If you are already receiving Social Security retirement benefits at age 65, then you will also be eligible for premium-free Part A coverage. If you do not yet receive retirement benefits, you still qualify for premium-free Part A as long as you or your spouse worked and paid Medicare taxes for around 10 years.

How to apply for Medicare without claiming social security?

How to Apply for Medicare Without Claiming Social Security. A Medicare card generally arrives in the mail three months before your 65th birthday, and Medicare Part B premiums are withheld from your Social Security check. "People can [sign up for Social Security] as early as age 62. If they do so before the age of 65,...

Will I have to pay Medicare Part B If I receive Social Security?

If you are not yet receiving Social Security benefits, you will have to pay Medicare directly for Part B coverage. Once you are collecting Social Security, the premiums will be deducted from your monthly benefit payment.

Can Social Security and Medicare be taken apart?

Social Security and Medicare are separate decisions. Some people are automatically enrolled in Medicare. Remember to sign up for Medicare on time. Beneficiaries who work can avoid the Medicare late enrollment penalty. Signing up for Medicare after you missed the Initial Enrollment Period can trigger penalties.

Do I have to pay for Medicare Part A?

You will have to pay Medicare directly for all coverage, including Part A (unless you or your spouse are among the small number of state and local government employees who paid Medicare taxes but not Social Security taxes ; in this case, you may be able to get Part A for free).

Can you get Medicare Part A without Social Security?

You will have to pay Medicare directly for all coverage, including Part A (unless you or your spouse are among the small number of state and local government employees who paid Medicare taxes but not Social Security taxes; in this case, you may be able to get Part A for free).

How do you pay for Medicare if you are not taking Social Security?

If you don't get benefits from Social Security (or the Railroad Retirement Board), you'll get a premium bill from Medicare. Get a sample of the Medicare bill. An extra amount you pay in addition to your Part D plan premium, if your income is above a certain amount.

Can you just get Medicare Part A only?

Just the Essentials... Eligible people can choose to join Medicare Part A only, but it covers only hospital stay expenses. Delayed enrollment in Part A can mean a 10% increase to your premium when you do sign up. If you sign up for Part A only, a similar penalty applies to delayed enrollment in Part B.

What makes someone eligible for Medicare Part A?

Some people may be 65 but ineligible for premium-free Medicare Part A. For instance, a person who did not work for 40 quarters and pay Medicare taxes would not be eligible. If a person has paid Medicare taxes for 30–39 quarters, they can pay a reduced premium for Medicare Part A, at $259 per month.

Does Medicare automatically start at 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

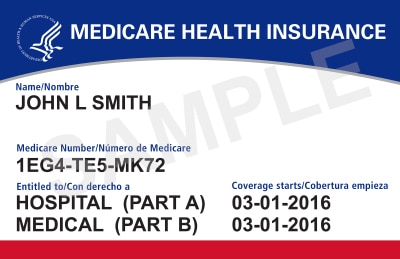

What documents do I need to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

How long before you turn 65 do you apply for Medicare?

3 monthsYour first chance to sign up (Initial Enrollment Period) It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

Can I get Medicare if I never worked?

You can still get Medicare if you never worked, but it will likely be more expensive. Unless you worked and paid Medicare taxes for 10 years — also measured as 40 quarters — you will have to pay a monthly premium for Part A. This may differ depending on your spouse or if you spent some time in the workforce.

Is my spouse eligible for Medicare if she never worked?

Can I Get Medicare If I've Never Worked? If you've never worked, you may still qualify for premium-free Medicare Part A. This is based on your spouse's work history or if you have certain medical conditions or disabilities. It's also possible to get Medicare coverage if you pay a monthly Part A premium.

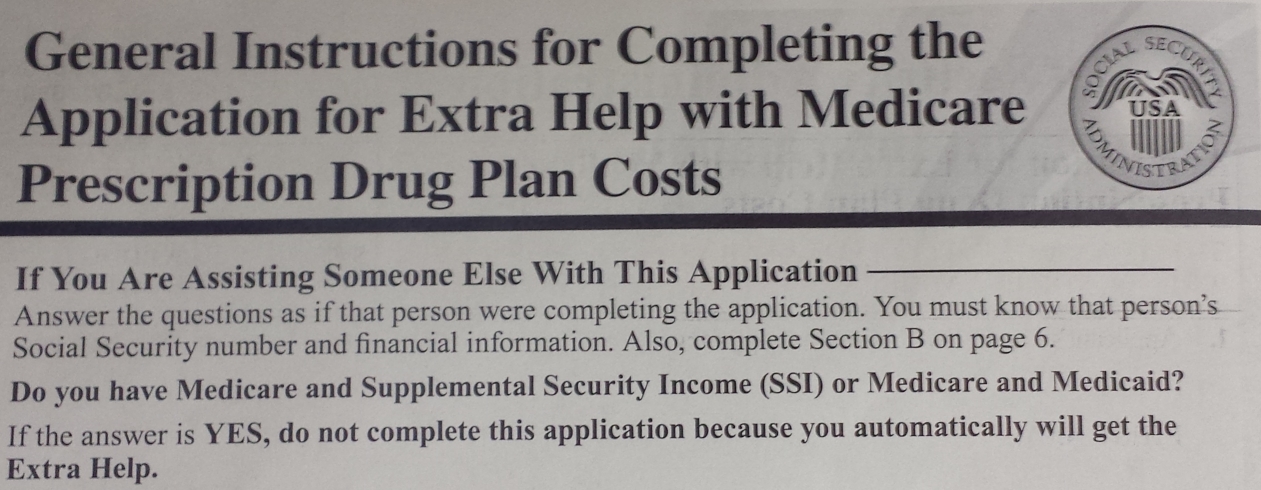

How do I qualify for dual Medicare and Medicaid?

Persons who are eligible for both Medicare and Medicaid are called “dual eligibles”, or sometimes, Medicare-Medicaid enrollees. To be considered dually eligible, persons must be enrolled in Medicare Part A (hospital insurance), and / or Medicare Part B (medical insurance).

How long do you have to sign up for Medicare if you don't sign up?

Here’s why you need to be on top of your deadline: If you don’t sign up during those seven months , you may be subject to a permanent surcharge once you do enroll. You’ll find more information on sign-up periods in Medicare publications on enrolling in Part B and Part D.

How long is Medicare for a person born in 1955?

For people born in 1955, it is 66 years and 2 months; it settles at 67 for people born in 1960 or later. Even if you don’t qualify for Social Security, you can sign up for Medicare at 65 as long you are a U.S. citizen or lawful permanent resident.

What is the FRA age for Medicare?

Keep in mind. The Medicare eligibility age of 65 no longer coincides with Social Security’s full retirement age (FRA) — the age when you qualify for 100 percent of the Social Security benefit calculated from your lifetime earnings. FRA was long set at 65 but it is gradually going up . For people born in 1955, it is 66 years and 2 months;

Does Social Security automatically sign you up for Medicare at 65?

But you should be aware of the enrollment deadlines, as Social Security will not sign you up automatically at 65 for “traditional Medicare” — Part A (hospitalization) and Part B (health insurance) — as it typically does for people already collecting Social Security benefits.

Can you deny Medicare if you have a preexisting condition?

Your Part D provider cannot deny coverage even if you are in poor health or have a preexisting condition. You can choose between paying Medicare directly or having Part D costs deducted from your Social Security payment.

How are Social Security and Medicare related?

Medicare and Social Security offer different types of benefits, so how are they related? Medicare enrollment is actually processed by the Social Security Administration, or SSA.

Eligibility for Medicare

You are eligible for Medicare health insurance coverage if you are 65 or older and are a U.S. citizen or permanent legal resident. If you are already receiving Social Security retirement benefits at age 65, then you will also be eligible for premium-free Part A coverage.

Social Security Disability Insurance

When people discuss Social Security benefits, they are usually referring to retirement benefits. However, Social Security also administers disability benefits to qualified individuals.

Enrolling in Medicare coverage after receiving Social Security benefits

If you began receiving Social Security benefits at least 4 months before turning 65, Medicare enrollment occurs automatically during your Initial Enrollment Period (IEP), which lasts for 7 months. It begins 3 months before the month you turn 65 and ends 3 months after your birth month.

Remember the Initial Enrollment Period

It is important to remember that you will still have an Initial Enrollment Period in this situation. It is the same 7-month period that surrounds your 65th birthday.

What should I do during the Initial Enrollment Period?

If you don't already receive Social Security benefits when your Initial Enrollment Period comes around, you will have to contact the SSA to manually enroll. This can be done in three ways: online, in person, or by phone.

Enrolling outside of the Initial Enrollment Period

Medicare enrollment is restricted to specific periods. If you miss your Initial Enrollment Period , you may sign up during either the General Enrollment Period or a Special Enrollment Period, if you qualify for one.

How much is Medicare Part A coverage?

Currently, the maximum premium for Medicare Part A coverage is $437 per month. Persons paying a premium for Medicare Part A coverage must also obtain and pay a premium for Medicare Part B coverage.

What is Medicare Part A?

Medicare Part A provides coverage if you are admitted to a hospital that accepts Medicare for inpatient care. The hospital admission must be ordered by a doctor. In some cases, a hospital is required to approve inpatient treatment during the hospital stay.

How old do you have to be to get Medicare?

Limited Eligibility Before Age 65. If you are under 65 years old, you may be eligible for Medicare Part A coverage if you are a U.S. citizen or have been a permanent legal U.S. resident for five years, and:

Is Medicare Part A part of Medicare Part B?

Medicare Part A is part of Original Medicare, which includes Medicare Part B. Medicare Part C involves Medicare Advantage plans that combine parts of coverages under Parts A and B. Medicare Part D involves prescription drug coverage. Click the links below for more information on the other parts of Medicare coverage.

Does Medicare cover hospice?

Medicare Part A covers hospice care when a hospice doctor and a primary care doctor certify that a patient is terminally ill with a life expectancy of six months or less. Covered patients must also accept palliative care rather than care intended to cure an illness.

Do you pay a premium on Medicare Part A?

Enrollees in Medicare Part A usually are not charged a monthly premium for coverage. If you are already receiving retirement benefits from Social Security or the Railroad Board (or are eligible for them) when you are eligible for Medicare Part A coverage you will not be charged a premium.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

Why does Part A end?

There are special rules for when premium-free Part A ends for people with ESRD. Premium Part A and Part B coverage can be voluntarily terminated because premium payments are required. Premium Part A and Part B coverage ends due to: Voluntary disenrollment request (coverage ends prospectively); Failure to pay premiums;

What happens if you decline Medicare Part B?

If you decline Part B coverage, you may be faced with late penalties when you sign up at a later time. Unlike with Part A, this will not cause you to lose your Social Security benefits. This is because you do not pay taxes for Medicare Part B.

Which law created both Social Security and Medicare?

The 1965 law that created both Social Security and Medicare provided the answer. Judge Rosemary Collyer stated that "requiring a mechanism for Plaintiffs and others in their situation to 'dis-enroll' would be contrary to congressional intent, which was to provide ' mandatory ' benefits under Medicare Part A for those receiving Social Security ...

What is Medicare Advantage?

Medicare Advantage plans include everything that Part A and Part B cover and may include Part D coverage if you choose. Like the other parts of Medicare, these plans will cost you a monthly premium. Other health plan costs include deductibles, coinsurance, and copayments too.

Can you decline Medicare if you don't have to?

In these cases, you may be tempted to decline Medicare in favor of another insurance. After all, no one wants to pay two premiums if they don't have to. However, you need to understand that declining Medicare can have serious repercussions.

Is Obamacare less expensive than Medicare?

When Other Insurance Plans Cost Less Than Medicare. You may find that other insurance options are less expensive for you than Medicare. Obamacare plans are an appealing but you are not allowed to have any part of Medicare while on an Obamacare plan.

Do you pay taxes on Medicare?

The number of years you or your spouse pay the federal government in payroll taxes determines not only your eligibility for the healthcare program but how much you will pay. These tax dollars are intended to safeguard entitlement benefits for you when you need them in the future.

Is Medicare free for disabled people?

While Medicare offers health care to the disabled, it is not free. You have to pay premiums for the different parts. Premiums must be paid for Part A if someone ( or their spouse) has not worked at least 40 quarters (10 years) of taxed employment. Everyone pays premiums for Part B, an amount determined by your income.