Full Answer

What is the best and cheapest Medicare supplement insurance?

Decide which plan you want. Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan. Step 2.

Is Medicare supplemental insurance worth buying?

If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second. What's Medicare Supplement Insurance (Medigap)? Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover. Find a Medigap policy. Find …

Who needs a Medicare supplement insurance policy?

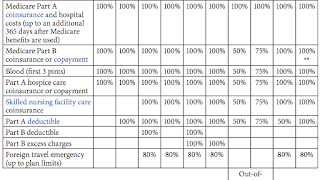

3 rows · Mar 24, 2022 · A Medicare Supplement policy can help you cover these costs. A Medigap policy only ...

How much does a Medicare supplemental insurance plan cost?

Medigap (Medicare Supplement Health Insurance) A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover. If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your …

In which Medicare supplemental policies are the core benefit found?

What does Medicare Supplement Plan A cover? As well as covering the coinsurance for Part A and Part B, Medigap Plan A covers the first three pints of blood and hospital costs up to 365 days after Original Medicare benefits are used up. This plan includes the most basic benefits.Jan 26, 2022

Which of the following would a Medicare Supplement policy cover?

Medicare Supplement insurance Plan A covers 100% of four things: Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up. Medicare Part B copayment or coinsurance expenses. The first 3 pints of blood used in a medical procedure.

What is the purpose of a Medicare Supplement policy?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

What must be in all Medicare Supplement policies?

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.Dec 1, 2021

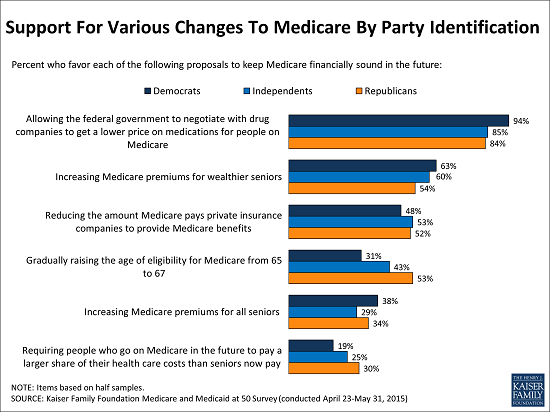

Does CMS regulate Medicare?

Medicare Supplement plans are standardized and offer various benefits to help offset your healthcare cost. The California Department of Insurance (CDI) regulates Medicare Supplement policies underwritten by licensed insurance companies.

Which of the following is true about Medicare supplemental insurance plans?

Which of the following is true about Medicare Supplement Insurance Plans? They are regulated by the Centers for Medicare & Medicaid Services (CMS). Plan benefit amounts automatically update when Medicare changes cost sharing amounts, such as deductibles, coinsurance and copayments.

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.May 16, 2018

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

What is the difference between Medicare Supplement and Advantage plans?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

Which renewal provision must all Medicare supplement policies contain?

A continuation provision must include any reservation by the issuer of the right to change premiums and any automatic renewal premium increases based on the policy holders age. Provisions must be captioned and appear on the first page of the policy. What is excluded under Medigap?

Which of the following is a requirement for standard Medicare supplement plans?

What are those requirements? People must be at least 65 years old, regardless of their health condition, and must apply for a Medicare supplement policy within six months of enrolling in Medicare Part B.

What is Medigap insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

How to choose a Medigap plan?

Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan. Step 2.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What is a medicaid supplement?

Medigap (Medicare Supplement Health Insurance) A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

What is the difference between Medigap and Medicare?

Generally, the only difference between Medigap policies sold by different insurance companies is the cost. You and your spouse must buy separate Medigap policies.Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

Do you have to pay for Medigap?

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Can insurance companies sell standardized Medicare?

Insurance companies can only sell you a “standardized” Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.”. It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that ...

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

What is Medicare Part A coinsurance?

Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood. Medicare Supplement Plan A is the most basic of the standardized, ...

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

Is community rated Medicare the least expensive?

Although the premium for a community-rated plan may be higher at first, it may be least expensive over time. Attained-age Medicare Supplement plans usually start with a low premium, but the increases at different age milestones can be steep.

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.