There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

Full Answer

Is a HMO cheaper than a PPO?

Dec 07, 2021 · According to the Kaiser Family Foundation, members of Medicare Advantage HMO plans that included prescription drug coverage paid an average premium of $23 per month in 2019. 2. Members of regional PPO plans with drug coverage paid an average premium of $44 per month in 2020, while members of local PPO plans with drug coverage paid an average ...

Which is cheaper HMO or PPO?

May 08, 2022 · We encourage you to speak with a professional, licensed Medicare broker prior to signing up for any Medicare Advantage HMO or Medicare Advantage PPO plan. Give us a call at 866-633-4427 to speak ...

Which is better Medicare or Medicare Advantage?

Oct 06, 2018 · A PPO plan may appeal to you. You may pay slightly more for Medicare Advantage PPO coverage than HMO coverage. Only you can decide whether the flexibility is worth the cost. Remember, if you decide on a PPO plan, make sure any health-care provider you visit accepts Medicare assignment, or you might have to pay even more for the visit.

What are the Medicare Advantage options?

May 08, 2022 · At Senior HealthCare Solutions, we try to provide the solutions you need to find suitable coverage. We offer over 25-top rated Medicare insurance companies. You can compare and enroll in many ways: Compare Medicare HMO Plans online. Compare Medicare PPO Plans online. Speak with a licensed agent now, 866-633-4427.

What are the advantages of an HMO or PPO for a Medicare recipient?

Why would a person choose a PPO over an HMO?

If flexibility and choice are important to you, a PPO plan could be the better choice. Unlike most HMO health plans, you won't likely need to select a primary care physician, and you won't usually need a referral from that physician to see a specialist.

What is one advantage and one disadvantage to choosing an HMO over a PPO?

Is PPO always better than HMO?

What are the pros and cons of PPO?

Are HMOs worth?

What are pros and cons of HMO?

- PPOs typically have a higher deductible than an HMO.

- Co-pays and co-insurance are common with PPOs.

- Out-of-network treatment is typically more expensive than in-network care.

- The cost of out-of-network treatment might not count towards your deductible.

What is one disadvantage of an HMO?

Why is HMO important?

Why is PPO more expensive?

Both HMOs and PPOs have a network of doctors, hospitals, and other healthcare providers. Your out-of-pocket costs are less when you use medical providers in this network. HMOs typically require you to choose a primary care provider from the network directory.

Why would a person choose a PPO over an HMO quizlet?

Is Blue Cross Blue Shield HMO or PPO?

What is Medicare Advantage HMO?

Medicare Advantage HMO plans typically give you access to a network of participating doctors and hospitals. Generally, you must use providers in the HMO plan’s network. An HMO plan might cover out-of-network services such as: Emergency care.

What are the differences between Medicare Advantage and PPO?

Medicare Advantage HMO vs. PPO plans: what do they have in common? 1 Private insurance companies contracted with Medicare offer Medicare Advantage HMO and PPO plans under the Medicare Advantage (Medicare Part C) program. 2 Many Medicare Advantage HMO and PPO plans provide additional benefits, such as Medicare Part D prescription drug coverage, routine vision, and dental coverage. 3 Medicare Advantage HMO and PPO plans generally have networks of participating hospitals and doctors that plan members use to receive full benefits for covered services, such as doctor visits. 4 Like all plans under Medicare Part C, Medicare Advantage HMO and PPO plans limit the amount you pay out-of-pocket during the year for covered services. If your out-of-pocket costs for covered services reaches a certain limit, the plan generally pays for any further covered medical care for the rest of the year.

How to choose a PPO or HMO?

Medicare Advantage HMO vs. Medicare Advantage PPO – How do you choose? 1 Take a look at the doctors and hospitals in the Medicare Advantage HMO network. Usually, you can read about individual doctors on the plan’s website. If you’re satisfied with what you see, you might want to choose the HMO plan. 2 Do you like your primary care doctor to coordinate all of your care? If so, a Medicare Advantage HMO plan may be a good option for you. 3 Do you have a long-standing, satisfactory relationship with a doctor who isn’t in a Medicare Advantage HMO plan’s network in your area? If you want to stay with that doctor, a PPO plan might be a good choice for you. Make sure the doctor accepts Medicare assignment. 4 Do you like being able to see the specialist of your choice without getting a referral? A PPO plan may appeal to you.

What are the benefits of Medicare Advantage?

Many Medicare Advantage HMO and PPO plans provide additional benefits, such as Medicare Part D prescription drug coverage, routine vision, and dental coverage. Medicare Advantage HMO and PPO plans generally have networks of participating hospitals and doctors that plan members use to receive full benefits for covered services, such as doctor visits.

What is urgent care in HMO?

Urgent care or dialysis treatment when you are temporarily traveling outside the HMO’s service area. Many Medicare Advantage HMO plans emphasize care coordination. You must select a primary care physician (PCP) within the plan’s network to provide your routine care and order other treatments.

What is the difference between Medicare Advantage and PPO?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

What is the difference between HMO and PPO?

The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

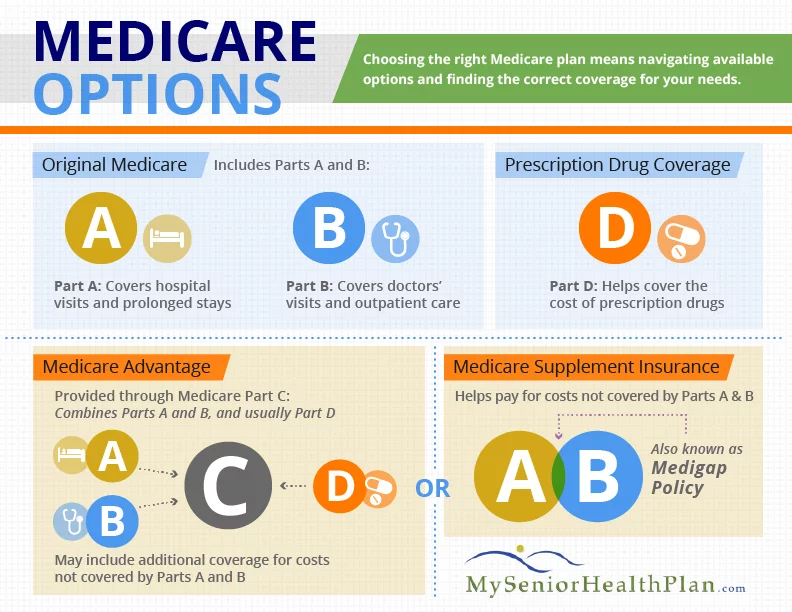

What is Medicare Advantage?

Medicare Advantage offers Medicare through a private insurer. Sometimes called Medicare Part C, these all-in-one plans often provide services original Medicare does not, such as vision and dental insurance and prescription drug ...

What is an HMO?

A health maintenance organization (HMO) requires you to seek care from in-network doctors, hospitals, and other clinicians. If you use a provider outside of the HMO network, the plan may not cover it.

Does HMO cover out of network care?

If you use a provider outside of the HMO network, the plan may not cover it. There are certain exceptions to this coverage rule. The plan may cover out-of-network care if:

What is a PPO plan?

Preferred provider organization (PPO) plans offer a list of preferred hospitals, doctors, and other providers. Enrollees get a discount for using these in-network clinicians. You'll pay a higher copay if you go out-of-network. You may also have a higher deductible for out-of-network care, or have limited coverage for non-preferred providers until you hit your deductible.

Is Medicare Advantage the right choice for everyone?

There's no right choice for everyone. Instead, Medicare Advantage beneficiaries should review the terms of specific plans available in their area. HMOs typically have lower monthly premiums, though fewer clinicians will be covered.

Is a PPO a Medicare Advantage?

PPO plans can offer prescription drug coverage, but this is not a requirement under Medicare Advantage. Private Fee-For-Service (PFFS): PFFS plans aren’t as common as PPOs or HMOs, but they can still be a viable choice.

What is a PPO plan?

Preferred Provider Organization (PPO): PPOs are also a popular choice for seniors, in spite of higher premiums on average. This kind of plan is a bit more flexible than an HMO; PPOs also use a network model, but coverage tends to be broader with some coverage available for out-of-network services.

Is Medicare Advantage flexible?

Page Reviewed / Updated – August 27, 2020. Unlike Original Medicare Parts A and B, which come in a one-size-fits-all model provided by the government, Medicare Advantage, also known as Medicare Part C, is highly flexible.

Is Medicare Advantage a one size fits all plan?

Each Medicare Advantage Plan is unique, based on the preferred specifications of the insurance provider.

Is Medicare Advantage the same as Original Medicare?

All Medicare Advantage plans must offer, at minimum, the same coverage as Original Medicare, but are permitted to offer additional options in excess of base coverage levels. Medicare Advantage plans come in several different structures, including both HMOs and PPOs.

What are the different types of Medicare Advantage plans?

Medicare Advantage plans come in several different structures, including both HMOs and PPOs. The four available forms of Medicare Advantage plans are as follows: Health Maintenance Organization (HMO): HMOs are among the most common and popular choices for Medicare Advantage users.

Do HMOs require a primary care physician?

HMOs generally require a designated primary care physician, and any specialist services must be approved through a PCP for coverage to apply.

What is Medicare Advantage HMO?

What is a Medicare Advantage HMO? HMO plans use provider networks to help keep costs low for their members. What this typically means for you as a consumer is that you will need to: Choose a primary care provider to act as a gatekeeper for all your health-care needs.

What is the difference between a PPO and an HMO?

If you are considering an HMO vs a PPO, these are the main differences to keep in mind: 1 Health coverage area: If you travel outside your HMO plan’s service area frequently, your health-care services (other than urgent or emergency care) may not be covered under your plan. PPO plans might cover you outside your area. 2 Provider network: If you don’t like the doctors and hospitals in your PPO plan’s preferred provider network, you do have the choice to go anywhere you want for your health care, as long as you don’t mind paying more out-of-pocket for it. Under an HMO plan, you typically do not have an option to use an out-of-network provider (except for urgent or emergency care) unless you are prepared to pay the full cost for your treatment.

Does Medicare cover hospice?

By law, these plans must cover everything that Original Medicare covers (except for hospice care, which is covered under Part A), but because they are offered by private companies approved by Medicare, they can offer additional benefits and design their own cost-sharing structures. Although there are several different types ...

What are the different types of Medicare Advantage plans?

Although there are several different types of Medicare Advantage plans allowed by law, three of the most common are the health maintenance organization, or HMO, the preferred provider organization, or PPO, and the private fee for service plan, or PFFS. If you’re not certain which plan type is right for you, or have questions about ...

What happens if you go out of network?

If you go out of network, you risk paying out-of-pocket for your health care services. On the plus side, most Medicare Advantage HMOs include Part D coverage for prescription drugs. Also, out-of-pocket costs such as copayments, deductibles, and coinsurance tend to be lower than for other types of Medicare Advantage plans ...

Is a PPO better than an HMO?

A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. More flexibility to use providers both in-network and out-of-network. You can usually visit specialists without a referral, including out-of-network specialists.

Is a PPO plan more expensive than an HMO?

A PPO plan might be right for you if you already have a doctor or team of specialists you want to continue seeing but might not be in your employer’s HMO plan network. A PPO plan is also generally more expensive than an HMO plan. Think higher cost with greater flexibility.

What is an HMO plan?

An HMO plan is based on a network of hospitals, doctors, and other health care providers that agree to coordinate care within a network in return for a certain payment rate for their services. Many HMO providers are paid on a per-member basis, regardless of the number of times they see a member.

What are the disadvantages of a PPO plan?

Disadvantages of PPO plans. Typically higher monthly premiums and out-of-pocket costs than for HMO plans. More responsibility for managing and coordinating your own care without a primary care doctor.

Do you need a referral for an EPO?

With an EPO, you typically don’t need a referral to see a specialist, which makes it more flexible than an HMO. However, like an HMO, there are no out-of-network benefits. A point of service (POS) plan also blends elements of HMO and PPO plans.