How long will Medicare pay for a hospital stay?

Once the deductible is paid fully, Medicare will cover the remainder of hospital care costs for up to 60 days after being admitted. If you need to stay longer than 60 days within the same benefit period, you’ll be required to pay a daily coinsurance.

Is inpatient hospice covered by Medicare?

Medicare does not cover room and board if you live in a nursing home or a hospice inpatient facility. However, some short-term inpatient care may be covered. Finally, emergency room visits and ambulance transportation are only covered if these services are arranged by your hospice team or are unrelated to your terminal illness.

How does Medicare reimburse hospitals?

- asthma

- atrial fibrillation

- cellulitis

- congestive heart failure

- chronic kidney disease

- chronic obstructive pulmonary disease

- diabetes

- gout

- hypertension

- infections

How much does Medicare pay for hospital stays?

In 2020, Part A carries a deductible of $1,408 for each benefit period. In addition to these deductible costs, there are also copayment costs associated with hospital stays that are longer than 61 days. For each day between day 61 and 90 of your stay, there is a $352 daily copayment. For lifetime reserve days, there is a $704 daily copayment.

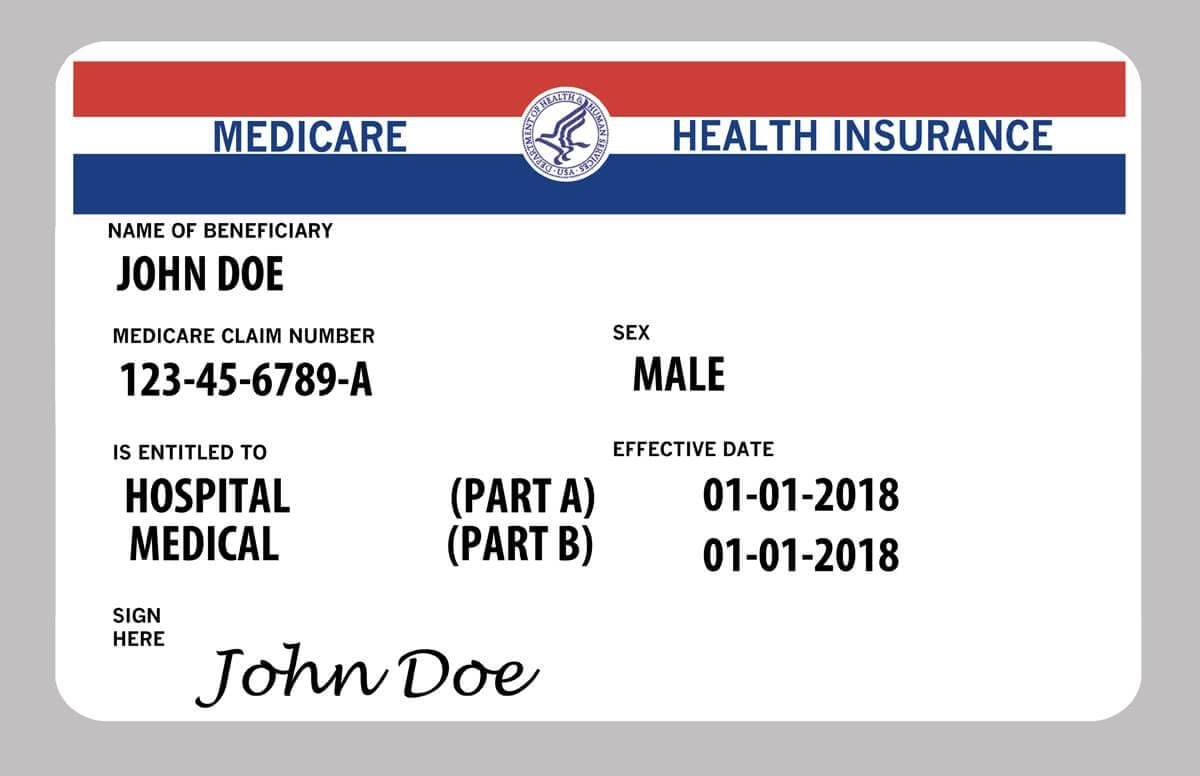

What is Medicare Part A and Part B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers. Outpatient care.

What is the difference between Part C and Part D Medicare?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

Which part of Medicare covers hospital services?

Medicare Part A hospital insuranceMedicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Which part of Medicare pays for inpatient?

Part APart A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is Medicare Part B also known as?

Medicare Part B (also known as medical insurance) is an insurance plan that covers medical services related to outpatient and doctor care.

What is Medicare Part N?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.

What is Part A insurance?

Premium-free Part A Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Which part of Medicare covers inpatient hospital charges quizlet?

Part A (also called Original Medicare) is managed by Medicare and provides Medicare benefits and coverage for Inpatient hospital care, Inpatient stays in most skilled nursing facilities, hospice, and home health services.

What does Medicare Parts A and B cover quizlet?

Medicare Part A covers hospitalization, post-hospital extended care, and home health care of patients 65 years and older. Medicare Part B provides coverage for outpatient services. Medicare Part C is a policy that permits private health insurance companies to provide Medicare benefits to patients.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

What benefits fall under Medicare Part A?

In general, Part A covers:Inpatient care in a hospital.Skilled nursing facility care.Nursing home care (inpatient care in a skilled nursing facility that's not custodial or long-term care)Hospice care.Home health care.

Does Medicare Part A pay 100 of hospitalization?

Medicare covers up to 100 days of care in a skilled nursing facility (SNF) for each benefit period if all of Medicare's requirements are met, including your need of daily skilled nursing care with 3 days of prior hospitalization. Medicare pays 100% of the first 20 days of a covered SNF stay.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What Can You Expect To Pay For An Approved Inpatient Surgery

Medicare Part A generally covers much of the cost related to your inpatient surgery and hospital stay. You may be responsible for a Medicare Part A deductible for each benefit period.

Is Medicare Part A Free At Age 65

Premium-free Part A coverage is available if you or your spouse paid Medicare taxes for a certain amount of time while working. You can receive this if:

Do You Have To Pay A Part A Premium

You may be wondering does Medicare Part A cover 100 percent? And while this is not the case, there are provisions in place to make Medicare affordable to beneficiaries.

Does Medicare Cover Inpatient Mental Health Treatment

You must have Medicare Part A to be covered for inpatient mental health treatment at a general or psychiatric hospital. Medicare will pay for most of your inpatient treatment services. However, you may still owe some out-of-pocket costs depending on your plan and the length of your stay.

Hospital Stay Coverage Under Medicare Advantage

You may choose to receive your Medicare Part A and Part B coverage through a local Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies that are approved by Medicare and cover at least the same level of benefits as Original Medicare Part A and Part B .

Hospital Observation Status And Medication Costs

Any prescription and over-the-counter drugs you receive in an outpatient setting arent covered by Part B. But if you have Medicare Part D , they may be covered in certain circumstances. If the drugs are covered, youll probably need to pay out of pocket and submit a claim to your drug plan for a refund.

What Medicare Part A Does Not Cover

While this part of Medicare covers stays in a nursing home, it will only do so if it is medically necessary. If you need non-medical long-term care, such as for chronic illness or disability, youâll have to consider other options like long-term care insurance.

What is Medicare Part A?

Medicare Part A – Hospital Insurance. Medicare Part A, often referred to as hospital insurance, is Medicare coverage for hospital care , skilled nursing facility care, hospice care, and home health services. It is usually available premium-free if you or your spouse paid Medicare taxes for a certain amount of time while you worked, ...

How many days can a skilled nursing facility be covered by Medicare?

The facility must be Medicare-approved to provide skilled nursing care. Coverage is limited to a maximum of 100 days per benefit period, with coinsurance requirements of $164.50 per day in 2017 for Days 21 through 100. Coverage includes: A semiprivate room.

How long does Medicare deductible last?

A deductible applies for each benefit period. Your benefit period with Medicare does not end until 60 days after discharge from the hospital or the skilled nursing facility. Therefore, if you are readmitted within those 60 days, you are considered to be in the same benefit period.

What is a skilled nursing facility?

A skilled nursing facility provides medically necessary nursing and/or rehabilitation services. To receive Medicare coverage for care in a skilled nursing facility: A physician must certify that you require daily skilled care that can only be provided as an inpatient in a skilled nursing facility. You must have been an inpatient in a hospital ...

How long does Medicare cover nursing?

Original Medicare measures your coverage for hospital or skilled nursing care in terms of a benefit period. Beginning the day you are admitted into a hospital or skilled nursing facility, the benefit period will end when you go 60 consecutive days without care in a hospital or skilled nursing facility. A deductible applies for each benefit period.

How much does Medicare pay for Grandpa's stay?

Grandpa is admitted to the hospital September 1, 2017. After he pays the deductible of $1,316, Medicare will pay for the cost of his stay for 60 days. If he stays in the hospital beyond 60 days, he will be responsible for paying $329 per day, with Medicare paying the balance.

What is home health care?

Home health care is care provided to you at home, typically by a visiting nurse or home health care aide. Medicare Part A covers medically necessary home health care offered by a provider certified by Medicare to provide home health care. Medicare pays the lower of:

Why would Medicare allow additional Part B payments?

Specifically, the proposed rule would allow additional Part B payment when a Medicare Part A claim is denied because the beneficiary should have been treated as an outpatient, rather than being admitted to the hospital as an inpatient. The proposed rule, Medicare Program; Part B Inpatient Billing in Hospitals, proposes that if ...

What is CMS 1455?

PROPOSED RULE (CMS-1455-P) AND ADMINISTRATOR RULING (CMS-1455-R) On March 13, 2013, the Centers for Medicare & Medicaid Services (CMS) released a proposed rule that would allow Medicare to pay for additional hospital inpatient services under Medicare Part B. Specifically, the proposed rule would allow additional Part B payment when ...

What is the reasonable and necessary standard for Medicare?

The “reasonable and necessary” standard is a prerequisite for Medicare coverage in the Social Security Act. The statutory timely filing deadline, under which claims must be filed within 12 months of the date of service, would continue to apply to the Part B inpatient claims. Also on March 13, CMS Acting Administrator Marilyn Tavenner issued an ...

How long after the date of service can a hospital bill?

Also under current policy, the hospital may only bill for the limited list of Part B inpatient ancillary services and those services must be billed no later than 12 months after the date of service.

Does Medicare pay for inpatient services?

Under longstanding Medicare policy, Medicare only pays for a limited number of ancillary medical and other health services as inpatient services under Part B when a Part A claim submitted by a hospital for payment of an inpatient admission is denied as not reasonable and necessary. Hospitals have expressed concern about Medicare’s policy, arguing that all Part B hospital services provided should be billable to Medicare because they would have been reasonable and necessary if the beneficiary had been treated as an outpatient and not as an inpatient.

Does the hospital rule cover self audits?

The Ruling does not cover hospital self-audits or situations where Part A payment cannot be made because the beneficiary has exhausted or is not entitled to Part A benefits. The Ruling only addresses Part A claims denied because the inpatient admission was not reasonable and necessary.

Should Medicare bill Part B?

Hospitals have expressed concern about Medicare’s policy, arguing that all Part B hospital services provided should be billable to Medicare because they would have been reasonable and necessary if the beneficiary had been treated as an outpatient and not as an inpatient. Last year, in response to hospitals’ concerns, ...

What is Medicare Part A?

Medicare Part A, also known as the Hospital Insurance program, helps cover the costs of: Inpatient care in hospitals. Inpatient care in a skilled nursing facility. Hospice care services.

What is hospice care?

Hospice care is for people with a terminal illness who are expected to live six months or less. Coverage includes medication for relief of pain and control of other symptoms; medical, nursing, and social services; and grief counseling. The services must be provided by a Medicare-approved hospice program .

What is covered by SNF?

Skilled Nursing Facility. Covered services include a semi-private room, meals, skilled nursing and rehabilitative services, and related supplies. Your stay in a SNF will be covered by Original Medicare only after a three-day minimum inpatient hospital stay for a related illness or injury.

How often do you have to pay your Medicare deductible?

So depending on how much treatment you need and how it's spread out through the year, it's possible that you may have to pay the deductible more than once in a year.

How many days are in a psychiatric hospital?

Additionally, inpatient mental health care in a psychiatric hospital is limited to 190 days for your lifetime.

What is home health insurance?

Coverage for home health care includes only medically necessary, part-time services such as skilled nursing care, a home health aide , physical or occupational therapy, speech-language pathology, and medical social services.

When do you get Medicare if you are 65?

Your Medicare Part A coverage starts on the first day of the month you turn 65, as long as you apply for coverage before that month.

What is an admission order for Medicare Part A?

At the time that each Medicare Part A fee-for-service patient is admitted to an IRF, a physician must generate admission orders for the patient's care. These admission orders must be retained in the patient’s medical record at the IRF.

What are non-covered services?

Medical and hospital services are sometimes required to treat a condition that arises as a result of services that are not covered because they are determined to be not reasonable and necessary or because they are excluded from coverage for other reasons. Services "related to" non-covered services (e.g., cosmetic surgery, non-covered organ transplants, non-covered artificial organ implants, etc.), including services related to follow-up care and complications of non-covered services which require treatment during a hospital stay in which the non-covered service was performed, are not covered services under Medicare. Services "not related to" non-covered services are covered under Medicare.

What are nonmedical DME items?

The DME items include canes, crutches, walkers, commodes, a standard wheelchair, hospital beds, bedpans, and urinals. Those RNHCIs offering home services may order these items without a physician order and without compromising the beneficiary election for RNHCI care. The need for each item of DME ordered must be supported by the RNHCI patient’s plan of care for the home setting and the RNHCI nurses’ notes for home services. It must be noted that the benefit is applicable only to what we shall refer to as “nonmedical DME items” and does not include any of the related services provided by RNHCI staff members.

What are the exclusions for RNHCI?

The RNHCI home benefit must exclude the same services that are excluded from the home health benefit, which include: drugs and biologicals; transportation; services that would not be covered as inpatient services; housekeeping services; services covered under the End Stage Renal Disease program ; prosthetic devices; and medical social services provided to family members. These exclusions are defined at 42 CFR 409.49. Additionally, the RNHCI home benefit excludes the items or services provided by any HHA that is not an RNHCI; or any supplier, independent RNHCI nurse or aide that is working directly for a beneficiary rather than under arrangements with the RNHCI. Medicare requires a brief letter of intent from the provider in order to determine the number of RNHCIs that will be implementing the home service benefit.

What is RNHCI in Medicare?

Beneficiaries elect the RNHCI benefit if they are conscientiously opposed to accepting most medical treatment, since accepting such services would be inconsistent with their sincere religious beliefs. The Medicare home health benefit provides skilled nursing, physical therapy, occupational therapy, speech language pathology and home health aide services to eligible beneficiaries under a physician’s plan of care. The home health benefit also provides medical supplies, a covered osteoporosis drug and durable medical equipment (DME) while under a plan of care (see chapter 7).

What is a revocation of a RNHCI?

Revocation is the cancellation of the RNHCI election and can be achieved in two ways: either by submitting a written statement to the intermediary indicating the desire to cancel the election or by seeking nonexcepted medical care for which Medicare payment is sought.

What happens if a beneficiary does not qualify for Medicare?

When a beneficiary has an effective election on file with CMS but does not have a condition that would qualify for Medicare Part A inpatient hospital or posthospital extended care services if the beneficiary were an inpatient of a hospital or a resident of a SNF that is not an RNHCI, then services furnished in an RNHCI are not covered by Medicare. A Medicare claim for services that were furnished to that beneficiary would be treated as a claim for noncovered services. If the beneficiary only needs assistance with activities of daily living, then the beneficiary's condition could not be considered as meeting the Medicare Part A requirements. Prior to submitting a claim to Medicare it is the responsibility of the RNHCI’s utilization review committee to determine that the beneficiary meets the Medicare Part A requirements.