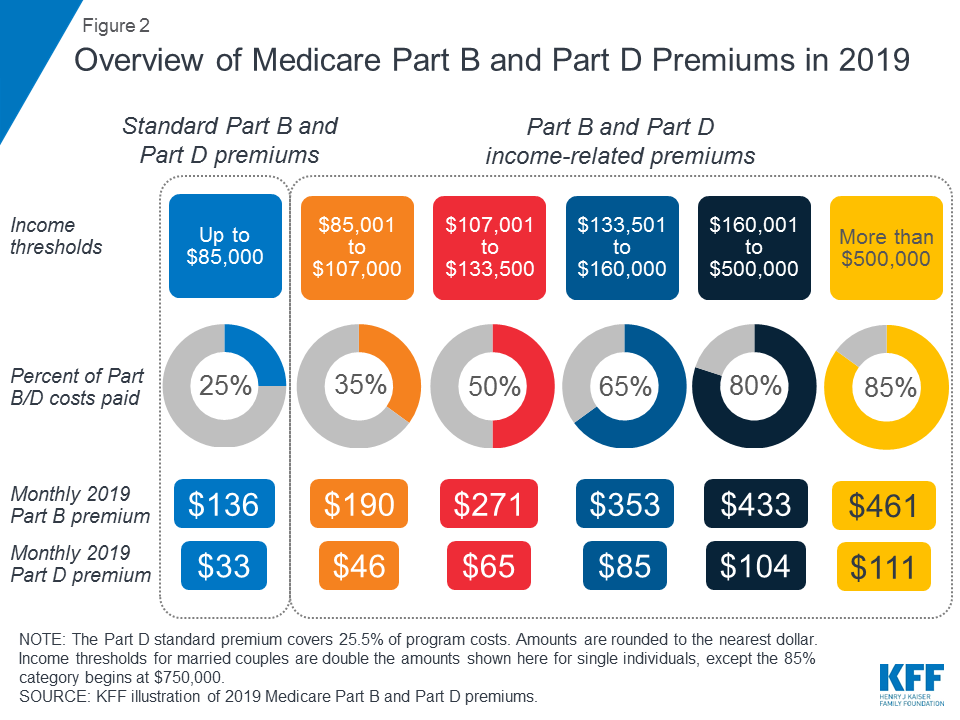

Medicare prices are tiered for higher incomes. For example, individual tax filers who made between $91,000 and $114,000 pay about 40% more for Medicare Part B, while rates increase by 240% for people earning $500,000 or more.

Medicare Part B (medical insurance) helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

How much is Medicare increasing?

Medicare's Part B standard premium is set to jump 14.5% in 2022, meaning those relying on the coverage will face an increase of more than $21 a month. In addition to the standard premium, the deductible for Part B will also increase next year, from $203 to $233. That's a 14.8% increase from 2021 to 2022. The Medicare Part A deductible is also on the rise and will go up by $72 to $1,556.

Will My Medicare premiums increase?

Your Medicare Supplement Insurance premiums may increase over time, but the amount and timing depend on several factors. Some insurance plans will have increases simply because you're getting older.

Why is my Medicare rising?

- Service price and intensity

- Population growth

- Population aging

- Disease prevalence or incidence

- Medical service utilization

Are Medicare premiums increasing?

The standard Medicare Part B premium will be $170.10 per month, up from $148.50 per month in 2021. This increase in monthly premiums means an annual cost increase of $259.20 for Medicare beneficiaries, Axios reports.

At what income level do Medicare premiums increase?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $170,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $85,000, you'll pay higher premiums.

Does Medicare cost change based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How much income before it affects Medicare?

To qualify, your monthly income cannot be higher than $1,010 for an individual or $1,355 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple. A Qualifying Individual (QI) policy helps pay your Medicare Part B premium.

What causes Medicare to increase?

CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system. Some of the higher health care spending is being attributed to COVID-19 care.

What income is used to determine Medicare premiums 2021?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How is modified adjusted gross income for Medicare premiums calculated?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

What is the Medicare levy threshold 2021?

2021-22 Medicare Levy Income Thresholds Medicare levy low-income thresholds for singles, families and seniors and pensioners are increased (by CPI) for the 2021-22 year. Single seniors and pensioners threshold: increases from $36,705 to $36,925. Singles threshold increases from $23,226 to $23,365.

How does working affect Medicare?

It depends on how you get your health insurance now and the number of employees that are in the company where you (or your spouse) work. Generally, if you have job-based health insurance through your (or your spouse's) current job, you don't have to sign up for Medicare while you (or your spouse) are still working.

Why is my Medicare Part B so expensive?

Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Why did Medicare premiums go up for 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.