Step 1: Determine which Medicare plan coverage option you want Medicare beneficiaries could potentially only be enrolled in Medicare Part A (hospital insurance). Medicare Part B (medical insurance) is optional, as are several other types of Medicare coverage.

Full Answer

What is the best Medicare Choice?

Only 15 weekdays are left for Medicare recipients to choose or change their plans. Only 15 days left for choosing the best Medicare coverage | News | annistonstar.com Thank you for reading! Please log in, or sign up for a new account andpurchase a subscription to continue reading. Sign Up Log In Purchase a Subscription

How to choose the right Medicare plan for You?

Original Medicare

- Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

- You can join a separate Medicare drug plan to get Medicare drug coverage (Part D).

- You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

What Medicare plan to choose?

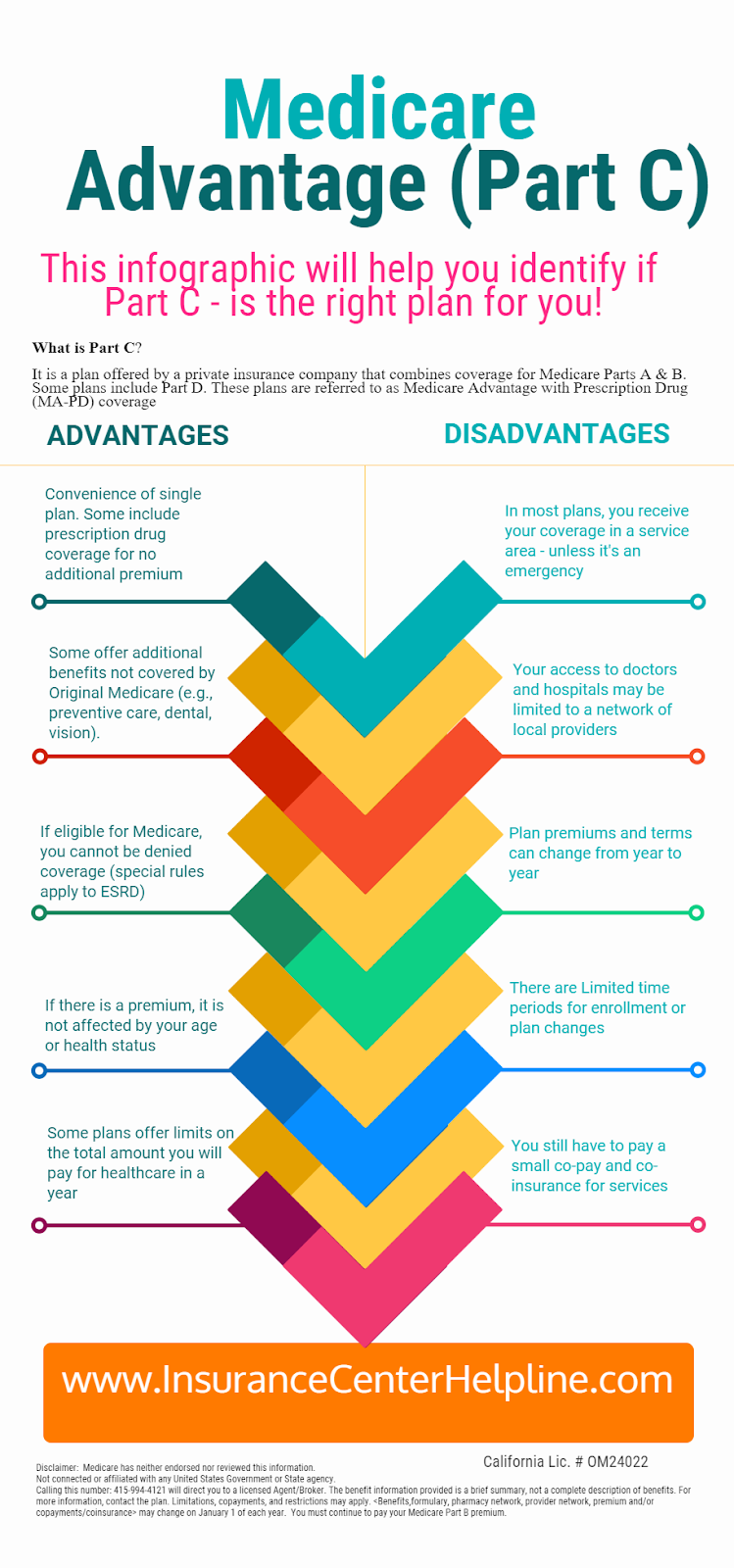

- Medicare Advantage offers Part A, Part B as well as additional benefits such as prescription, dental, vision, and hearing coverage and even fitness club memberships. ...

- You have to see in-network providers, which is problematic if you want to select your own doctor.

- It offers low-cost premiums, deductibles, coinsurance, and copays.

What is the best Medicare plan for You?

Ranking the best medicare supplement plans of 2021

- Humana. Humana is one of the largest providers of healthcare and healthcare insurance in the country. ...

- Mutual of Omaha Medicare Supplement. Mutual of Omaha offers eight Medicare supplement plans that cover most out of pocket expenses most people will incur.

- United Medicare Advisors. ...

- Aetna Medicare Supplement. ...

- Cigna. ...

How do I choose the right Medicare plan?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

Is there a choice of Medicare Part B?

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

Do I automatically get Medicare Part B when I turn 65?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Is Part B Medicare the same for everyone?

Medicare premiums are calculated based on your modified adjusted gross income from two years prior. Thus, your premium can change if you receive a change in income. Does everyone pay the same for Medicare Part B? No, each beneficiary will pay a Medicare Part B premium that is based on their income.

Does Medicare Part B pay for prescriptions?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. covers a limited number of outpatient prescription drugs under certain conditions. A part of a hospital where you get outpatient services, like an emergency department, observation unit, surgery center, or pain clinic.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

How long does it take to get Medicare Part B after?

This provides your Part A and Part B benefits. If you are automatically enrolled in Medicare, your card will arrive in the mail two to three months before your 65th birthday. Otherwise, you'll usually receive your card about three weeks to one month after applying for Medicare.

When should I apply for Social Security when I turn 66 and 2 months?

You can apply up to four months before you want your retirement benefits to start. For example, if you turn 62 on December 2, you can start your benefits as early as December. If you want your benefits to start in December, you can apply in August.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What income is used for Medicare Part B premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Understanding What Medicare Part B Offers

First, let’s take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications:...

Medicare Part B Enrollment Options and Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed...

The Cost of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium. For the most part, the premium for Medicare Part B is $134 per month. You also pay $204...

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment (known as a premium) for its services, some people may find it difficult to pay for the monthly...

Medicare Part B Special Circumstances and Updates

Some people don’t need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special condi...

Benefits of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage o...

What is covered by Medicare Part B?

In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

How long do you have to be in Medicare to get Medicare Part B?

You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

Why don't people enroll in Medicare Part B?

And some people choose not to enroll in Medicare Part B, because they don’t want to pay for medical coverage they feel they don’t need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage.

How much does Medicare pay if you make less than $500,000?

Individuals who earn more than $163,000 but less than $500,000 per year will pay $462.70 in Medicare Part B premiums per month. If you earn $500,000 per year or more, your Medicare Part B premium will be $491.60 per month. These amounts reflect individual incomes only.

How much is Medicare Part B in 2021?

That premium changes each year, usually increasing. In 2021, the Part B premium is $148.50 a month. You’ll also have an annual deductible of $203 in 2021 (an increase from the $198 deductible in 2020).

What is the number to call for Medicare?

1-800-810-1437 TTY 711. If you are about to turn 65 and need information regarding the various portions of Medicare, then you’ve come to the right place. We know how overwhelming all of the information regarding Medicare can be. And we want to help you choose a plan that meets your individual needs.

How much does a person make on Part B?

If you earn more than $109,000 and up to $136,000 per year as an individual, then you’ll pay $289.20 per month for Part B premiums. If you earn more than $136,000 and up to $163,000 for the year as a single person, you’ll pay $376.00 per month for Part B premiums.

Your other coverage

Do you have, or are you eligible for, other types of health or prescription drug coverage (like from a former or current employer or union)? If so, read the materials from your insurer or plan, or call them to find out how the coverage works with, or is affected by, Medicare.

Cost

How much are your premiums, deductibles, and other costs? How much do you pay for services like hospital stays or doctor visits? What’s the yearly limit on what you pay out-of-pocket? Your costs vary and may be different if you don’t follow the coverage rules.

Doctor and hospital choice

Do your doctors and other health care providers accept the coverage? Are the doctors you want to see accepting new patients? Do you have to choose your hospital and health care providers from a network? Do you need to get referrals?

Prescription drugs

Do you need to join a Medicare drug plan? Do you already have creditable prescription drug coverag e? Will you pay a penalty if you join a drug plan later? What will your prescription drugs cost under each plan? Are your drugs covered under the plan’s formulary? Are there any coverage rules that apply to your prescriptions?

Quality of care

Are you satisfied with your medical care? The quality of care and services given by plans and other health care providers can vary. Get help comparing plans and providers

Convenience

Where are the doctors’ offices? What are their hours? Which pharmacies can you use? Can you get your prescriptions by mail? Do the doctors use electronic health records prescribe electronically?

How much is Medicare Part B 2020?

Medicare Part B comes with an annual deductible of $198 for 2020. After you meet the deductible for the year, you typically pay 20% of the Medicare-approved amount for doctor services and other Medicare Part B benefits.

What to check after choosing Medicare Advantage?

So, after you choose a Medicare Advantage plan, you’ll want to check each year during open enrollment to see if there are any changes in your network. It’s also a good idea to find out which specialists, hospitals, home health agencies and skilled nursing facilities are in the plan’s network.

What is the copayment for Medicare?

Part D and Medicare Advantage plans with prescription drug coverage almost always charge a copayment or coinsurance for each of the medicines you purchase. Copays are a set amount you pay for each prescription filled, say $10 or $20.

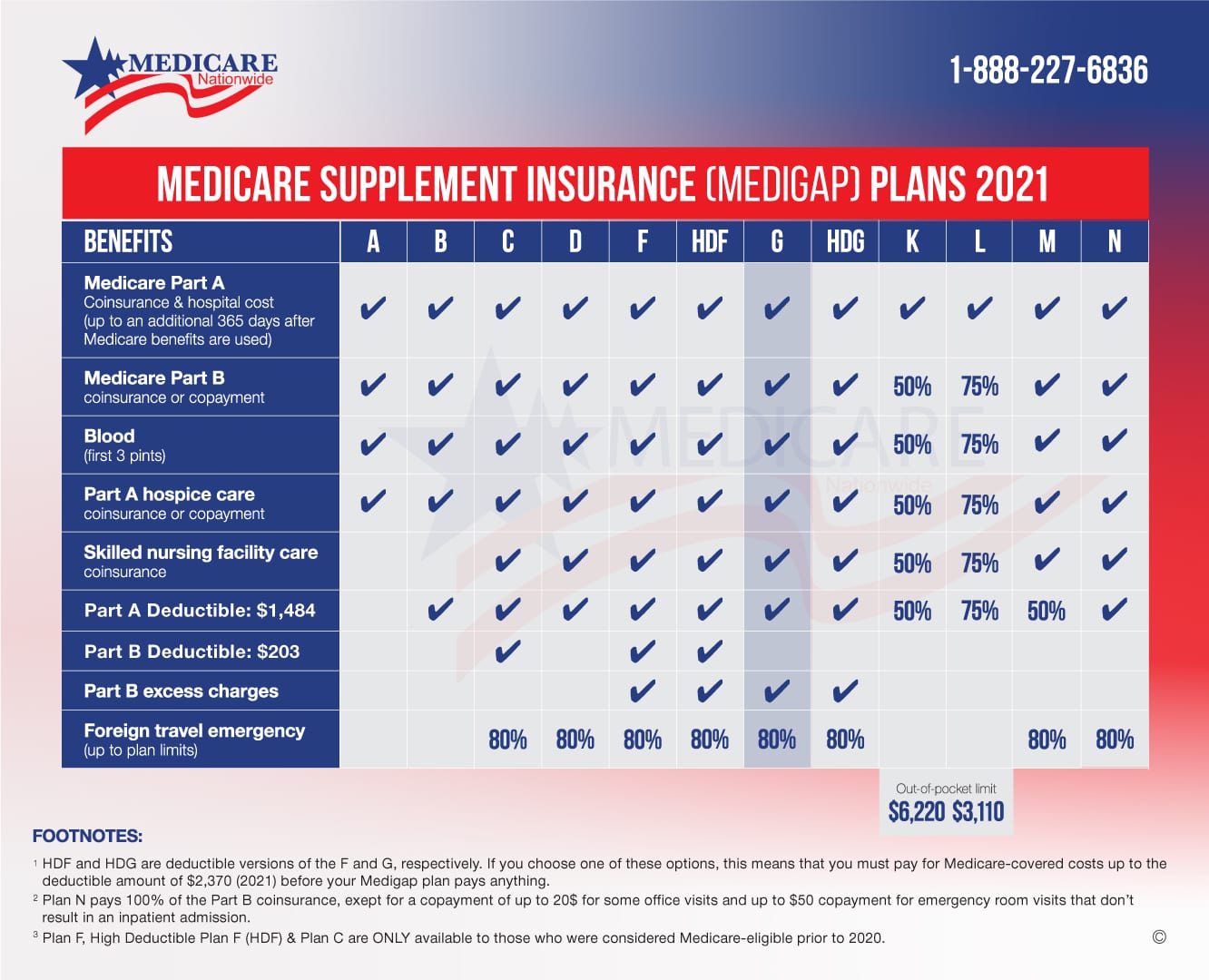

What is Medicare Supplement Insurance?

Medicare Supplement Insurance helps cover the out-of-pocket health care costs you can incur with Original Medicare Part A and Part B and hospice and home health care services. (If you have an Advantage plan, you may not purchase Medicare Supplement Insurance.) There are 10 standardized plans and premiums are regulated by the states. Massachusetts, Maine and WIsconsin have their own standardization. What you pay in monthly premiums can depend on where you live, what coverage you get and how old you are. You can learn more in this guide on comparing and selecting plans, with a side-by-side comparison of the different policies.

How much is Part D 2020?

In 2020, when you and your insurer have paid $4,020 in prescription drug costs, you are then responsible for 25% of all of your medicine costs.

How many standardized plans are there?

There are 10 standardized plans and premiums are regulated by the states. Massachusetts, Maine and WIsconsin have their own standardization. What you pay in monthly premiums can depend on where you live, what coverage you get and how old you are.

Does Medicare.gov compare plans?

Medicare.gov offers a tool to help compare Medicare Advantage Plans.

What is the difference between Medicare Part A and Part B?

Step 1: Determine which Medicare plan coverage option you want. Medicare beneficiaries could potentially only be enrolled in Medicare Part A (hospital insurance). Medicare Part B (medical insurance) is optional, as are several other types of Medicare coverage .

What are the different types of Medicare Advantage plans?

There are several different types of Medicare Advantage plans. These plan types include Medicare HMO plans, Medicare PPO plans and others. Learn more about the different types of Medicare Advantage plans to help you decide which one might be the best fit for you. Medicare Part D plans can also come in different types of formats, ...

How does Medigap work with Medicare?

How it works with Original Medicare: A Medigap plan works in conjunction with Original Medicare and helps to pay for some of Medicare’s out-of-pocket costs. You might consider this type of Medicare plan if: You wish to have less uncertainty with your out-of-pocket health care costs.

What is a Medigap plan?

Medigap plans can help provide coverage for some of the out-of-pocket expenses that are tied to Original Medicare. These can include Medicare deductibles, coinsurance, copayments and more. There are 10 different types of standardized Medigap plans available in most states, and each type of plan offers its own combination of benefits.

What is a Part D plan?

The Part D plan provides the prescription drug coverage that Original Medicare and some Medicare Advantage plans do not. You might consider this type of Medicare plan if: You want to have some help paying for your prescription drug costs. You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online ...

What is Medicare Part D?

Medicare Part D. Medicare Part D plans provide coverage for many prescription drugs. There are many different types of Medicare Part D plans, and each one offers its own formulary, which is the list of drugs covered by the plan. How it works with Original Medicare: Part D plans are used alongside Original Medicare or a Medicare Advantage plan ...

What are the benefits of Medicare Advantage?

Some of these additional benefits can include coverage for prescription drugs, dental, hearing, vision and more.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

What is the difference between Medicare Part A and Medicare Part B?

Original Medicare comprises two parts: Medicare Part A, which provides coverage for most costs related to hospital stays , and Medicare Part B, which covers doctor visits, lab work, outpatient services and preventive care. Part A is free to most people who qualify ...

How many days are there to make Medicare choices?

That’s day one of the 54 days when Americans 65 and older have to make their Medicare choices for 2018. These choices could save you hundreds, perhaps thousands of dollars a year and could well determine the quality of your health care, and your health, for years to come.

How much does Medicare cover for hospital stays?

There are many other costs you need to cover under Medicare. For example, Medicare Part A covers 100 percent of the first 60 days of a hospital stay. But for original Medicare enrollees, you must cover a deductible for each hospital stay. In 2017 that deductible was $1,316.

How much is Medicare Advantage premium?

The Centers for Medicare and Medicaid Services (CMS) says the average Medicare Advantage premium is expected to be about $30 a month for 2018, a slight dip from 2017. CMS also is predicting that enrollment in MA plans will reach an all-time high next year of 20.4 million people.

When did Medicare Part C start?

So in 1997 it created Medicare Part C, or what is known today as Medicare Advantage plans.

What happens if you don't enroll in Part D?

If you choose not to enroll in Part D when you're first eligible, you likely will pay a penalty when you do sign up, unless you’ve had creditable drug coverage from another source. One challenge: Part D plans vary widely. For example, two plans may have very different copays for the same drug.

What is Medicare Part B?

Medicare Part B covers some prescription drugs depending on if you meet specific criteria. Most medications covered by Part B are administered by a health professional. Some examples of medications Part B covers include: vaccines, such as flu, pneumonia, hepatitis B. certain injectable and infusion medications.

What are the out-of-pocket costs for Part B?

outpatient hospital services. mental health services. There are out-of-pocket costs you will pay for Part B including premiums, deductibles, and coinsurance. The rates change from year to year, and your out-of-pocket costs also depend on your earned income.

Why is Medicare Part D important?

Medicare Part D is an important benefit to help pay for prescription drug costs. Medicare pays a large part of drug costs but you still have to pay some portion. Since the cost of medications has steadily increased over the years, having Part D coverage can save you significantly on your medications.

What to consider when choosing a health insurance plan?

When choosing a plan, consider the following: what medications are covered. if your doctor and pharmacy are on the plan. the out-of-pocket costs. the plan rating (5-star plans are more expensive) if you need injections at the doctor’s office. each plan’s limits for medication coverage.

How much does Medicare pay for medications?

Medications account for a large part of costs for beneficiaries. Almost $1 for every $5 spent on Medicare services is for medications. A few medications are responsible for a large majority of money spent on Medicare Part B drug costs. Part B covers some very expensive medications, such as: immunosuppressants.

What are the parts of Medicare?

There are many misunderstandings about Medicare coverage, especially prescription drug coverage. The four parts (A, B, C, and D) cover different healthcare services, from hospital stays and doctor visits to prescription drugs and other benefits.

What is the average premium for Part B in 2021?

The average monthly premium for Part B in 2021 is $148.50, and the annual deductible is $203. In addition, you must pay 20 percent coinsurance for certain services after meeting your deductible. This includes doctor’s fees and medications.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.