What percentage of the population is covered by Medicare?

18 percentMedicare is an important public health insurance scheme for U.S. adults aged 65 years and over. As of 2020, approximately 18 percent of the U.S. population was covered by Medicare, a slight increase from the previous year.Sep 24, 2021

How large is the Medicare population?

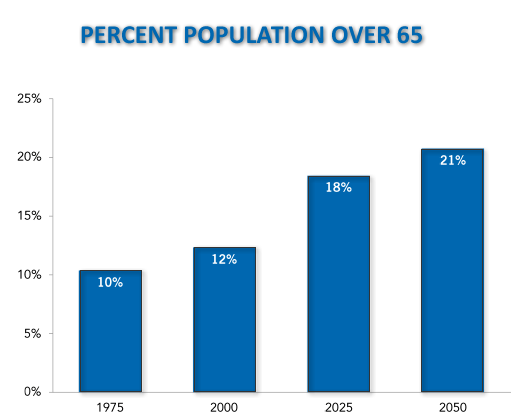

Currently, 44 million beneficiaries—some 15 percent of the U.S. population—are enrolled in the Medicare program. Enrollment is expected to rise to 79 million by 2030. Only one in 10 beneficiaries relies solely on the Medicare program for health care coverage.

What percentage of the US population is on Medicare and Medicaid?

Of the subtypes of health insurance coverage, employment-based insurance was the most common, covering 54.4 percent of the population for some or all of the calendar year, followed by Medicare (18.4 percent), Medicaid (17.8 percent), direct-purchase coverage (10.5 percent), TRICARE (2.8 percent), and Department of ...Sep 14, 2021

What percentage of the US population is on Medicaid?

around 17.8 percentThe percentage of Americans covered by the Medicaid public health insurance plan increased slightly from 2019 to around 17.8 percent in 2020. However the percentage of those insured through Medicaid remains lower than the peak of 19.6 percent in 2015.Sep 24, 2021

What is Medicare for adults?

Medicare is the federal health insurance program administered by the CMS for adults over the age of 65, people with ESRD, or people with disabilities . Medicare has multiple public and private options to make accessing healthcare easier and more flexible for most people.

How is Medicare funded?

Medicare is funded mainly by taxpayers. In particular, it is funded by income tax paid into the Social Security and Medicare fund and partly by premiums that Medicare participants pay. Additional payment depends on the type of plan.

Why do people choose Medicare Supplement Plans?

Some people choose Medicare Supplement Plans in addition to Original Medicare to bridge the gaps in coverage and reduce their out-of-pocket payments. Others may choose a Medicare Advantage Plan as an alternative to Original Medicare.

What is Medicare insurance?

Medicare is the federal health insurance plan designed to help certain populations meet their health care needs. Medicare is like a regular private insurance plan, except the government runs it. Specifically, it is run by a federal agency called the Centers for Medicare and Medicaid Services (CMS). While many people confuse Medicare ...

What is original Medicare?

Original Medicare aims to create a flexible environment for people to access healthcare while also minimizing costs. This means that consumers can go to any doctor or hospital that accepts Medicare. They do not need to assign a Primary Care Physician and do not need to receive a referral to see a specialist.

When do you have to enroll in Medicare?

While the exact method of enrolling in Medicare differs depending on the population, most people get Medicare by enrolling in Social Security right before they turn 65. If you already get Social Security benefits, you will automatically be enrolled in Medicare at age 65.

Is Medicare the same as Medicaid?

While many people confuse Medicare and Medicaid, the two are, in fact, different. Medicare is for older people or people with disabilities, while Medicaid is for people with limited incomes. Read more to learn more about the basics of Medicare.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

Introduction

This report presents statistics on health insurance coverage in the United States based on information collected in the Current Population Survey Annual Social and Economic Supplement (CPS ASEC).

Highlights

In 2020, 8.6 percent of people, or 28.0 million, did not have health insurance at any point during the year.

America Counts Stories

Private Health Coverage of Working-Age Adults Drops From Early 2019 to Early 2021

Visualizations

Figure 1. Percentage of People by Type of Health Insurance Coverage and Change From 2018 to 2020

Tables

Table 1. Number and Percentage of People by Health Insurance Coverage Status and Type: 2018 to 2020

Health Insurance Historical Tables - HHI CPS (2017-2020)

HHI-01. Health Insurance Coverage Status and Type of Coverage--All Persons by Sex, Race and Hispanic Origin: 2017 to 2020

Health Insurance Detailed Tables

The Current Population Survey is a joint effort between the Bureau of Labor Statistics and the Census Bureau.

What does Medicare cover?

Medicare coverage: what costs does Original Medicare cover? Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. If you’re an inpatient in the hospital: Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per ...

How much does Medicare Supplement pay for hospital visits?

(Under Medicare Supplement Plan N, you might have to pay a copayment up to $20 for some office visits, and up to $50 for emergency room visits if they don’t result in hospital admission.)

What type of insurance is used for Medicare Part A and B?

This type of insurance works alongside your Original Medicare coverage. Medicare Supplement insurance plans typically help pay for your Medicare Part A and Part B out-of-pocket costs, such as deductibles, coinsurance, and copayments.

How much is a deductible for 2021?

You’ll usually need to pay a deductible ($1,484 per benefit period* in 2021). You pay coinsurance or copayment amounts in some cases, especially if you’re an inpatient for more than 60 days in one benefit period. Your copayment for days 61-90 is $371 for each benefit period in 2021.

How much is coinsurance for 61-90?

Your copayment for days 61-90 is $371 for each benefit period in 2021. After you’ve spent more than 90 days in the hospital during a single benefit period, you’ll generally have to pay a coinsurance amount of $742 per day in 2021.

What does Part B cover?

Part B typically covers certain disease and cancer screenings for diseases. Part B may also help pay for certain medical equipment and supplies.

Does Medicare have a maximum spending limit?

Be aware that Original Medicare has no annual out-of-pocket maximum spending limit. If you meet your Medicare Part A and/or Part B deductibles, you still generally pay a coinsurance or copayment amount – and there’s no limit to what you might pay in a year.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

What percentage of births were covered by Medicaid in 2018?

Other key facts. Medicaid Covered Births: Medicaid was the source of payment for 42.3% of all 2018 births.[12] Long term support services: Medicaid is the primary payer for long-term services and supports.

What percentage of Medicaid beneficiaries are obese?

38% of Medicaid and CHIP beneficiaries were obese (BMI 30 or higher), compared with 48% on Medicare, 29% on private insurance and 32% who were uninsured. 28% of Medicaid and CHIP beneficiaries were current smokers compared with 30% on Medicare, 11% on private insurance and 25% who were uninsured.

What is the federal Medicaid share?

The Federal share of all Medicaid expenditures is estimated to have been 63 percent in 2018. State Medicaid expenditures are estimated to have decreased 0.1 percent to $229.6 billion. From 2018 to 2027, expenditures are projected to increase at an average annual rate of 5.3 percent and to reach $1,007.9 billion by 2027.