Medicare Part Ais free to most Medicare qualified individuals and helps to pay for inpatient hospital care, skilled nursing care, hospice and home health care. If you are enrolled and require any of these services Medicare would be either the primary or secondary payer for your claims, depending on your other policy.

How does Medicare work with other insurance?

How Medicare works with other insurance. If you have Medicare and other health insurance or coverage, each type of coverage is called a "payer.". When there's more than one payer, " Coordination of benefits " rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to...

Do you automatically get extra help if you have Medicare?

You may automatically qualify for Extra Help if you have Medicare and also: Receive full Medicaid coverage (meaning you’re eligible for the full range of Medicaid benefits). Are enrolled in a Medicare Savings Program, which pays for your Part B premium. Receive Supplemental Security Income (SSI) benefits.

Can I get Medigap If I have only Medicare Part A?

This is true even if you have only Medicare Part A or only Part B. If you want coverage designed to supplement Medicare, you can find out more about Medigap policies. You can also learn about other Medicare options, like Medicare Advantage Plans.

Do I have to pay for Medicare as I get It?

You typically pay a portion of the costs for covered services as you get them. Under Original Medicare, you don’t have coverage through a Medicare Advantage Plan or another type of Medicare health plan. Refer to Medicare glossary for more details.

What benefits do you get with Medicare Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Which benefits are not covered by Medicare Part A?

What's not covered by Part A & Part B?Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

What does Medicare Part A typically cover?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Will I automatically be enrolled in Medicare Part A?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Does Medicare Part A cover emergency room visits?

Does Medicare Part A Cover Emergency Room Visits? Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

Does Medicare Part A have a deductible?

Does Medicare have a deductible? Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Is Medicare Part A free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

Does Medicare coverage start the month you turn 65?

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month. If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

How do I apply for Medicare Part B?

Contact Social Security to sign up for Part B:Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). ... Call 1-800-772-1213. ... Contact your local Social Security office.If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

What are the benefits of Medicare?

Expanded Medicare benefits for preventive care, drug coverage 1 Medicare benefits have expanded under the health care law – things like free preventive benefits, cancer screenings, and an annual wellness visit. 2 You can also save money if you’re in the prescription drug “donut hole” with discounts on brand-name prescription drugs.

How long do you have to sign up for Part B?

During the 8-month period that begins the month after the job or the coverage ends, whichever happens first.

Is Medicare part of the Marketplace?

Changing from the Marketplace to Medicare. Medicare isn’t part of the Health Insurance Marketplace®, so if you have Medicare coverage now you don’t need to do anything. The Marketplace won’t affect your Medicare choices or benefits. No matter how you get Medicare, whether through Original Medicare or a Medicare Advantage Plan (like an HMO or PPO), ...

Does the Shop Marketplace cover my spouse's health insurance?

Yes. Coverage from an employer through the SHOP Marketplace is treated the same as coverage from any job-based health plan. If you’re getting health coverage from an employer through the SHOP Marketplace based on your or your spouse’s current job, Medicare Secondary Payer rules apply. Learn more about how Medicare works with other insurance.

Is Medicare Advantage changing?

Yes. The Medicare Advantage program isn’t changing as a result of the health care law. Learn more about Medicare Advantage plans.

Does Medicare Part B meet the Medicare Part B requirement?

But having only Medicare Part B (Medical Insurance) doesn’t meet this requirement.

Can you get Medicare if you have ESRD?

You have a medical condition that qualifies you for Medicare, like end-stage renal disease (ESRD), but haven’t applied for Medicare coverage

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

Which insurance pays first, Medicare or No Fault?

No-fault insurance or liability insurance pays first and Medicare pays second.

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

Why is it important to have other coverage for Medicare?

Having other coverage gives you options when deciding how to utilize the Medicare program. Knowing the deadlines and requirements for avoiding penalties can ensure you get the most benefits without incurring penalties.

When can I enroll in Medicare Part A?

Regardless of other coverage, most people choose to enroll in Medicare Part A when they reach the qualifying age of 65 years old. Medicare Part A is free to most Medicare qualified individuals and helps to pay for i npatient hospital care, skilled nursing care, hospice and home health care. If you are enrolled and require any of these services Medicare would be either the primary or secondary payer for your claims, depending on your other policy. Having a primary and secondary payer could help limit your exposure to potential out-of-pocket expenses.

How to know if Medicare is primary or secondary?

How do you know which policy will be primary? Generally speaking if the private policy is through a larger employer—with 20 or more employers—then it will be the primary payer and Medicare will be secondary. If your private insurance policy is through a smaller employer—with less than 20 employees—then Medicare will be primary and the private policy will be secondary. Keep in mind that if your employer insurance is the secondary payer, you might need to enroll in Part B before your insurance will pay.

How long does Medicare coverage last?

This special period lasts for eight months after the first month you go without your employer’s health insurance. Many people avoid having a coverage gap by signing up for Medicare the month before your employer’s health insurance coverage ends.

What is a small group health plan?

Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage a small group health plan. If your employer’s insurance covers more than 20 employees, Medicare will pay secondary and call your work-related coverage a Group Health Plan (GHP).

Does Medicare pay second to employer?

Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance ...

Is Medicare the primary or secondary payer?

The first thing you want to think about is whether Medicare will be the primary or secondary payer to your current insurance through your employer. If Medicare is primary, it means that Medicare will pay any health expenses first. Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs.

Does Medicare cover health insurance?

Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage ...

Can an employer refuse to pay Medicare?

The first problem is that your employer can legally refuse to make any health-related medical payments until Medicare pays first. If you delay coverage and your employer’s health insurance pays primary when it was supposed to be secondary and pick up any leftover costs, it could recoup payments.

What extra benefits does Medicare not cover?

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services )

What is Medicare Supplement Insurance?

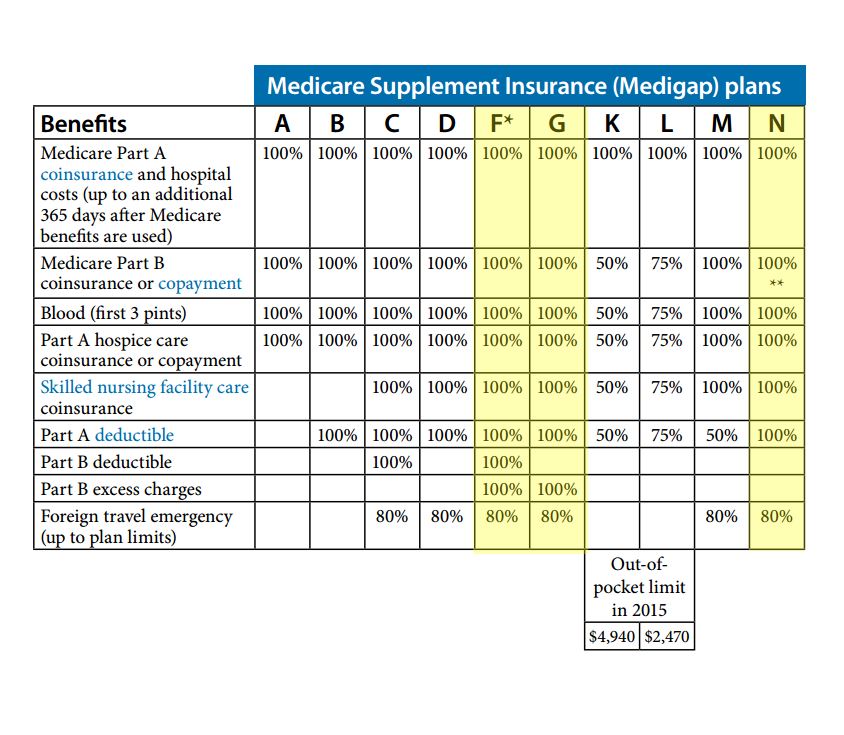

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

How to get free health insurance counseling?

Contact your local State Health Insurance Assistance Program (SHIP) to get free personalized health insurance counseling. SHIPs aren’t connected to any insurance company or health plan.

Do you pay monthly premiums for Part B?

Most plans have a monthly premium that you pay in addition to your Part B premium. You’ll also pay other costs when you get prescriptions.

Why does Medicare not cover everything?

Because Medicare doesn’t cover everything, these policies are available to fill in the gaps. This helps reduce costs. Most states offer 12 different plan options, with varying levels of coverage. Each plan is subject to federal regulations, ensuring that the benefits are the same regardless of the carrier.

Why do you need a supplement insurance policy?

Because Medicare pays first, it is primary. But , Medicare doesn’t pay for everything. So, a Supplemental policy is beneficial to have in place to protect you from unexpected medical costs. If you’re looking for the best secondary insurance with Medicare, it’s wise to become familiar with what each Medigap plan includes.

How does secondary insurance work?

How Secondary Insurance Works. When you have two insurance policies that cover the same kinds of risks, one of them is primary and the other is secondary. For example, suppose you have Medicare along with Medigap Plan G. Medicare will be your primary health insurance, and the Medigap plan is secondary. If you go to the doctor, Plan G will cover the ...

What is supplemental insurance?

Supplemental insurance is available for what doesn’t get coverage. For example, Part D is drug coverage, which is supplemental insurance. Dental, vision, and hearing policies are also available for purchase to supplement your existing coverage. Yet, these policies stand on their own and are not primary or secondary insurance.

Is Medigap a secondary insurance?

Medigap is not the only type of insurance that can be secondary to Medicare. For example, those with TRICARE For Life have TFL as their secondary plan. A series of rules known as the coordination of benefits decides the order of payment in each case. Sometimes, although rarely, there can be up to three payers.

Is Medicare a primary or secondary plan?

Primary vs. Secondary Medicare Plans. Medicare is primary to a Supplement plan because it pays first. After reaching the limit, your Medigap plan will pay second. Often, secondary insurance will not pay if the primary insurance doesn’t pay. Medigap is not the only type of insurance that can be secondary to Medicare.

Is Medicare secondary to employer?

What is Secondary Insurance to Employer Coverage. Medicare recipients who are still working might have a large employer group health plan. In this case, Medicare is secondary to the employer plan. It’s also possible to delay Part B if you reach age 65 and have creditable coverage through your employer.

What is not covered by Medicare?

Offers benefits not normally covered by Medicare, like nursing home care and personal care services

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

What is extra help?

And, you'll automatically qualify for. Extra Help. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. paying for your.

Which pays first, Medicare or Medicaid?

Medicare pays first, and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Does Medicare cover health care?

If you have Medicare and full Medicaid coverage, most of your health care costs are likely covered.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

What are the resources that Medicare doesn't consider?

When counting your resources to determine eligibility for Extra Help, Medicare includes items such as: Bank accounts. Stock and bonds. Real estate other than your primary residence. Medicare doesn’t consider the following resources when it comes to eligibility: Your house. One vehicle.

What is Medicare Extra Help?

If you’re eligible for the Medicare Extra Help program, the level of assistance you get depends on your income and financial resources. The program caps the costs you pay for covered generics and brand-name medications.

How to reduce Medicare Part D cost?

Here are other ways to reduce costs for Medicare Part D prescription medications: Switch to a generic form of the prescription drug if available (check with your doctor first). Ask your doctor about less expensive brand-name drugs. Use a mail-order pharmacy, which may provide savings if you’re ordering a larger quantity of medications.

What happens if you don't get a notice from Extra Help?

If you don’t get any notices in the mail, you can expect to receive the same level of assistance with prescription drug costs that you got the previous year.

How much is Medicare Part D extra help 2021?

In 2021, you may be eligible for Medicare Part D Extra Help if: Individual: your annual income no more than $19,320, and the value of your assets is no more than $14,790. Married couple: your combined income is no more than $26,130, ...

What does it mean to receive full medicaid?

Receive full Medicaid coverage (meaning you’re eligible for the full range of Medicaid benefits).

What to do if you don't qualify for extra help?

If you don’t qualify to receive Extra Help, there are still ways to save money. Your State Medical Assistance (Medicaid) office or your State Health Insurance Assistance Program (SHIP) can provide you more information on payment assistance for prescription drug costs.

What is Medicare for people 65 and older?

Medicare. Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD) and. group health plan.

What is a group health plan?

group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families. (retiree) coverage from a former employer, generally Medicare pays first for your health care bills, and your. group health plan. In general, a health plan offered by an employer ...

Does stop loss cover out of pocket costs?

It might only provide "stop loss" coverage, which starts paying your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance. only when they reach a maximum amount.

Does retirement insurance include extra benefits?

and deductibles. Sometimes retiree coverage includes extra benefits, like coverage for extra days in the hospital.