How much is coinsurance for Medicare?

After meeting your $233 deductible, coinsurance is usually 20 percent of the Medicare-approved cost of most doctor services. Coinsurance varies from policy to policy.

What is the typical coinsurance amount for Medicare Part D plans?

Private Medicare plans, such as Medicare Advantage and Medicare Part D Prescription Drug Plans (PDP), may feature coinsurance of their own. While 20 percent is the typical coinsurance amount for Medicare Advantage plans, some plans may feature a 70-30 or 90-10 split.

What is the difference between Medicare coinsurance and copays?

The primary difference between coinsurance vs. copays is that copayments are a flat fee amount instead of a percentage. One way you can get some coverage for Medicare coinsurance is by purchasing Medicare Supplement Insurance.

When will the Medicare deductible and coinsurance and premium rates change?

Page 1 of 4 Update to Medicare Deductible, Coinsurance and Premium Rates for Calendar Year (CY) 2022 MLN Matters Number: MM12507 Related CR Release Date: November 30, 2021 Related CR Transmittal Number: R11136GI Related Change Request (CR) Number: 12507 Effective Date: January 1, 2022 Implementation Date: January 3, 2022

How much does Medicare pay for Part B?

You pay $166.00 per year for your Part B deductible. After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and durable medical equipment.

Does Medicare have a deductible?

Some Medicare drug plans don't have a deductible. Look for specific Medicare drug plan costs, and then call the plans you're interested in to get more details. If you have limited income and resources, your state may help you pay for Part A and/or Part B.

How much is Medicare Part B coinsurance?

With Medicare Part B, after you meet your deductible ( $203 in 2021), you typically pay 20 percent coinsurance of the Medicare-approved amount for most outpatient services and durable medical equipment.

How much will Medicare pay in 2021?

If you have Medicare Part A and are admitted to a hospital as an inpatient, this is how much you’ll pay for coinsurance in 2021: Days 1 to 60: $0 daily coinsurance. Days 61 to 90: $371 daily coinsurance. Day 91 and beyond: $742 daily coinsurance per each lifetime reserve day (up to 60 days over your lifetime)

What is Medicare supplement?

Medicare supplement or Medigap plans cover various types of Medicare coinsurance costs. Here’s a breakdown of what Medigap plans cover in terms of Part A and Part B coinsurance. Plan A and Plan B cover: Part A coinsurance and hospital costs up to 365 days after you’ve used up your Medicare benefits. Part A hospice coinsurance.

What is Medicare Part B?

Medicare Part B. Medigap. Takeaway. Medicare coinsurance is the share of the medical costs that you pay after you’ve reached your deductibles. Although original Medicare (part A and part B) covers most of your medical costs, it doesn’t cover everything. Medicare pays a portion of your medical costs, and you’re responsible for the remaining amount.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much is coinsurance for hospitalization?

Afterward, for an additional 30 days, the recipient will be charged a coinsurance amount of $352 per day.

What is coinsurance in insurance?

Coinsurance is the fee that is passed on to the recipient after a deductible has been met and premiums are current. This differs from a co-payment in that co-pays are generally flat fees that stay the same regardless of deductible or premium amounts.

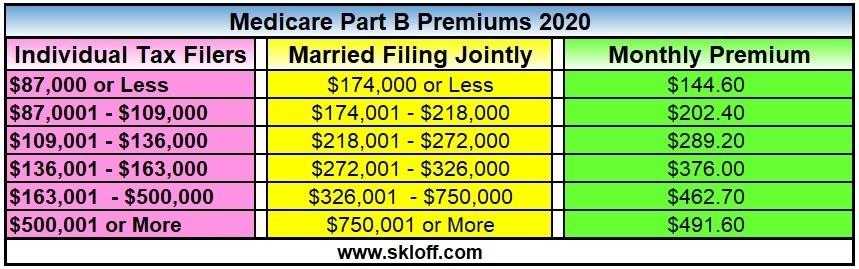

How much is coinsurance for 2020?

When considering the increase in coinsurance amounts, you’ll also need to factor in premium increases. In 2020, your last tax return and filing status will determine the bracket in which you are placed. For many individuals, married or not, the monthly premium required in order to maintain Medicare coverage is $144.60, but it can reach as high as $491.60 per month. Deductible rates are also on the rise in 2020 as most Medicare members will see an increase of around $13 that needs to be met prior to benefits applying to healthcare costs. Once again, this is where it pays to discuss your individual situation with a Medicare expert who can explain your options and possibly point you in the direction of plans that make sense for your financial and healthcare needs.

What changes will Medicare see in 2020?

Medicare recipients in 2020 will see some changes to the way that Medicare structures its financial requirements, and this includes the recipient’s co-insurance liability . If you depend on Medicare for healthcare, contact your plan manager to discuss your current and anticipated healthcare needs so that you can fully understand how changes in 2020 ...

Can you take advantage of additional savings with Medicare?

Additional Savings May Be Available. If you’re having a hard time meeting your financial obligations to Medicare for coverage, you may be able to take advantage of additional savings through dual-enrollment with Medicaid.

What percentage of coinsurance is required?

An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20% ). , these amounts may vary throughout the year due to changes in the drug’s total cost. The amount you pay will also depend on the.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay . (if the plan has one). You pay your share and your plan pays its share for covered drugs. If you pay. coinsurance. An amount you may be required to pay as your share ...

How much does a lower tier drug cost?

Generally, a drug in a lower tier will cost you less than a drug in a higher tier. level assigned to your drug. Once you and your plan spend $4,130 combined on drugs (including deductible), you’ll pay no more than 25% of the cost for prescription drugs until your out-of-pocket spending is $6,550, under the standard drug benefit.