Are there limits to my Medicare coverage?

This limit cap is known as the limiting charge. Providers that do not fully participate only receive 95 percent of the Medicare-approved amount when Medicare reimburses them for the cost of care. In turn, the provider can charge the patient up to …

What is a non facility limiting charge?

Effective January 1, 1993, the limiting charge is 115 percent of the fee schedule amount for nonparticipating physicians. EXAMPLE: Participating fee schedule amount $2000 Nonparticipating fee schedule amount $1900 (95% of $2000) …

What is the income limit for Medicare?

May 07, 2010 · What is Limiting Charge. The Limiting Charge for any service (s) billed to Medicare by non-participating physicians and non physician practitioners subject to the Limiting Charge is 115% of the non-participating fee schedule amount for that/those service (s).

Is there a limit on Medicare supplemental insurance?

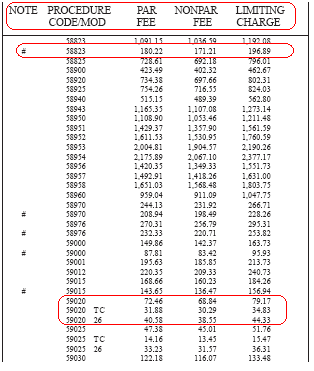

Nov 15, 2021 · A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis. CMS develops fee schedules for physicians, ambulance services, clinical laboratory services, and durable medical equipment, …

What does Medicare limiting charges mean?

A limiting charge is the amount above the Medicare-approved amount that non-participating providers can charge. These providers accept Medicare but do not accept Medicare's approved amount for health care services as full payment.

How can I calculate Medicare limiting charge?

Therefore, to calculate the Medicare limiting charge for a physician service for a locality, multiply the fee schedule amount by a factor of 1.0925. The result is the Medicare limiting charge for that service for that locality to which the fee schedule amount applies.

Is there an allowable fee schedule for Medicare?

Medicare will accept 80% of the allowable amount of the Medicare Physician Fee Schedule (MPFS) and the patient will pay a 20 % co-insurance at the time services are rendered or ask you to bill their Medicare supplemental policy.

What is an allowable fee schedule?

An allowable fee is the dollar amount typically considered payment-in-full by Medicare, or another insurance company, and network of healthcare providers for a covered health care service or supply. The allowable fees for covered services are what is listed in the Medicare Fee Schedules.May 3, 2021

Can a doctor charge more than Medicare allows?

A doctor is allowed to charge up to 15% more than the allowed Medicare rate and STILL remain "in-network" with Medicare. Some doctors accept the Medicare rate while others choose to charge up to the 15% additional amount.

What is the intent of the limiting charge?

The limiting charge is a higher limit, or ceiling, for medical providers who do not accept Medicare's approved amount as payment in full. A medical provider may request higher reimbursement from Medicare in these instances. The limiting charge would dictate the maximum amount allowable when approved.Sep 20, 2021

What percent of the allowable fee does Medicare pay the healthcare provider?

80 percentMedicare pays the physician or supplier 80 percent of the Medicare-approved fee schedule (less any unmet deductible). The doctor or supplier can charge the beneficiary only for the coinsurance, which is the remaining 20 percent of the approved amount.Jan 1, 2021

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.Nov 10, 2020

Is the Medicare 2022 fee schedule available?

The Centers for Medicare & Medicaid Services (CMS) released the 2022 Medicare Physician Fee Schedule and Quality Payment Program final rule on Nov. 2 .Nov 5, 2021

What are the types of fee schedule?

Fee schedules are used to charge fees that differ from the practice's standard fees. There are two types of fee schedules - insurance fee schedules and patient fee schedules. Insurance fee schedules are used when a practice is contracted with an insurance company, often referred to as in network, contracted, or PPO.

How are fee schedules determined?

Most payers determine fee schedules first by establishing relative weights (also referred to as relative value units) for the list of service codes and then by using a dollar conversion factor to establish the fee schedule.May 3, 2016

What is the CMS conversion factor?

In implementing S. 610, the Centers for Medicare & Medicaid Services (CMS) released an updated 2022 Medicare physician fee schedule conversion factor (i.e., the amount Medicare pays per relative value unit) of $34.6062.Jan 3, 2022

What is the limiting charge for Medicare?

The limiting charge is 15% over Medicare's approved amount. The limiting charge only applies to certain services and doesn't apply to supplies or equipment. ". The provider can only charge you up to 15% over the amount that non-participating providers are paid.

What is a Medicare claim?

claim. A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered. directly to Medicare and can't charge you for submitting the claim. Note.

What does assignment mean in Medicare?

Assignment means that your doctor, provider, or supplier agrees (or is required by law) to accept the Medicare-approved amount as full payment for covered services.

What is the percentage of coinsurance?

An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

Can a non-participating provider accept assignment?

Non-participating providers haven't signed an agreement to accept assignment for all Medicare-covered services, but they can still choose to accept assignment for individual services. These providers are called "non-participating.". Here's what happens if your doctor, provider, or supplier doesn't accept assignment: ...

What is coinsurance in Medicare?

coinsurance. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%). amount and usually wait for Medicare to pay its share before asking you to pay your share. They have to submit your.

Do you have to sign a private contract with Medicare?

You don't have to sign a private contract. You can always go to another provider who gives services through Medicare. If you sign a private contract with your doctor or other provider, these rules apply:

What is the Medicare Physician Fee Schedule?

The Medicare Physician Fee Schedule (MPFS) uses a resource-based relative value system (RBRVS) that assigns a relative value to current procedural terminology (CPT) codes that are developed and copyrighted by the American Medical Association (AMA) with input from representatives of health care professional associations and societies, including ASHA. The relative weighting factor (relative value unit or RVU) is derived from a resource-based relative value scale. The components of the RBRVS for each procedure are the (a) professional component (i.e., work as expressed in the amount of time, technical skill, physical effort, stress, and judgment for the procedure required of physicians and certain other practitioners); (b) technical component (i.e., the practice expense expressed in overhead costs such as assistant's time, equipment, supplies); and (c) professional liability component.

What are the two categories of Medicare?

There are two categories of participation within Medicare. Participating provider (who must accept assignment) and non-participating provider (who does not accept assignment). You may agree to be a participating provider (who does not accept assignment). Both categories require that providers enroll in the Medicare program.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When will Medicare update payment policies?

This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022. This proposed rule proposes potentially misvalued codes and other policies affecting the calculation of payment rates. It also proposes to make certain revisions ...

What is the CY 2021 rule?

The calendar year (CY) 2021 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

What is the 2020 PFS rule?

The calendar year (CY) 2020 PFS final rule is one of several rules that reflect a broader Administration-wide strategy to create a healthcare system that results in better accessibility, quality, affordability, empowerment, and innovation.

When is the 2021 Medicare PFS final rule?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

When will CMS accept comments?

CMS will accept comments on the proposed rule until September 13, 2021, and will respond to comments in a final rule. The proposed rule can be downloaded from the Federal Register at: https://www.federalregister.gov/public-inspection.

When will Medicare update the PFS?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2019.