What is the size of the Medicare reference?

Feb 06, 2012 · How to Organize Your Records and Important Information The first step in getting your affairs in order is to gather up all your important personal, financial and legal information so you can arrange it in a format that will ... Medicare, …

How long should you keep your tax records?

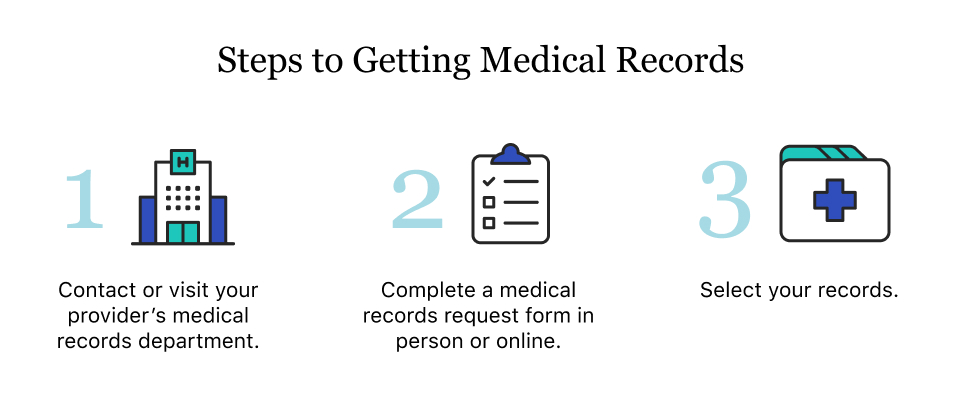

• Suggestions about how to organize your records. • Tips on how to read the bills from UWMC. • Answers to common questions about patient billing. • Resources and contact information for departments, agencies, and organizations related to this topic. • Definitions of terms used in health care billing matters. About Your Health Care Bills

What is the best way to store important documents?

Mar 10, 2022 · How To Organize Your Records. Weltman says a good way to start is todivide your financial papers into four categories. Keep for less than a year. In this file, Weltman says to store your ATM, bank-deposit, and receipts until you reconcile them with your monthly statements.

What records need to be kept for 7 years?

Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return. Keep records indefinitely if you do not file a return.Feb 25, 2022

How long should you keep monthly statements and bills?

Key TakeawaysMost bank statements should be kept accessible in hard copy or electronic form for one year, after which they can be shredded.Anything tax-related such as proof of charitable donations should be kept for at least three years.More items...

What papers should I keep and for how long?

To be on the safe side, McBride says to keep all tax records for at least seven years. Keep forever. Records such as birth and death certificates, marriage licenses, divorce decrees, Social Security cards, and military discharge papers should be kept indefinitely.Feb 25, 2022

Do I need to keep bank statements for 7 years?

KEEP 3 TO 7 YEARS Knowing that, a good rule of thumb is to save any document that verifies information on your tax return—including Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receipts—for three to seven years.

How many years of credit card statements should you keep?

The IRS retains the right to audit anyone's financial history for up to six years. In this case, it's wise to keep credit card statements for at least three years, preferably six if there is a very high risk of audit.Mar 26, 2021

What receipts should I keep?

Keep all of your credit card receipts and statements, invoices and cash register receipts. You'll need them to maximize your tax deductions for eligible transportation, gift and travel expenses.Feb 3, 2022

Is there any reason to keep old tax returns?

You probably learned that you should keep a tax return for at least three years after filing it. The reason for the three-year answer is that the IRS has up to three years to audit you and assess additional taxes. That's also the time limit for you to file an amended return.Jul 9, 2018

What do you do with old bank statements?

Bank statements These can be discarded after one year and shredding means your banking and personal details won't be on show to be copied. Better still, opt for paperless statements. That way you can check them via online banking anytime (and print them out only if you need to).Feb 12, 2016

What is the 4 most important US documents?

Located on the upper level of the National Archives museum, the Rotunda for the Charters of Freedom is the permanent home of the original Declaration of Independence, Constitution of the United States, and Bill of Rights.Feb 17, 2022

How long should you keep Cancelled checks?

Keep canceled checks for one year unless you need them for tax purposes. Refer to them when you reconcile your accounts each month so you know what has cleared. If your bank does not return your canceled checks, you can request a copy for up to five years.Feb 17, 2021

How do I get old bank statements from a closed account?

Request copies of your bank statements in person at a bank branch, over the phone or in writing. The bank will need some photo identification, like your driver license or a passport. Provide identifying information for the bank account, such as the account number, when you opened and closed it and the closing balance.

How long should you keep P60?

22 monthsThe P60 is an annual statement that shows all of the money you were paid in the tax year. It also shows the income tax paid and National Insurance contributions made during the same year. HMRC recommends that you keep your payslips and P60s for at least 22 months from the end of the tax year.Jan 14, 2021

It's Not Just About Taxes

While you’re focused on your tax papers, it’s good idea to organize all your financial documents, says Barbara Weltman, who runs the website Big Ideas for Small Business and is the author of “J.K. Lasser’s Small Business Taxes 2019” (Wiley, 2018).

How to Organize Your Records

Weltman says a good way to start is to divide your financial papers into four categories.

How to Store Your Files

There are many ways to store important documents. Weltman says it’s a good idea to use a fireproof safe or password-protected electronic file for documents such as bank and investment statements, estate-planning documents, pension information, pay stubs, and tax documents.

Why do clients love key tax changes?

Clients, prospects, and COIs will love Key Tax Changes because it’s simple and easy to comprehend at a glance. It tells you what the new rules are and how they’re different from the old ones. Nearly all the changes affecting family and business finances are included.

What is generational planning?

Generational Planning is a modern, forward-thinking, and intentional two-phase process of first passing on a family’s tangible wealth and assets, and secondly, conveying its values and history, all for the benefit of the next generation. The program has three phases.

When will the stretch IRA be legalized?

The biggest retirement-related legislation in over a decade finally became law at the tail end of 2019. Some of the biggest changes will impact your clients, like the death of the stretch IRA and the ability to contribute to IRAs after age 70.

What is a key birthday postcard?

The Key Birthdays postcard is an ideal client touch with a lot of potential. It simply and clearly asks people if they know anyone crossing these landmark birth dates. Details:

What is STRS in military?

Treatment Records (STRS) Many OMPFs contain both personnel and active duty health records. Health records cover the outpatient, dental and mental health treatment that former members received while in military service. Health records include induction and separation physical examinations, as well as routine medical care when the patient was not admitted to a hospital. In comparison, clinical records were generated when active duty members were actually hospitalized while in the service. Typically, these records are NOT filed with the health records but are available elsewhere in the Center.

How many military records were destroyed in the 1973 fire?

On July 12, 1973, a disastrous fire at the Military Personnel Records Center – the original records repository south of the new facility – destroyed approximately 16 million to 18 million Official Military Personnel Files (OMPF). The records affected were: Branch. Personnel and Period Affected.

Where is the National Personnel Records Center located?

Located in multiple facilities in the St. Louis area , the Center stores and services over 4 million cubic feet of military and civilian personnel and medical records dating back to the Spanish-American War.

Do military records have photos?

For most military personnel records since the late 1960s the following information may be part of the record. Not everyone will have all these items. Most files do not have photographs; few have restricted items.

What is a VBMS?

VBMS is a computer system used to develop awards from applications for Compensation claims. The advent of an electronic folder ("eFolder") within VBMS eliminated the need for producing paper and establishing physical claim folders, which had been VA's business practice for the better part of a century.

How to get veterans records?

One of the fastest and easiest ways to obtain specific records in a veterans claims folder is to call the National Call Center at 800-827-1000. These people usually respond to a call within a reasonable period of time and are very helpful. They will only talk to the veteran claimant or to someone else if the veteran claimant is also on the phone or nearby. The records center will in no way provide copies of all service treatment records, medical records or personnel records that are already in the Veterans Benefits Management System database. They may provide a few specific documents if the claimant can identify dates for those document.

Where is the RMC located?

This facility is located 6 miles directly south of the NPRC in the Goodfellow Federal Center – a suburban office park situated on a 62.5 acre, with 23 buildings comprising the campus. The RMC is one of many federal and civilian organizations housed in this huge complex.

What is the Plus plan in QuickBooks?

The Plus plan, which QuickBooks advertises as its most popular option, lets small businesses create estimates and invoices, manage and pay bills, and track inventory, among other advanced functions. At all plan levels, the mobile app can be used with an online QuickBooks account. Platform: Apple and Android.

Who is the founder of FileThis?

Brian Berson, CEO and co-founder of FileThis, says his app acts as an electronic filing cabinet. It allows users to store and categorize documents of all kinds and makes it easy to find necessary paperwork at tax time.

Is QuickBooks good for self employed?

They've built a product that's genuinely helpful.". QuickBooks offers accounting software at a variety of price points. The least expensive plan is geared toward the self-employed and allows them to track expenses and mileage as well as download bank data and calculate quarterly tax payments.

Is Expensify a QuickBooks?

Like QuickBooks, Expensify is geared toward self-employed or small business users, although it could be useful to anyone who wants to easily track expenses and mileage in the same place.

Can Evernote be used to scan receipts?

If you already use Evernote, the service's Scannable app might be a logical choice for you to scan and organize your receipts. You can tag tax-related items to find them easily in April.

Why do people go out on their own?

Perhaps the most enthusiastically given reason for going out on your own is the ability to answer to no one but yourself. You don't have to ask for a raise — instead, you can raise your own pay.

What is an independent contractor?

An independent contractor is a person or business that provides goods or services to others under terms spelled out in a contract or other agreement. An independent contractor does not work regularly for an employer, as an employee does. Rather, he works for himself.

How much does a house painter make an hour?

For example, a house painter might earn $15 an hour for an employer but $50 per hour on her own. One reason independent contractors charge more is that they have to pay for their own benefits and their self-employment tax. Some even factor periods of downtime into their charges.

Is being your own boss good?

Being your own boss has its benefits and drawbacks. The benefits include setting your own hours. Regarding the drawbacks, a pundit once said, "I am my own boss, and I can work any 23 hours a day I choose.". Weigh the advantages and disadvantages carefully to prepare for your choice, and visualize yourself handling both.

What dictates your earnings?

At a regular job, your earnings are dictated by the company, with raises on a schedule and determined by the health of the company. On your own, they are dictated by you and are often subject to prevailing market trends.

How to choose a business name?

Your business will need a name. Think carefully about it, because your business's name will help frame how the world sees it. Imagine how it will sound when spoken, how it will look in emails or on signs, and what it might mean when others hear it.

Is an individual an independent contractor?

The IRS definition. The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. You are not an independent contractor if you perform services that can be controlled by an employer ...