If Medicare is primary, it means that Medicare will pay any health expenses first. Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first.

How does Medicare work with my health insurance?

If Medicare is primary, it means that Medicare will pay any health expenses first. Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs.

What happens if my insurance company doesn't pay Medicare?

If the insurance company doesn't pay the Claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should've made. How Medicare coordinates with other coverage.

What happens to my health insurance when my spouse goes on Medicare?

If your health insurance coverage comes through your spouse’s job, you may lose that coverage when he or she retires and goes on Medicare. Not so long ago, this was a scary and expensive prospect, but things have changed.

What should I consider when switching to Medicare from current insurance?

The first thing you want to think about is whether Medicare will be the primary or secondary payer to your current insurance through your employer. If Medicare is primary, it means that Medicare will pay any health expenses first. Your health insurance through your employer will pay second and cover either some or all of the costs left over.

Can I keep my insurance if I have Medicare?

It is possible to have both private insurance and Medicare at the same time. When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer.

Can you have Medicare and employer insurance at the same time?

Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

What benefits come along with Medicare?

What Part A covers. Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What documents do I need to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Does Medicare reduce Social Security?

In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Does Medicare always pay 80 percent?

You will pay the Medicare Part B premium and share part of costs with Medicare for covered Part B health care services. Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10.

What procedures are not covered by Medicare?

Some of the items and services Medicare doesn't cover include:Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

How long does Medicare coverage last?

This special period lasts for eight months after the first month you go without your employer’s health insurance. Many people avoid having a coverage gap by signing up for Medicare the month before your employer’s health insurance coverage ends.

Does Medicare cover health insurance?

Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance coverage in different ways. If your company has 20 employees or less and you’re over 65, Medicare will pay primary. Since your employer has less than 20 employees, Medicare calls this employer health insurance coverage ...

Does Medicare pay second to employer?

Your health insurance through your employer will pay second and cover either some or all of the costs left over. If Medicare pays secondary to your insurance through your employer, your employer’s insurance pays first. Medicare covers any remaining costs. Depending on your employer’s size, Medicare will work with your employer’s health insurance ...

Can an employer refuse to pay Medicare?

The first problem is that your employer can legally refuse to make any health-related medical payments until Medicare pays first. If you delay coverage and your employer’s health insurance pays primary when it was supposed to be secondary and pick up any leftover costs, it could recoup payments.

Medicare: How it Works

Medicare works with a range of other insurance providers to pay your medical bills. How payment is worked out will vary, depending on your health insurance plan. When you shift to Medicare at age 65, you have many choices on arranging your health insurance.

Medicare Part C

Medicare Part C, or a Medicare Advantage Plan, are bundled plans offered by private health insurance companies that meet all Medicare requirements.

Medicare Part D (Medicare Drug Plans)

Medications can be extremely expensive, so you should consider including a Medicare Drug Plan when you arrange your health insurance when you reach age 65. Sign up for this insurance in the first year, because if you do not, the price increases.

What if I am Still Employed?

If you are still employed and your employer has more than 20 employees, they are legally required to continue paying for your health insurance. You are required to take Medicare, but it is well worth reviewing your options at that time.

Navigating Medicare

If you are nearing age 65 and need help with Medicare, you can speak to one of our helpful agents. Navigating the system can be confusing and complicated, and once you make a choice, you must live with it until the next Medicare enrollment period. You want to arrange your health insurance so it works best for youth a reasonable cost.

When does Mary have to sign up for Medicare?

If Mary does qualify for Social Security, she probably will have to sign up for Medicare during her seven-month initial enrollment period. This period includes three months before her 65th birthday, her birth month and the following three months. Terry – N.Y.: I turn 65 in July. I am now receiving Supplemental Security Income.

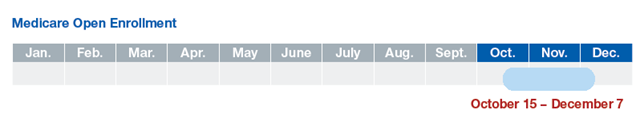

When is open enrollment for Medicare?

Open enrollment runs each year from Oct. 15 through Dec. 7.

What percentage of medical expenses are covered by Part B?

Part B covers not only doctor’s bills but other outpatient expenses plus durable medical equipment, which can be very expensive. Basic Part B covers only 80 percent of these changes.

How many quarters of earnings do you need to be disabled to get Social Security?

People who are not disabled will qualify for Social Security retirement benefits after they have accumulated at least 40 quarters of covered earnings. If Mary has not accumulated 40 quarters of covered earnings by the time she turns 65, she will not be eligible for free Part A insurance premiums.

Does Medicare Advantage have Part D?

Because money is tight, I suggest you look for a basic Medicare Advantage plan that has Part D coverage bundled into it. You’ll still have to pay your monthly Part B premium, but many Medicare Advantage plans charge a zero premium, so this will let you get your drug coverage at little if any cost.

Will Mary have to give up her health insurance?

Phil Moeller: Mary has a great health plan, but most likely will have to give it up . That’s because most people covered under an Affordable Care Act marketplace plan will have to switch to Medicare when they turn 65.

Can private insurance be used to cover gaps in Medicare?

Because Medicare is the first, or primary, payer of health claims, your private insurance would at best be used to cover any coverage gaps in your Medicare coverage . But there already are Medicare products that do this.

Protecting Your Spouse and Children

There is no family coverage under Medicare, so if your spouse and children are on your health insurance, you will want to carefully consider which parts of Medicare to sign up for and when.

Combining Medicare and Employer Group Coverage

As long as you have paid Medicare taxes for at least 10 years, Medicare Part A is available at no cost to you. Because it is free and you are entitled to it, most people choose to enroll in Part A when they turn 65. If you are covered by a large employer group plan, with at least 20 employees, you can delay enrolling in Part B.

Protecting Your Staff

If you are a practice owner, you may feel like you have two families. Your family at home and your family at work. Your medical practice staff and their dependents probably have their health insurance through your employer group plan.

Help is Just a Call or Click Away

Transitioning to Medicare is complicated. Not every situation can be covered in this article.

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

How long do you have to pick a new insurance plan after losing your spouse's insurance?

Losing the coverage you had under your spouse's plan will make you eligible for a time-limited special enrollment period in the individual insurance market, on- or off-exchange (note that in this case, you have 60 days before the loss of coverage, and 60 days after the loss of coverage, during which you can pick a new plan).

How long does it take to get Medicare if you don't have Cobra?

If you’re not going to be eligible for Medicare yourself within 18 months (or up to 36 months, depending on the circumstances), you’ll have to come up with another plan for coverage when your COBRA continuation coverage runs out.

Is Medicaid a separate program from Medicare?

It’s easy to confuse Medicaid and Medicare, but they're separate programs with different benefits and different eligibility criteria. In many states, low-income people making up to 138% of federal poverty level are eligible for Medicaid.

Can I get medicaid if my income is low?

If your income is low enough, you may be eligible for government-provided health insurance through Medicaid. In some states, the Medicaid program goes by another name like SoonerCare in Oklahoma or Medi-Cal in California. It’s easy to confuse Medicaid and Medicare, but they're separate programs with different benefits and different eligibility criteria.

What happens if you leave Medicare without a creditable coverage letter?

Without creditable coverage during the time you’ve been Medicare-eligible, you’ll incur late enrollment penalties. When you leave your group health coverage, the insurance carrier will mail you a creditable coverage letter. You’ll need to show this letter to Medicare to protect yourself from late penalties.

What happens if you don't have Part B insurance?

If you don’t, your employer’s group plan can refuse to pay your claims. Your insurance might cover claims even if you don’t have Part B, but we always recommend enrolling in Part B. Your carrier can change that at any time, with no warning, leaving you responsible for outpatient costs.

What is a Health Reimbursement Account?

Beneficiaries who participate can get tax-free reimbursements, including their Part B premium. A Health Reimbursement Account is a well-known Section 105 plan. An HRA reimburses eligible employees for their premiums, as well as other medical costs.

Is Medicare billed first or second?

If your employer has fewer than 20 employees, then Medicare becomes primary. This means Medicare is billed first, and your employer plan will be billed second. If you have small group insurance, it’s HIGHLY recommended that you enroll in both Parts A and B as soon as you’re eligible. If you don’t, your employer’s group plan can refuse ...

Is a $4,000 hospital deductible a creditable plan?

For your outpatient and medication insurance, a plan from an employer with over 20 employees is creditable coverage. This safeguards you from having to pay late enrollment penalties for Part B and Part D, ...

Can employers contribute to Medicare premiums?

Medicare Premiums and Employer Contributions. Per CMS, it’s illegal for employers to contribute to Medica re premiums. The exception is employers who set up a 105 Reimbursement Plan for all employees. The reimbursement plan deducts money from the employees’ salaries to buy individual insurance policies.

When does Medicare enrollment end?

For most people, the Initial Enrollment Period starts 3 months before their 65th birthday and ends 3 months after their 65th birthday.

When does Medicare pay late enrollment penalty?

If you enroll in Medicare after your Initial Enrollment Period ends, you may have to pay a Part B late enrollment penalty for as long as you have Medicare. In addition, you can enroll in Medicare Part B (and Part A if you have to pay a premium for it) only during the Medicare general enrollment period (from January 1 to March 31 each year).