Can You cash out a HSA?

Your HSA can also function as a backup emergency fund, letting you withdraw tax-free cash when you really need it. You can only do this if you delay reimbursing yourself for previous medical expenses you paid out of pocket for. This allows you to withdraw a larger amount of money at a later time.

When do you pay taxes on your HSA?

What Is IRS Form 1099-SA: Distributions from an HSA, Archer MSA, or Medicare Advantage MSA?

- Plan tax benefits. If you make contributions to one of these accounts, you stand to save a significant amount of money in taxes both in the short and long term.

- Qualified medical expenses. None of the money received from these plans is taxable if it is spent on "qualified" medical expenses.

- HSA distributions. ...

- MSA distributions. ...

How the uninsured can avoid paying a tax penalty?

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Lab services

- Preventive and wellness services

- Pediatric care, including vision and dental services

Can a person on Medicare have a HSA?

savings account (HSA). Although Medicare enrollees cannot establish HSAs or make or receive contributions to their existing accounts, these individuals can withdraw any remaining balances in previously established accounts. This In Focus provides an overview of HSA rules and highlights how these rules apply to Medicare enrollees. Health Savings Accounts

Are HSA contributions taxable for Medicare?

With this setup, as the employer, you also benefit from even lower payroll taxes if you choose to contribute to your employees' HSAs, because your employer HSA contributions aren't included in your employees' income and therefore aren't subject to federal income tax, or Social Security or Medicare taxes (commonly known ...

Do you have to pay taxes on HSA after 65?

Age 65 General Distributions At age 65, you can take penalty-free distributions from the HSA for any reason. However, in order to be both tax-free and penalty-free the distribution must be for a qualified medical expense. Withdrawals made for other purposes will be subject to ordinary income taxes.

When should I stop contributing to my HSA before Medicare?

The takeaway here is that you should delay Social Security benefits and decline Part A if you wish to continue contributing funds to your HSA. Finally, if you decide to delay enrolling in Medicare, make sure to stop contributing to your HSA at least six months before you do plan to enroll in Medicare.

When should I stop making HSA contributions?

age 65Simply put, once a person is covered by Medicare, they must stop contributing to their HSA or risk paying penalties to the IRS. More and more Americans are working past age 65 and may desire to continue making HSA contributions.

What is the tax rate for Medicare after a HSA?

Excess contributions will be taxed an additional 6 percent when you withdraw them. You’ll pay back taxes plus an additional 10 percent tax if you enroll in Medicare during your HSA testing period.

What is an HSA account?

A health savings account (HSA) is an account you can use to pay for your medical expenses with pretax money. You can put money in an HSA if you meet certain requirements. You must be eligible for a high-deductible health plan and you can’t have any other health plan. Because Medicare is considered another health plan, ...

How long do you have to be on Medicare before you turn 65?

When you enroll in Medicare after you turn age 65, the IRS will consider you to have had access to Medicare for 6 months prior to your enrollment date. In general, it’s a good idea to stop HSA contributions if you’re planning to enroll in Medicare anytime soon. That way, you can avoid any tax penalties and save money.

What is Medicare Part B?

Medicare Part B (medical insurance) has standard costs, including a monthly premium and an annual deductible. Additionally, you’ll pay 20 percent of the Medicare-approved cost for most covered services. You can use the funds in your HSA toward any of these costs.

Does MSA money count toward deductible?

So while you can spend your MSA funds on a service Medicare doesn’t cover, it won’t count toward your deductible.

Is MSA the same as HSA?

This plan is similar to an HSA, but there are a few key differences. Just like a standard HSA, you’ll need to be enrolled in a high-deductible plan. With an MSA, this means you’ll need to select a high-deductible Medicare Advantage plan. Once you’ve selected a plan, things will look a little different than your HSA.

Can a 65 year old retire without Medicare?

As another example, let’s say a retired person chooses not to enroll in Medicare when they turn 65 years old. They don’t have another health plan and pay all health costs out of pocket. In this case, they’ll pay a late enrollment penalty if they do decide to enroll in Medicare later.

What is the penalty for HSA withdrawals?

Prior to age 65, if you use your money for non-qualified expenses, the IRS imposes a hefty HSA withdrawal penalty of 20 percent on the amount withdrawn. For example, if you spend $500 on non-qualified expenses, your penalty will be $100.

How to avoid spending HSA?

One way to avoid spending your HSA dollars on non-qualified medical expenses is to check with your HR department or benefits administrator in advance. Learn more about HSA eligible expenses. In addition, if you are using a HSA debit card, many have security features built in to them:

What is an HSA account?

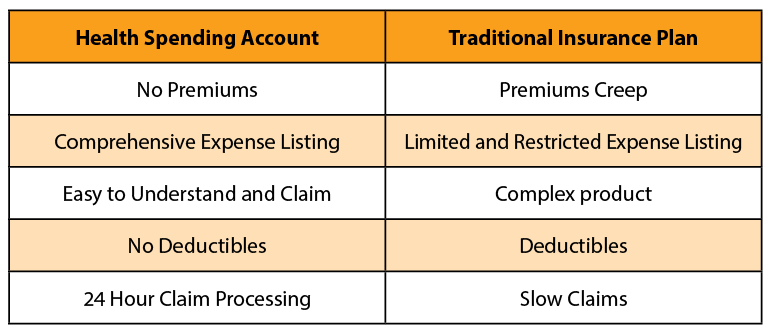

Health Savings Accounts (HSAs) are a popular tool for saving on taxes while setting aside money for medical and healthcare expenses. When you enroll in a qualified high deductible health plan (HDHP) and sign up for an HSA, you contribute pre-tax money into an account and then withdraw those funds for qualified healthcare expenses ...

Is an HSA a pre-tax account?

In some ways, an HSA is similar to a Flexible Spending Account (FSA). Each payday you contribute money into the HSA on a pre-tax basis. That means the funds come out of your paycheck before taxes are taken out, which lowers your taxable income and saves you money. Those HSA funds can be spent to cover out-of-pocket healthcare expenses for you and your family. So long as the money is used for qualified expenses, withdrawals are not taxed or penalized.

Is HSA money taxable?

In addition to the 20 percent penalty, the IRS will also consider any HSA funds spent on non-qualified expenses as taxable income.

Is HSA taxed?

So long as the money is used for qualified expenses, withdrawals are not taxed or penalized. One distinct advantage with an HSA is that you own the account – just like a checking or savings account; you can keep and use the money even if your employment status changes.

Does an HSA stay with you?

Unlike FSAs, your HSA stays with you for life unless you choose to close it. This is true whether the account is sponsored by your employer or you opened it on your own. This is one of the features that makes HSAs an effective tool for saving, investing, and adding to your retirement nest egg.

What is the excise tax on Medicare?

If you continue to contribute, or your Medicare coverage becomes retroactive, you may have to pay a 6% excise tax on those excess contributions. If you happen to have excess contributions, you can withdraw some or all to avoid paying the excise tax.

What is HSA 2021?

Medicare and Health Savings Accounts (HSA) Home / FAQs / General Medicare / Medicare and Health Savings Accounts (HSA) Updated on June 9, 2021. There are guidelines and rules you must follow when it comes to Medicare and Health Savings Accounts. A Health Savings Account is a savings account in which money can be set aside for certain medical ...

What is a health savings account?

A Health Savings Account is a savings account in which money can be set aside for certain medical expenses. As you get close to retiring, it’s essential to understand how Health Savings Accounts work with Medicare.

Can you withdraw money from a health savings account?

Once the money goes into the Health Savings Account account, you can withdraw it for any medical expense, tax-free. Additionally, you can earn interest, your balance carries over each year, and this can become an investment for a retirement fund. Unfortunately, some restrictions come along with having a Health Savings Account with Medicare.