People covered by traditional Medicare paid an average of $6,168 for health care in 2018. They spent almost half of that money (47 percent) on Medicare or supplemental insurance premiums. The remainder was out-of-pocket spending for health care services that Medicare covers (26 percent) and for those that the program does not cover (27 percent).

Full Answer

Who pays for higher Medicare spending?

Taxpayers who receive wages, salaries, or self-employment income are required to pay Medicare tax on all of their wages. Previously, there was a limit on the amount of income on which Medicare tax was assessed, but this was eliminated in 1993.

How much is spent on Medicare?

NHE grew 4.6% to $3.8 trillion in 2019, or $11,582 per person, and accounted for 17.7% of Gross Domestic Product (GDP). Medicare spending grew 6.7% to $799.4 billion in 2019, or 21 percent of total NHE. Medicaid spending grew 2.9% to $613.5 billion in 2019, or 16 percent of total NHE.

What does Medicare spending per beneficiary mean?

Medicare Spending per Beneficiary (MSPB) below. Beneficiary populations eligible to be included in the MSPB Measure are made up of beneficiaries who were enrolled in both Medicare Parts A and B for the period 93 days prior to IPPS hospital admission until 30 days after discharge from a short-term acute care hospital stay, where the stay occurs

Is Medicare funded by state or government?

That means Medicare is primarily funded by taxpayers through general federal tax revenue, payroll tax revenue from the Medicare tax, and premiums paid by its beneficiaries. How Medicare is funded Funding for Medicare comes from the Medicare Trust Funds, which are two separate trust fund accounts held by the U.S. Treasury:

What type of spending is Medicare?

Medicare spending is a major driver of long-term federal spending and is projected to rise from 4 percent of gross domestic product (GDP) in fiscal year 2020 to about 6 percent in fiscal year 2051 due to the retirement of the baby-boom generation and the rapid growth of per capita healthcare costs.

What is healthcare spending?

Health spending measures the final consumption of health care goods and services (i.e. current health expenditure) including personal health care (curative care, rehabilitative care, long-term care, ancillary services and medical goods) and collective services (prevention and public health services as well as health ...

Where does the money for Medicare go?

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. deductibles, coinsurance, and copayments if you meet certain conditions.

Where is money spent in healthcare?

Public spending in 2020 represented half (51%) of overall spending. Public sector spending includes spending on insurance programs, such as Medicare and Medicaid, as well as other government spending, such as spending on public health and research.

What is current expenditure?

Current expenditure is expenditure on goods and services consumed within the current year, which needs to be made recurrently to sustain the production of educational services. Minor expenditure on items of equipment, below a certain cost threshold, is also reported as current spending.

What is the largest component of healthcare expenditures?

The main categories of personal health care spending include spending on hospital care ($1,082.5 billion or 32.4 percent of total health spending), physician services ($521.7 billion or 15.6 percent), clinical services ($143.2 billion or 4.3 percent), and prescription drugs ($328.6 billion or 9.8 percent).

What is Medicare funding?

How is Medicare financed? Funding for Medicare, which totaled $888 billion in 2021, comes primarily from general revenues, payroll tax revenues, and premiums paid by beneficiaries (Figure 1). Other sources include taxes on Social Security benefits, payments from states, and interest.

How does Medicare get paid for?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

How is Medicare Part A funded?

Part A, the Hospital Insurance (HI) trust fund, is financed primarily through a dedicated payroll tax of 2.9 percent of earnings paid by employers and their employees (1.45 percent each).

What percentage of Medicare is hospital expenditure?

Hospital expenses are the largest single component of Medicare’s spending, accounting for 40 percent of the program’s spending. That is not surprising, as hospitalizations are associated with high-cost health episodes. However, the share of spending devoted to hospital care has declined since the program's inception.

What is Medicare budget?

Budget Basics: Medicare. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

What percentage of Medicare is home health?

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for about one-fifth of all healthcare spending in the United States, including 32 percent of all prescription drug costs and 39 percent of home health spending in the United States — which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury. 4

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

Overview of Medicare Spending

Medicare is currently the nation’s second-largest social insurance program. Last year, Medicare insured 62.6 million Americans, including 54.1 million seniors and 8.5 million disabled beneficiaries under 65. Annual expenditures totaled $926 billion.

Projections for Medicare Spending

Trustees estimate that spending for Medicare Part A could climb from 1.7% to 2.2% by 2045. On the other hand, Trustees predict that Part B and Part D will grow at an even faster rate. According to the report, over the next seven years, spending for Part B will grow from 2.0% to 3.6%.

What is the Future of Government Spending on Medicare?

The debate over the $3.5 trillion infrastructure bill continues. It’s unknown how Congress plans to control Medicare spending in the future. However, Democrats want to expand Medicare coverage in the near future to include dental, vision, and hearing benefits.

How much did Medicare cost in 1970?

In 1970, some 7.5 billion U.S. dollars were spent on the Medicare program in the United States. Almost fifty years later, this figure stood at some 796.2 billion U.S. dollars. This statistic depicts total Medicare spending from 1970 to 2019.

What is Medicare coverage?

Increasing Medicare coverage. Medicare is the federal health insurance program in the U.S. for the elderly and those with disabilities. In the U.S., the share of the population with any type of health insurance has increased to over 90 percent in the past decade.

How much will Alzheimer's cost in 2020?

In 2020, Alzheimer's disease was estimated to cost Medicare and Medicaid around 206 billion U.S. dollars in care costs; by 2050, this number is projected to climb to 777 billion dollars.

How is Medicare funded?

How Medicare Is Funded. Medicare is funded by two trust funds that can only be used for Medicare. The hospital insurance trust fund is funded by payroll taxes paid by employees, employers, and the self-employed. These funds are used to pay for Medicare Part A benefits. 11 .

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

How is Medicare supplemental insurance fund funded?

Medicare's supplementary medical insurance trust fund is funded by Congress, premiums from people enrolled in Medicare, and other avenues, such as investment income from the trust fund. These funds pay for Medicare Part B benefits, Part D benefits, and program administration expenses.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is the Medicare tax rate for 2013?

On Jan. 1, 2013, the ACA also imposed an additional Medicare tax of 0.9% on all income above a certain level for high-income taxpayers. Single filers have to pay this additional amount on all earned income they receive above $200,000 and married taxpayers filing jointly owe it on earned income in excess of $250,000.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How much did Medicaid increase in 2014?

The ACA Medicaid expansion’s effect on spending is evident in 2014. Medicaid spending increased by 11 percent—the largest single year increase since 2001—and its share of spending increased from 15.5 percent to 16.4 percent.

What are the changes in Medicare and Medicaid?

Changes in the share of spending paid for by Medicare and Medicaid are tied to changes in program expansion and payment policy as well as economic cyclical factors for Medicaid. Private health insurance has historically been the largest source of funds for health care spending since the 1970s.

What is a close look at national health expenditures?

A close look at national health expenditures can offer physicians a clearer vision of the total costs and funding that are required each year to keep the health care system functioning. A new analysis (log in) from the AMA sheds light on health care spending. How our health care dollars are spent.

Summary

- Medicare, the federal health insurance program for nearly 60 million people ages 65 and over and younger people with permanent disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the m…

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 47 percent to 42 percent, sp…

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

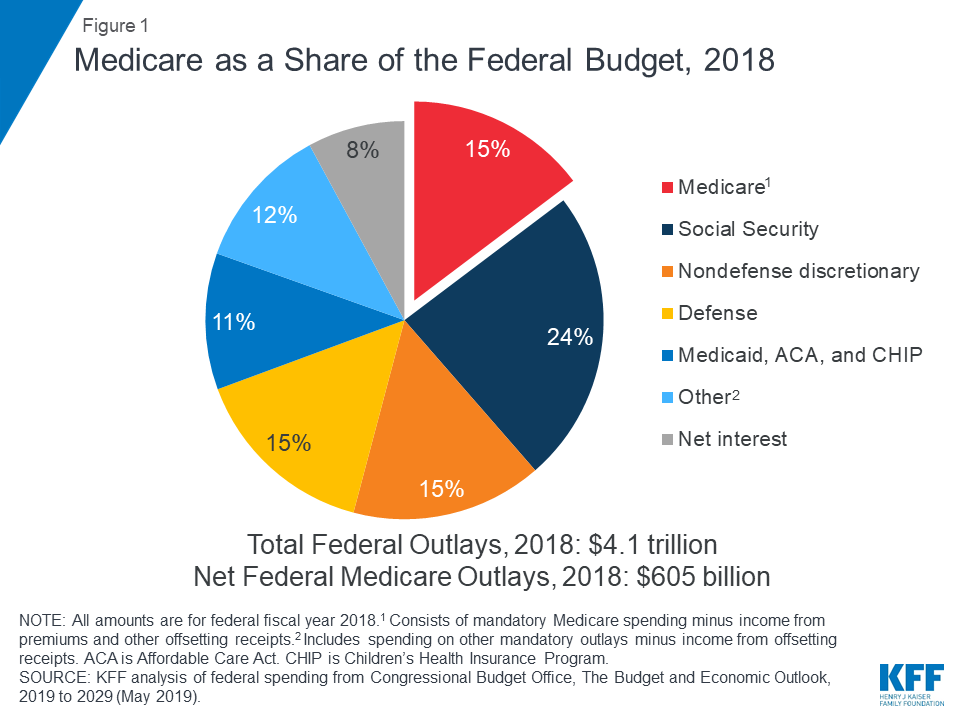

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…