- Decide on the Medicare Benefits That You Consider as Must-Haves. ...

- Think about how You Want to Manage Your Medicare Costs. Costs are a major determining factor in how to choose a Medicare plan. ...

- Consider Your Lifestyle and Travel Plans. Travel is one of the perks of retirement, and many seniors even choose a dual-resident lifestyle, living in warmer climates during the ...

- Review Your Part D Prescription Drug Coverage Needs. There is generally no coverage for prescription drugs you take at home under Original Medicare. ...

- Get Help Choosing a Medicare Plan if You Have Questions. The average person can choose from among 39 Medicare Advantage plans and 28 prescription drug plans.

Full Answer

How to choose the perfect Medicare plan?

Your Ultimate Guide to Choosing the Perfect Medicare Plan

- Importance of Medicare Advantage Plans. ...

- Enrol early. ...

- You can evaluate your coverage each year. ...

- Select a plan with an extensive network. ...

- Check out what’s NOT covered. ...

- Don’t miss the deadline for enrolment. ...

- Choose the Right Medicare Plan. ...

Which Medicare plan is best for You?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of-pocket costs than Original Medicare. In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs.

What are the best Medicare plans?

... Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers. Sign up today for a FREE virtual event and let Silver Supplements Solutions help you understand your best option for your own peace of mind!

How to choose the best Medicare drug plan?

How to Choose With 5 Tips

- Consider the Timing. Timing plays a key role in signing up for a Medicare plan. ...

- Do Your Research. There are two main types of Medicare plans: Original Medicare and Medicare Advantage. ...

- Review Drug Coverage. Many Medicare eligibles overpay for their Medicare plan by hundreds of dollars. ...

- Choose the Right Plan. ...

- Enroll. ...

How do I choose the right Medicare plan?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

Which Medicare plan do most people choose?

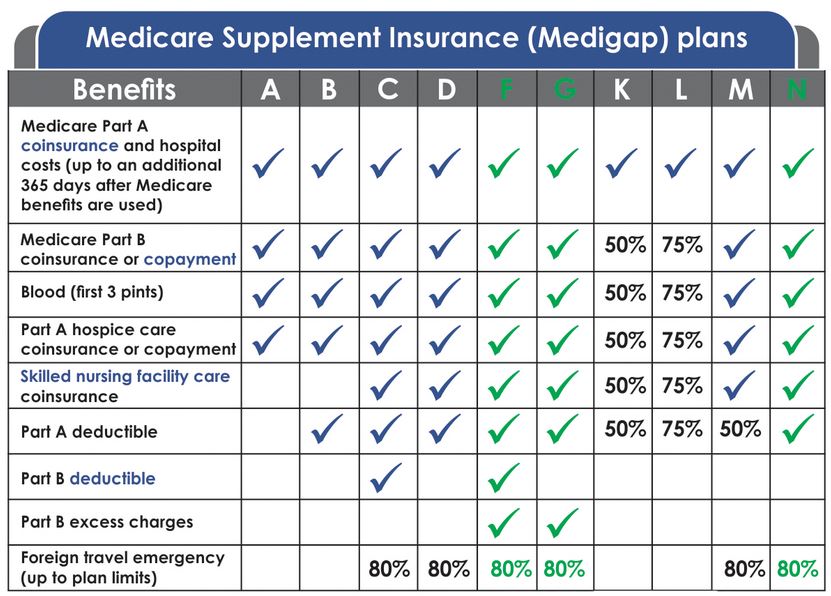

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).

What are 4 types of Medicare plans?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is Medicare Advantage?

Medicare Advantage is a plan offered by a private insurance company that contracts with Medicare. These plans include Part A and Part B coverage, and may be set up as an HMO, PPO, fee-for-service or other type of plan. They typically include prescription drug coverage and may offer vision, dental and other services. [.

What are the two types of Medicare?

There are two types of Medicare plans: Original Medicare and Medicare Advantage. According to Medicare.gov, Original Medicare is a government-provided, fee-for-service plan that is made up of two parts: Part A is hospital insurance and Part B is medical insurance.

When is the best time to switch Medicare?

For those already enrolled, the annual open enrollment period, which runs from Oct. 15 until Dec. 7 each year , is the best time to consider switching plans or adding coverage. 2. Learn about your options. There are two types of Medicare plans: Original Medicare and Medicare Advantage.

Does Medicare change if you work with a different insurance company?

The premiums are set by Medicare or the insurance company if you select a Medicare Advantage or Medigap plan. Medicare premiums do not change regardless of who you work with, but the other plans vary among companies based on the state they are licensed to do business in.

Can you enroll in health insurance after your 65th birthday?

Patients may be responsible for late penalties and lapses in coverage if they don't qualify for a Special Enrollment Period, which allows you to enroll outside your 65th birthday window or during annual open enrollment, for unplanned events like losing a job and associated health insurance coverage.

Can an employer group health plan be the primary carrier over Medicare?

That is true except with people still covered by an employer plan," Omdahl says. Federal law says that an employer group health plan (sponsored by a company with 20 or more employees) can be the primary carrier over Medicare. "People working at 65 or past 65, that population makes the most of the mistakes with enrollment," she says.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

How does Medigap work with Medicare?

How it works with Original Medicare: A Medigap plan works in conjunction with Original Medicare and helps to pay for some of Medicare’s out-of-pocket costs. You might consider this type of Medicare plan if: You wish to have less uncertainty with your out-of-pocket health care costs.

What is the difference between Medicare Part A and Part B?

Step 1: Determine which Medicare plan coverage option you want. Medicare beneficiaries could potentially only be enrolled in Medicare Part A (hospital insurance). Medicare Part B (medical insurance) is optional, as are several other types of Medicare coverage .

What is a Medigap plan?

Medigap plans can help provide coverage for some of the out-of-pocket expenses that are tied to Original Medicare. These can include Medicare deductibles, coinsurance, copayments and more. There are 10 different types of standardized Medigap plans available in most states, and each type of plan offers its own combination of benefits.

What is a Part D plan?

The Part D plan provides the prescription drug coverage that Original Medicare and some Medicare Advantage plans do not. You might consider this type of Medicare plan if: You want to have some help paying for your prescription drug costs. You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online ...

What is Medicare Part D?

Medicare Part D. Medicare Part D plans provide coverage for many prescription drugs. There are many different types of Medicare Part D plans, and each one offers its own formulary, which is the list of drugs covered by the plan. How it works with Original Medicare: Part D plans are used alongside Original Medicare or a Medicare Advantage plan ...

What are the benefits of Medicare Advantage?

Some of these additional benefits can include coverage for prescription drugs, dental, hearing, vision and more.

What are the different types of Medicare Advantage plans?

There are several different types of Medicare Advantage plans. These plan types include Medicare HMO plans, Medicare PPO plans and others. Learn more about the different types of Medicare Advantage plans to help you decide which one might be the best fit for you. Medicare Part D plans can also come in different types of formats, ...

Step 1: Decide on the Medicare Benefits That You Consider as Must-Haves

If you’re used to employer group insurance, you probably have been provided with benefits such as vision and dental coverage. But what most people don’t realize is that these routine services aren’t covered by Original Medicare.

Step 2: Think about how You Want to Manage Your Medicare Costs

Costs are a major determining factor in how to choose a Medicare plan. The fact is that most people don’t realize how unpredictable out-of-pocket costs can be with Original Medicare, and even with some Medicare Advantage plans.

Step 3: Consider Your Lifestyle and Travel Plans

Travel is one of the perks of retirement, and many seniors even choose a dual-resident lifestyle, living in warmer climates during the winter. The good news for this niche of retirees is that there are no provider restrictions with Original Medicare, meaning that you can use Medicare with any provider in the country who accepts it.

Step 4: Review Your Part D Prescription Drug Coverage Needs

There is generally no coverage for prescription drugs you take at home under Original Medicare. As such, if you want help with prescription drug costs, you’ll need a Part D prescription drug plan.

Step 5: Get Help Choosing a Medicare Plan if You Have Questions

The average person can choose from among 39 Medicare Advantage plans and 28 prescription drug plans. With so many options, it’s not surprising that people are perplexed about how to choose the best Medicare plan.

What if I Still Have Private Health Insurance?

If you're turning 65 but will still have private insurance through your or your spouse's job, you might be thinking about waiving Medicare Part A hospital coverage and Part B medical coverage for now. In this case, you've still got some research to do.

Important Facts About Medicare

Medicare can be a big help for people, so learn more about this program, including when you can sign up, what’s included, and what you can add.

Tips for Plan-Shopping

These tactics may help you once you plunge into the sea of Medicare plans:

Should You Get Help?

Many people decide they can handle Medicare decisions on their own. But you may feel more comfortable with one-on-one expert help. You might start by calling 800-MEDICARE (800-633-4227) or with a live help chat on the Medicare.gov site.