The income requirements for Medicare savings programs in 2021 are summarized in the following table:

| Medicare savings program | Individual monthly income limit | Married couple monthly income limit | Individual resource limit | Married couple resource limit |

| QMB | $1,094 | $1,472 | $7,970 | $11,960 |

| SLMB | $1,308 | $1,762 | $7,970 | $11,960 |

| QI | $1,469 | $1,980 | $7,970 | $11,960 |

| QDWI | $4,379 | $5,892 | $4,000 | $6,000 |

Full Answer

How do I qualify for Medicare savings programs?

Your income must be at or below specified limits each month. Your household resources must also be at or below certain limits. If you qualify for one or more of the Medicare savings programs, you may also qualify for the Extra Help program to help with your prescription drug costs. What are Medicare savings programs?

Who can benefit from a Medicare savings program?

A person with a low income may benefit from a Medicare savings program. Medicare savings programs assist people with low income levels. The programs have tiered levels, based on an individual’s income. If a person’s income is too high for one program, then a different program with a higher income limit may suit them.

Do I qualify for Medicare cost-saving programs?

If your monthly income is below $1630 (or below $2198 if married) you may qualify for several Medicare cost-savings benefit programs. The following information will help us determine which programs you might be eligible for. What is your marital status?

What are the different types of Medicare savings programs?

Types of Medicare Savings Programs 1 Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. ... 2 Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium. ... 3 Qualifying Individual (QI) Program s are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. ... More items...

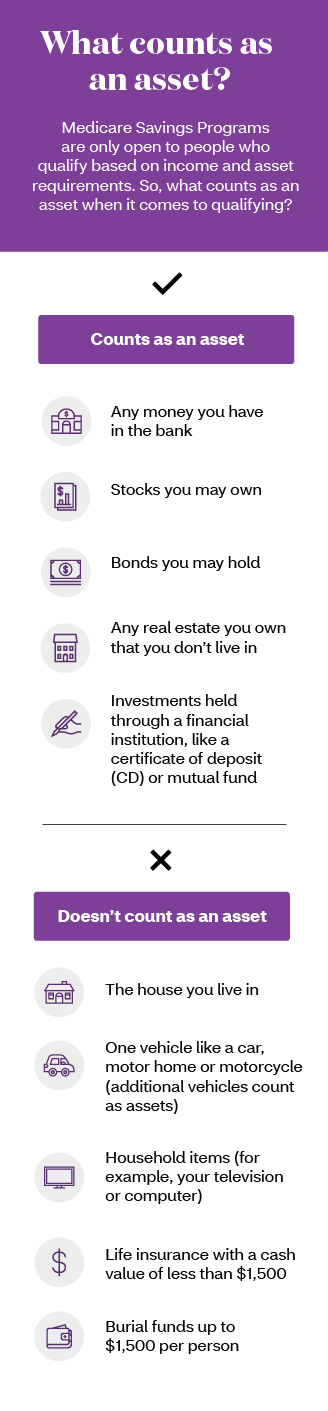

What assets are considered for Medicare?

Assets are resources such as savings and checking accounts, stocks, bonds, mutual funds, retirement accounts, and real estate....These include:Your primary house.One car.Household goods and wedding/ engagement rings.Burial spaces.Burial funds up to $1,500 per person.Life insurance with a cash value of less than $1,500.

How much money can you have in the bank if your on Medicare?

You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple. As of July 1, 2022 the asset limit for some Medi-Cal programs will go up to $130,000 for an individual and $195,000 for a couple. These programs include all the ones listed below except Supplemental Security Income (SSI).

Is Medicare eligibility based on assets?

Older People with Low Incomes Generally Have Few Assets In determining eligibility for Medicaid and the Medicare Savings Programs, countable assets include items such as money in checking or savings ac- counts, bonds, stocks, or mutual funds.

What are asset limits?

Asset limits serve as a barrier to economic security and mobility by actively discouraging families from attempting to save and build the resources they need to get ahead. They can also prevent middle-income families from accessing needed assistance in the event of an unexpected economic shock.

Does Medicare look at your bank account?

Medicare will usually check your bank accounts, as well as your other assets when you apply for financial assistance with Medicare costs. However, eligibility requirements and verification methods vary depending on what state you live in. Some states don't have asset limits for Medicare savings programs.

Does Medicare look into your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

Is Medicare based on income or assets?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Does inheritance count as income for Medicare?

Medicare eligibility is based on age, illness and/or disability status rather than income. Inheriting money or receiving any other windfall, such as a lottery payout, does not bar you in any way from receiving Medicare benefits.

How can I hide money from Medicaid?

5 Ways To Protect Your Money from MedicaidAsset protection trust. Asset protection trusts are set up to protect your wealth. ... Income trusts. When you apply for Medicaid, there is a strict limit on your income. ... Promissory notes and private annuities. ... Caregiver Agreement. ... Spousal transfers.

What are 3 types of assets?

Assets are generally classified in three ways:Convertibility: Classifying assets based on how easy it is to convert them into cash.Physical Existence: Classifying assets based on their physical existence (in other words, tangible vs. ... Usage: Classifying assets based on their business operation usage/purpose.

What assets can you have and still qualify for SSI?

To get SSI, your countable resources must not be worth more than $2,000 for an individual or $3,000 for a couple. We call this the resource limit. Countable resources are the things you own that count toward the resource limit.

Are assets considered income?

Assets themselves are not counted as income. But any income that an asset produces is normally counted when determining a household's income eligibility.

What Are the 4 Medicare Savings Programs?

There are four Medicare Savings Programs, and each is designed to help adults with different levels of income and resources. If you have Original M...

What Is the Income Limit for the Medicare Savings Program?

Each MSP was created to help different groups of people pay for their Medicare costs. Because of this, each Medicare Savings Program has different...

Who Is Eligible for Medicare Savings Program?

Remember, what is Medicare Savings Program built to do? MSPs are designed to help people with limited incomes and resources afford Medicare health...

What items are not counted as resources?

As you read above, each MSP has resource limits you can’t exceed. Resources typically refer to the money you have in the bank, stocks and bonds. Be...

How Much Money Can You Have in the Bank on Medicare?

Money in bank accounts is considered a resource when determining whether you’re eligible for a Medicare Savings Plan. This amount changes depending...

Key Takeaways

Wondering how to get help with Part A & B costs? You may qualify for the Medicare Savings Programs (MSPs).

What are Medicare Savings Programs?

These are Medicaid-administered benefits that help cover Medicare premiums and out-of-pocket costs, such as deductibles and coinsurance. Who qualifies for Medicare Savings Programs? MSPs are available for Medicare beneficiaries with limited incomes and resources who do not qualify to be fully enrolled in Medicaid.

What is the income limit for Medicare Savings Programs?

It depends. The four programs are listed below, along with what each one pays for and the income and resource level limits that must be met to qualify. If you want to know, “Do I qualify for Medicare Savings Programs?”, this chart can provide an answer*.

Get help with Part D Prescription Drug Costs

Does Medicare pay for prescriptions? Yes— Medicare Part D is available to help cover the cost of prescription drugs. This benefit is offered through private, Medicare-approved plans. Most people enrolled in a Part D plan have out-of-pocket expenses.

What is Extra Help from Medicare?

Extra Help is a federal program that helps people with limited income and resources pay for their Part D premiums and drug costs. What exactly does Extra Help with Medicare cover? Most people who qualify will pay:

Qualifying for Extra Help with Medicare Costs

You may be wondering, “Am I qualified for Medicare Extra Help?” There are different levels of Extra Help available, depending on income and assets. People with a lower income and fewer assets get more help with their Medicare drug plan costs.

Need help sorting through your Medicare choices?

Are Medicare Advantage plans worth it? Does Medicare cover cataract surgery? What home health care is covered by Medicare? If you have questions and need help navigating your Medicare options, we can help.

Key Takeaways

Medicare Savings Programs (MSP) help pay the medical costs for Medicare beneficiaries who have limited income and resources.

What Are the 4 Medicare Savings Programs?

There are four Medicare Savings Programs, and each is designed to help adults with different levels of income and resources. If you have Original Medicare (Parts A and B) and have trouble paying your medical bills, one of these four programs may be able to help you:

What Is the Income Limit for the Medicare Savings Program?

Each MSP was created to help different groups of people pay for their Medicare costs. Because of this, each Medicare Savings Program has different income and resource limits you’ll need to meet to qualify. These limits get adjusted each year. For 2021, the Medicare Savings Program income and resource limits are:

Who Is Eligible for Medicare Savings Program?

Remember, what is Medicare Savings Program built to do? MSPs are designed to help people with limited incomes and resources afford Medicare health coverage. Because each MSP is administered at the state level, there may be different qualifying factors based on where you live.

How to Apply to the Medicare Savings Program

To apply for a Medicare Savings Program, you’ll need to contact your State Health Insurance Assistance Program (SHIP). These state-run organizations receive federal funding to help provide financial assistance through MSPs and Part D Extra Help. You can also contact a licensed insurance agent, like the ones at GoHealth.

How Much Money Can You Have in the Bank on Medicare?

Money in bank accounts is considered a resource when determining whether you’re eligible for a Medicare Savings Plan. This amount changes depending on which Medicare Savings Program you qualify for. Just like with income limits, your state may accept your application if your resources are higher than the limits allowed.

Sources

This website is operated by GoHealth, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) is designed to cover all or part of Medicare out-of-pocket expenses that encumber Medicare recipients who live within limited financial means.

What is a Medicare summary notice?

You will also receive a Medicare Summary Notice (MSN), which is proof of being in the program and shows the healthcare provider you should not be billed for services, deductibles, coinsurance or copayments. An exception is outpatient prescriptions.

What is QDWI in Medicare?

Qualified Disabled and Working Individuals (QDWI) Program for Part A premiums. If your application for the QMB Program is accepted, you will receive a QMB card. Be sure to show this card along with your Medicare or Medicaid card every time you receive healthcare services. You will also receive a Medicare Summary Notice (MSN), ...

Is Medicare cost prohibitive?

The cost of Medicare benefits in the form of premiums, coinsurance, copayments and deductibles can raise concerns about affordability, especially when you are on a limited income. For Medicare recipients under a certain income and asset level, Medicare benefits can be cost prohibitive.

Who funds Medicare savings programs?

These four Medicare savings programs are funded by the federal government but operated by Medicaid in each state:

What can Medicare save you?

Medicare savings programs can help you pay Part A and Part B premiums, deductibles, copays, and coinsurance.

Why were Medicare and Coinsurance created?

These programs were created because not everyone reaches retirement age with the same ability to handle expenses like Medicare premiums, copays, coinsurance, deductibles, and the cost of prescription drugs.

What to do if medicaid denies application?

If Medicaid denies your application, you may be able to file an appeal. Here are some steps you can take to apply for a Medicare savings program: Familiarize yourself with the kinds of questions you may be asked when you apply. The form is available in multiple languages.

What documents are needed to apply for Medicare?

Before you begin applying, gather supporting documents such as your Social Security and Medicare cards, proof of your address and citizenship, bank statements, IRA or 401k statements, tax returns, Social Security awards statements, and Medicare notices.

How to apply for medicaid?

To apply for the a program, you’ll need to contact your state Medicaid office. You can check online to find your state’s office locations, or call Medicare at 800-MEDICARE. Once you submit your application, you should receive a confirmation or denial within about 45 days. If you’re denied, you can request an appeal.

How old do you have to be to qualify for QDWI?

To qualify for the QDWI program, you must be disabled, working, and under 65 years old. If you went back to work and lost your premium-free Medicare Part A coverage, and if you’re not getting medical help from your state right now, you may be eligible for the QDWI program. You must enroll each year.

What if I don't qualify for QMB?

If you don’t qualify for either the QMB or SLMB programs, you might be eligible for the Qualifying Individual Program (QI). Like the SLMB Program, the QI Program only pays for Medicare Part B premiums. But, if you qualify, then you automatically qualify for the Extra Help Program.

What is QMB in Medicare?

The Qualified Medicare Beneficiary Program (QMB) is great because it helps individuals pay for both Medicare Part A and Medicare Part B premiums. Its funds can also be used toward deductibles, coinsurance, and copayments.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

How many types of MSPs are there?

There are four kinds of MSPs. Each type of MSP is tailored to different needs and circumstances. Qualified Medicare Beneficiary (QMB) Programs pay most of your out-of-pocket costs. These costs include deductibles, copays, coinsurance, and Part B premiums. A QMB will also pay the premium for Part A if you haven’t worked 40 quarters.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

Do you have to have limited resources to qualify for an MSP?

In addition to the income limits, you must have limited resources to qualify for an MSP.

Does QMB pay for Part A?

A QMB will also pay the premium for Part A if you haven’t worked 40 quarters. Those who qualify for the QMB program are also automatically eligible for the Extra Help program for prescription drugs. Specified Low-Income Medicare Beneficiary (SLMB) Programs pay your Part B premium.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What are the criteria for Medicaid?

Medicaid limits enrollment to individuals who meet the following criteria: is aged years, is working, and has a disability. returned to work and lost the premium-free Part A. is not getting state medical assistance. meets the resources and income limits.

What are the eligibility criteria for MSP?

To receive MSP benefits individuals must meet the following eligibility criteria: have or be eligible for Medicare Part A. live in the state where they are applying for the QMB program. have limited income, savings, and resources.

What is SLMB in Medicare?

The SLMB program helps people who are enrolled in Medicare Part A to pay for their Medicare Part B premiums. They must also have limited resources and income. The program does not help with any other costs, such as copays or deductibles.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How many MSPs are there?

In this article, we discuss the four MSPs, eligibility, and enrollment. Finally, we look at the Extra Help program.

What is the monthly income for Medicare?

If your monthly income is below $1630 (or below $2198 if married) you may qualify for several Medicare cost-savings benefit programs. The following information will help us determine which programs you might be eligible for.

What is extra help for Medicare?

Extra Help is the federal program that helps with Part D prescription drug costs if you meet the income and asset requirements. This change helps more people become eligible for MSPs and was a result of the Medicare Improvements for Patients and Providers Act (MIPPA). In 2021, the asset limits for full Extra Help are $9,470 for individuals ...

What are the asset limits for extra help in 2021?

In 2021, the asset limits for full Extra Help are $9,470 for individuals and $14,960 for couples. There is an automatic disregard (subtraction) of $1,500 from these limits for burial funds. This means that you could be eligible for an MSP with assets totaling $7,970 for individuals and $11,960 for couples. MSP limits appear lower than Extra Help limits because they do not automatically include burial funds. This means that the $1,500 disregard for MSP eligibility typically will not apply unless you prove that you have set aside these funds in a designated account or in a pre-paid burial fund.

What states do not have asset limits for MSPs?

* Alabama, Arizona, Connecticut, Delaware, Mississippi, New York, Oregon, Vermont, and the District of Columbia do not have asset limits for MSPs (as of January 2019).

What is the Medicare Rights Center?

If you live in New York, the Medicare Rights Center can help you enroll in various Medicare cost-savings programs. Please answer a few questions to see if we can connect you with a trained benefits enrollment counselor.

Why is the MSP limit lower than the extra help limit?

MSP limits appear lower than Extra Help limits because they do not automatically include burial funds. This means that the $1,500 disregard for MSP eligibility typically will not apply unless you prove that you have set aside these funds in a designated account or in a pre-paid burial fund.

Does the federal government give free counseling?

Each state offers a State Health Insurance Assistance Program (SHIP), partly funded by the federal government, to give you free counseling and assistance. A SHIP counselor may be available by phone or in person.

What is the monthly income for Medicare?

If your monthly income is below $1630 (or below $2198 if married) you may qualify for several Medicare cost-savings benefit programs. The following information will help us determine which programs you might be eligible for.

How to apply for MSP?

Before applying for an MSP, you should call your local Medicaid office for application steps, submission information (online, mail, appointment, or through community health centers and other organizations), and other state-specific guidelines. Call your State Health Insurance Assistance Program (SHIP) to find out if you are eligible for an MSP in your state.

What is the Medicare Rights Center?

If you live in New York, the Medicare Rights Center can help you enroll in various Medicare cost-savings programs. Please answer a few questions to see if we can connect you with a trained benefits enrollment counselor.

Does the federal government give free counseling?

Each state offers a State Health Insurance Assistance Program (SHIP), partly funded by the federal government, to give you free counseling and assistance. A SHIP counselor may be available by phone or in person.

Does Ship offer free counseling?

Each state offers a SHIP, partly funded by the federal government, to give you free counseling and assistance. A SHIP counselor may be available by phone or in person.