- When it comes to receiving Medicare benefits, there are no income restrictions.

- You may be asked to pay more money for a premium depending on your income.

- If you have a minimal income, you may be eligible for Medicare premium assistance.

What are the income limits for Medicare?

Nov 16, 2021 · You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,379 or less an individual resources limit of $4,000 a married couple monthly income of $5,892 or less a married couple resources limit of $6,000

Is there a cap on Medicare taxable income?

Nov 11, 2021 · In 2021, IRMAA surcharges apply to individual Medicare beneficiaries who earn more than $88,000, and to couples who earn more than $176,000. For 2022, these limits are projected to increase to $91,000 and $182,000, respectively.

Are there limits to my Medicare coverage?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833 A …

How does income affect monthly Medicare premiums?

Nov 17, 2021 · There are no Medicare income limits that pertain to eligibility, but income can decide some monthly costs. Those with higher incomes must pay higher monthly premiums for two Medicare programs....

What are Medicare income limits?

Medicare beneficiaries with incomes above a certain threshold are charged higher premiums for Medicare Part B and Part D. The premium surcharge is...

Why does Medicare impose income limits?

The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. And for Part D, they took effect in 2011, under the Affor...

Who is affected by the IRMAA surcharges and how does this change over time?

There have been a few recent changes that affect high-income Medicare beneficiaries: In 2019, a new income bracket was added at the high end of the...

Will there be a rate increase in 2022?

We don’t yet have concrete details from CMS. But the Medicare Trustees Report, which was published in late August, projects that the standard Part...

What is SLMB in Medicare?

SLMB, or Specified Low-Income Medicare Beneficiary. If you earn less than $1,296 per month and have less than $7,860 in assets, you may be eligible for SLMB. Married couples must make less than $1,744 per month and have less than $11,800 in debt to qualify. This plan covers your Part B premiums.

What happens if you retire in 2020 and only make $65,000?

Loss of income from another source. If you were employed in 2019 and earned $120,000 but retired in 2020 and now only make $65,000 from benefits, you may want to challenge your IRMAA. To keep track of your income fluctuations, fill out the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form.

How much does Medicare pay for Part D?

If you earn more than $88,000 but less than $412,000, you’ll pay $70.70 on top of your plan premium. If you earn $412,000 or more, you’ll pay $77.10 in addition to your plan premium. Medicare will bill you for the additional Part D fee every month.

How much do you have to pay in taxes if you make more than $412,000 a year?

If you earn more than $412,000 per year, you’ll have to pay $504.90 per month in taxes. Part B premiums will be cut off directly from your Social Security or Railroad Retirement Board benefits. Medicare will send you a fee every three months if you do not receive either benefit.

What is the income limit for QDWI?

You must meet the following income criteria if you want to enroll in your state’s QDWI program: Individuals must have a monthly income of $4,339 or less and a $4,000 resource limit. A married couple’s monthly income must be less than $5,833. A married couple’s resource limit must be less than $6,000.

How much will Part D cost in 2021?

Through the Extra Help program, prescriptions can be obtained at a significantly reduced cost. In 2021, generic drugs will cost no more than $3.70, while brand-name prescriptions will cost no more than $9.20.

How much do you have to pay for Part B?

If this is the case, you must pay the following amounts for Part B: If you earn less than $88,000 per year, you must pay $148.50 per month. If you earn more than $88,000 but less than $412,000 per year, you must pay $475.20 per month.

How does Medicare determine premiums?

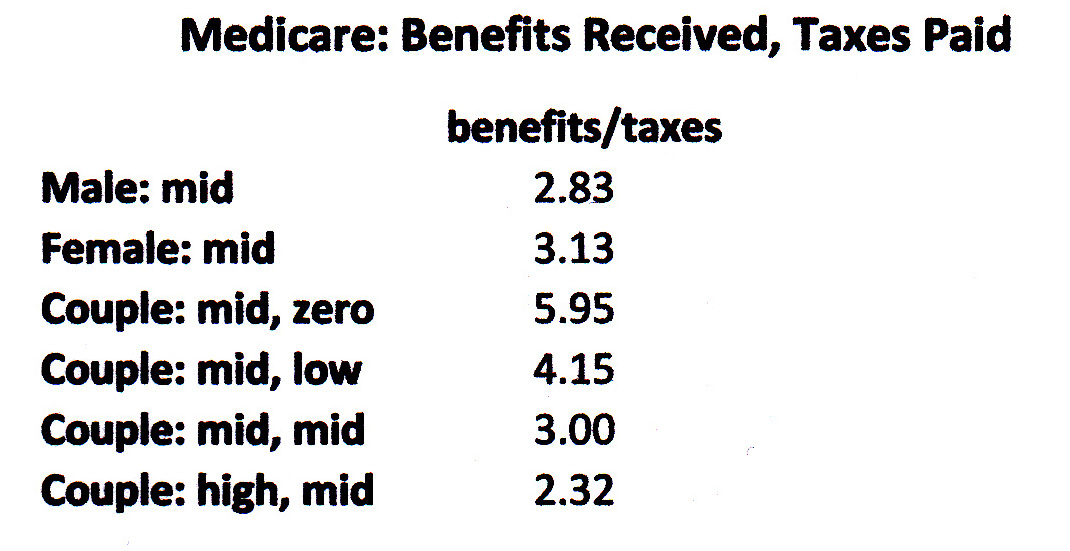

To determine the premiums it assigns, Medicare uses someone’s federal tax return from the Internal Revenue Service (IRS). In figuring the premiums of beneficiaries for 2021, Medicare uses tax returns from 2019, which is the most recent year the IRS provides to Social Security. Most of the income thresholds for premium adjustments are subject ...

What are the two Medicare programs that require higher monthly premiums?

Those with higher incomes must pay higher monthly premiums for two Medicare programs. These include Part B , which is the outpatient medical coverage of original Medicare, and Part D , the program that provides prescription drug coverage. This article discusses the parts of Medicare that higher premiums may, or may not, affect.

What is Medicare supplement insurance?

This plan combines the benefits of original Medicare parts A and B into one policy. Medigap, which is Medicare supplement insurance. This plan is available for purchase to a person with original Medicare. Private insurance companies administer both Medicare Advantage and Medigap plans.

How to appeal Medicare premium adjustment?

If an individual does not agree with Medicare’s decision about their income-related premium adjustment, they can file an appeal. To do this, a person may call Social Security at 800-772-1213. A deaf or partially deaf person may call 877-486-2048.

What is the standard rate for Medicare 2021?

The majority of people fall into the income range associated with the standard rate, which in 2021 is $148.50. This amount can change each year.

When will premium adjustments be changed?

Most of the income thresholds for premium adjustments are subject to change. Starting in 2020 , the government will change all the thresholds every year to reflect general price inflation. The only exception to these changes is the threshold for the top income level.

Can income be high for Medicare?

A person’s income cannot be so high that it disqualifies them for Medicare. Even those who receive very high incomes may enroll. However, individuals with higher incomes pay higher premiums for parts B and D, but Medicare income limits that affect premium rates only affect a small percentage of people.

What is the Medicare donut hole?

Medicare Part D prescription drug plans feature a temporary coverage gap, or “ donut hole .”. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs. Once you and your plan combine to spend $4,130 on covered drugs in 2021, you will enter the donut hole. Once you enter the donut hole in 2021, you ...

How much is Medicare Part A deductible in 2021?

You are responsible for paying your Part A deductible, however. In 2021, the Medicare Part A deductible is $1,484 per benefit period. During days 61-90, you must pay a $371 per day coinsurance cost (in 2021) after you meet your Part A deductible.

What happens if you spend $6,550 out of pocket in 2021?

After you spend $6,550 out-of-pocket on covered drugs in 2021, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

What is Medicare Part B and Part D?

Medicare Part B (medical insurance) and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium. Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

What is Medicare Advantage Plan?

When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

How long does Medicare cover hospital care?

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs. For the first 60 days of ...

How many reserve days do you get with Medicare?

Medicare limits you to only 60 of these days to use over the course of your lifetime, and they require a coinsurance payment of $742 per day in 2021. You only get 60 lifetime reserve days, and they do not reset after a benefit period or a calendar year.

Medicaid Income Limits by State

See the Medicaid income limit for every state and learn more about qualifying for Medicaid health insurance where you live. While Medicaid is a federal program, eligibility requirements can be different in each state.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

How long does it take to get a medicaid test?

A free, non-binding Medicaid eligibility test is available here. This test takes approximately 3 minutes to complete. Readers should be aware the maximum income limits change dependent on the marital status of the applicant, whether a spouse is also applying for Medicaid and the type of Medicaid for which they are applying.

What are the expenses that go away when you receive Medicaid at home?

When persons receive Medicaid services at home or “in the community” meaning not in a nursing home through a Medicaid waiver, they still have expenses that must be paid. Rent, mortgages, food and utilities are all expenses that go away when one is in a nursing home but persist when one receives Medicaid at home.

Is income the only eligibility factor for Medicaid?

Medicaid Eligibility Income Chart by State – Updated Mar. 2021. The table below shows Medicaid’s monthly income limits by state for seniors. However, income is not the only eligibility factor for Medicaid long term care, there are asset limits and level of care requirements.

How much is Medicare Part B?

As of 2019, individuals who report earning more than $85,000 were required to pay more for Medicare Part B (Medical Insurance) premiums. This equates to $170,000 per year for married couples filing jointly. As income levels continue to rise above either $85,000 or $170,000, there is an increase in premium payments for Part B.

What other sources of income count as income?

These forms of income may include capital gains, revenue from a rental property or residual payments for previous works.

Is Social Security income taxed?

In simple cases, Social Security benefits are not taxed and are not counted as income by the Internal Revenue Service (IRS). This means that if Social Security payments are the only means by which an individual subsides, he or she does not need to report the payments as income, and these payments should not effect eligibility for medical benefit ...

Does disbursement affect your financial standing?

If you have these types of income, the amounts and timing of disbursement may affect your financial standing under the rules of any type of government benefit program. Income payments that are taxable may also have their own special rules regarding percentages and timing of tax payments, so be mindful of the rules governing your case ...