must pay up to $20 copays for office visits and up to...

Can I switch from Plan N to Plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to ans...

Do people prefer Plan N over Plan G?

Plan N is very appealing as it tends to have lower premiums than Plan G. For those who don’t visit the doctor often, this plan may be a great fit!...

What is Medicare Supplement Plan N?

Medicare Supplement Plan N works with Original Medicare#N# Original Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage....#N#(Part A and Part B) to cover the cost gaps. Also known as Medigap Plan N, this plan covers all of the major gaps (i.e., deductibles#N#A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share....#N#, coinsurance#N#Coinsurance is a percentage of the total you are required to pay for a medical service. ...#N#, copayments#N#A copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service....#N#, blood, and foreign travel emergencies) that traditional Medicare does not cover, but costs less than more comprehensive plans because you share some of the costs when you see your doctor. This is why the plan is gaining popularity.

How much does Medicare pay for a doctor visit?

With a Plan N policy, you pay your Medicare Part B deductible on your first doctor visit. Thereafter you pay up to $20 to see your doctor and up to $50 if you need to use the emergency room.

Does Medicare cover excess charges?

Medicare Plan N does not cover excess charges, so you’ll pay this cost out-of-pocket when you choose a doctor that does not accept Medicare assignment. To recap, here are the costs not covered by Plan N: The Medicare Part B Deductible. Medicare Part B Excess Charges. A $20 (max) Doctor Visit Copayment.

What is a copay?

A copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service.... , blood, and foreign travel emergencies) that traditional Medicare does not cover, but costs less than more comprehensive plans because you share some of the costs when you see your doctor.

Does Medicare Supplement Plan F cover Part B?

You might be thinking that Medicare Supplement Plan F is... cost and coverage comparison. Like Plan N, Plan G does not cover the Part B deductible. That means that the only real difference between these two policies is what you pay to see your doctor and to use the E.R., and coverage of excess charges.

What is premium insurance?

A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... are higher, too. This is one of the reasons Plan N policies work so well for healthy seniors.

Is Plan N a good supplement?

For healthy people who don’t have a family history of chronic illnesses as they age, a Plan N Medicare supplement is a great way to save a lot of money without taking a big risk. And that’s really what insurance is all about, mitigating financial risk.

What is Medicare Plan N?

Medicare Plan N is a supplemental policy that typically has lower premiums while you pay your Part B deductible, excess charges and some copays for doctor and emergency visits. It has been popular since it was first introduced in 2010. Also called Medigap Plan N, this option was created for consumers who like the idea ...

What is Medicare Supplement Plan N?

Also called Medigap Plan N, this option was created for consumers who like the idea of paying a lower premium in exchange for taking on a small annual deductible and some copays. All Medicare Supplement Plan N policies are the same, no matter which insurance company you choose.

How much is the Part B deductible for 2021?

First, you agree to pay the small annual Part B deductible ($203 in 2021). You will also pay co-payments up to $20 for doctor appointments. Emergency room visits have a $50 copay. Finally, people with Medigap N also pay excess charges to some medical providers. Providers can charge 15% more than what Medicare allows.

Does Medicare pay for hospital services?

Your Medicare Part A hospital benefits provide coverage for inpatient hospital services, skilled nursing, home health, hospice and blood transfusions. While you would normally owe a deductible for your hospital stay, your Medigap Plan will pay that for you. Here’s a quick list of items covered in the hospital by Medicare Supplement Plan N: ...

What is the difference between Medicare Plan N and Plan G?

People who enroll in Plan N also often look at Plan G as an alternative because Plan G is only slightly more expensive. The primary difference is that Plan G covers the little copays and excess charges so there are less bills showing up in your mailbox.

Does Plan N cover Medicare?

Plan N does not cover this for you like Plan F or G would. This can result in small bills from time to time. However, you can avoid this by simply asking your providers up front if they accept Medicare assignment. If they do, you need not worry about excess charges.

Is Medicare Plan N standardized?

Though Medicare Plan N is one of the 10 federally standardized Medicare Supplement options , each insurance company can choose whether to sell it or not. Fortunately, this policy is fairly easy to find since many carriers offer it.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N. Medicare Supplement Plan N is one of the more popular plans among beneficiaries in 2021. It’s the plan for those who prefer lower monthly premiums without forfeiting benefits. Yet, when you enroll in this plan, you’re responsible for deductibles and a few copays.

What is the difference between Plan G and Plan N?

Plan G covers Part B excess charges , which are not a concern in most cases but especially not if they aren’t allowed in your state to begin with. Plan N also involves cost-sharing via copayments and coinsurance, which Plan G covers. However, premiums for Plan G are usually higher than those for Plan N.

Why is Plan N so popular?

This popularity is not surprising, because the policy offers a decent amount of coverage at a reasonable price. Plan N offers extra coverage to supplement your Medicare benefits without breaking the bank. The small copays this plan involves keeping the monthly premium lower.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What are the factors that affect your monthly premium rates?

Among the factors that affect your monthly premium rates is the pricing method that your carrier uses. In the last five years, premium rates for Plan N have increased between 2% and 4%. These increases are lower when compared to Plan F and comparable when compared to Plan G.

How much does Medigap cost in 2021?

How Much Does Medigap Plan N Cost in 2021. The average cost of Plan N is around $120-$180 per month. However, in some states, it can be as much as $200 and in others, it can be as low as $80. Your premium rates depend on your personal information as well as the plan letter you choose. Factors such as your state of residence, gender, age, ...

What is a plan F?

Plan F is a Medigap plan offering comprehensive coverage. It covers 100% of your out-of-pocket costs. Outside of the monthly premium, you never need to pay out-of-pocket. Plan N is two steps down from Plan F in terms of coverage. Yet, the premiums for Plan F are higher because the more benefits a plan offers, the higher the premiums will be.

What is Medicare Plan N?

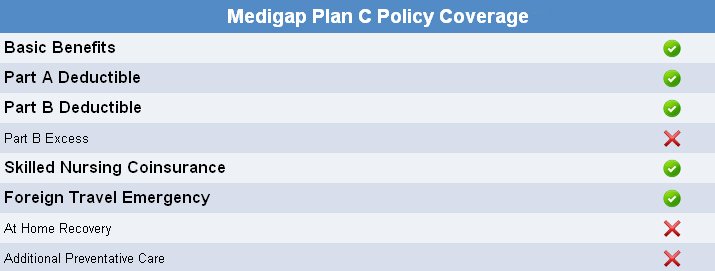

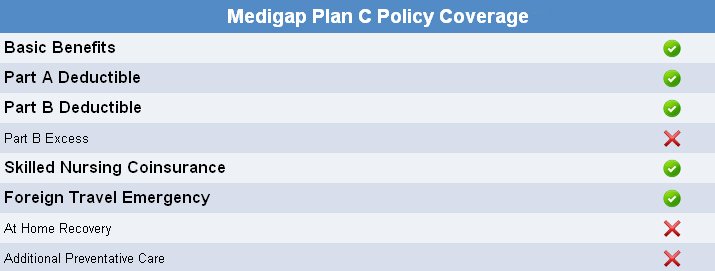

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B . It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.

How long does Medicare cover hospitalization?

Hospitalization: pays Part A coinsurance and provides coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance (excluding copays for office visits and ER) and 20% of Medicare-approved expenses or copayments for hospital outpatient services.

How do insurance companies set prices?

But how do companies set these prices? They use one of three price rating systems to set premiums: 1 Community-rated: everyone with the policy pays the same price regardless of age. Pricing can still change based on inflation but cannot increase due to your age. 2 Issue-age-rated: the premium is based on the age you are at the time of purchase. Therefore, it costs less for people who buy at a younger age. The price cannot increase after the issue date due to age. 3 Attained-age-rated: the premium starts low and increases as you age.

How old do you have to be to get Medigap?

Medigap plans are standardized by the federal government. This means that plans of the same letter offer the same benefits, no matter who you buy it from. But keep in mind that insurance companies are allowed to offer additional benefits, so compare plans carefully before you purchase a policy. You are eligible to purchase a Medicare supplement insurance plan if you are 65 years old or older and enrolled in Medicare Part B. If you are under 65 and disabled, you will likely be limited as to which Medigap plan you can purchase.

How old do you have to be to get Medicare Supplement?

You are eligible to purchase a Medicare supplement insurance plan if you are 65 years old or older and enrolled in Medicare Part B. If you are under 65 and disabled, you will likely be limited as to which Medigap plan you can purchase. There are 10 Medigap plan options in total. But we are going to focus on Medicare Supplement Plan N.

Does Medicare cover a doctor's office?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor’s office and emergency room visits.

Does Medigap cover you?

With Medigap plans, there is no insurance network limiting you. Medicare Plan N covers you no matter where you go throughout the country – as long as your provider accepts Medicare.

When was Medicare Supplement Plan N introduced?

UPDATED Dec. 9, 2020. Medicare Supplement Plan N, also known as Medigap Plan N, was introduced in June of 2010. To lower monthly premium costs, Plan N uses copays which include: up to $20 for a doctor’s visit, and $50 for emergency visits. The result is an affordable and top-rated plan with a monthly premium 30%-35% lower than the all-covering ...

How much is Medicare Part A coinsurance?

Medicare Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits end. Medicare Part B coinsurance (usually about 20% of outpatient expenses) or copayment (hospital outpatient services). Copayments are required: up to $20 for a doctor’s office visit and $50 for an emergency visit.

How much is Medicare Part B deductable in 2021?

Part B Deductible (in 2021 – $203 per year) Medicare Part B Excess Charges (defined as the amount the doctor may charge above the Medicare-approved amount. It cannot be more than15% of what Medicare pays). Return to Top.

Is Medigap dependent on vendors?

The benefits of Medigap plans are NOT dependent on vendors. All Medicare Supplement plans are standardized, i.e., any plan bought from one company is identical to the same plan purchased from any other company. Plan N premium, however, may vary from vendor to vendor.

Does Medigap Plan G cover Medicare Part B?

Medigap Plan G is the same as the Medigap Plan F, but it does not cover Medicare Part B deductible ($203 is 2021). Does any doctor accept the Medigap Plan N? YES, as long as your doctor accepts Medicare. Are Plan N benefits depend on Medigap vendor?

What is Medicare Supplement Plan N?

How Medicare Supplement Plan N from Aetna Covers You. Plan N is one of the newest Medicare plans. Aetna Health and Life Insurance Co offers it some areas (see above) because it helps seniors fill the gaps in their original Medicare benefits in a unique way.

How much is Medicare Part B coinsurance?

Medicare Part B coinsurance or co-payments (except for a co-payment of up to $20 for some office visits and up to a $50 co-payment for emergency room visits that do not result in inpatient care) First three pints of blood used in a medical procedure.

Why do we verify reviews?

We verify all reviews, because real opinions matter. To do this we require that you verify your email address after you submit your review. Your information will not be used for any purpose other than verifying that you are a real person ( no fake reviews! ).