Specifically, Medicare beneficiaries may only deduct Medicare expenses from their taxes if their total deductible medical and dental expenses exceed 7.5% of their adjusted gross income (AGI). If you meet this qualification, you will need to complete Schedule A of Form 1040. The amount you deduct is subtracted from your gross income.

Full Answer

Is Medicare Part A considered qualifying health coverage?

Michigan. You have several options for health insurance that qualify for the HCTC, including options chosen by the State of Michigan as HCTC qualified health insurance coverage. The State of Michigan has chosen the following plans offered by Blue Cross Blue Shield of Michigan: HCTC Plan 1 – Community Blue PPO. HCTC Plan 2 – Simply Blue PPO.

Where do I put medicare on my tax return?

The Qualifying Health Coverage (QHC) notice lets you know that your Medicare Part A (Hospital Insurance) coverage is considered to be qualifying health coverage under the Affordable Care Act. If you have Part A, you can ask Medicare to send you an IRS Form 1095-B. In general, you don't need this form to file your federal taxes.

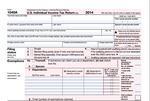

How do I check single on 1040 Form 2020?

Beginning in tax year 2019, Forms 1040 and 1040-SR do not have the “full-year health care coverage or exempt” box and Form 8965, Health Coverage Exemptions, is no longer being used. You need not make a shared responsibility payment or file Form 8965, Health Coverage Exemptions, with your tax return if you don’t have minimum essential coverage for part or all of …

What is a 1095-B qualifying health coverage notice?

Beginning in Tax Year 2019, Forms 1040 and Form 1040- SR will not have the “full-year health care coverage or exempt” box and Form 8965, Health Coverage Exemptions, will no longer be used. You need not make a shared responsibility payment or file Form 8965, Health Coverage Exemptions, with your tax return if you don’t have a minimum essential coverage for part or all …

When was the American Rescue Plan Act enacted?

The American Rescue Plan Act of 2021, enacted on March 11, 2021, suspended the requirement to repay excess advance payments of the premium tax credit (excess APTC) for tax year 2020.

When will the APTC be suspended?

The American Rescue Plan Act of 2021, enacted on March 11, 2021, suspended the requirement to repay excess advance payments of the premium tax credit (excess APTC) for tax year 2020. If you already filed a 2020 return and reported excess APTC or made an excess APTC repayment, you don't need to file an amended return or take any other action.

What to do if you haven't filed your 2020 taxes?

If you have not filed your 2020 tax return, here's what to do: If you have excess APTC for 2020, you are not required to report it on your 2020 tax return or file Form 8962, Premium Tax Credit. If you're claiming a net Premium Tax Credit for 2020, you must file Form 8962, Premium Tax Credit. For details see: Tax Year 2020 Premium Tax Credit ...

What is a 1095-A?

Form 1095-A, Health Insurance Marketplace Statement. If you or your family had coverage through a Marketplace, the Marketplace will send you information about the coverage on Form 1095-A. The form will show coverage details such as the effective date, amount of the premium, and the advance payments of the premium tax credit or subsidy.

What is the simplest way to file a tax return?

Filing a tax return electronically is the simplest way to file a complete and accurate tax return as it guides you through the process and does all the math for you. Electronic Filing options include free Volunteer Assistance, IRS Free File, commercial software and professional assistance.

When will the 1040 be reduced?

Under the Tax Cuts and Jobs Act, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 2018. Beginning in Tax Year 2019, Forms 1040 and Form 1040- SR will not have the “full-year health care coverage or exempt” box and Form 8965, ...

When will the shared responsibility payment be reduced?

Under the Tax Cuts and Jobs Act, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 2018.

What is shared responsibility?

The individual shared responsibility provision requires you and each member of your family to have qualifying health care coverage, qualify for a coverage exemption, or make an individual shared responsibility payment when you file your federal income tax return. Qualifying health care coverage is also called minimum essential coverage.

Complete your tax return

If you and your dependents had qualifying health coverage for all of 2020:

More than one coverage status?

If you were enrolled in other health coverage for only part of 2020, or other family members had different coverage, visit the relevant pages below.

What are qualified medical expenses?

Qualified Medical Expenses are generally the same types of services and products that otherwise could be deducted as medical expenses on your yearly income tax return. Some Qualified Medical Expenses, like doctors' visits, lab tests, and hospital stays, are also Medicare-covered services. Services like dental and vision care are Qualified Medical ...

Does Medicare cover dental and vision?

Services like dental and vision care are Qualified Medical Expenses, but aren't covered by Medicare. Qualified Medical Expenses could count toward your Medicare MSA Plan deductible only if the expenses are for Medicare-covered Part A and Part B services. Each year, you should get a 1099-SA form from your bank that includes all ...

What is a 1095-B?

The 1095-B Qualifying Health Coverage Notice is a tax form that was developed in response to a provision of the 2010 Affordable Care Act (ACA). The ACA was phased in over several years, and in 2014, everyone was required to have health insurance through the individual mandate provision. If you had Medicare Part A or Medicare Part C, ...

What happens if you don't have Medicare?

If you had Medicare Part A or Medicare Part C, you met the individual mandate. If you didn’t have health insurance coverage, though, you were subject to a penalty fee, which was calculated as a percentage of your income. In 2019, the U.S. Department of Justice and federal appeals courts ruled that the individual mandate was unconstitutional.

When is the ACA decision due?

A decision on that question is due later in 2020.