Comparison of Plan F and Plan G

| Medigap Plan F | Medigap Plan G | |

| Medicare Part A coinsurance and copays | 100% | 100% |

| Medicare Part A deductible | 100% | 100% |

| Medicare Part B coinsurance and copays | 100% | 100% |

| Medicare Part B deductible | 100% | No |

Should You Choose Medicare supplement plan F or Plan G?

The reason is simple: Plan G is less expensive than F and there is speculation that because of the Changes in Medicare Supplement plans in 2020, the prices of Plan F will increase significantly. While nothing is yet certain, switching to Plan G is worth considering. What is the difference between Medigap Plan G and Plan F?

Which is better Medicare Plan F or G?

When it comes to coverage, Plan F will give you the most coverage since it’s a first-dollar coverage plan and leaves you with zero out of pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Plan G may be better for you.

Is Medicare Plan G better than Plan F?

Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible. Is Medicare Plan F being discontinued? Yes, but only for new enrollees on or after January 1, 2020.

Is Plan G the best Medicare supplement plan?

With Plan F not available to people new to Medicare, Medigap Plan G has now become the most popular of all the Medicare supplement plans for 2022, and for good reason. Plan G offers fantastic coverage for those on Part A and B Medicare, with only one small annual deductible to pay.

What is the difference between F and G on Medicare?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What's the difference between Plan F and G?

Medicare Supplement Plan G is almost identical to Plan F, except for the Part B deductible. If you select Plan G, you'll need to pay your Part B deductible ($233 for 2022), yourself. After you pay your deductible, you have no other out-of-pocket costs, just like the Plan F.

What is Medicare G?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Should I switch from F to G?

When it comes to coverage, Medicare Supplement Plan F will give you the most coverage since it's a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Medicare Supplement Plan G may be better for you.

What is a Medicare F plan?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

What Plan G does not cover?

Medigap Plan G does not cover dental care, or other services excluded from Original Medicare coverage like cosmetic procedures or acupuncture. Some Medicare Advantage policies may cover these services. Like Medigap, Medicare Advantage is private insurance.

What does Medigap G not cover?

What Does Plan G Cover? Plan F is considered the top-of-the-line Medigap policy. It covers 100% of the gaps in Medicare. Plan G's coverage is nearly as good with one exception: Plan G does not cover the Part B deductible, which is $233 in 2022.

Does Medicare Part G cover prescriptions?

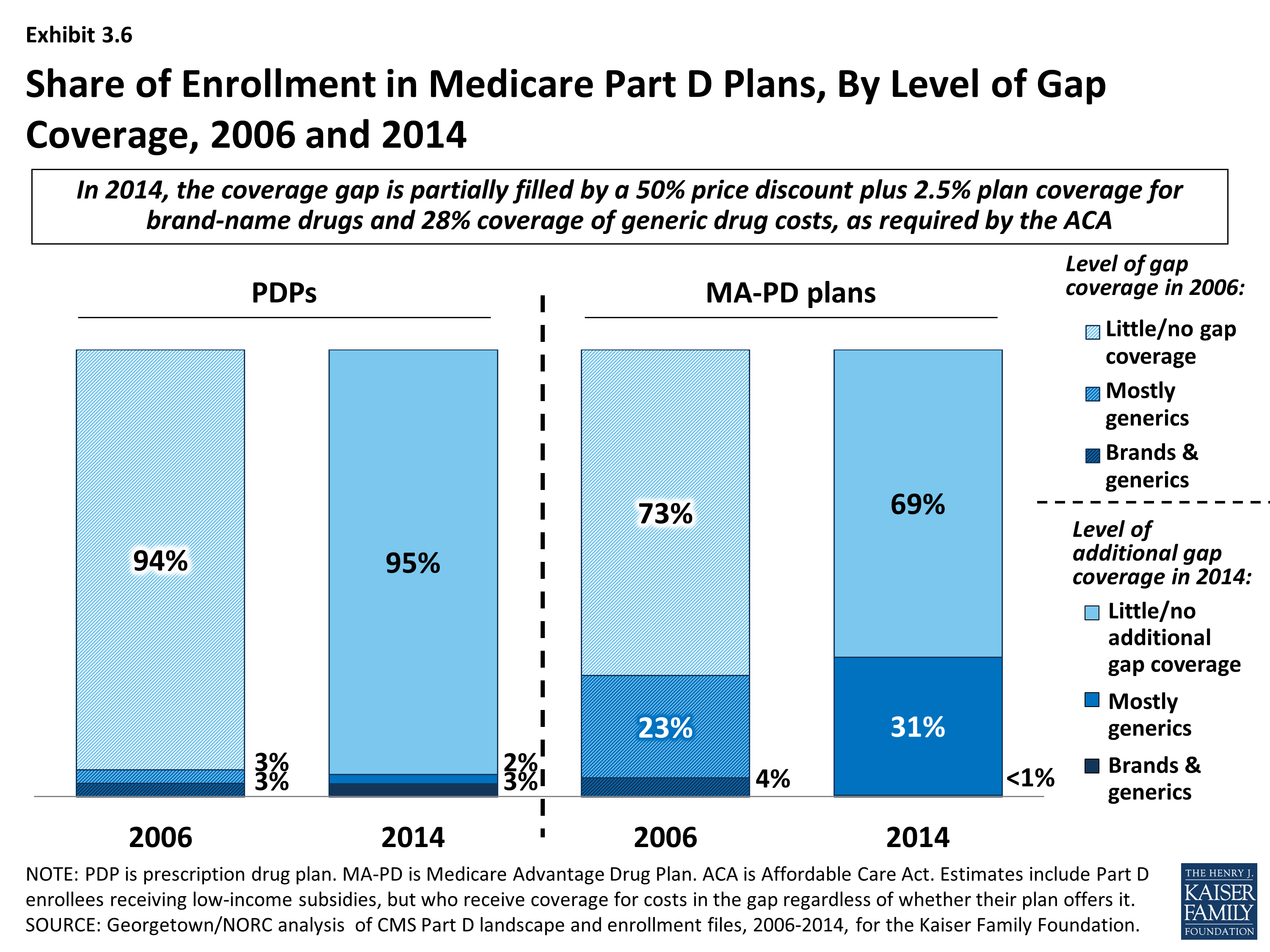

Medicare Supplement plans, including Plan G, do not cover the cost of prescription medications. To tap into this coverage, you'll need to add a Medicare Part D prescription drug policy to your Original Medicare plan.

Can I keep my plan F after 2020?

If you already have Medicare Supplement Plan F (or Plan C, which also covers the Part B deductible), you can generally keep it. If you were eligible for Medicare before January 1, 2020, you may be able to buy Medicare Supplement Plan F or Plan C.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

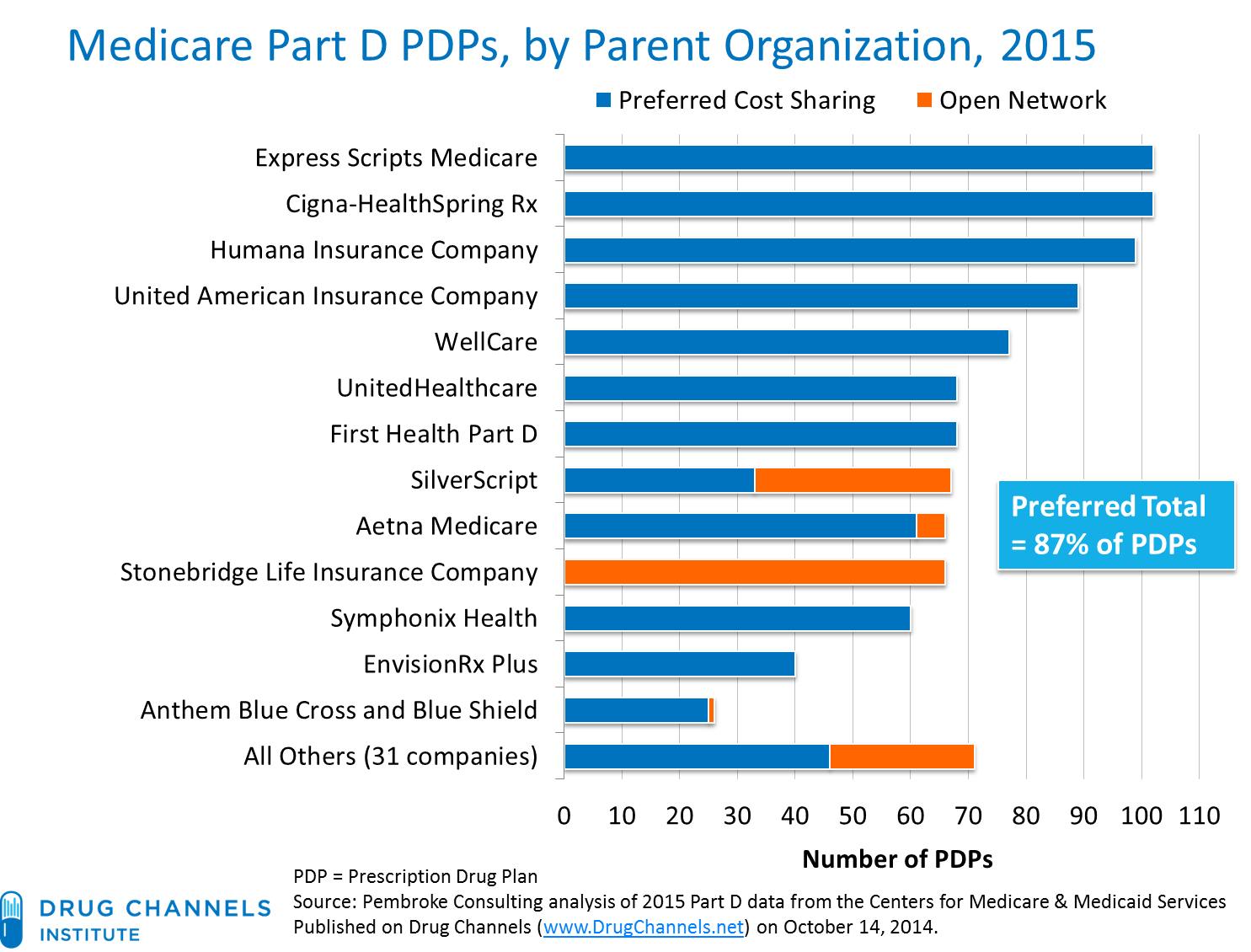

What percent of private insurance companies sell Plan F?

85 percent of private insurance companies sell Plan F, and 66 percent sell Plan G policies. While new Plan F policies are no longer sold to new Medicare beneficiaries, existing policies still provide ongoing coverage in many states. Residents in most states can purchase and use Plan G policies, though Massachusetts, Minnesota, ...

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

What percentage of Medicare beneficiaries are enrolled in a Medigap plan?

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance (Medigap) plan. These optional plans, issued by private insurance companies, help pay for some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Plan F has long been the most popular Medigap plan.

Is Medigap Plan F deductible?

While the deductibles mean you must pay a certain amount of money out of pocket before the plan coverage kicks in, the monthly premiums are typically much lower than the premiums for other Medigap plans or for the standard non-deductible versions of Plan F and Plan G.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Can I sell my Medicare Part B policy?

As part of that act, from January 1, 2020, insurers couldn't sell a policy that covers the annual Medicare Part B deductible to new Medicare beneficiaries. This ruling effectively meant insurers couldn't offer Plan F or Medigap Plan C ...

What is Medigap Plan F?

Medigap Plan F provides a person with coverage for some parts of healthcare that original Medicare does not cover. However, there are some restrictions on enrollment: A person newly enrolled in Medicare can no longer get Plan F.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How many Medigap policies are there?

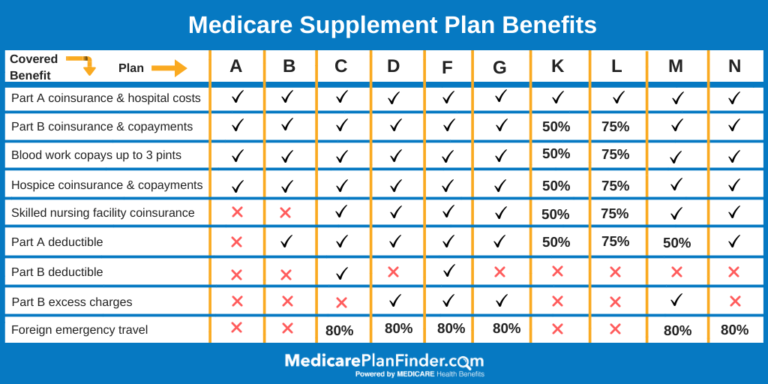

There are 10 Medigap policies: A, B, C, D, F, G, K, L, M, and N. The plans offer standardized benefits to Medicare recipients and help pay coinsurance, deductibles, and copays that original Medicare may not cover. Medigap plans may also cover emergency healthcare if a person needs treatment while they are away from the United States.

How much is the deductible for Medicare 2021?

In addition to the basic Plan F, there is a high deductible version of Plan F available. In 2021, this has a deductible of $2,370. A person must reach the deductible before the plan starts to cover costs.

What is the maximum amount of medical expenses for a foreign traveler?

A $250 annual deductible may be applied by Plan F and Plan G to cover foreign travel emergency services, with a lifetime limit generally set at $50,000. The healthcare must begin during the first 60 days of a person’s trip, and no other Medicare benefit may cover it.

Can you have a Medigap plan if you are enrolled in Medicare Advantage?

In addition, if a person is enrolled in a Medicare Advantage plan, they cannot also have a Medigap plan.

Does Medigap work with original Medicare?

Comparing the plans. Costs. Summary. Medicare supplemental health insurance plans, also called Medigap, work with original Medicare. Medigap Plan F provides many of the same benefits as Plan G, with some differences. Medigap plans help a person pay their out-of-pocket Medicare expenses. A person can get a Medigap plan, ...

What is the difference between a plan F and a plan G?

The main difference is that Plan F covers the Medicare Part Bdeductible while Plan G doesn’t. Both plans also have a high-deductible option. In 2021, this deductible is set at $2,370, which must be paid before either policy begins paying for benefits. Another big difference between Plan F and Plan G is who can enroll.

What is a Medigap plan?

Medigap is supplemental insurance that helps cover costs that aren’t covered by original Medicare. Medigap Plan F and Plan G are two of the 10 different Medigap plans that you can choose from.

How many different Medigap plans are there?

Medigap is made up of 10 different plans, each designated with a letter: A, B, C, D, F, G, K, L, M, and N. Each plan includes a specific set of basic benefits, no matter what company sells the plan.

How long does it take to get Medicare Part B?

This is a 6-month period that begins the month you turn age 65 and you’ve enrolled in Medicare Part B. Some people are eligible for Medicare before age 65. However, federal law doesn’t require companies to sell Medigap policies to people under age 65.

Do you have to pay for Medigap?

You’ll have to pay a monthly premium for your Medigap plan. This is in addition to the monthly premium that you pay for Medicare Part B if you have Plan G. Your monthly premium amount can depend on your specific policy, plan provider, and location. Compare Medigap policy prices in your area before deciding on one.

Does Medigap cover Part B?

Similar to Plan F, Medigap Plan G covers a wide variety of costs; however, it does not cover your Medicare Part B deductible. You have a monthly premium with Plan G, and what you pay can vary depending on the policy you choose. You can compare Plan G policies in your area using Medicare’s search tool.

Can you enroll in Medicare Part B in 2020?

The enrollment rules for Plan F changed in 2020. As of January 1, 2020, Medigap plans are no longer allowed to cover the Medicare Part B premium. If you were enrolled in Medigap Plan F before 2020, you are able to keep your plan and benefits will be honored. However, those new to Medicare are not eligible to enroll in Plan F.

What is Medicare Plan F and G?

Medicare Plan F and Plan G are two of the 10 different types of standardized Medicare supplemental health insurance plans available in most states. You pay a premium for both types of plans, but both plans help pay for out-of-pocket expenses that Original Medicare doesn’t cover. The following chart provides a side-by-side look at all 10 ...

What is the difference between Medicare Plan F and Plan G?

Another big difference between Medicare Plan F and Plan G is who is eligible to enroll. Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

Why switch to Medicare Plan G?

Switching to a Medicare Plan G might be a good idea because you’ll pay lower premiums, and you might also never pay the $203 Medicare Part B deductible.

How much does Medicare cover if you have a plan F?

If you have Medicare Plan F and you haven’t yet met your Medicare Part B deductible, it would cover the $203 deductible plus the 20% of the Medicare-approved coinsurance amount. If you have Medicare Plan G, you’ll need to pay the $203 Medicare Part B deductible first. Then your Medicare Supplement plan would cover the 20% coinsurance.

What is the deductible for Medicare 2021?

If you became eligible for Medicare. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When will Medicare change to Plan F?

Both plans require you to first have Original Medicare, but the enrollment guidelines for Plan F changed at the beginning of 2020. If you first became eligible for Medicare on or after January 1, 2020, you cannot enroll in Medicare Plan F.

Is everyone eligible for Medicare Plan F and Plan G?

Medicare Plan F and Plan G can help you save money on your Medicare costs. However, as of January 1, 2020, not everyone is eligible for both plans, and you need to understand the new requirements.

How much is a high deductible plan G?

A High Deductible Plan G requires you to pay $2,370 in 2021 before the plan begins to pay. Once you reach the deductible, you will receive the coverage of a regular Plan G. Monthly premiums tend to be lower than regular Plan G because of the high deductible.

How much does Plan N copay?

While Plan N pays 100% of the Part B coinsurance, providers are allowed to require copays up to $20 for doctor’s visits and up to $50 for emergency room visits .

How long does Medicare Part A coinsurance last?

Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out. * Medicare Supplement Plan F and Plan G also offer a plan with a high deductible in some states. You must pay $2,370 in shared costs before the plan begins to pay.

How long does Medicare open enrollment last?

The Medicare supplement open enrollment period lasts six months. It begins the month you turn 65 and are enrolled in Part B. You can enroll through a private insurance company (via their websites or by phone), or by connecting with a GoHealth licensed insurance agent. Learn more about Medicare Supplement enrollment.

How much will Medicare cost in 2021?

In 2021, you have to pay $2,370 in shared costs before you get the same benefits of regular Plan F. Please note, a High Deductible Plan F also is not available to new Medicare enrollees in 2021.

How much do you have to pay for Medicare in 2020?

You must pay $2,370 in shared costs before the plan begins to pay. * As of January 1, 2020, new Medicare enrollees are not eligible for Plan C or Plan F. If you were eligible for Medicare before January 1, 2020, but did not enroll, you may still be eligible.

What is deductible insurance?

A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself.

What Is a Medigap Plan?

First, we need to know what a Medigap plan is. Medigap plans were designed to fill in the “gaps” left by Parts A and B of Original Medicare. Neither Part A nor Part B covers your medical expenses at 100%. There are always out-of-pocket expenses associated with Original Medicare, whether that comes from a deductible, copay, or coinsurance cost.

Medigap Plan F

Medigap Plan F is the most comprehensive Medigap plan on the market. Medicare beneficiaries who enroll in Plan F will pay the monthly premium for Plan F and the monthly premium for Medicare Part B but will have nearly no other out-of-pocket costs for medical services.

Medigap Plan G

Medigap Plan G is almost exactly the same as Plan F, with one small exception. Plan G does not cover the Part B deductible. However, it is the second most comprehensive coverage of all Medigap plans.

How to Choose Between Plan F and Plan G

If Plan F has better coverage, why would anyone choose Plan G over Plan F? There are two main considerations when making this decision: eligibility and premiums.

What is the difference between Medicare Supplements Plan F and Plan G?

The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise they function just the same. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans.

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

What happens if you don't have Medicare?

When you see a provider that doesn’t participate with Medicare, he can charge up to 15% more than the standard Medicare rate for your services. You will pay this money out of pocket unless you have Medigap Plan F or Plan G. It’s definitely something to consider if provider choice is important to you.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Which is the most comprehensive Medicare plan?

The most comprehensive plan currently available is Medigap Plan F. It covers all of the gaps in Medicare. The next most comprehensive plan is Plan G, which covers nearly as much, with the Part B deductible being the only difference. Finally, Plan N is probably the third most popular plan because it operates similar to Plan G except ...

How much does a 66 year old spend on Medicare?

The average 66-year-old couple spends about 57% of their Social Security benefits on health care, according to a 2016 study. Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course.

Is Medigap Plan G the same as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deduct ible, which is $203 in 2021. Medigap Plan G is now the most popular plan among beneficiaries new to Medicare.

Which is better, Plan F or Plan G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more than Plan G since it picks up the annual Part B deductible. COMPARE PLANS AND PRICING.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

What is a small deductible for Medicare?

Medigap Plan G: A Small Deductible = Big Savings. Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, ...

Why is Medicare Supplement G more expensive than Plan N?

Medicare Supplement G usually costs more than Plan N, because it covers more. People seem to like the security and peace of mind that a comprehensive policy like Plan G seems to offer. Want to know which companies offer the best Medicare Plan G policies. Read our Plan G Reviews here or attend one of our free New to Medicare webinars ...

How long does a hospital stay last after Medicare runs out?

It also covers the expensive daily copays that you might encounter for a hospital stay that runs longer than 60 days. It provides an additional 365 days in the hospital after Medicare runs out, and it covers your skilled nursing facility co-insurance, too.

How often does Frank see his doctor?

Frank is a diabetic who has Medicare Supplement Plan G. He sees his primary care doctor once per year, but visits his endocrinologist several times a year to renew his prescriptions. In January, he goes to his first doctor visit for the year.